Online Reputation Management

Turn Ratings and Reviews into Revenue

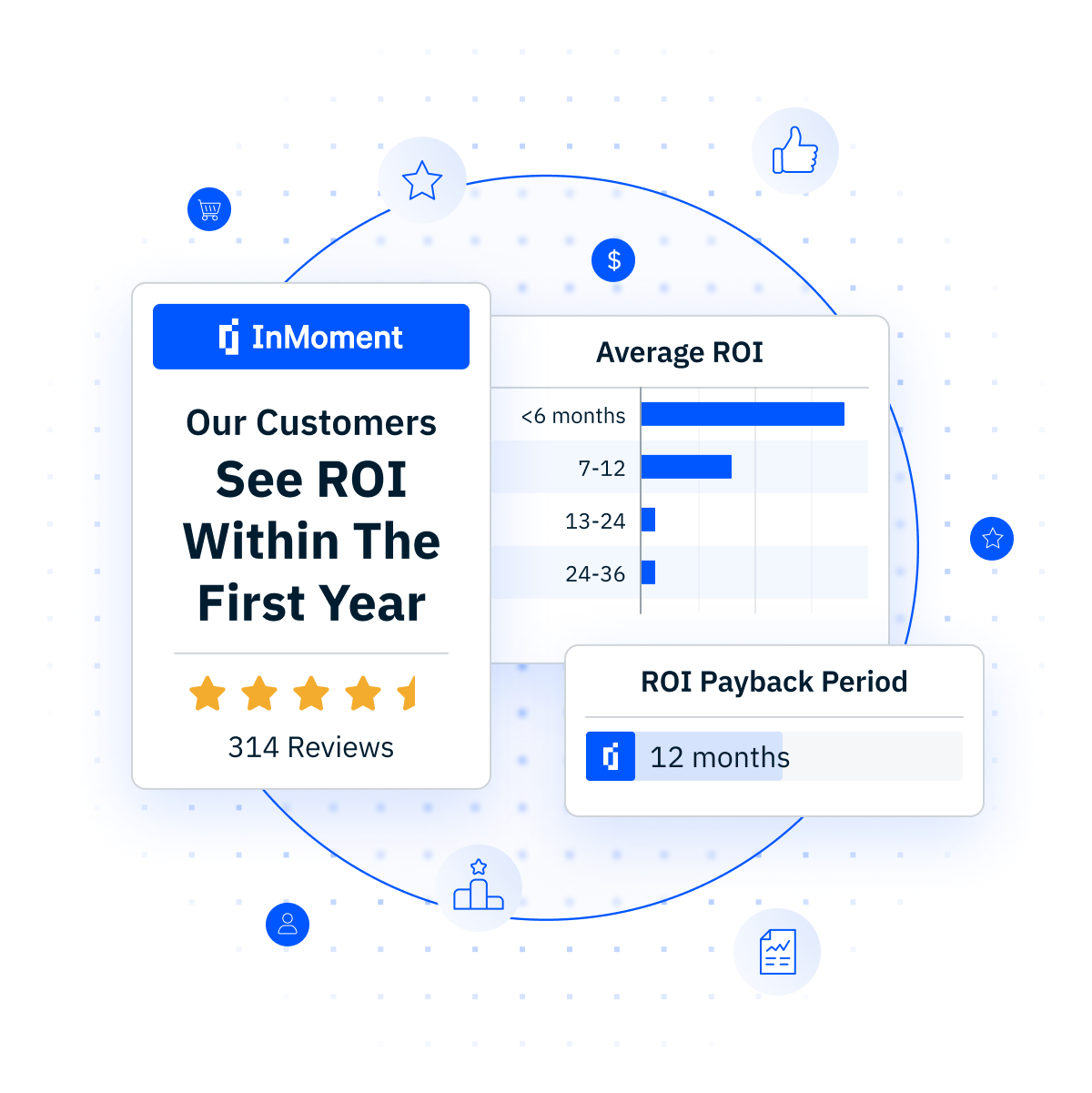

Build your brand reputation, convert online searches into location visits, and transform customers into raving fans – achieving ROI in half the time as your current solution.

Benefits of InMoment’s Reputation Management Software

We help you monitor and improve your online presence by tracking reviews and ratings. Our reputation management solution lets you respond quickly to customer concerns, maintain a positive brand image, and make data-driven decisions to enhance customer satisfaction and loyalty.

