How Prepared Are Financial Firms Feeling for Consumer Duty?

In our recent virtual panel discussion, we explored how different financial firms are embracing the Consumer Duty Act and identified areas where most of their resources have been designated. The panelists engaged in insightful discussions, sharing their organisational challenges and best practices, while attendees were to engage in polls aimed at answering three key questions on preparedness, challenges, and changes related to Consumer Duty.

And because at InMoment, we value sharing knowledge as widely as possible, I’m going to share the results of that in-event poll with you here, along with a few thoughts about our learnings.

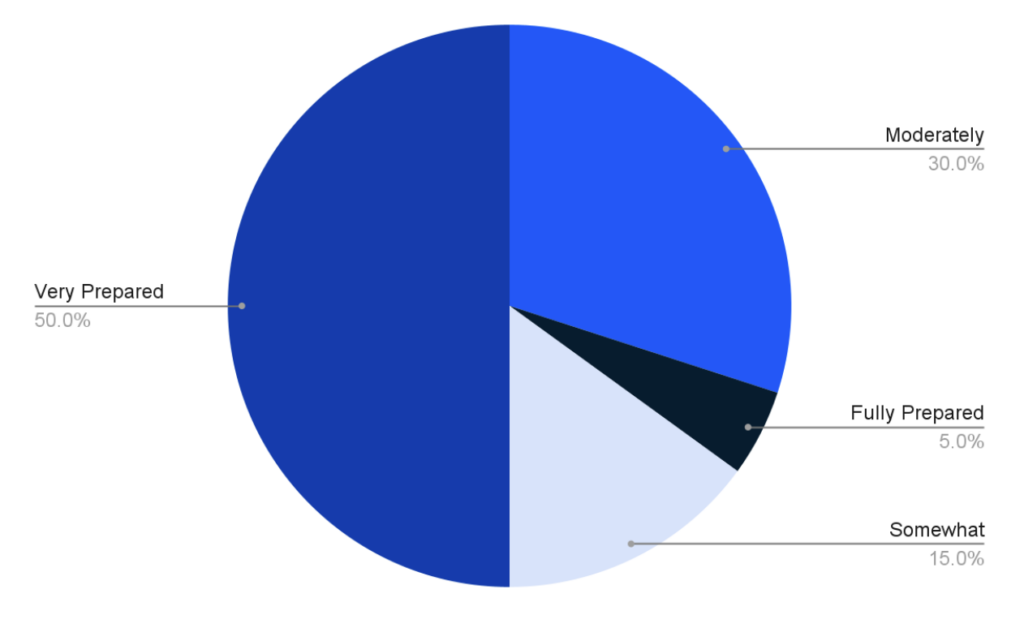

How Prepared Do You Feel for Consumer Duty?

We were pleased to see that the majority of firms who joined us felt very prepared, with 50% selecting this option, and no one stating that they weren’t prepared at all.

The panelists shared valuable insights on embracing changes and putting customers at the center of their business. A key takeaway was the importance of ensuring that everyone in the organisation was informed and that they understood what Consumer Duty means for the whole business, but also their specific accountability in delivering against it. Increasing awareness and providing comprehensive training to employees are crucial steps toward ensuring adherence to the act’s expectations.

The discussion around preparation also highlighted the importance of assessing product alignment with target customers, the risks of non-compliance, and the benefits of adopting a customer-first approach.

Furthermore, the concept of “substantive compliance” was emphasized as a means to exceed expectations and gain a competitive advantage. Ensuring the needs of vulnerable customers are met was also discussed as a crucial aspect of achieving desired outcomes.

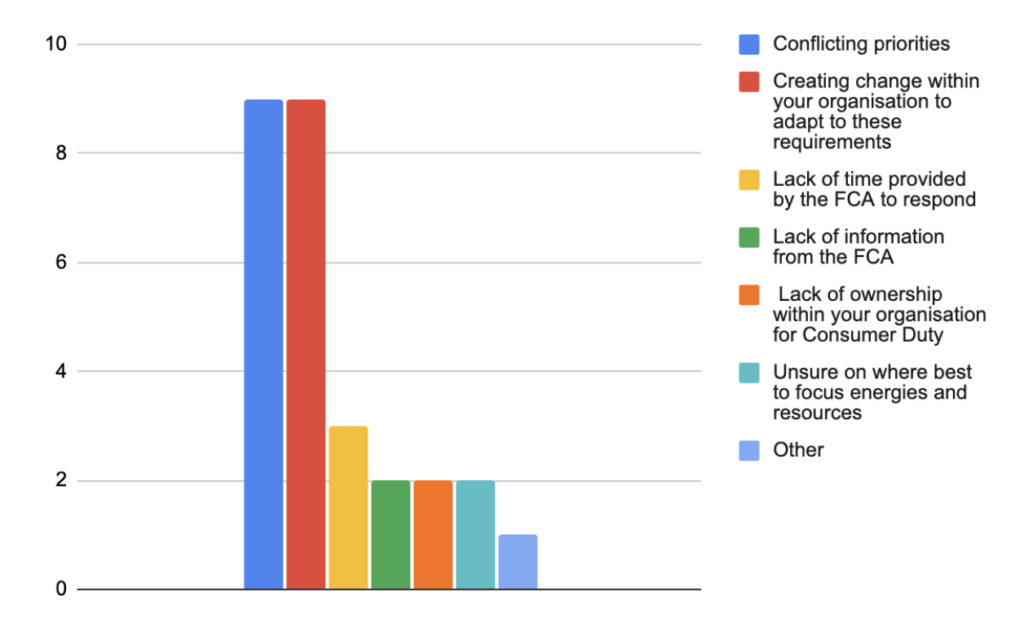

What Have Been Your Biggest Challenges in Getting Ready for Consumer Duty?

