Since you’re here on the Wootric blog, you probably already know that providing a high-quality experience to your customers is vital to your business.

You’ve heard people talk about CX becoming the key differentiator for brands in the coming years.

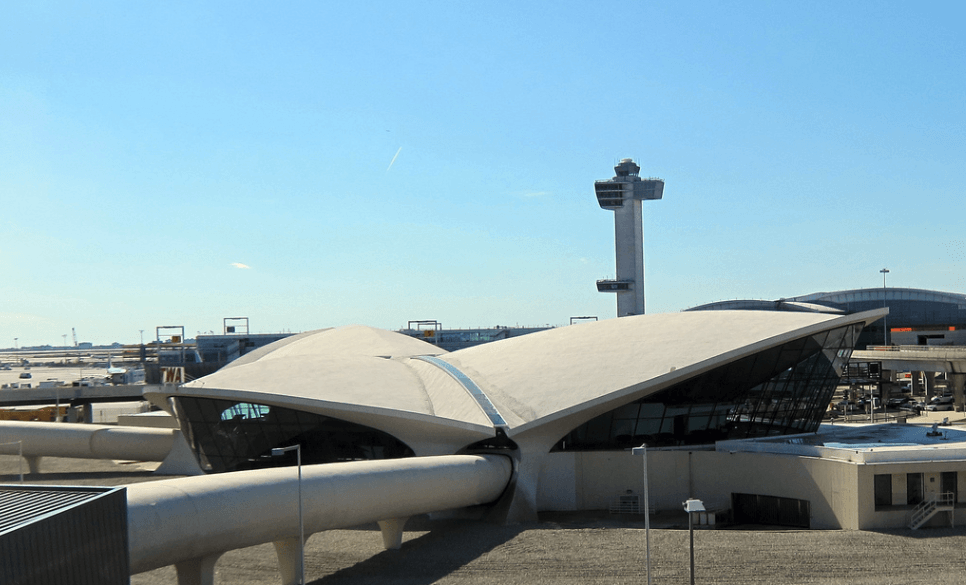

(Source)

You’ve watched brands in a variety of industries revamp their customer-facing operations to improve the consumer’s experience.

You may have even begun investing in improving your brand’s customer experience in a variety of different ways.

But, when it comes down to it, you still aren’t exactly sure if your efforts are paying off for the customer—or for your business.

Don’t worry, you’re not alone: According to a 2018 report from CustomerThink, only 30% of brands report experiencing enhanced differentiation or any other tangible benefit from their CX-related initiatives. Moreover, Oracle reports that only 43% of CX executives are highly confident in their organization’s preparedness and ability to provide an enhanced CX as time goes on.

While there are a number of reasons this is (which we’ll get to), the overarching takeaway is that improving the overall customer experience requires much more from an organization than most realize. In order for a company to make sustainable improvements to its CX—improvements that lead to tangible benefits for the business—a fundamental shift within the organization must occur.

This is where customer experience enablement comes in.

What is Customer Experience Enablement?

Customer experience enablement is an holistic approach to improving CX by making foundational changes to both customer-facing and internal processes within a company. It is worth noting that approach is sometimes known as customer experience management (CXM or CEM). So many acronyms!

Breaking that down a bit more, customer experience enablement (CXE) is all about:

- Providing a branded experience that aligns with both the customer’s expectations and the experience the company intended the customer to have

- Enabling teams and individual employees within an organization to provide this experience to the customer effectively and efficiently—so that the customer’s experience is equally as efficient throughout their buyer’s journey

As we mentioned above, it’s the second part of our breakdown that organizations often overlook. Unfortunately, this leads said companies into a situation in which they have a pretty good idea of what needs to be done to improve their CX—but are unable to actually put these initiatives into action in ways that benefit both the customer and the business.

That being said, let’s now dig into the key components of customer experience enablement—and why becoming more aligned with these components is essential to the growth of your business.

3 Key Components of Customer Experience Enablement

In the previous section, we broke down customer experience enablement into the customer-facing and internal sides of the same coin.

As you’ll see as you read through the rest of this article, the key components of CXE can touch on either side of this coin—and can sometimes touch on both at the same time, as well.

(If this is a bit confusing, don’t worry: It will start to make sense right away. We promise.)

Without further ado, let’s dig into the three key components of customer experience enablement.

1. Organizational Alignment

In order for an organization to become truly able to enhance the experience they provide their customers, everyone within the organization needs to be on board with the initiative.

Instill Ownership of CX Throughout Your Organization

In some cases, this is pretty obvious. Of course your marketing, sales, and support staff will be involved in CX-related initiatives; they do engage directly with the customer, after all.