Increase brand reputation with more positive reviews and higher ratings.

Close the loop in-channel with your customers across the web.

Improve location performance and drive more foot traffic.

Outperform the competition with insights from their performance.

Dominate local search results with accurate and optimized business listings.

Increase Location Performance

Measure and Boost ROI Using a Single Score

InMoment’s Performance Scoring quantifies the ROI of your reputation management efforts. Our Industry Score, backed by data and research, links to the views businesses get on Google Profile to help you drive more location visits. We understand every business measures success differently – our Target Score lets you tailor metrics and weightings to reflect your unique goals and drive meaningful results.

Get Your Local Reputation KPIs Report

MAXIMIZE ORGANIC PIPELINE AND SALES

Measure and Improve Conversions From Your Google Listings

Extract ROI-focused insights from Google Maps listings, including impressions, website, call, and navigation clicks, and show the impact of your reputation management and customer experience initiatives. Use this intelligence to continuously increase brand awareness, organic pipeline, and sales, and drive store visits by effectively managing listings.

Learn MoreGET MORE REVIEWS WITH AUTOMATED WORKFLOWS

Make Online Reputation Your Acquisition Strategy

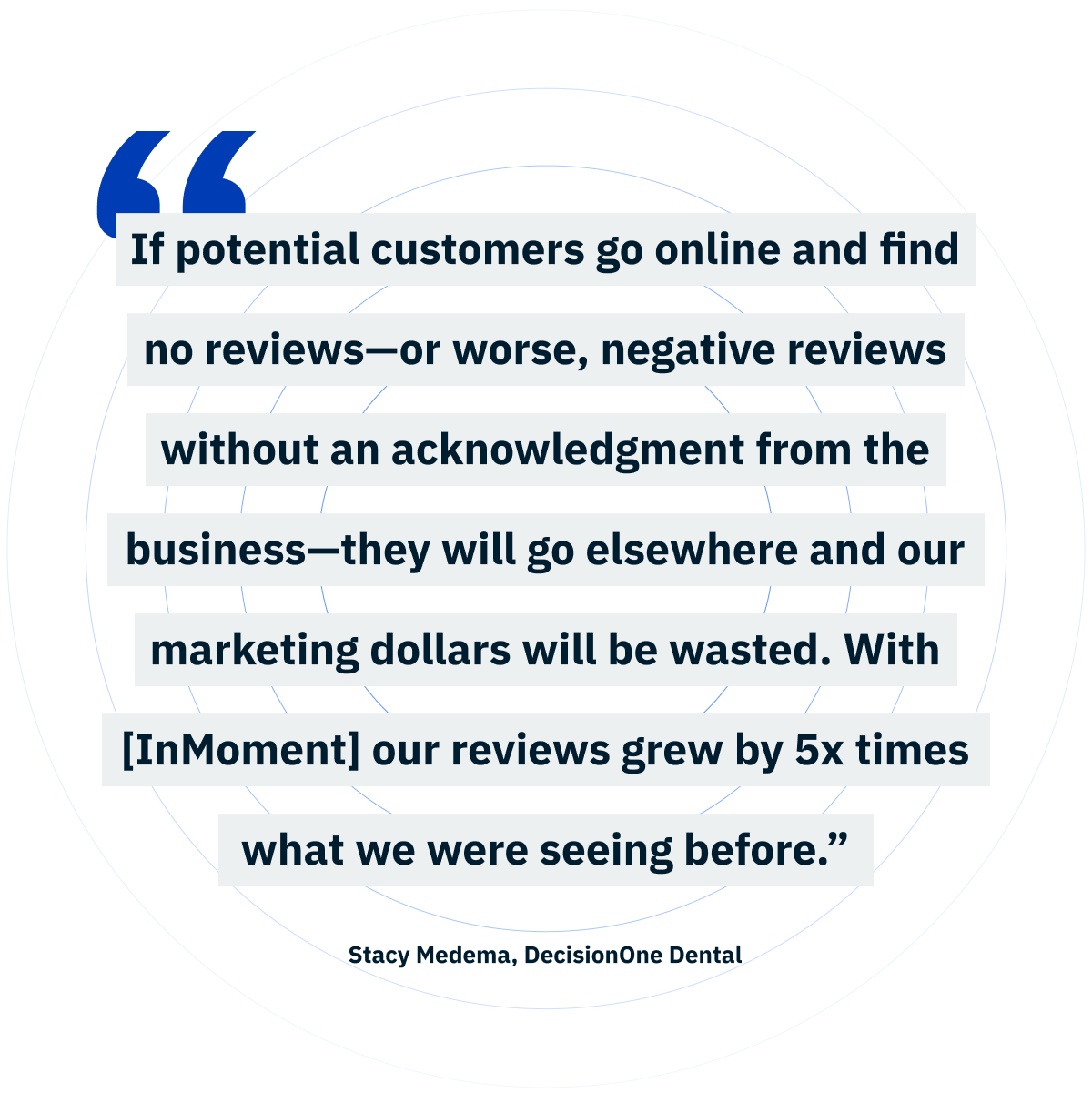

Monitor reviews and ratings across 100+ sources, and never miss a new review with immediate alerts. Get more high-quality, positive reviews and increase your ratings with automated review requests via hundreds of direct integrations with platforms like Salesforce and HubSpot. Amplify happy voices on the web pages where customers convert to foster trust and increase sales.

See It in Action

LEVERAGE AI TO CLOSE THE LOOP

Engage With Customers 7x Faster to Improve Retention

Show your customers you care about their experiences by proactively responding to their reviews in the same channel where they’re delivered. Generative AI technology analyzes review sentiment, understands nuances, and suggests meaningful responses that make your customers feel heard and validated and want to return.

