Credit Union Reputation Management: Why It’s Key for Member Trust and Satisfaction

Credit union reputation management is the process of listening to members and analyzing their feedback to build experiences that encourage positive reviews. It helps credit unions establish themselves as trustworthy and reliable financial institutions.

Credit unions are significantly reliant on the trust of their members for success. Their community-centric nature encourages prospects to value public opinion when making a decision. This is true for financial institutions in general, with almost 90% of consumers using online reviews to make banking decisions. Focusing on credit union reputation management is crucial for building trust with existing and potential members.

Why Is Reputation Management Important for Credit Unions?

- Attracting New Members

- Member Loyalty

- Competitive Advantage

- Crisis Management

Credit unions are member-driven financial cooperatives. As a result, their success relies on the trust their members place in them. The online space, especially in the form of social media and review sites, amplifies public opinion. One bad experience with your credit union leads to a negative review that can be enough to turn away many potential members.

In fact, 49% of consumers trust online reviews as much as personal recommendations. Here are four key reasons why online reputation management for credit unions is important:

Attracting New Members

Your credit union’s online reputation is a major deciding factor for prospective members. A positive reputation encourages new memberships by highlighting your reliability and value. Meanwhile, negative reviews and testimonials make it easy for potential members to consider other options.

Member Loyalty

Existing members are more likely to remain loyal to a credit union they trust. Reputation management efforts ensure you make your members feel heard and valued. This member-centric approach helps build stronger relationships and improves retention rates.

Competitive Advantage

The reality is that you are competing not just with other unions but also with larger banks. A positive reputation highlights the unique benefits your credit union offers to members.

For example, glowing online reviews will likely convince individuals to choose your member-first approach over traditional banking. With customer feedback influencing decision-making, a strong reputation is your key to standing out in a competitive space.

Crisis Management

Online complaints about your financial institution can quickly escalate and damage your reputation. With community ties playing a pivotal role in your institution, a single negative experience can spread like wildfire online.

Proactive reputation management enables credit unions to navigate crises by monitoring and analyzing member sentiment. A quick and empathetic response is crucial for transforming reputational risks into opportunities to strengthen trust.

What Are the Benefits of Reputation Management for Credit Unions?

Credit union reputation management offers a competitive edge by boosting member trust and loyalty. Key benefits include:

- Improved member retention as a result of quick responses and effective issue resolution.

- Stronger customer loyalty due to increased member satisfaction. For example, closing the feedback loop with a disgruntled member can turn them into a loyal advocate.

- Community ties strengthen as reputation management efforts reinforce positive perceptions and member engagement.

- Competitive edge over financial institutions as a result of consistently high member satisfaction leading to positive brand image.

Why Are Listings and Reputation Management for Credit Unions Important?

- Boost Discoverability

- Enhance Local SEO

- Build Trust

- Drive Member Growth

Digital search is one of the most popular channels for discovering your credit union. Most prospective members are likely to look you up on Google, Bing, or Apple Maps before making a decision. Here are four powerful results you can accomplish with listings management:

Boost Discoverability

Prospective members often rely on online searches to find nearby credit unions. Maintain accurate listings on platforms like Google, Yelp, and Apple Maps. This ensures your credit union appears in search results with correct contact details, work hours, and locations. As a result, you boost your visibility, making it easier for potential members to find and trust you.

Enhance Local SEO

Accurate listings improve your local SEO, which helps attract more members. Start by understanding your local audience, including pain points and preferences. Incorporate relevant keywords in your listings to boost visibility in search results. Track SEO performance by monitoring changes in local rankings. The insights will help you adjust your strategy and target the right individuals.

Build Trust

Consistency across online listings and your website strengthens trust. For example, conflicting information about your hours or address can frustrate potential members. This negative sentiment can impact your market share as members flock to competitors. Listings management prevents such confusion by ensuring accurate and complete business information.

Drive Member Growth

Credit unions with accurate listings and strong reputations see higher engagement and membership growth. For example, a member searching for “credit union with great loan rates” will likely choose an institution with glowing reviews over one with unresolved complaints or poor online visibility.

How to Improve Your Credit Union’s Online Reputation?

