Retail Auto: Client Loyalty is not Dead, But Client Follow-Up is!

You’ll never see a dealership Google image that isn’t like the one above—a smiling couple, seemingly happy with their experience of buying a vehicle. But are car buyers really that happy with the sales experience they receive, or happy to have it behind them?

Are they still smiling with the dealership experience after the initial sell? Did the sales staff properly introduce them to the next phase of their dealership customer journey, the service center? Was their “service experience” with free maintenance and warranty work after, well delivered? Did the follow-up experience after the sale consist of the typical, but dated, dealership follow up email of “congratulations” and maybe even a birthday card before they were receiving “pitches” for their next vehicle purchase?

Ask most any dealer principal or general manager and they’ll tell you that customer retention is front and center on their list of priorities. But with many dealers, when you measure the dollars formally allocated towards customer retention, those numbers are usually nowhere to be found.

Where are the Customer Experience Dollars?

As Customer Experience Manager for a large automotive dealer, I was fortunate enough to be invited to weekly advertising meetings between our leadership and ad agency. The purpose was to discuss what worked, what didn’t work and what was ahead.

But never, in all those weekly meetings, over almost three years of attending, did I ever witness one discussion about retaining past customers. There was time spent discussing community events, but no time spent on a formalized strategy for retention.

What was discussed? Facebook, YouTube, Snapchat, Pandora, Instagram, television, radio, on-site remotes, and even newspaper to the tune of tens of thousands of dollars spent each month on “getting them” and not one formal dollar designated for “keeping them”.

It is assumed in far too many dealerships that a respectable majority of past buyers will return because of the warranty or the free first maintenance offered by the manufacture. But after that, at roughly three years for leases and five to seven years for vehicle purchases, research reveals they begin to go elsewhere for service, mainly to an independent repair shop or franchise.

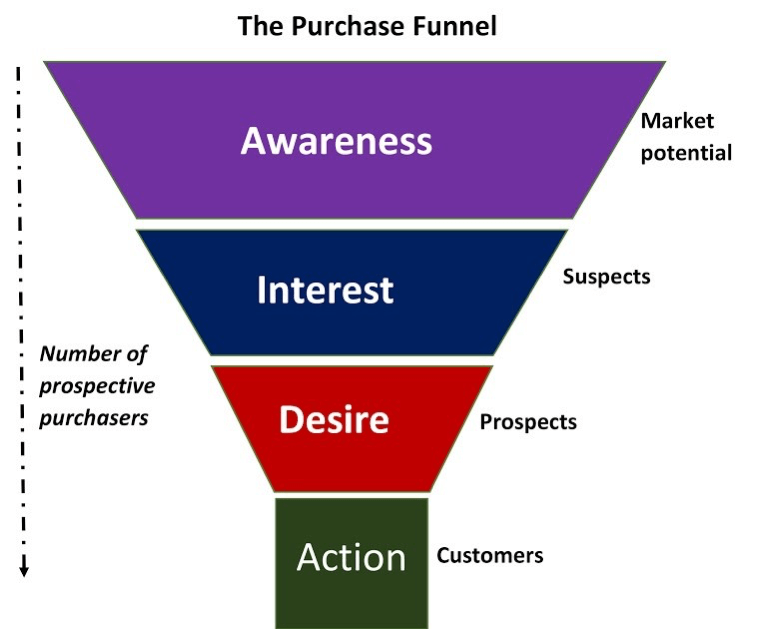

The Typical Dealership Sales Model

The sales funnel has been used in retail auto for decades, but where is the “retention” part of the model? Many dealers would answer that they have their have their own rewards program for retention, but is it a rewards program that provides surprise and delight on a continual basis? Or like most dealer rewards programs that only apply discounts on products and services? What’s surprising and delightful about that?! Will that be enough reason for the client to return if the previous sales or service was poor?

Candidly, most dealer “experiences” are transactional. And when the showroom sale is completed, and the vehicle is delivered to the customer, most of the focus is on the next prospect (new prospect generated by ad dollars). Dealership retention efforts are mainly focused on the experience of buying and servicing the car, but will that top-of-mind awareness remain in the vehicle owner’s mind three years later when the lease is up? Will it trigger an initial contact with that car buyer to return to that same store five to seven years later when the vehicle owner starts a new car search?