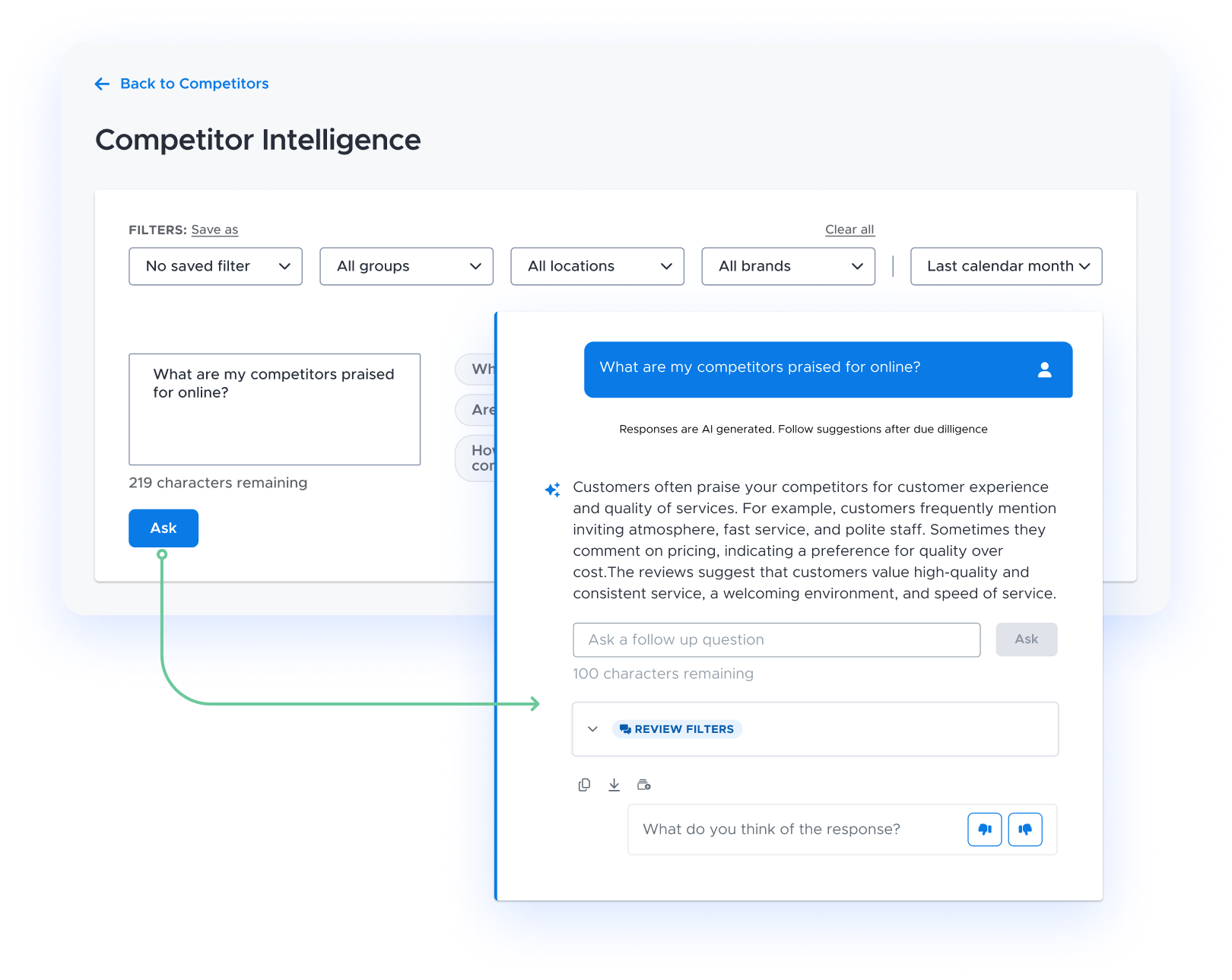

Try It OutANSWER QUESTIONS ABOUT YOUR COMPETITION IN SECONDS

Outpace the Competition and Increase Your Market Share

Go beyond generic competitor highlights into conversational AI-driven insights and leverage benchmarks to gain competitive advantage. See how you stack up in local search and boost your search visibility in crowded markets. Combine competitor reviews with your experience data to understand how your brand compares and build strategies to capitalize on your strengths for the long term.

