InMoment for Financial Services

Customer Experience Solutions for Financial Services

Build Customer Loyalty with a Blend of Technology and Personal Touch

Start Improving Performance Today!

Our Customers

Metro Bank: Creating Lifelong Fans, Not Customers

- 5% increase in revenue

- Grew over 3 million customer accounts

- Ranked #1 for in-store engagement

Australian Financial Services Firm Reduces Non-Compliance Risk

- Automated manual and unreliable review processes

- Increased cross-sell opportunities through personalized interactions

- Reduces risk of non-compliance with BI integrations

Virgin Money: Creating a Customer-Obsessed Culture

- Transactional NPS increased by nearly 30% in an 18-month period

- NPS more than doubled year-over-year

- Reduced targeted monthly complaint volume by 27%

Humanizing Financial Experiences to Increase Share of Wallet

Financial institutions are increasingly being asked to offer more personalized solutions that foster deeper customer relationships. To remain competitive, providers must create frictionless yet personalized experiences that meet evolving customer expectations. In fact, 89% of consumers switch to a competitor after a poor customer experience, highlighting the importance of delivering frictionless yet personalized experiences.

Stronger Signals

Richer Insights

Smarter Actions

InMoment for Financial Services

Provide Stand-Out Experiences for Your Evolving Customer and Business Accounts

InMoment empowers financial institutions to provide personalized experiences that build trust, improve satisfaction, and drive long-term loyalty. The XI platform delivers valuable insights that help banks, credit unions, and financial firms analyze customer sentiment, personalize services, and build long-term trust.

Personal, Consistent Channel Experiences

Today’s customers demand consistency—78% of consumers expect a consistent experience wherever they engage, whether it’s online, in-app, or in-branch. With InMoment’s Omnichannel Feedback Solutions, financial institutions can capture customer interactions across multiple platforms, ensuring consistent experiences from online banking to in-branch visits.

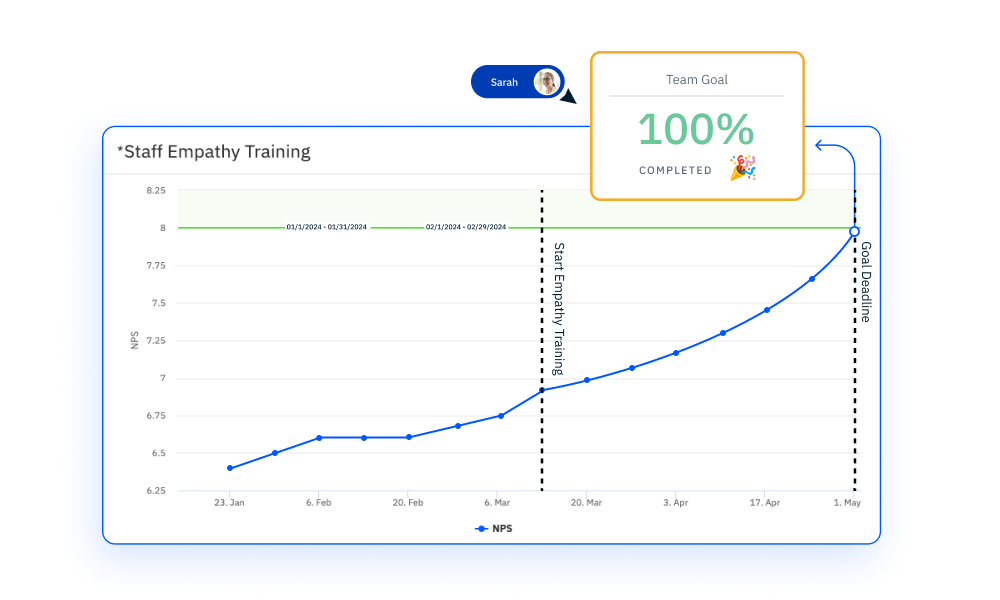

The Most Valuable Asset: Your Employees

InMoment’s employee experience tools provide financial institutions with insights into staff performance and perspective, allowing managers to implement targeted coaching programs that improve service delivery and customer satisfaction.

Keeping Customers Engaged With Value-Oriented Product Growth Opportunities

InMoment’s sentiment analysis and custom alerts help identify customers at risk of leaving, enabling proactive engagement strategies to enhance loyalty and reduce churn.

