Recently more and more of our clients are considering adding a significant reward component to their customer experience (CX) programs. This may take place by directly rewarding CX outcomes, or by adding them to an existing reward-based incentive program. Many automotive manufacturers have been using CX outcomes in their reward-based incentive programs for decades.

The insights provided below are based on our experience running the CX component of many of those programs. There’s a lot to think about if you are considering combining reward or compensation components with your CX program.

Your program will come under much more scrutiny and participants will care much more about it. Participants, especially those who do not achieve the reward, may also

challenge your program. This is why the process of setting, communicating, and enforcing program rules (i.e., program governance) becomes very important.

For the purposes of clarity, in the descriptions below we are going to use a typical example of a customer experience program that is run by a company to obtain feedback about experiences across its retailers (i.e., the reward program participants). However, when we refer to “retailers,” they could be any customer-facing program participants like franchise locations, bank branch managers, insurance agents, hotel managers, etc.

Consider What You Want to Accomplish

Adding a successful reward component to a program involves making many decisions about how to structure your program, that will ultimately determine its success. Before you begin making these decisions, it is important to clearly articulate (ideally in writing) what you hope to accomplish. For example:

- What kinds of behaviors are you trying to change, and in whom?

- Are you looking to reward people whose feedback indicates they are doing an exceptional job?

- Are you hoping to nudge low-performing retailers to begin focusing more on customer experience?

- Do you just want to incentivize people to keep doing what they’re doing?

Most programs we’ve encountered are set up to award the majority of retailers, both for marketing and retailer improvement purposes. However, due to budgets, there is a trade-off between the number of retailers you can reward and the size of the rewards you can give.

This is just one example of why it’s important to have alignment on the purpose of your program up front, so that the goals you set, metrics you collect, rewards you give, etc. can be strategically chosen to bring about the specific impact you want.

Qualification Criteria

Once you know what you want to accomplish with your program, you’ll want to decide what criteria need to be met for a retailer to qualify for consideration for the reward. There several factors that should be considered:

Pre-qualifiers: Some programs set criteria for a retailer to be eligible for reward consideration, no matter what their score. These criteria may be financial-based (e.g., minimum sales) or CX program-based.

For instance, if the retailers in the program are the source of the customer contact information, the percentage of provided sample with valid email addresses (i.e., data cleanliness) and/or the overall percentage of customers with valid email addresses (i.e., data coverage) are often used as pre-qualification criteria.

This encourages retailers to collect and report email contact information to be used for surveying purposes. Other pre-qualifiers can include retailers having completed training and other activities that contribute to the delivery of exceptional customer experiences.

Number of Returns: You will need a reliable and valid measure of customer experience upon which to base your rewards. To have enough surveys responses to produce a valid score, the general rule is 1000 is great, 100 is good, 30 is acceptable, and anything below that is questionable.

However, even when using 30 as the minimum responses needed, problems often occur because each retail unit needs to have that number of returns in the time period being measured. For context, many of our programs that receive over a million responses per year have difficulty meeting the 30 minimum responses at the retailer level because those responses are unevenly spread across thousands of retailers.

So, what do you do?

You need to look at the distribution of responses across your retailers and pick the highest number of returns that won’t exclude too many retailers due to low sample size. This analysis will also help you decide what time frame is needed to gather enough returns at the retailer level. Meaning, you might not have enough returns to support a program that gives quarterly rewards, but you may be able to give rewards semi-annually or annually.

Goals and Cut Off Scores

When implementing a reward program, you’ll need a goal or cut-off score that determines who earns the reward and who does not. These goal scores have many characteristics you need to consider.

SMART Goals: First of all, your goals should follow the SMART guidelines. In other words, your goals should be Specific, Measurable, Attainable, Relevant, and Time-Based. Describing the details of SMART goals is too large of a topic to address here, but that information can easily be found online.

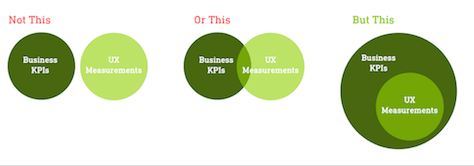

A Single-Item Measure vs. an Index: You also need to decide if your goal is going to be determined by a single customer experience measure (e.g., Net Promoter Score, Overall Satisfaction with the Transaction) or an index that combines measures.

An index of key performance indicators (KPIs) is usually preferred because it is more statistically reliable, and you can focus your employees on achieving various KPIs. The KPIs making up the index can also be weighted to account for their relative importance in determining the customer experience.

We recommend that an index contains no more than three or four measures because people and businesses can only focus on a few things at a time.

A Universal Goal vs. Different Goals: Another important decision is if you will use a universal goal for everyone in the program or if you will have different goals for different groups of participants. While a universal goal is easiest to administer, in many cases it is not the best choice.

Because CX performance can vary greatly by geography, most reward-based CX programs set different goals for different countries, and many set different goals by region within countries to ensure fairness.

