Organizations should take a closer look at predictive analytics examples to discover the myriad of ways that data and artificial intelligence (AI) can power more personalized customer experiences and enhance brand loyalty and customer retention. From a cost and ROI perspective, the impact and benefits of predictive analytics in customer experience management cannot be ignored.

It’s an opportunity that your company can capitalize on today. According to Forrester, fewer than 10% of enterprises are advanced in their insights-driven capabilities. By equipping your organization with predictive analytics tools, you can gain rich insights into customer behavior, make data-driven decisions, and optimize business operations.

What is Predictive Analytics?

Predictive analytics is a category of data analytics and the process of using data, statistical algorithms, AI, and machine learning techniques to identify the likelihood of future outcomes based on historical data. Put simply: it involves analyzing current and historical data to make predictions about future events or trends.

Advancements in computing power, storage, and algorithms, along with the rise of AI, have made predictive analytics more feasible and accessible to businesses of all sizes. Machine learning algorithms can analyze large datasets quickly and efficiently, enabling businesses to derive insights in real time.

In other fields, the application of predictive analytics is making a big impact. Scientists are combining linguistics, robotics, machine learning, and camera engineering to decode the language of sperm whales. Meanwhile, healthcare algorithms are being used to detect the warning signs of serious illness.

Benefits of Predictive Analytics in CX

Predictive analytics is also making an impact on the way companies manage the customer experience. By leveraging data-driven insights from predictive analytics, your company can foster meaningful connections with customers and achieve differentiation in today’s competitive marketplace. The wide-ranging benefits of predictive analytics applications in customer experience management include:

- Enhanced customer loyalty and satisfaction. By predicting what customers want before they even ask for it, your company can provide a proactive and personalized experience that increases satisfaction and fosters loyalty.

- Improve customer lifetime value. Predictive analytics helps identify the most valuable customers and understand their behavior, allowing you to implement strategies that maximize the value these customers bring over their lifetime.

- Reduce customer churn. By identifying patterns that indicate a customer is at risk of leaving, you can take proactive measures to retain them, thereby reducing customer churn.

- Enhance cross-selling and up-selling opportunities. With predictive analytics, marketers can identify which customers are most likely to be interested in additional products or services, creating more opportunities for successful cross-selling and up-selling.

- Accelerate operational improvement. By enhancing the customer experience and making operations more efficient, predictive analytics contributes to accelerated business growth and increased profitability.

Examples of Predictive Analytics: Applications in Customer Experience Management

A number of predictive analytics examples show how the process is being applied by companies looking to better understand their customers, anticipate their needs, and deliver personalized and proactive experiences that drive satisfaction, loyalty, and ultimately, business success.

Predict Behavior and CLV

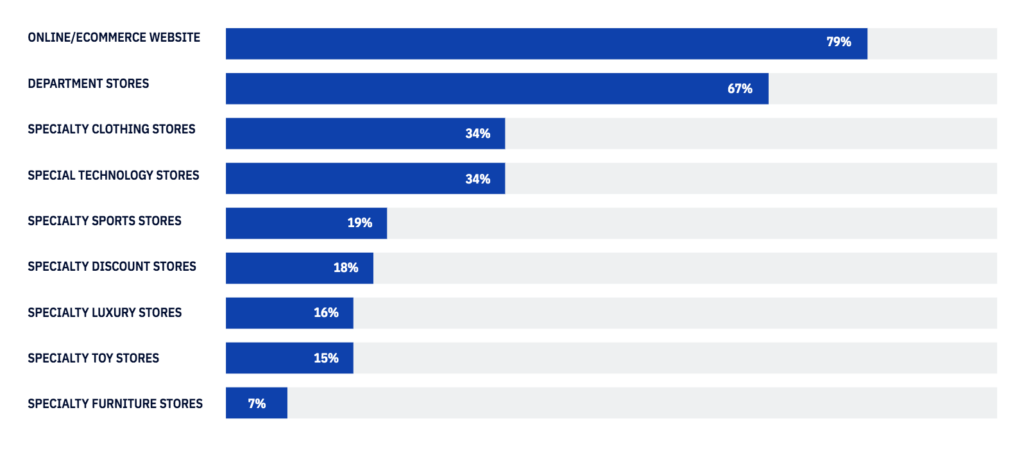

More and more retail brands are deploying predictive analytics software to forecast customer behavior and monitor market trends.

A classic example comes from Amazon. The e-commerce and retail giant implements predictive analytics techniques across various facets of its operations, from its powerful product recommendation engine (“Customers also bought these items”) to dynamic pricing adjustments.

Retailers can personalize the shopping experience and increase sales by analyzing information such as past purchase history, browsing behavior, and demographic data. Brands can also leverage predictive analytics algorithms to analyze historical data and market trends, helping predict the optimal price points for products in order to maximize revenue while remaining competitive.

By recommending relevant products, delivering personalized content, and identifying cross-selling and up-selling opportunities based on individual customer profiles and purchase history, brands can create highly personalized retail experiences that drive customer lifetime value (CLV).

The key is to connect customer experience data from every touchpoint and channel for a complete view of the customer journey. Jim Katzman, Principal of CX Strategy & Enablement for InMoment, suggests that companies should “expand the data sources that you use to understand what your customers are saying and how they perceive you. While surveys will continue to be important, they only give you part of the picture. Expanding your data repertoire to such sources as purchasing data, location-tracking data, web searches, social media, and online reviews is a must.”