Integrated CX

Collecting Feedback Across Channels

Over half of financial services consumers report having low trust in their provider. InMoment gathers and consolidates customer feedback from surveys across channels such as email, SMS, and digital banking apps, providing a unified view of customer sentiment and satisfaction.

AI You Can Trust, and Explain

You’ve heard all the AI promises. We believe AI needs to be grounded in precise NLP to not just explain data, but also predict and validate insights. Multichannel data collection helps FinServ leaders have the best data for AI analysis to correlate positive experiences with tangible ROI

AI-Powered Conversational Surveys for 70% More Detailed Data

InMoment’s dynamic surveys adapt to customer responses in real time, enabling financial institutions to collect more accurate and actionable feedback with minimal effort.

Tailored Alerts from Award-Winning Natural Language Processing

We have 100s of models for you to choose from out-of-the-box, but we never stop at the industry standard. Your AI and NLP models inform customizable alerts, enabling you to quickly identify emerging trends and respond proactively to improve customer experience.

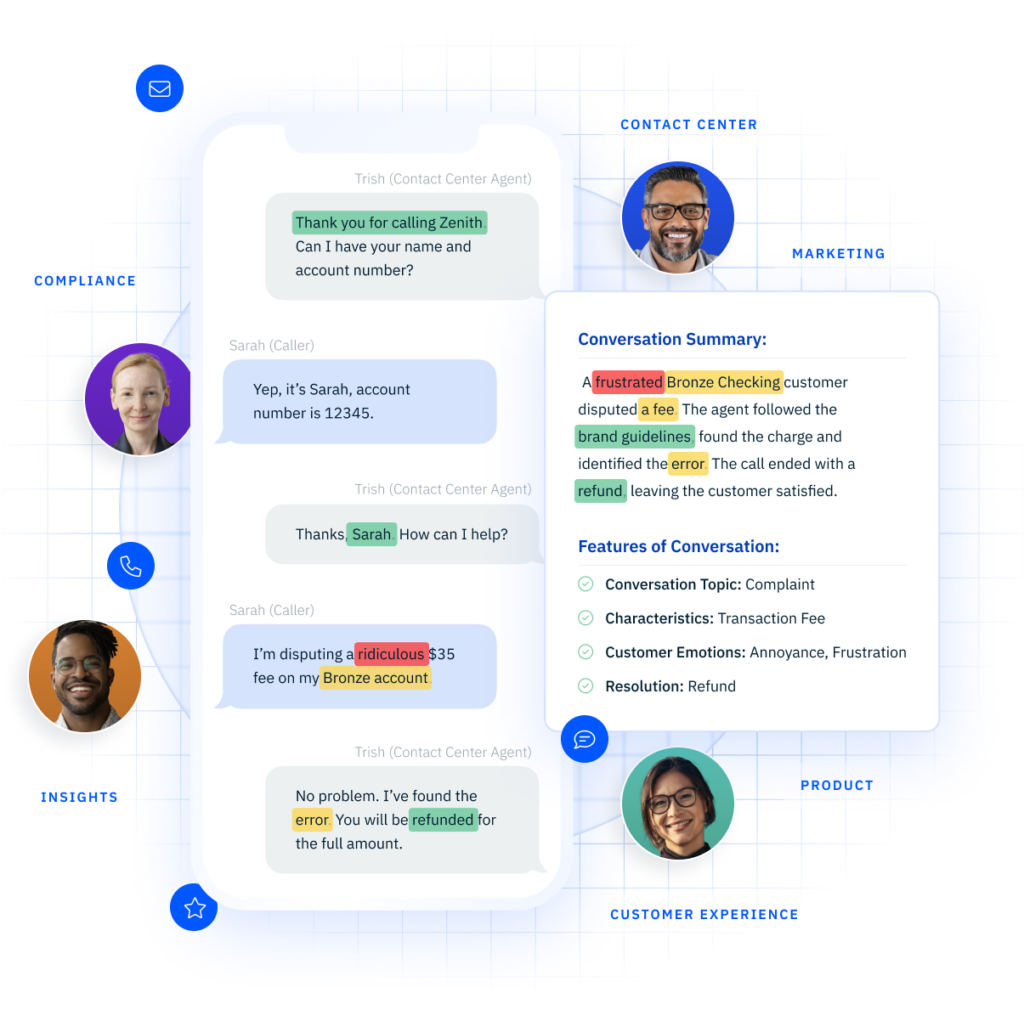

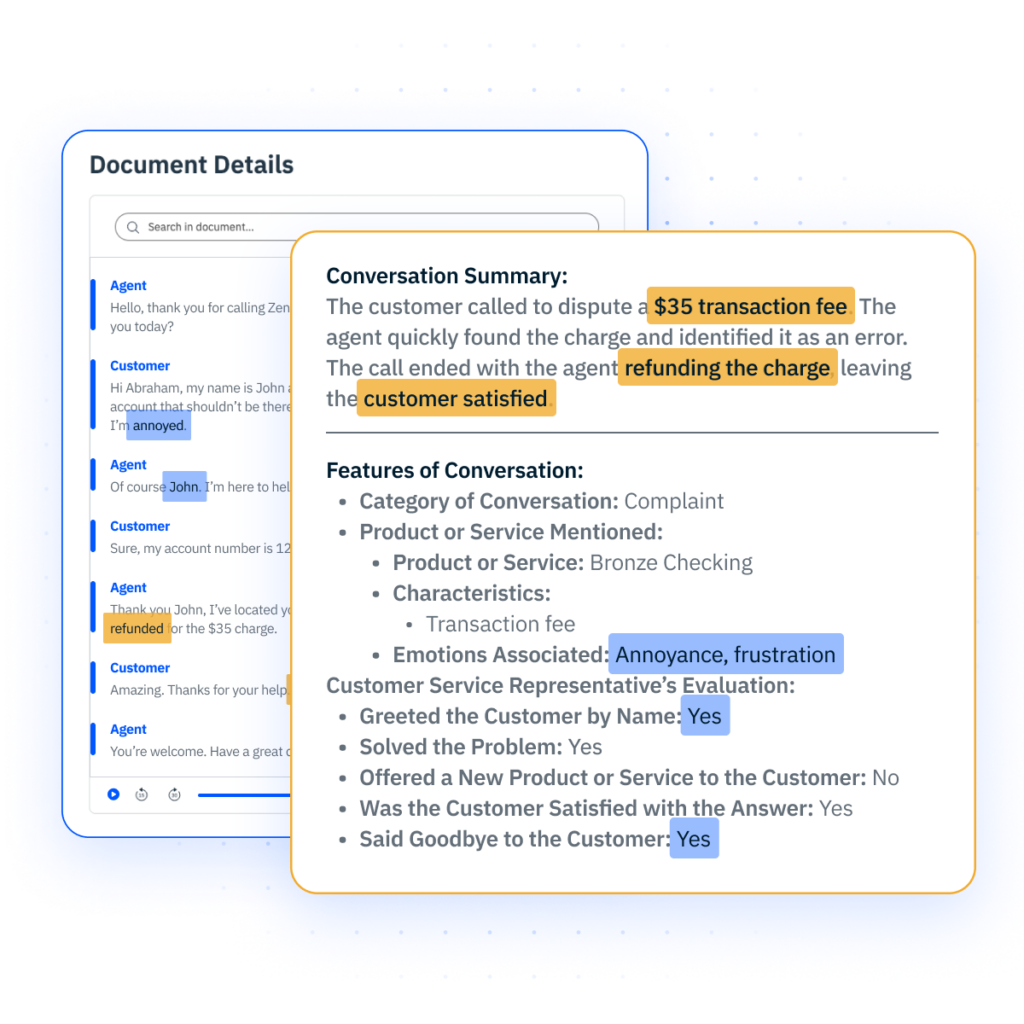

Conversational Intelligence

Transform Every Conversation into a Catalyst for Customer and Business Account Loyalty

From interacting with chatbots, to researching loan options, to calling into your contact center—there are virtually as many methods for consumers to interact with your brand as there are reasons to.

AI-Driven Text Analytics to Surface Speaker-Specific Insights

Scorecards and AI-generated snapshot reports give agents the ability to self coach, make immediate adjustments, and reduce training team and resourcing needs.