A Single All-or-Nothing Goal vs. Tiered Goals: One problem with setting a single all-or-nothing goal is that the goal may not be motivating for program participants who are so far away from the goal that they have virtually no chance of obtaining it. Therefore, you might consider adding a smaller reward solely based on improvement or provide rewards based on level of goal attainment (e.g., at 80%, 90%, 100% and 110%).

Another problem with having one all-or-nothing goal is that, when the value of the reward is significant, it can lead to undesirable behaviors when retailers are unable to achieve the goal by honest means. In these cases, retailers may resort to survey manipulation or other gaming behaviors to obtain the all-or-nothing reward.

A tiered structure with different attainment levels and corresponding reward values can help prevent this.

Absolute Goals vs. Relative Goals: Absolute goals are goals that are set before the beginning of the reward period. Relative goals are usually goals that are finalized at the end of the reward period and are based on all retailers’ performance during that time period. Common relative goals are the national average, or the score associated with the top “X” percent of retailers for the reward period.

In general, we recommend use of absolute goals because relative goals cause retailers to “shoot at a moving target.” This can lead to confusion and frustration, reducing program engagement.

While absolute goals are preferred, that does not mean they can’t be set using relative comparisons. Many programs set their absolute goals by using the national average or score associated with top tier dealers from the previous reward period.

Goal Level: How high you set the bar has important implications for people’s effort, and for the success of the program. Ideally, each individual or retailer will have a goal that is “just reachable” – a goal that is high enough so as to stretch them to perform to the best of their ability, but not beyond their reach in which case they may give up and disengage from the program.

Characteristics of the Reward

There are several aspects of the reward itself that you need to consider:

Type of Reward: The most common decision here is whether you are going to offer cash or non-monetary rewards like merchandise or travel experiences. While cash is often used, it may not be the best choice for a number of reasons.

First, it is important that the reward is a “bonus” to the participants, not something that they need to achieve to maintain their business or livelihood. While most people will say they would prefer cash, it can easily become absorbed into one’s personal budget and spent on necessities, thus becoming a need.

When this occurs, it is much more difficult to discontinue a cash-based rewards program because participants are relying on it for their livelihood.

Non-monetary rewards, on the other hand, are perceived as distinctly different from cash and usually deliver greater motivational and emotional value because they represent the opportunity to treat oneself or others with luxury items that might be difficult to justify if purchased. Also, non-monetary rewards usually have trophy or social value whereas cash does not.

Most program participants would be reluctant to tell friends they received a $5000 cash reward, and many would not remember how they spent that reward money a couple of years later. However, tangible items like merchandise and travel experiences provide lasting memories of being rewarded that are socially acceptable to talk about with others or post on social media. This extends the emotional arc of the reward, making it more meaningful and valuable to the recipient.

Amount of the Reward: Obviously, the amount of the reward will depend on your budget and how many winners you anticipate. Rewards need to be valuable enough to be motivating or people will either fail to engage or consider them unfair in exchange for their time and effort. Conversely, the rewards should not be so large that the need to win them triggers undesirable behavior or resentment if they are discontinued.

Timing of the Reward: You also need to determine the time period in which the rewards will be earned. Most reward programs we have seen provide rewards either quarterly or annually. It is particularly important that you set the time period long enough so the vast majority of participants will reach the minimum survey returns criterion.

For those who cannot meet the criteria in that time frame, you may want to find a fair alternative solution so they will not feel devalued.

Program Administration

Program administration is one of the things that will change most if you add a significant reward omponent to your CX program because there will be more scrutiny of scores and more “score chasing”.

Survey Appeals Process: Most CX programs with significant rewards have some sort of survey appeals process, either a formal set of rules or a “one-off” decision making process. For consistency and fairness, a formal set of rules is preferred. Generally, survey appeals should be granted only in cases where egregious survey errors have occurred. Sending the survey to the wrong customer or having the customer rate the wrong retailer or transaction would qualify as egregious errors.

The remedy for successful appeals should be to remove the surveys in goal score calculation rather than giving “full credit.” Many CX programs set a limit to the number of appeals a retailer can make to prevent appeals from getting out of hand.

“Mulligans:” In golf, a “mulligan” is a free do-over without a penalty stroke. In the CX world some programs allow “mulligans” by dropping retailers’ bottom one to five percent of surveys in a given time period. This is done to hopefully minimize the survey appeals process and to address the common complaint that, “you can’t satisfy everyone.”

Generally, allowing “mulligans” is not a good idea for a number of reasons:

- It often does not minimize the appeals process. Retailers still challenge surveys in the hopes they won’t count toward their mulligans.

- Most programs set goals based on national/regional performance across units. For something to truly be a “mulligan”, goal scores need to be set without removing mulligans, but retailer scores need to be calculated while removing mulligans. Otherwise, you are just “raising the bar” by removing mulligans. While necessary, this process can cause unnecessary confusion to the understanding of program rules and thus less participant engagement.