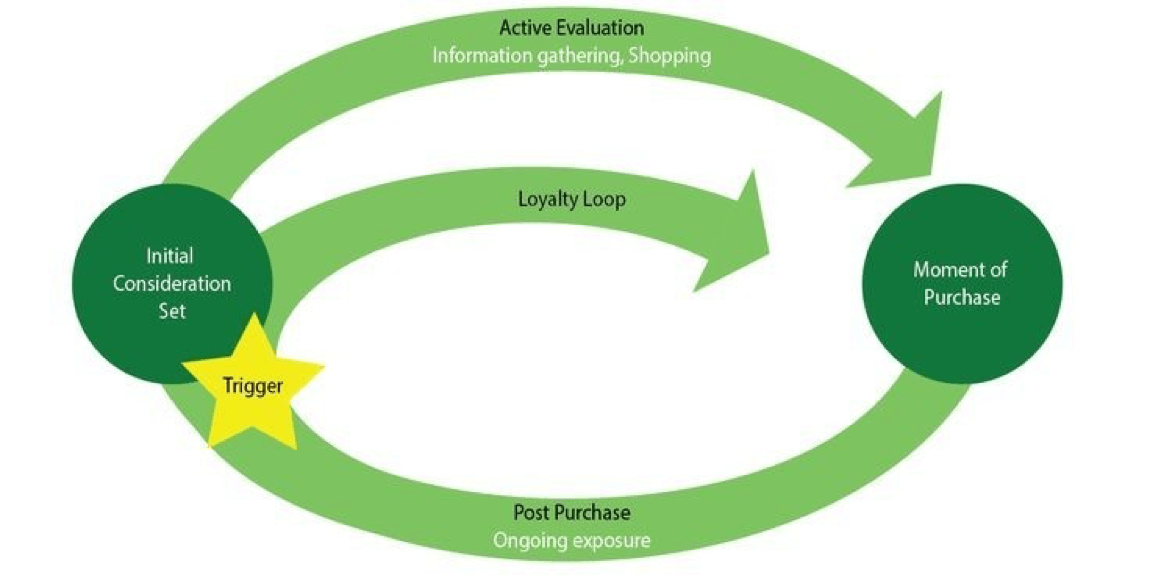

The Loyalty Loop: an inclusive model for sales and retention

Photo Credit:McKinsey

Where is “the funnel” for client retention? Where is a formalized model for dealer retention of past customers? The Loyalty Loop was developed by Mckinsey and Company, a top consulting company used by many of the country’s top companies. But look how it focuses on a loyalty loop inside the traditional sales model. That inside loop consists of what the customer experiences with the dealer between car purchases.

While rewards programs are better than nothing, those rewards are not what I would call surprise and delight. They also offer discounts that involve coming to the dealership. Even though we know that vehicle owners are usually not surprised and delighted to return to the dealer for most anything.

Here’s an example of surprise and delight. Some dealers give FREE car washes as a retention tool. All the owner needs to do is come to the service lane to redeem it. But most customers don’t want to come to the dealer for anything. How about this, give them a free “mobile” car wash. Now that’s surprise and delight!

The Ownership Retention Gap

Consider these NADA statistics with respect to the retention of previously sold customers:

- Dealers spent an average of $7.00 on retaining their already sold customers (2017)

- Luxury dealers spent an average of $762.00 on each vehicle sold, non-luxury spent $670.00 (2017)

- Average gross on referral vehicle sales was $1,200.00 vs $817.00 for fresh “ups”

- Referrals have a 51% service usage vs 29% for fresh ups

- Referrals have a 96% CSI score vs 73% for fresh ups

What’s is wrong with this picture? Far too many dealerships are ignoring their past customers who would be more loyal, produce more gross per vehicle, send referrals, deliver higher CSI scores and use their dealer service center more often than “newsuspects” who consume most all of the monthly ad budget for dealers.

We’ll expand on this topic in our next post.