Learn More

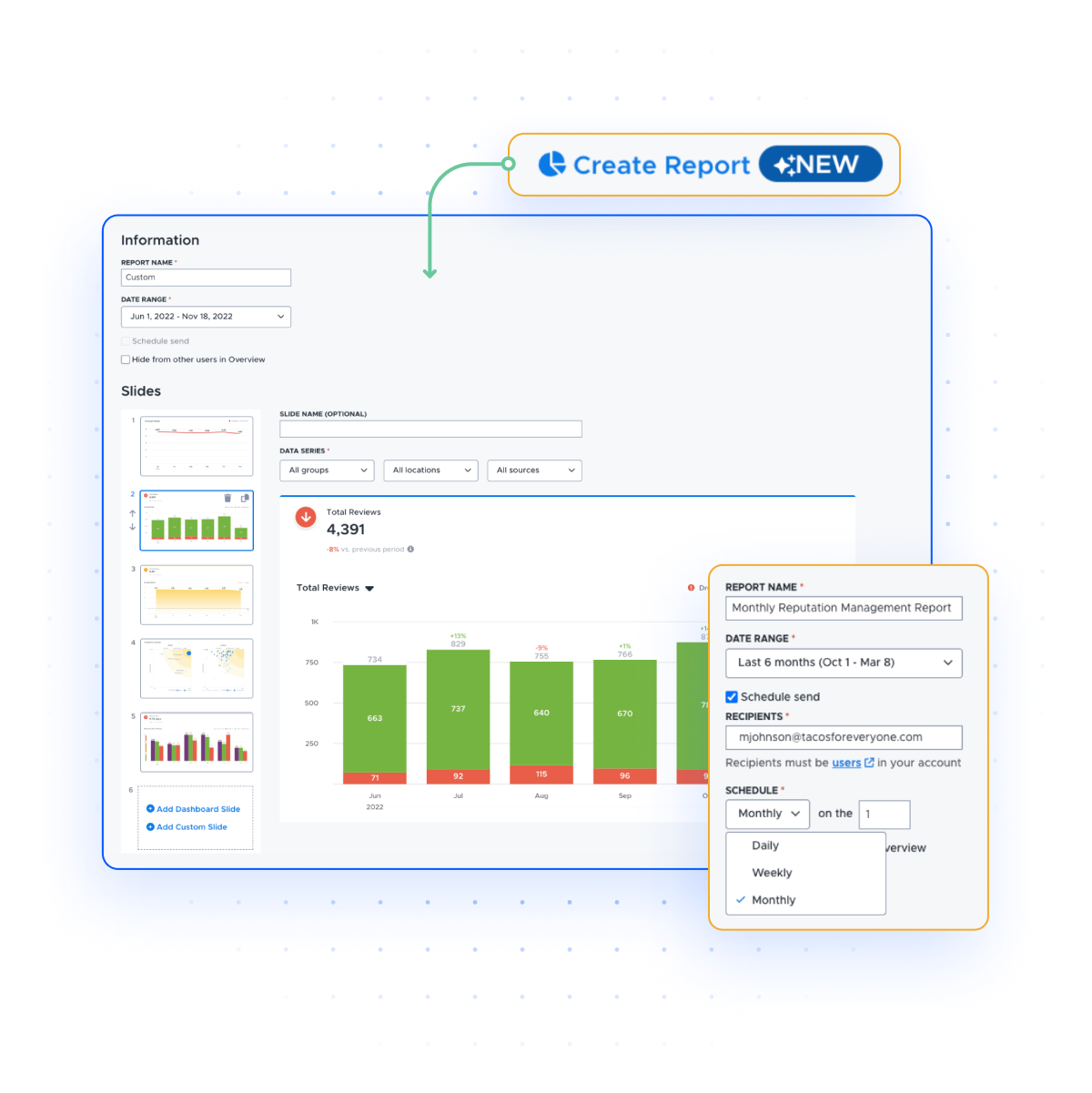

Reporting for All Company Sizes

Simplify Complex Data and Distribute Across Stakeholders

Easily build, schedule, and customize reports based on stakeholders’ interests and empower data-driven decision-making across your entire organization. Take smarter actions for continuous improvement with presentable, slide-based reports that visualize key insights from your online presence and brand performance.

Take a Sneak PeakREPUTATION MANAGEMENT SERVICES

Watch Your Customer Base Grow and Loyalty Strengthen

Let us handle your reviews while you focus on what matters the most – your customers. InMoment’s team of reputation management experts will deliver prompt and consistent review responses and make your customers feel heard and validated. We’ll also continuously launch review solicitation campaigns to help you boost your online reputation and sales.

Discover Our Managed Services

COMPLETE THE CUSTOMER PUZZLE

Combine Reviews With Omnichannel Feedback

Embed online reviews alongside your experience data to gain the full spectrum of the customer’s voice. Other reputation management solutions, limit you to reviews and short-form feedback signals. With InMoment, you can combine experience data in every format, at every stage of the customer journey, and extract richer insights that drive smarter actions for the most impactful business outcomes.

Experience The DifferenceA Leader in Reputation Management

InMoment is proud to be a leader in enterprise reputation management and prominently featured in the “Leaders” quadrant for Experience Management Software.

Common Reputation Management FAQs

What is a reputation management software?

Reputation management software is a tool that helps businesses monitor, manage, and improve their online reputation by collecting customer reviews, ratings, and other feedback from various platforms and review sites. It provides insights into how the brand is perceived and typically includes features such as review monitoring, asking and responding to reviews, sentiment analysis, alerts, listings management, and competitor intel. These features allow businesses to maintain a positive reputation and quickly address customer concerns.

How can reputation management software help my business?

