Churn Prediction: How to Predict It for Customer Retention

Customers leave a business for several reasons, from poor support to lack of personalization. Churn prediction helps you identify key drivers of churn and accurately detect clients likely to leave your business. This enables you to take proactive action to retain and satisfy customers.

Did you know that U.S. companies could save over $35 billion annually by satisfying existing customers? Understanding why customers want to leave can help you retain them and reduce acquisition costs. But, how do you identify customers at risk of leaving? You could guess based on their activity, but that would be ineffective. Instead, you need to leverage churn prediction to learn why customers may leave and what you can do about it.

What is Churn Prediction?

Churn prediction detects which customers are likely to discontinue business with you. This churn could occur as a canceled subscription or product abandonment. There are several types of churn you can predict, including:

- Customer churn is the most familiar type of churn. Customer churn focuses on the specific decline in the number of customers instead of revenue alone.

- Revenue churn represents the loss of revenue due to customers downgrading their plans or leaving the business altogether.

- Active churn is when customers cancel their service and communicate their decision to the business.

- Passive churn occurs when customers don’t explicitly cancel their service. However, they haven’t attempted to renew it either. For example, a subscription that ends without renewal or communication from the subscriber.

- Voluntary churn is when customers actively decide to stop using a service or product. This decision can be due to dissatisfaction, finding a better alternative, or changing requirements.

- Involuntary churn occurs against the customer’s will. It’s usually a result of payment issues, like credit card expirations or insufficient funds. It doesn’t represent a problem with customer satisfaction, but it indicates that you could improve your payment processor or methods.

Why is Customer Churn Prediction Important?

Predicting churn in any form is key to customer retention and satisfaction. It is important for businesses because:

- It helps retain customers. Acquiring new customers is more expensive than retaining current ones. Proactively monitoring customer health can help businesses cut churn by over 34% for at-risk clients.

- It informs effective marketing strategy. Churn prediction helps you tailor your marketing efforts to re-engage customers at risk of leaving. For example, you can send gift cards to at-risk customers after their next purchase.

- It enhances customer satisfaction. Modelling churn helps you understand why customers want to leave. It provides rich insight into specific pain points. This will help you better understand and serve customers.

- It supports long-term growth. Lowering the churn rate contributes to a stronger, more loyal customer base. This creates a foundation for sustainable growth, enabling you to fulfill key business goals.

- It provides a competitive advantage. With insights into customer behavior, you can act faster and smarter than competitors. With effective customer experience management, you can re-engage customers who might otherwise be lost to your competition.

A good example of the importance of reducing customer churn comes from nib New Zealand. Through its partnership with InMoment, nib rolled out a closed-loop feedback process to improve the customer experience. InMoment’s churn propensity modeling was crucial to identifying and retaining customers showing signs of dissatisfaction. As a result, nib improved its NPS and reduced churn by 6% within six months of rolling out the program. To learn more, download the full story below!

How to Predict Customer Churn?

To predict customer churn, you need to know how to model it. A data scientist can achieve this by building a machine learning prediction model trained on a dataset. This dataset includes the target variable you want to predict (customer churn) and features that describe customer profiles.

InMoment’s data analysis capabilities give you the power to automatically sort through your customer feedback data and detect sentiments such as intent to churn. Using these insights, you can create actionable customer segments based on customer behavior data.

Here are the key steps for using data analysis to predict churn:

- Collect and Prepare Data

- Select and Train a Model

- Analyze Predictive Patterns

- Take Proactive Action

Collect and Prepare Data

Consider diverse data sources that capture customer interactions and behaviors. This can include CRM data, social media, call center logs, service requests, and chat messages.

Pulling unstructured data from different sources helps you build a comprehensive dataset covering every touchpoint in the customer journey.

The next step is to clean and preprocess the data to ensure consistency. This includes removing duplicate entries and standardizing formats. For example, different sources may record customer names in different formats. Standardizing the format will help ensure clarity.

Identifying the most relevant features for churn prediction helps improve model accuracy. For example, someone’s name isn’t a good indicator of whether they will churn. However, their transaction frequency or last purchase date are stronger indicators. Including these features would help you prepare high-quality data for reliable predictions.

Select and Train a Model

Select a machine learning model that best fits your data and business goals. Logistic regression algorithms are ideal as they can predict a binary outcome (churn or not) based on volumes of historical data.

The next step is to feed the labeled data to the model to train it. During the training phase, the model detects patterns in customer activity to understand why churn happens. For example, low engagement or transaction frequency will likely be true for most churn cases.

Training is an iterative process. Evaluate the model’s performance on test data to see how well it predicts churn. A data scientist might also tweak the model or choose additional features to improve predictive power.