- Understand Your Target Audience

- Encourage Member Reviews

- Monitor and Respond to Feedback

- Analyze Competitors

- Invest in Reputation Management Software

Understand Your Target Audience

It’s essential to understand your target audience profiles to improve your chances of engaging them. For example, if you want to target younger members, a good practice would be to enhance your social media presence. You can even identify and use viral trends to better connect with such members.

Active engagement with current and potential members will help you tailor your marketing efforts. Use a social listening tool like InMoment to track and analyze online conversations around credit unions. The insights will help you understand specific pain points that you can solve to engage your target audience. It also helps you customize your outreach efforts, establishing your brand as reliable and trustworthy.

Encourage Member Reviews

Positive reviews influence potential members by highlighting you as a credible organization. 88% of both millennial and Gen-Z consumers rely on online reviews when evaluating a financial product or institution.

Therefore, it’s important to improve your members’ experiences and encourage them to leave positive reviews online. The authentic voice of a satisfied member can be enough to build trust with prospects.

Monitor and Respond to Feedback

Implement a member feedback loop by monitoring and responding to feedback. Responding to both positive and negative reviews enhances your reputation by showing members you care.

Leverage survey requests and online mentions of your credit union to collect feedback. InMoment’s XI platform is an excellent tool for connecting member feedback from various channels and analyzing it for insights. Its automated alerts feature is especially useful for quickly identifying and responding to a member review. Quick and effective responses help close feedback loops and enhance member satisfaction.

Analyze Competitors

Monitoring competitors’ online reputations can help you identify market gaps and differentiate your offerings. For example, let’s say your competitor is facing complaints about limited branch hours. You could take advantage of this opportunity by highlighting your 24/7 digital banking options in your marketing.

Pay attention to what members appreciate or criticize about other credit unions. Use this information to improve your services and position yourself as a better alternative. This approach will help establish your service as a reliable alternative and increase your market share.

Invest in Reputation Management Software

Collecting, analyzing, and responding to member reviews is an essential but tedious process. A good reputation management platform can streamline these processes for you. InMoment’s industry-recognized review management software helps you track each piece of incoming feedback for effective monitoring and analysis. It provides actionable insights for your credit union so that you can invest more time in managing member relationships.

Reputation Management Tools for Credit Unions

- InMoment

- Rize Reviews

- Hootsuite

- Brandwatch

- MemberXP

With many options to choose from, selecting the right reputation management tool can be a daunting task. In this section, we have rounded up the five best tools to help you narrow your focus and make an informed decision.

