Creating and executing the perfect survey that avoids obtaining misleading feedback can be tricky business. To be successful, you’ve got to watch out for inaccurate data such as sampling bias, framing bias, and most importantly, response bias.

What is Response Bias?

Response bias is our human tendency to self-report inaccurate (or even false) answers to survey questions. For example, if someone asks you how much you exercise, you might be inclined to say four times a week, even if the answer is two.

It doesn’t matter if it’s intentional or accidental—if humans are inaccurately reporting on their experiences, this false information can negatively affect the data gathered from your survey. Unfortunately, if you aren’t getting accurate data from your surveys because of response bias, you can’t rely on it to improve experiences for your customers and employees.

How Common Is Response Bias?

Response bias can occur to varying degrees in almost any survey or study involving human participants. Its occurrence depends on several factors, including the nature of the questions asked, the survey methodology used, the characteristics of the sample population, and the efforts made to minimize bias.

In some cases, response bias may be minimal, especially if researchers take proactive steps to mitigate it, such as ensuring anonymity, using randomized sampling, and designing neutral survey questions. However, in other cases, response bias can be more pronounced, particularly if the survey topic is sensitive or if participants have strong opinions or motivations that influence their responses.

It’s essential to recognize that while response bias can never be eliminated, but researchers can take steps to minimize its impact. By employing best practices in survey design, sampling, and data analysis, researchers can reduce the likelihood of response bias and improve the accuracy and reliability of their findings.

Can A High Response Rate Decrease Response Bias?

A high response rate doesn’t necessarily guarantee a decrease in response bias, although it can help mitigate certain types of bias.

When a survey achieves a high response rate, it generally means that a larger proportion of the target population has participated. This can reduce voluntary bias, as a more representative sample of the population is likely to have been captured. However, even with a high response rate, other forms of response bias, such as social desirability bias or acquiescence bias, may still be present if respondents provide inaccurate or misleading answers.

To reduce response bias effectively, researchers should focus on employing strategies aimed specifically at minimizing bias. While a high response rate can be an indicator of a more representative sample, it’s not a standalone solution for addressing response bias.

What Causes Response Bias?

Response bias can stem from several sources. Respondents may alter their responses to present themselves in a more favorable light or conform to social norms. Similarly, some individuals tend to agree with statements regardless of their content. Both of these things can skew results from a questionnaire.

Can the Wording of A Question Create Response Bias?

Yes, the wording of a question can create response bias. The way a question is phrased can influence how respondents interpret it and, consequently, how they choose to answer.

For example, leading questions that suggest a particular answer or contain biased language can lead respondents to answer in a way that aligns with the wording of the question. An example of this would be the question “Don’t you agree that product X is better than product Y?” This question implies that one product is better than the other, which may lead the respondent to agree.

What Are the Different Types of Response Biases?

According to the experts, there are lots of response biases. Here is an overview of the seven major types of response biases and an example of each.

- Social response bias: This happens when survey respondents overreport on good behaviors and under-report on bad behaviors. Think about it this way—few people will admit they eat 5-6 bars of chocolate per week, so respondents will tend to under-report their chocolate consumption, skewing the data in the process.

- Non-response bias: This happens when a survey sample isn’t representative of the target population. Imagine you’re trying to survey customers who attended a grand opening via email. However, half of the surveys went to the attendees’ spam folder. So, the responses you receive only represent half of the attendees.

- Hostility bias: When you ask survey respondents about unpleasant memories or negative experiences, the responses might become hostile. An example of this is asking emergency room hospital patients how their experience was—they might only remember their pain and suffering.

- Satisficing: Respondents who display this form of response bias are likely to leave questions unanswered or to answer dishonestly. These types of customers are trying to satisfy the task of completing the survey, and typically rushing through questions, instead of carefully reflecting on their experiences and providing valuable feedback.

- Recency bias: This is a psychological phenomenon of simply picking the answer the respondent reads—one of the reasons why it’s so important to randomize choices.

- Wording bias: When it comes to surveys, wording matters. Even something as simple as greeting a customer by name can psychologically influence their responses—they might assume someone is personally reading the survey, and be less likely to provide honest feedback

- Voluntary Bias:Voluntary response bias occurs when individuals choose whether or not to participate in a survey or study, and their decision to participate is influenced by factors related to the topic being studied or their own characteristics.