When asked about the biggest challenges they have faced, there was an equal split between “creating change within the organisation to adapt to the FCA requirements” and “conflicting priorities.” Both challenges undoubtedly speak to the need to implement new processes as well as ways of thinking, especially when strategic plans or other requirements such as digital transformation were already planned as necessities.

Solving for these challenges requires an organisation to embrace the Consumer Duty Act as an opportunity for a strategic evolution, rather than a complete upheaval of existing business strategies. The key is in adapting your perspective to see these adjustments as a fine tuning rather than a complete abandonment of the preexisting travel plan.

There was also emphasis on fostering a culture of ongoing learning and improvement. By embracing a mindset of adaptability and remaining attuned to shifting customer expectations and regulatory landscapes, organisations will be best able to meet the challenges and seize the opportunities presented by the act.

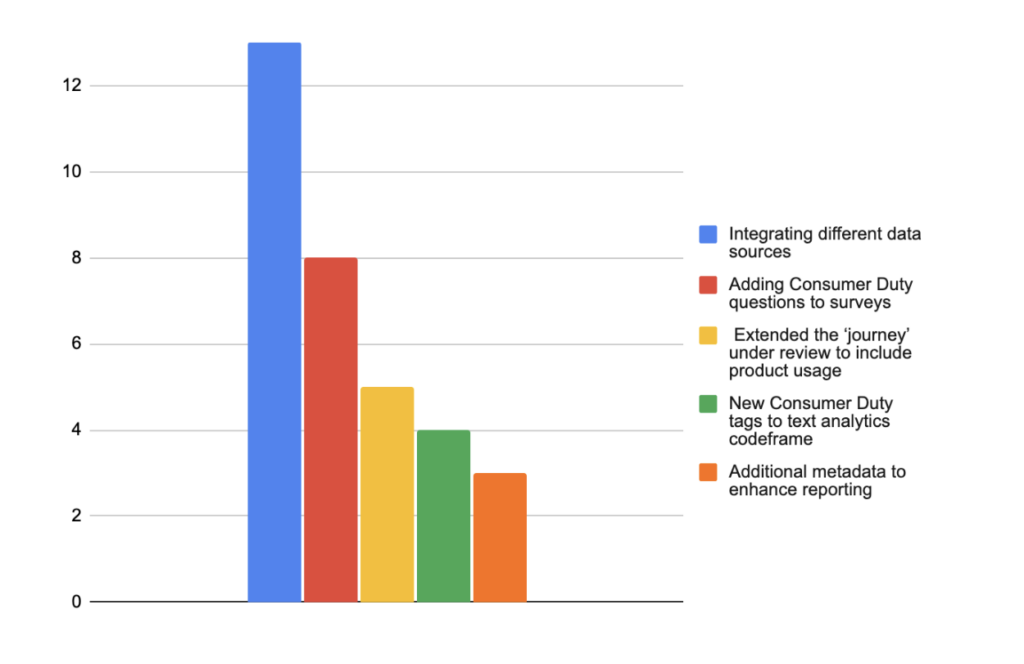

What Are the Biggest Changes That You Have Made Towards Identifying Risk Amongst Your Customers?

Lastly, we asked attendees about the biggest changes they had made to identify at-risk customers. The poll and the subsequent discussion revealed the significant industry-wide adoption of integrating diverse data sources (other than traditional surveys) into Marketing Intelligence (MI), with the third poll showing that 81% had integrated different data sources into their reporting. This integration empowers organisations to leverage comprehensive data, driving focus and strategic changes that are aligned with evolving customer needs.

Leaders in this space have continued to make adjustments to their CX programmes to support Consumer Duty requirements such as reviewing touchpoints and customer journeys to bridge gaps, more effective dissemination of customer insights to stakeholders, and a greater focus on measuring consumer understanding in order to take proactive action to address improvement areas. This final action leads to not only improved communication out to customers but also improved internal communication around expectations and making material more inclusive to drive better understanding.

“Firms should harness the benefits of data and technology to improve their services and understand the outcomes they achieve for their customers.”

The FCA

To get access to detailed notes, poll data and more, you can click here for a full summary of the Consumer Duty Panel Discussion!

It’s clear that the most successful brands will be those that focus on enhancing their customer-centric culture, putting the customer at the heart of all decision making, rather than focusing only on a compliance-first approach.

Having the right experience programme in place can help build customer centricity and use it to your advantage!

Find out how InMoment can help you embrace these changes to:

- Deliver positive outcomes for your customers

- Gain an improved consumer understanding

- Identify customers at risk to complain and churn

- Develop a culture of continuous experience improvement

Click the link if you would like to learn more about how InMoment can help you with Consumer Duty Compliance!