The next step is to take a long view when looking at customer relationships. Adds Katzman, “You’ll be surprised at how many brands get caught up in the lure of ‘What can I sell you today?’ without considering what seeds to plant for even more success tomorrow.”

“Equally important is to understand how your competitors view this dynamic and what, if anything, they’re also doing to be proactive when it comes to building lifetime value.

Score Leads by Analyzing Customer Data

Another great application example of predictive is lead-scoring marketers leveraging historical data and machine learning algorithms to predict the likelihood of leads converting into customers. Today more than ever, marketers are empowered to make data-driven decisions when scoring and prioritizing leads, resulting in more effective lead management, higher conversion rates, and improved overall sales and marketing performance.

- Identify Ideal Customer Profiles (ICPs). Predictive customer analytics tools can analyze historical data to identify patterns and characteristics common among high-value customers. By identifying these attributes, marketers can create an ideal customer profile (ICP) that serves as a benchmark for scoring leads based on their similarity to the ICP.

- Assign predictive lead scores. Marketers are also utilizing statistical algorithms to analyze various data points such as demographics, firmographics, online behaviors, engagement with marketing content, and past purchase history to assign a predictive score to each lead. This score indicates the likelihood of a lead becoming a customer based on similarities to past successful conversions.

- Prioritize sales efforts. Marketers can use predictive analytics to prioritize leads based on their likelihood to convert. Leads with higher predictive scores can be routed to sales teams for immediate follow-up, while leads with lower scores can be nurtured through targeted marketing campaigns until they demonstrate stronger buying signals.

- Reduce sales cycle length. Predictive lead scoring enables marketers to identify leads that are further along in the buying process and more likely to make a purchase. By prioritizing these leads for immediate engagement, marketers can accelerate the sales cycle and shorten the time to conversion, leading to faster revenue generation and increased productivity for sales teams.

Harness NLP and Sentiment Analysis to Monitor Brand Reputation

Predictive analytics can also have a significant impact on brand reputation management efforts, helping companies anticipate, monitor, and respond to potential reputation threats more effectively.

Algorithms, for example, can analyze large volumes of data from various sources such as social media and online reviews to gauge customer sentiment toward the brand. By identifying patterns and trends in sentiment data, teams can proactively address emerging issues or negative perceptions before they escalate into major reputation crises.

These analytical techniques help crystallize information contained in reviews into insights — helping companies achieve a more accurate, complete, and unified view of the customer.

With online reputation management software, companies can also analyze customer feedback and sentiment data to identify areas for improvement and proactively address customer concerns. By identifying recurring themes or issues in customer feedback, brands can take corrective actions to improve products, services, and overall customer experience, which in turn enhances brand reputation.

InMoment’s approach is based on machine learning, a method of data analysis that allows companies to find patterns and unlock insights as it is exposed to new review and feedback data. This approach is fast, consistent, and programmable, helping teams quickly understand — at a glance and at scale — exactly what customers are saying. Proprietary relevancy scores for sentiment analysis also provide measurement of positive and negative language, with unparalleled accuracy.

Use AI to Improve Personalization

Predictive analytics empowers companies to better understand their customers, anticipate their needs, and deliver personalized experiences. It’s a particularly powerful tool for curating content based on historical customer data.

One of the best predictive analytics examples comes from streaming giant Netflix, which has a powerful personalized content recommendation engine. The company analyzes user data, including viewing history, ratings, and browsing behavior, to make predictions about what users might want to watch next. This is all reflected as soon as viewers land on Netflix’s home page, which displays content tailored to individual users, improving user engagement and satisfaction.

With predictive analytics, teams can dynamically customize website content, email marketing campaigns, and other communication channels based on individual customer preferences and behaviors. By delivering content that is relevant and timely, businesses can improve personalization, create more engaging customer experiences, and drive higher conversion rates.

Extract Insights from Reviews and Social Media Data

Online reviews and social media data provide a wealth of insights for a business but can be labor-intensive to read through and digest. There are many ways to try to automate this task. Currently, the leading approaches use deep learning models that extract many different kinds of keywords, predict their sentiment, and classify them into relevant categories. This allows companies to improve operations, make better decisions, and elevate the customer experience with data.

Using AI and advanced machine learning techniques, predictive analytics tools can read through thousands of reviews, comments, and feedback in the time it would take a human to read through just a few. The right technology will provide valuable insights, summaries, trends, and statistics that can be applied to support data-driven decision-making and customer-centric innovations.

Rural King, a family-owned farm supply store with 128 stores across 13 states, is no stranger to leveraging predictive analytics in order to create memorable customer experiences. The company regularly analyzes massive amounts of unsolicited feedback to unlock the potential of all its stores’ review data.

“We are hearing directly from customers about the store experience as well as pricing and product challenges,” says Kirk Waidelich, VP of Marketing for Rural King. “This allows us to narrow in on the stores that are experiencing issues — and to target and understand these issues versus simply guessing.”

Learn more about how Rural King is harnessing review data to create memorable in-store experiences.

Let InMoment’s AI Take the Guesswork Out of Your CX Program

The above examples of predictive analytics in action demonstrate that the right use of data and AI can take the guesswork out of any organization’s customer experience program. The world’s top brands partner with InMoment AI, the leading predictive customer analytics solution, to facilitate the discovery of real-time insights, drive individual customer recovery, and turn unstructured feedback into a predictable source of business growth.

References

Forrester. “Data Governance Unlocks The Impact Of Analytics: Data Strategy & Insights 2023” (https://www.forrester.com/blogs/data-governance-unlocks-the-impact-of-analytics-data-strategy-insights-2023/). Access 03/16/2024.