How to Check for Response Bias

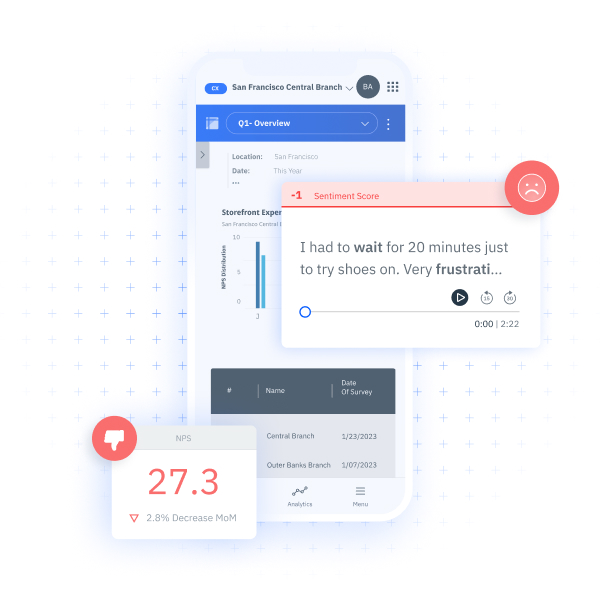

To identify response bias, you will need to cross-reference survey responses with other data. For example, comparing self-reported behaviors with objective measures or official records can reveal inconsistencies.

Another way to identify response bias is by examining response patterns within the survey data that can uncover indications of bias. Trends such as consistently high or low ratings, excessive agreement or disagreement with statements, or patterns related to question order.

How Can CX Leaders Reduce Response Bias?

Now, let’s take a break down some ideas for reducing response bias. Here are some tips from our InMoment experts:

- Understand Your Demographic. This should be the first exercise your brand takes on when designing a survey. Ask yourself who are you surveying, what kind of information are you looking for, and what might be some of the obstacles in the way of an accurate data set. Of course, we recommend running this workshop with an expert in human behavior to make sure you have all your bases covered!