The last step is to validate the model with new data to ensure it generalizes well. This will help confirm the model’s ability to forecast new churn cases accurately.

Analyze Predictive Patterns

A trained model can reveal predictive patterns leading to customer churn. For example, a drop in purchase frequency, low engagement with customer support, or consistently negative feedback indicates churn likelihood.

Begin by analyzing key indicators within your model’s output. Look at variables like purchase recency, CSAT (customer satisfaction score), and interaction frequency. This will help identify common attributes among churned customers. Identifying these patterns helps you understand the specific reasons customers might leave.

A good practice is to break down these patterns by customer segments. For example, younger customers might churn due to a lack of personalization. High-value customers might leave because of pricing concerns. Categorizing insights by customer segments helps create targeted retention strategies for each demographic.

Take Proactive Action

This step involves acting on the churn predictions to engage at-risk customers before it’s too late.

Proactive actions can include personalized outreach addressing specific concerns. For example, you can send them special offers or product recommendations to reignite their interest. High-value customers might benefit from loyalty rewards or exclusive access to new features. These steps will help make customers feel valued and appreciated.

If certain offers or messages reduce churn, incorporate these strategies into a long-term retention plan. Acting on churn predictions highlights your commitment to customer satisfaction. The resulting customer loyalty is key to stronger relationships and business growth.

What Are the Challenges of Predicting Customer Churn?

- Inaccurate Model Predictions

- Identifying the Right Features

- Collecting High-Quality Data

- Data Integration

- Changing Customer Behaviors

- Transforming Insights into Action

Predicting customer churn is valuable for customer retention. However, it can be tricky to navigate. Some common challenges businesses face include:

Inaccurate Model Predictions

Accurate model predictions require careful data analysis and calibration. Without proper testing and validation, a model is likely to produce inaccurate predictions. For example, if it overfits the training data, it won’t be able to make accurate predictions on new data. Regular testing and refinement are time-consuming but crucial for improving model accuracy.

Identifying the Right Features

Selecting the right features is important for building an effective churn prediction model. Irrelevant features can add noise to the dataset and confuse the model. Similarly, overlooking impactful features makes it difficult to understand the true drivers of churn. Data scientists often need to experiment with different features to identify the ones most relevant to churn.

Collecting High-Quality Data

Data quality is a key component in churn prediction. Incomplete or low-quality data can skew results and lead to unreliable predictions.

Data Integration

One of the biggest challenges is integrating large volumes of customer data from various sources. A CX platform like InMoment can help by collecting and connecting every piece of valuable data in one place. This effective integration helps build cohesive, model-ready datasets for churn prediction.

Changing Customer Behaviors

Customer needs and behaviors evolve. As a result, attributes responsible for churn last year might not necessarily be relevant today. Businesses must regularly update their models based on customer behavior analysis to reflect changing customer expectations. The continuous monitoring and adjustment require considerable time and effort.

Transforming Insights into Action

Once you identify at-risk customers, you must act on the predictive insights to re-engage customers. This might include personalized offers, targeted communication, or enhanced customer support. Creating these strategies and making them effective can be challenging.

What Are the Benefits of Predicting Customer Churn?

Predicting customer churn is a worthy investment despite the challenges. Businesses can expect to realize the following benefits:

- It reduces customer acquisition costs. Acquiring new customers is difficult and costly. Identifying at-risk customers early enables businesses to re-engage them with tailored incentives. As a result, you spend less on acquiring new clients to help your business thrive.

- It improves customer relationships. Predictive insights highlight what matters to your customers. This information helps you refine retention strategies to keep clients on board. For example, offering proactive customer support or loyalty rewards helps retain customers by showing them you care.

- It provides stronger customer insights. Patterns in churn data provide insight into customer satisfaction. It helps you understand different customer segments better. These insights help improve messaging and engagement efforts for both retention and acquisition.

- It enables business growth and stability. Repeat customers spend 67% more than new clients. As a result, retaining more customers helps maintain a stable revenue stream. This contributes to consistent business growth and innovation.

- It provides a competitive advantage. At-risk customers are considering alternative businesses. Churn prediction improves your chances of retaining them and maintaining your competitive edge. It also informs strategies that better meet customer needs, reducing their chances of choosing competitors.

How to Choose Churn Prediction Software?

The right churn prediction software does the predictive heavy lifting so that you can focus on improving customer relationships. Key features to look for include:

Data Integration

Building a comprehensive dataset involves pulling customer data from diverse sources. These sources can include CRM systems, customer feedback questionnaires, and social media. The right software should be adept at integrating every single data point for effective model training.

InMoment simplifies this process by connecting customer signals from each relevant source into a single place for analysis. The accuracy and reliability of its data integration help produce complete datasets.