In other cases, though, it can be a bit difficult to get certain team members on board. That is, it’s not exactly uncommon for teams that don’t interact with the customer (e.g., accounting, logistics, etc.) to overlook the role they play in the customer experience.

The thing is:

Your team needs to be willing to put in the effort required to improve your CX before they are able to do so. Or, more accurately, if your various teams aren’t willing to work toward improving your brand’s CX, it won’t matter if they’re able to or not: it’s just not going to happen.

Unfortunately, data collected by Adobe shows that a “lack of clear ownership of the customer…holds companies back from a true customer focus,” with nearly half of responding organizations denoting this as a problem.

Furthermore, Kapost’s 2016 B2B Benchmark report found that only 12% of B2B marketers believe that they’re “very effective at delivering a consistent customer experience.”

(Source)

The silver lining of all this is that, if you can instill ownership of the customer throughout your organization, you’ll be a step ahead of half of your competitors.

Communicate the Benefits of CX Ownership

Another area in which generating buy-in is vital to your CX-related initiatives is in proving the value of doing so to your company’s various stakeholders.

At this point, it’s important to frame the benefits of CXE in ways that matter to a specific team or individual. For example, marketing managers will likely care more about engagement metrics, while executives will be focused on revenues and profit margins of the potential initiative. For teams responsible for internal processes, this value likely comes in an ability to be more efficient in their duties, overall.

(Keep this all in mind, as we’ll talk a bit more about it toward the end of this post.)

Enabling Your Teams and Facilitating Ownership

Once you’ve generated buy-in throughout your organization, the next step is enabling all of your teams to actually play a more active role in creating a top-notch experience for your customers.

As CXE specialist Melissa Madian explains in an interview with Vision Critical, CXE is about enabling “revenue-generating and customer-facing teams with the processes, tools and training they need to help close business faster and deliver a superior customer experience.”

While “playing a more active role” can mean different things to different team members (and different organizations), the key to being able to do so is active, intentional, cross-team communication throughout a given organization.

For one thing, this means building avenues of communication between all teams—and breaking down any barriers to communication that may exist within your organization. In a literal sense, this may mean making it easier for your various teams to interact with each other (whether physically or via technology). More symbolically, this means breaking down silos and cutting through any red tape that may hinder communication between certain teams.

Secondly, you’ll need to actively facilitate and systematize internal communication processes (as opposed to just hoping it occurs organically simply because you’ve “enabled it”).

This may mean restructuring processes to include more of your team members as needed—with the focus remaining on the customer experience at all times. Again, even if a certain internal process doesn’t seem to impact CX all that much, your marketing, sales, and support teams might discover otherwise when an internal decision ends up causing chaos for your customers.

Going along with this, another way to facilitate and enhance internal communications is via knowledge management, specifically by making use of knowledge sharing and knowledge transferring systems. Doing so will allow various teams to stay apprised of the goings-on throughout your organization, and can also easily communicate vital information from their department to other teams as necessary.

To reiterate, the goal of this initial step toward customer experience enablement is to get your team members on board with your initiative—and to begin putting structures in place that allow all of your team members to pursue this initiative both individually and as a company.

Bluntly speaking, without this piece of the puzzle in place, it’s nearly impossible to accomplish what we’ll be discussing next.

2. Focus on Customer Intelligence and Other Valuable Data

The second key component of customer experience enablement revolves around the collection, assessment, and analysis of audience-related data.