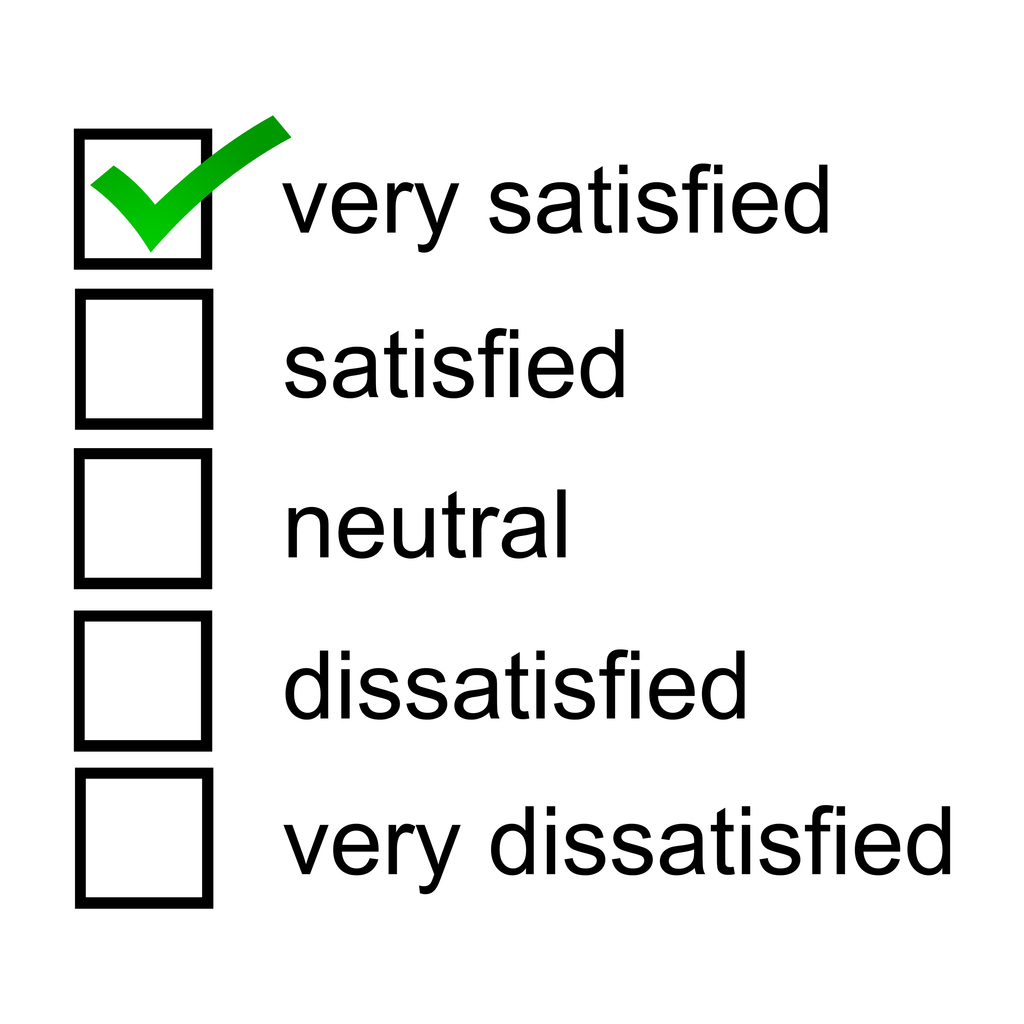

- Diversify Questions. No one likes to fill out a repetitive survey— change up the questions and the formats to keep your respondents engaged. You can swap between a mix of binary response questions (yes or no) with those that offer a range of responses with checkboxes, which will keep the participants’ brains focused on the task at hand instead of zoning out.

- Allow Participants to Say “No.” This is a simple, yet powerful solution to ensure you’re getting accurate data. Allowing participants the power to say “no” or “I’m not sure,” will help you avoid those respondents who don’t have insightful commentary on this particular question.

- Avoid Question-Wording Bias. The best way to avoid this type of bias is to balance the response options between an equal amount of positive and negative options. If you ask a survey respondent a question like, “It’s ok to eat ice cream once a week, right?” This will surely solicit a skewed and biased response.

- Avoid Emotionally Charged Terms. Ideally, surveys are designed with neutral language wherever possible. Adding in active verbs like “smash” or “brutalized” are sure to elicit an emotional response from a participant.

Why You Want to Avoid Response Bias

Avoiding response bias is crucial because it compromises the validity and reliability of survey data, which leads to inaccurate conclusions and potentially misleading insights. Response bias distorts the true representation of the population being studied, as it skews the distribution of responses away from what would be expected in the absence of bias. This undermines the integrity of the research findings and can have serious implications for decision-making based on the survey results.

Is Response Bias a Sampling Error?

Response bias is not classified as a sampling error per se. Sampling error refers to the variability that occurs when a sample is selected from a population rather than surveying the entire population. It is inherent in any sampling process and can be quantified using statistical methods.

Response bias, on the other hand, occurs when the responses from the selected sample do not accurately reflect the true characteristics or opinions of the population due to systematic errors in the data collection process. While both sampling error and response bias can affect the accuracy of survey results, they arise from different sources and may require distinct strategies for mitigation.

How to Minimize Response Bias

Eliminating response bias can be almost impossible. However, some measures can be taken to minimize response bias and ensure that the data you are collecting is as accurate as it can be. Here are some steps you can take to minimize response bias:

- Use randomized sampling techniques: Employing sampling methods such as systematic sampling helps ensure that every member of the population has an equal chance of being selected for the survey. This reduces the likelihood of voluntary bias and ensures that the sample is representative of the population.

- Guarantee anonymity and confidentiality: Assure respondents that their responses will remain confidential and anonymous. This can encourage honesty and reduce social desirability bias, as respondents feel more comfortable providing truthful answers without fear of judgment.

- Use multiple response formats: Incorporate a variety of response formats, such as multiple-choice, open-ended, and Likert scales. Offering different response options allows respondents to choose the format that best reflects their opinions or experiences, reducing the likelihood of response bias.

By implementing these strategies, researchers can help mitigate response bias and improve the quality and reliability of survey data.

Let InMoment Reduce Response for You

At InMoment, we believe the best experience programs are a combination of best-in-class technology + human expertise. And at InMoment, we’ve got both of these covered:

Solution #1: Take Advantage of InMoment’s Best-In-Class Tech

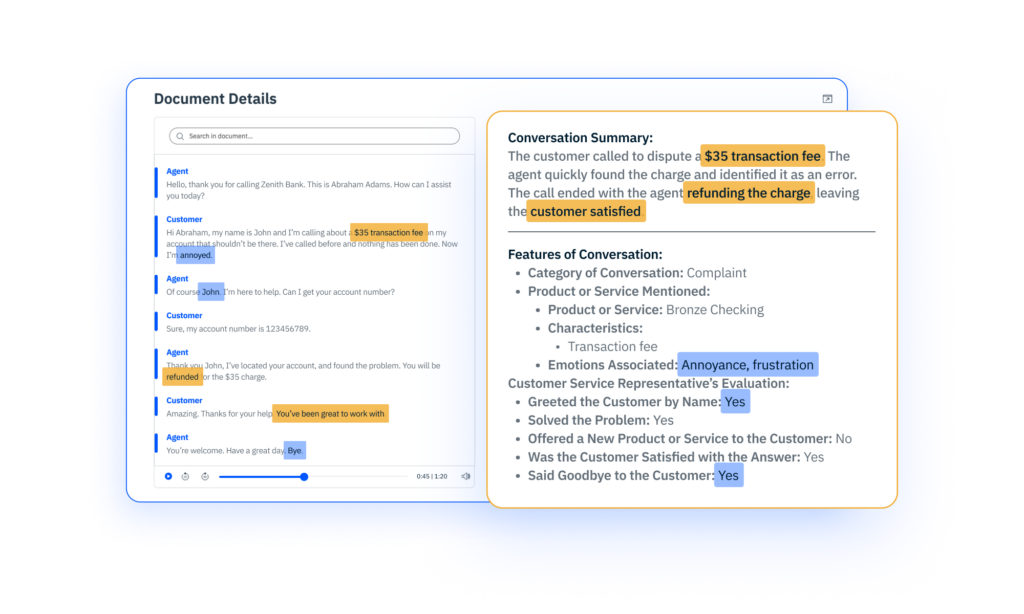

InMoment’s Experience Improvement (XI) Platform is made up of a series of applications to help you design the perfect survey and come up with results that help your business actually improve experiences for customers and employees.

Specifically, InMoment’s patented, AI-powered Active Listening Studio is used to, well, actively listen to survey respondents when they are filling in their answers. The application is designed to encourage rich conversations by listening and responding to customers in real-time, eliciting not only more, but more valuable responses. One example of this is prompting the respondent to “share more.” For instance, if the question is, “Tell me about your experience in-store today,” you can set up parameters and triggers in the Active Listening Studio to ensure the customer provides feedback of 200+ characters.

Wondering what kind of results InMoment clients have seen? Using the Active Listening Studio to revamp its listening, a leading global retailer increased survey response rates by 37% and response length by 38%. This meant more and better customer-sourced guidance for every department across the organization.

Solution #2: Leverage InMoment’s Human Expertise

At this stage in the customer experience landscape, we can’t solve problems using technology alone. True innovation often requires a human touch.

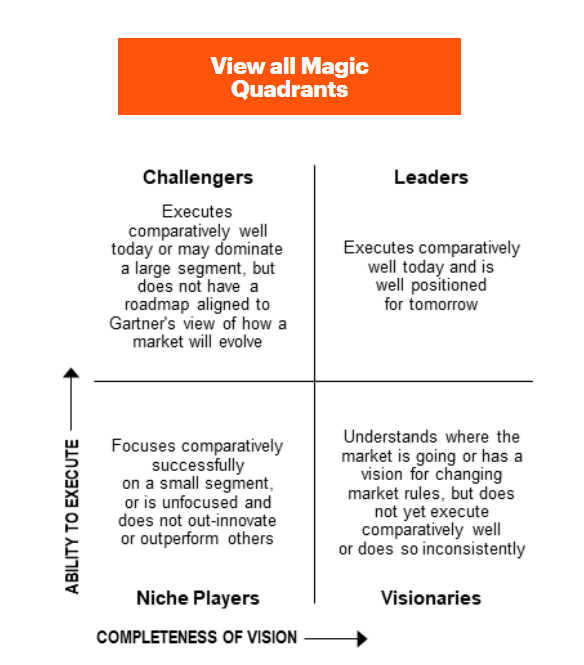

InMoment is made up of lots of people, and some of those are data science experts. Yes, we’re experts in CX, EX, and MX, but more importantly—we’re experts in human behavior. Our data scientist- and PhD-led Strategic Insights team are the best in the business when it comes to helping our clients design and execute surveys without response bias. Don’t take our word for it though! In a recent Forrester Wave report, InMoment was classified as a leader!

Response Bias: A Recap

When it comes to surveys, customer experience practitioners should avoid response bias at all costs. And there are so many types to look out for! Whether it’s hostility bias, recency bias, or non-response bias, all types of bias can skew your data set and affect your overall experience improvement goals. The end result of a survey without response bias is cleaner data, more accurate insights, and a clearer picture of how to improve experiences for customers and employees.

InMoment is here to help you every step of the way with our award-winning customer experience platform that combines best-in-class technology and experts in data science and human behavior.