Advanced Text Analytics

Your churn prediction platform should be able to analyze customer feedback. This helps uncover customer sentiment and identify churn indicators.

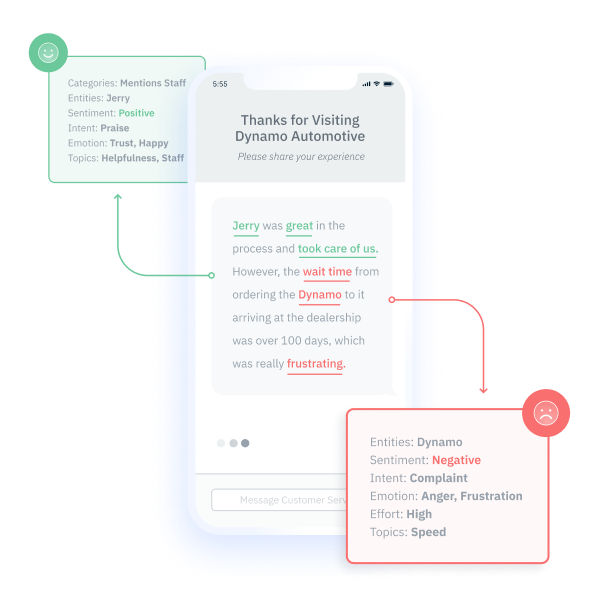

InMoment’s text analysis software helps you proactively uncover what a customer intends to do next. It leverages advanced AI to process feedback and highlight customer intent. The intent appears as a complaint, praise, suggestion, inquiry, purchase, will return, comparison, requested help, recommend, not recommend, and churn. Instead of a simple binary outcome, you get more context into the customer’s expectations!

Customizable Alerts

Look for tools that enable you to set alerts for at-risk customers. These customer experience automation features make it easier to respond to customers quickly, improving your chances of retaining them.

Competitor Analysis

The right tool should offer competitor insights to help you understand churn in the market context. For example, do customers have a better alternative in mind? If so, what can you offer them to sway them away from the competition?

InMoment’s competitor analysis software helps you stay up-to-date on your competition. Besides identifying competitors, it lets you see how you rank against them. You can also set alerts for performance changes. This helps identify opportunities to fulfill customer needs better for retention.

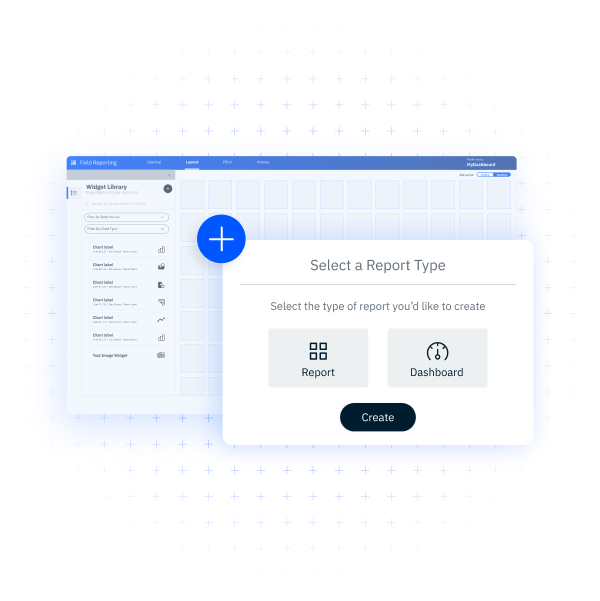

Actionable Reporting

A good platform helps you visualize predictive insights. Dashboards and competitive reports make it easier for teams to understand and respond to churn patterns.

With InMoment’s reporting capabilities, you can easily build customizable reports and share them across your organization. It enables you to prioritize features that will improve your chances of engaging at-risk customers.

How InMoment Can Help with Churn Prediction and Reduce Customer Churn

Churn prediction is key to improving relationships, reducing acquisition costs, and increasing profits. InMoment offers a comprehensive approach to churn prediction that enables businesses to take proactive steps for customer retention. It processes volumes of unstructured data with the help of machine learning and text analysis to accurately identify churn drivers. Take a look at our text analytics solutions today and see how they can help reduce churn rates!

References

Semrush. 65 Customer Retention Statistics You Need to Know in 2024 (https://www.semrush.com/blog/customer-retention-stats). Accessed 11/07/2024.

InMoment. InMoment Market Pulse (https://www.linkedin.com/posts/weareinmoment_b2b-customersuccess-ai-activity-7251989745914818560-haGe?utm_source=share&utm_medium=member_desktop). Accessed 11/07/2024.