Weekends in my household are often consumed by time well spent with my wife and two young children, who enjoy everything from hide & seek and board games with crazy rules, to baseball and bike riding. While I love these activities and the family memories they create, I too enjoy weekend time spent alone on personal projects around the house. I call these “garag-ects”—projects generally accomplished in the garage.

Over the years, the bikes and sports equipment, toys and old ping-pong table, tools and materials have taken over my work space, each time requiring me to prepare a space to get started. It’s an unmotivating and incredibly inefficient environment, but I know that until I dedicate the time to organize the space required to tackle many garagectsin a single weekend, I will continue to lack the motivation and resources to engage in even a single item on the growing list of ‘to-do’ items. In years past, I found myself able to fill a weekend with a list of accomplishments and was highly productive in the garage. When I could start and complete a garagectin one sitting, I found myself entirely engaged in the process and motivated by the accomplishments each completion would bring.

Perception of Productivity Drives Employee Engagement

In this way, I have something in common with the vast majority of employees who work in any role across all types of industries and organizations. Perhaps not just the family aspect or the growing list of projects in the garage, but the continuous intrinsic need to be productive in order to feel truly engaged. In fact, research suggests that employee happiness and engagement at work is driven by the perception of productivity – an employee’s sense of being able to effectively execute his or her duties and role for the organization in an effective and efficient manner. Coupled with the ability for an employee to see his or her contribution, the feeling of productivity is powerful in establishing and maintaining high engagement levels.

The social and physical environment for an employee in the workplace may be just as important as an organized garage when it comes to enabling a higher sense of productivity. As organizations invest in employees by regularly asking for feedback and insight in order to make effective changes and promote a culture for employee-generated insights, it can be valuable to include measures that connect productivity and the outcomes of the work done day in and day out.

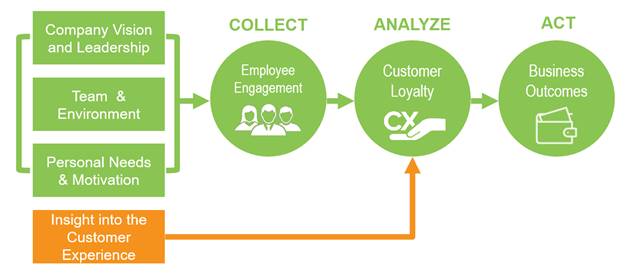

Bridging Concepts of Productivity with Employee Surveys and CX Measures

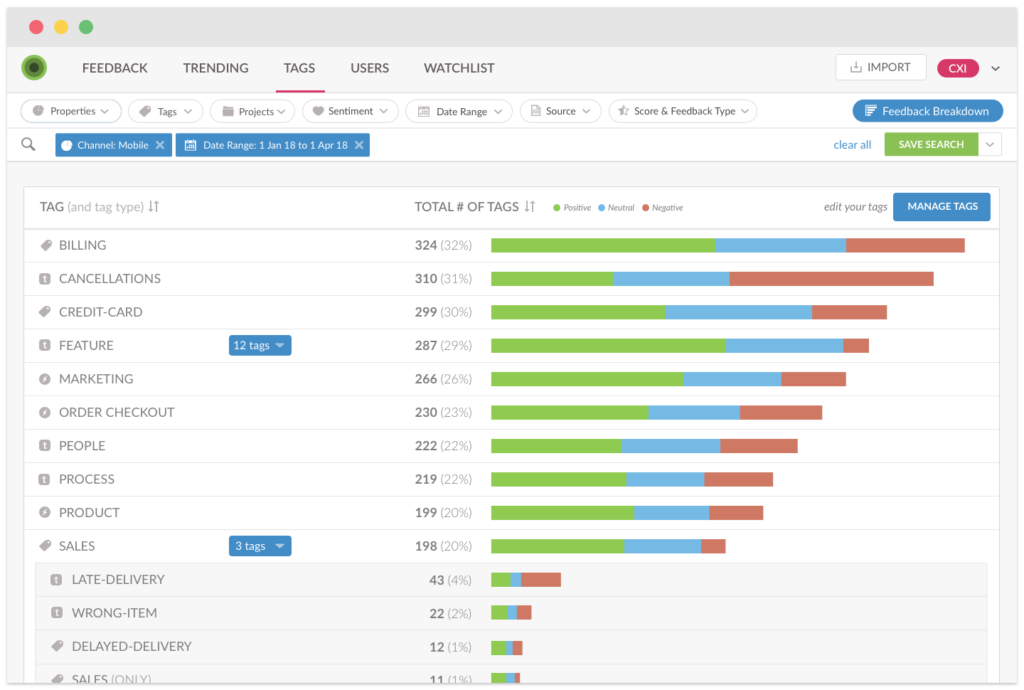

Many organizations are beginning to find ways to include such measurement within regular employee engagement surveys, where for example, employees are presented with specific items connecting the concepts of productivity while also bridging data between employee surveys and customer experience measures. These items may cover processes & procedures and incentives, to goal-setting and technology, and might include items such as;

- Our organization always acts in the best interests of our customers.