Reduce Cost to ServePreempt Call Volume Increases

Nip volume spikes in the bud by gaining a holistic view of customer issues from every channel, and share insights with your counterparts in product, marketing, services and more.

Automate Quality Assurance at Scale

Stop manually reviewing every single call. With InMoment, Quality Assurance can be automated at the individual call or aggregate level so you can focus on solving quality issues, and not searching for them.

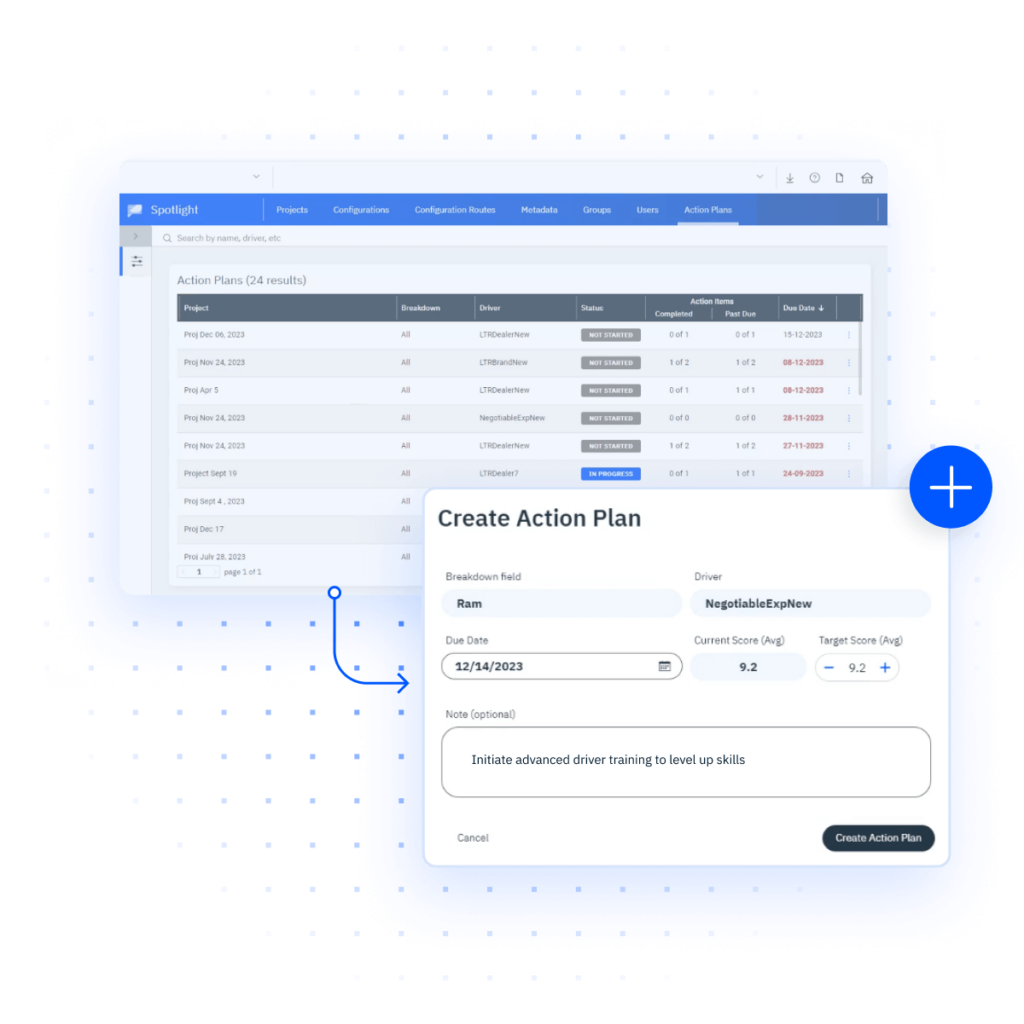

Predict the Impact of Improvements

Identify drivers of customer experience, and see how proposed improvements translate to CSAT, NPS, Effort—and of course, the bottom line. By leveraging predictive modeling, financial institutions can anticipate customer needs and proactively address potential issues before they escalate.

Change Region

Selecting a different region will change the language and content of inmoment.com