The Greatest CX Opportunities for Financial Services in 2021

One of our favorite things about the 2020 Wealth Poll is that it didn’t just dissect the investor mindset. It took that understanding one step further by identifying the best opportunities for wealth management firms, banks, and other financial services businesses to improve their experience in 2021.

So without further ado, let’s dive into our findings!

About the 2020 Wealth Poll

The InMoment Wealth Poll is a multi-wave poll of affluent investors done every few years for the past fifteen years. From June 30, 2020 to July 2, 2020, we surveyed 1,212 investors with over $100,000 of privately held assets to understand how the unsettled market has affected them, how they feel about their client experience, and where opportunities may lie for investment firms to improve and expand business.

Here is a quick breakdown of the investors we surveyed:

- 790 Mass Affluent Investors ($100,000 to less than $1,000,000 in investable

- 400 High Net Worth Investors ($1,000,000 to less than $10,000,000 in investable assets)

- 22 Ultra-High Net Worth Investors ($10,000,000 or more in investable assets)

Experience Improvement Opportunities in 2021

Perhaps one of the most important functions an experience program can serve is helping an organization to identify what they do well in the eyes of the customer—and where there’s room to improve. Only when brands pinpoint those areas can they remove friction and improve experiences (and even move on to increase customer retention, save costs, and more).

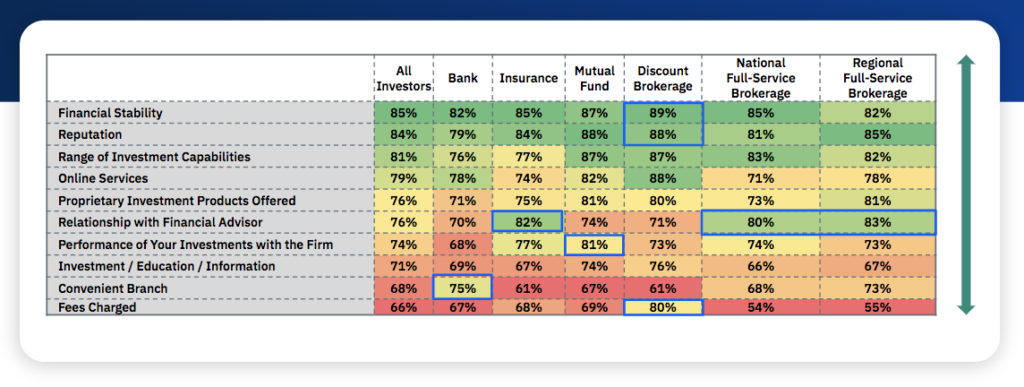

That’s the idea that inspired one of the most telling questions in the InMoment Wealth Poll, “Thinking About Your Primary Investment Firm, How Satisfied Are You with Each of the Following.” The answers we received for this question are sure to inform financial services organization’s experience strategies for the upcoming year. Let’s take a look!

It is important to note which firm types have advantages in specific areas. Mutual fund firms, for instance, are currently outperforming others when it comes to “Investment Performance” according to their clients. Additionally, full-service brokerage and insurance firms are showing particular strength when it comes to delivering for their clients, specifically when it comes to the relationships clients have with their financial advisors. Discount firms are also showing strength when it comes to their online services.

When it comes to the big picture, however, it is clear that elements like “Financial Stability” and “Reputation” are mere table stakes for investors. “Fees” are areas of dissatisfaction across the board—which is not surprising—but discount brokerages seem to have a particular advantage here in that investors seem more satisfied with their fees.