- Our organization eliminates processes and procedures that interfere with best serving my customers.

- Staff in our organization are given incentives to provide the best possible service to our customers.

- My co-workers consistently think about how to better serve our customers.

- Our organization hasformal programs and processes for improving customer experience.

- Our organization sets specific goals for achieving and improving customer experience.

- Our organization effectively uses technologyto deliver a consistently positive customer experience.

- Our organization commits the resources required to exceed the expectationsof customers.

Such measures offered to employees serve as a great way to connect traditional siloes between HR and CX Professionals who independently measure the employee and customer experience respectively and provide a mechanism for employees to weigh in foundational concepts affecting their work and the outcomes for customers.

Asking the Right Employee, with the Right Measures, at the Right Time

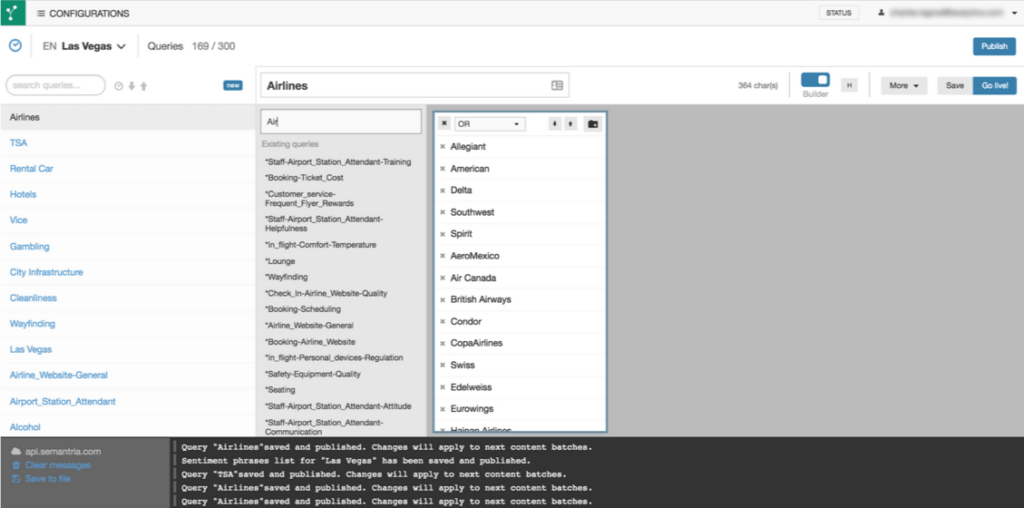

Another growing strategy organizations are deploying includes the use of employee experience (EX) surveys to monitor the more standard aspects of the employee life cycle. This process includes asking the right employees, the right measures, at the right time – while they are top of mind and while the employee is most invested in a particular experience. By measuring the initial impressions of an organization during the recruitment and hiring stages, through onboarding and acclamation, to communication and recognition, and typically ending with exit experience, an organization can identify employee-driven ideas for improving the experience in each of these areas affecting nearly all current and future employees. These surveys can be administered in a more intelligent, automated fashion by leveraging employee record files to distribute certain survey types based on tenure, employment events (such as promotion or training) and communication processes by the organization, including quarterly townhall meetings. By including even just a single item on an employee’s perception of productivity, the organization can better identify quick wins across processes in the employment life cycle to improve this concept and engagement.

Make Sharing Experiences Easy

One other emerging trend includes the use of open-ended prompts, either as part of the regular employee survey process or as part of an open listening strategy where employees can share a story/idea at any time through a dedicated portal or open exchange. Just as we do as customers when we experience something very positive or negative, employees also want to share their stories. One positive and inspiring method is to provide a mechanism for employees to identify any instances where colleagues, processes, or the work environment allowed them to be overly productive and/or provide an exceptional experience to a customer. Every employee has days where, from their vantage point they accomplish an incredible feat or series of feats in one day. Providing opportunities for employees to share these stories will generate ideas for how to foster such productivity while recognizing employees for their accomplishments. Such stories can even be shared publicly in electronic employee boards and in recognition mechanism across the organization to further drive engagement.

Speaking personally, I can physically feel the difference in my engagement when I’m in an environment that promotes focus and productivity. Whether provided to me by the leadership at my place of work, or self-created in my garage, my working conditions including the processes, tools, space and people should foster productivity and be intentional in design to allow for my best work. When this occurs, I’m most likely to remain engaged in my efforts and connected to the purpose of my work. In my case, this means a weekend engaged in making my garage a more productive environment.