Author: Daniel Hickey, Senior Research Manager at InMoment

To paraphrase Samuel Clemens, reports of the bank branches’ death are exaggerated. The pandemic left many people thinking that the brick-and-mortar or branch experience was finished (or on its way out) in banking and retail. But was that really true?

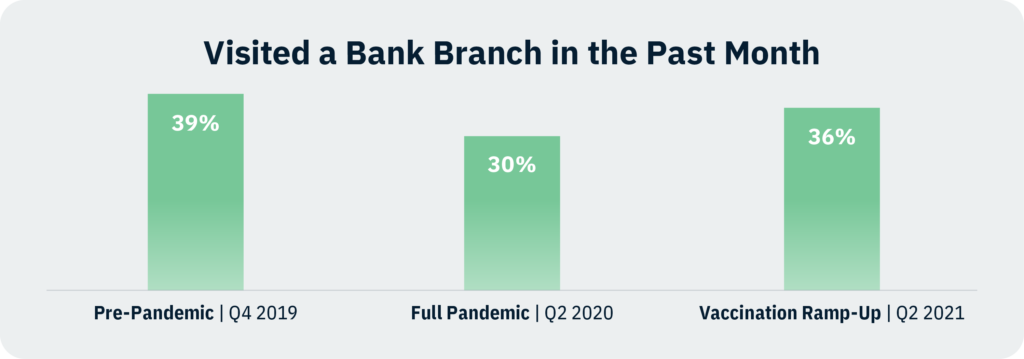

The InMoment CX Standards Poll has been tracking key transactions for over a decade and while we found a 25% drop in bank branch visits during the height of the pandemic, we are already seeing branch visits return to close to pre-pandemic levels. (Note: This excludes visits just to the ATM)

Not Your Grandma’s Bank Branch

Despite this upward trend, it’s important to note that the bank branch of the future will not be your grandmother’s bank branch. In the 1960s and the 1970s, most people visited their local bank branch as often as they visited the dry cleaner. Today, a significant number of people don’t go to the branch at all. Instead, they leverage online, direct deposit, and cash back to handle their banking. Others don’t make it past the vestibule and the ATM.

This evolution in consumer behavior means two things for banks:

- The volume of in-branch transactions is much lower than it was 20 or 30 years ago

- The foot traffic into the branch for sales opportunities is down as well

What the Future Bank Branch Customer Experience Will Look Like

So, what will the “second act” for bank branches look like? We don’t know for certain, but several new models are at the concept stage—or already up and running. Here is a brief review of those options, including the opportunities and obstacles that might come along with them.

The “Skinny” Branch

This branch recognizes both the need for the physical branch and the reality of diminished traffic. Fewer branches, a smaller footprint, and/or fewer staff are a hallmark of this style of branch. Citibank uses this model with a hub of branches in major cities and ATM/satellites in other locations. But even here, Citibank is evolving roles by creating a concierge function to meet, direct, and help with certain transactions and questions. And Zoom meetings with bankers during the pandemic created a way to stay connected that likely will continue beyond the immediate needs of the pandemic.

The Tech Branch

This branch is more like an Apple or Microsoft store in that it tries to encourage customers to come in, learn something, and buy when ready. Staff are out from behind the desk and counters are carrying tablets and interacting on the floor. The feel is high tech with screens, kiosks, and interactive stations. Umpqua debuted a prototype in its San Francisco flagship with roving concierge-style bankers and an interactive tech wall that combines finance, local business overviews, and general inspiration. Here the emphasis is on technology with a human touch to combine the best of both in the customer experience.

The Branch Café/Lounge

Technology still plays a role here, but the emphasis is on making the branch a meeting point and more integrated into the community and consumers’ daily lives. The most famous U.S. example is the Capital One Café where the branch is transformed into a gathering place where one can do more than just basic banking transactions. The Virgin Group offers “Virgin Money” lounges where members can enjoy refreshments, conduct business meetings, enjoy complimentary Wi-Fi, and workstations while also conducting their banking needs.

Learning from Retail

As banking often does, these models borrow heavily from retail which has set the standard for integrating the digital and in-store experience. In fact, Danish bank Jyske modeled some of its branches along the lines of a retail store providing a tangible buying experience for an intangible service. Financial services still has a ways to go in catching up to retail in terms of integrating mobile, online, and “in-store” experiences but that is on pretty much everyone’s radar and most are taking steps in that direction.

Test-and-Learn and Hybrid Models

These new experiences signify that banks are trying to make better use of the branch experience—and drive greater revenue. All of these prototype models have several common elements:

- Encourage consumers to think of the bank as a place to get ideas about how to live their lives, not just a place to deposit checks and get cash

- Make the experience more interactive

- Leverage technology in the branch and at home

As banks experiment with new branch models, they need to rethink not only the network strategy, but the branch design, and the roles and skill sets of branch staff. We will likely see hybrids of some of the models described above as banks continue to evolve the bank branch for the 21st century.

Whatever the future holds, two things seem certain: Bank branches are not going to be the same as they were—and bank branches aren’t going anywhere.

References

- American Banker, Branch of the Future Will Still Be a Branch

- BAI, Two Visions of the Branch of the Future

- Capgemini Consulting, The Future of Bank Branches Coordinating Physical with Digital

- McKinsey & Company, The future of US retail-banking distribution

- The Financial Brand, Why Citi Won’t Dump Its Skinny Branch Network and Go All Digital

- The Financial Brand, New Umpqua Flagship Store Shatters Stuffy Branch Mold

Download the full article as a PDF by selecting the button below!

Download