InMoment

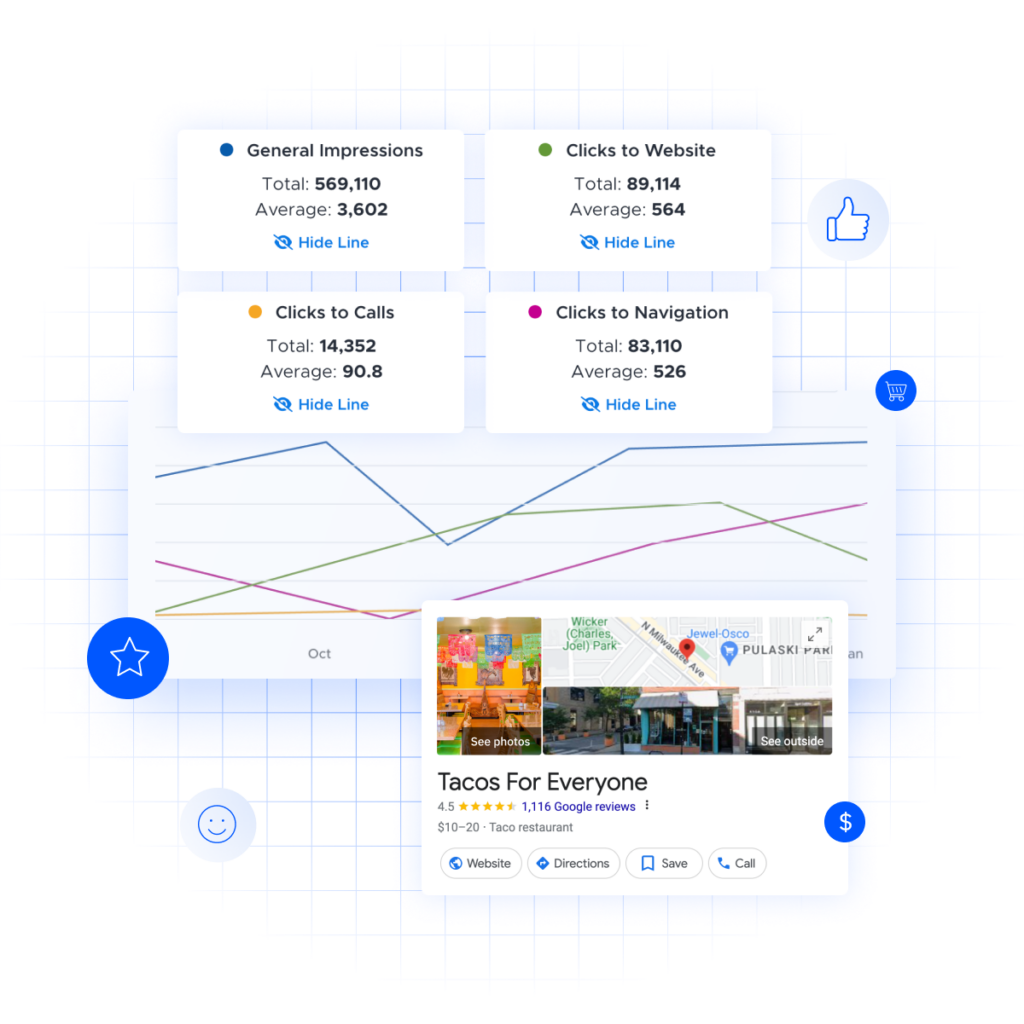

InMoment provides reputation management solutions for credit unions looking to dominate local search. It allows financial institutions to monitor and connect customer reviews from various channels, including social media and review sites.

With its response automation feature, you can leverage generative AI to provide quick and helpful responses. This enables you to implement and close feedback loops with members. Beyond collecting feedback, you can use InMoment’s AI-enabled analytics to better understand member sentiment and behavior. The insights you gain from this analysis help you identify areas for improvement and address market gaps.

Boosting your local search rank is essential for visibility. The platform’s local listings management software provides ROI-specific insights from your Google or Apple Maps listings. This information helps you outrank competitors and enhance your online presence without increasing ad spend.

Fill out the calculator below to see the return on investment you could get from utilizing InMoment’s reputation management tools:

Rize Reviews

Rize Reviews simplifies the process of acquiring reviews to manage your online reputation. Key features include automated review requests, real-time feedback alerts, and a centralized dashboard for managing reviews. These features help credit unions improve their search rankings with high-quality reviews.

Hootsuite

Hootsuite is a review tracking and analysis tool that helps credit unions understand conversations around their services. Its InMoment integration lets financial institutions monitor reviews on a dashboard for effective responses. The integration is also useful for filtering out the best reviews and highlighting them for reputation enhancement.

Brandwatch

Brandwatch enables real-time monitoring of brand mentions across social media and online review sites. Its analytics and reporting features are useful for gaining insight into member behavior and sharing them with stakeholders.

MemberXP

MemberXP is an experience management platform that focuses on feedback collection and analysis. It enables real-time review monitoring to help credit unions provide immediate responses. The platform also provides competitor insights highlighting how organizations compare to other credit unions.

Improve Your Credit Union’s Reputation with InMoment

Credit unions thrive on a positive online reputation that strengthens member relationships. Building trust is key, which is why you need reputation management to highlight your credibility to members and prospects. InMoment’s XI platform makes it easy to establish trust by tracking, analyzing, and acting on member feedback. Schedule a reputation management demo today to see how you can get started!

References

The Financial Brand. How Much Do Online Reviews Matter to Banking Decisions? A Whole Lot. (https://thefinancialbrand.com/news/customer-experience-banking/how-much-do-online-reviews-matter-to-banking-decisions-a-whole-lot-178414). Accessed on 12/04/2024.

Forbes. Online Review Trends Affecting Today’s Consumers (https://www.forbes.com/councils/forbesbusinesscouncil/2024/02/08/online-review-trends-affecting-todays-consumers). Accessed on 12/04/2024.