Reputation management software can directly impact your business’s ROI by increasing customer trust and boosting your brand’s online visibility. By promptly addressing negative feedback and engaging with positive reviews, you foster stronger customer relationships, which leads to higher retention rates and increased lifetime value. Positive reviews and improved ratings can attract new customers, lowering customer acquisition costs. The insights gained from customer sentiment analysis help refine your offerings, reduce churn, and improve product-market fit. All these factors contribute to increased sales, greater customer loyalty, and a measurable improvement in ROI.

How much does reputation management software cost?

The cost of a reputation management tool typically varies based on features and scale, ranging from low-cost options to thousands of dollars per month. InMoment makes it simple for customers by offering location-based pricing and access to a comprehensive suite of reputation management tools, ensuring businesses of all sizes can benefit. Investing in reputation management can yield significant returns through improved brand credibility, customer loyalty, and ultimately, revenue growth.

How long does it take to implement reputation management software?

Most InMoment customers can start using our reputation management software within days of signing up. Companies with more advanced needs may require additional time for customization, employee training, and data migration. However, our tool is designed for quick onboarding, offering a user-friendly interface to streamline the process and get you started within days.

Can reputation management software intercept bad reviews?

Intercepting or manipulating bad reviews, often known as review gating, is against the policies of many platforms like Google and can result in penalties or account suspension. Instead of filtering out negative feedback, our software empowers you to address bad reviews promptly and transparently. By responding quickly, you demonstrate to potential customers that your business is attentive and committed to resolving issues, which fosters trust. Attempting to hide or gate bad reviews makes all your reviews appear inauthentic, raising doubts about your brand’s credibility. Our software helps you identify recurring customer experience issues, offering actionable insights to improve your service and reduce the likelihood of negative reviews in the future.