- All retailers have to deal with unreasonable customers. That’s part of the job and the effects of having difficult to satisfy customers should “wash out” over retailers.

Establish Rules for Survey-Related Behavior: The key to having a CX component in a rewards program is to ensure that the survey responses are in sync with the actual experience and that participants aren’t asking for a rating inconsistent with actual performance.

Unfortunately, when there is a significant reward on the line, many retailers talk to customers about filling out the survey and encourage them to “give me a good grade.” Therefore, you need to set and clearly communicate rules for what behaviors are allowed and not allowed.

Some programs prohibit retailers from even mentioning the survey to the customer. Others allow retailers to inform the customer that a survey will be coming and ask the customer to please fill it out, but that is all they can say. Things that are typically not allowed include: Telling customers they are “graded” on the survey, showing customers a survey with all top-box responses checked, telling customers their pay depends on survey results, and providing incentives for good survey scores.

Program Adherence Monitoring: Most companies that have significant rewards based on their CX programs have processes in place to detect if retailers are attempting to manipulate the results. There are several markers that could indicate manipulation: duplicate customer contact information (e.g., email addresses), retailer domains in the email address, unusually low percentages of valid email addresses, unusually low or high response rates, unusually high number of multiple responses from the same IP address, and multiple responses from the same computer or smartphone.

A best practice in this area is to keep the specific survey manipulation detection methods unpublished to make it difficult for participants to figure out work arounds. However, the general fact that survey returns are being assessed for manipulation should be publicized. Retailers are less likely to try to game the system if they know their company is monitoring results for cheating.

Establish and Communicate Consequences of Cheating: This is where many programs fall short because cheating is implicitly allowed through the lack of consequences for getting caught. If cheating is allowed, many people will not go to the effort to do the behaviors your program is designed to incentivize.

It can also undermine a program by creating a sense of unfairness for the participants who try to earn their rewards honestly. Programs that do enforce cheating rules usually use an escalation approach where the retailer first receives a warning and is given time to rectify the situation. If infractions continue, the penalties usually grow in severity.

Publish a Program Manual: As you can see, you’ll have to establish many program rules and these rules will need to be clearly communicated to the program participants. Many program managers do this by publishing an annual program manual that describes both the rewards and the rules.

Final Points

The primary point we hope you take away from reading this paper is that combining a significant reward program with your CX program is a very big decision that needs to be considered carefully. It is a decision that is usually very difficult to reverse.

Once you start giving rewards based on customer experience, if you decide not to continue to do so in the future, your retailers will likely interpret that decision as, “the company doesn’t prioritize customer experience anymore.” As a result, your customers’ experiences will probably suffer.

Finally, if you add a rewards component to your CX program, your program will likely become much more complicated. Many decisions will need to be made about such things as the ultimate goals of the program, the criteria for inclusion, and how success will be measured and rewarded. You will also need to implement many new rules and procedures to oversee the program.

Overall, a well-designed and well-executed reward program can have a meaningful impact on the loyalty and behavior of your stakeholders.

franchise owners, player agents, and PR teams to separate meaningful mentions from general chatter and address PR problems before they get out of hand.

franchise owners, player agents, and PR teams to separate meaningful mentions from general chatter and address PR problems before they get out of hand.

Promoter Score (NPS) is an essential measurement for the company. However, the volume and the qualitative format of their post-event surveys make it challenging to garner insight.

Promoter Score (NPS) is an essential measurement for the company. However, the volume and the qualitative format of their post-event surveys make it challenging to garner insight.

organization, then the next step is to reach out to a vendor. If you speak with InMoment, we’ll start by sitting down with you to understand precisely what you’re trying to achieve, the context you’re working in, and why other providers don’t meet your needs.

organization, then the next step is to reach out to a vendor. If you speak with InMoment, we’ll start by sitting down with you to understand precisely what you’re trying to achieve, the context you’re working in, and why other providers don’t meet your needs.

However, this approach fails to capture the real-time, dynamic customer data picked up over the phone, much of which is recorded in notes taken by call center workers.

However, this approach fails to capture the real-time, dynamic customer data picked up over the phone, much of which is recorded in notes taken by call center workers. It’s doing so in a few ways. One of them is by tapping into past survey results to help businesses create high-performing surveys with high completion rates. The system delivers real-time recommendations for adjusting which questions are asked and how in order to generate higher quality data. The data received by SurveyMonkey comes from unpaid survey-takers, so optimizing for high-quality responses is essential.

It’s doing so in a few ways. One of them is by tapping into past survey results to help businesses create high-performing surveys with high completion rates. The system delivers real-time recommendations for adjusting which questions are asked and how in order to generate higher quality data. The data received by SurveyMonkey comes from unpaid survey-takers, so optimizing for high-quality responses is essential.