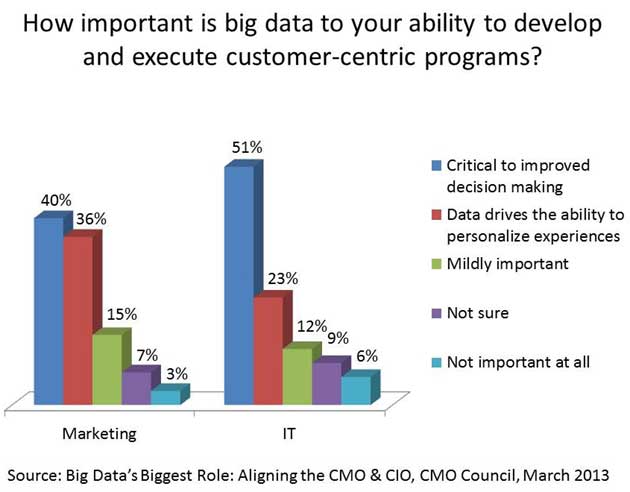

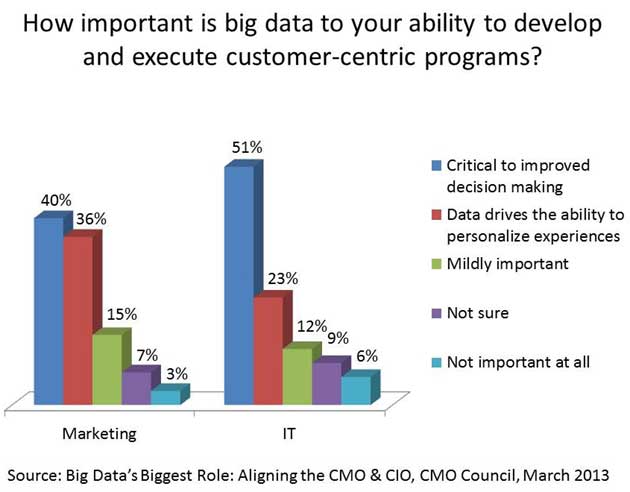

To be sure, most modern organizations already know that big data plays a huge role in their CX-related initiatives and efforts. According to data collected by MarketingProfs, 40% of marketers say data is “critical to improved decision making,” while 36% say data “drives the ability to provide personalized experiences.”

(Source)

The problem, though, is that most organizations don’t feel fully equipped to actually put the data they collect to good use. Case in point, 61% of CMOs admit to shortcomings when it comes to using big data to make improvements to CX.

While Adobe’s data shows companies are adept at data hygiene-related processes (i.e., ensuring data is accurate and reliable), this is only a part of the equation. It’s in understanding the contextual meaning behind the data that causes issues for most companies. And, when it comes to data relating to the customer experience, context is key.

Collecting Customer Data that Matters

With the above in mind, your first order of business is to focus on uncovering the data that provides the most valuable and accurate insight into your customers’ expectations. This is where Voice of the Customer is huge: it’s all about digging into the specifics of what your customers want from your brand—and minimizing the potential for your customer-facing data to be taken completely out of context in the future.

It’s important to note, here, that customer experience—and, by extension, CXE—refers to all engagements that occur between your organization and your customers, whether pre-, post-, or during a given purchase.

By looking at a specific data point, metric, or piece of customer feedback with the customer’s journey in mind, you’ll add an extra layer of context to the data you collect and analyze. In turn, you’ll be able to tailor their experience with your company even further—making them more likely to stay loyal to your brand for some time to come.

(Again, we’ll get to that momentarily.)

Collecting Internal Data that Matters

Another data-related part of CXE is prioritizing customer-facing info that provides the most value to your company.

Essentially, this means focusing on data that refers to your most valuable and loyal customers, as well as your highest potential prospects. This will enable your team to start making CX-related improvements to get your high-value customers even more engaged with your brand. Needless to say, this will lead to nothing but good things for your business moving forward.

Speaking of making improvements to your customer experience…

3. Improvements to CX that Matter—and Last

Before we get too far into this last section, let’s quickly go over the aspects of CXE we’ve discussed thus far:

Now, to be clear, all of these initiatives are done for one main reason:

To be able to make impactful and lasting improvements to your brand’s processes—in turn enhancing your brand’s overall customer experience.

As we said earlier, these improvements can manifest in any number of ways, such as:

- Streamlining transactional processes, making it easier for customers to receive the product or service they require quicker and with less downtime

- Improving onboarding processes, allowing customers to “hit the ground running” with your product or service—and maximizing the value they get out of it, as well

- Making iterative changes to your product or service based on customer feedback, ensuring your customers continue to receive more and more value from your brand over time

Notice that each hypothetical improvement listed above is tied to a specific target outcome focusing directly on the customer’s experience. At the risk of being redundant, that’s literally the point of customer experience enablement: to enable your team to provide a better experience to your customers.

CXE is also about making sustainable and long-lasting improvements to your processes, ensuring that you’ll be able to provide an enhanced experience to your customers not just once or twice, but from here on out.

This is why it’s essential for CXE to start at the foundational and systemic level of your organization: Skipping this crucial step could cause your team to revert back to the “old way” of doing things—rendering any gains you may have experienced in the meantime moot.

But, with a deep-seeded, evidence-backed understanding of all that goes into enhancing CX, your organization will understand the importance of adopting and integrating new CX-related processes into their daily operations.

While any temporary or superficial improvements made will likely not lead to any long-lasting benefits for your organization, those more systemic and strategic improvements can only lead to great things for your business.

First of all, the more enjoyable and valuable your CX in the eyes of your customer, the higher your customer satisfaction rate will climb. Of course, with this increase in customer satisfaction, you’ll also likely experience a boost in retention, advocacy, and acquisition, as well.

Additionally, as your organization becomes more acclimated with your CXE-related initiatives, your teams will become more proficient and efficient in completing their individual duties. More efficiency means less wasted resources—which, in turn, means more resources on-hand to reinvest into improving your CX even further.

Finally, we’d be remiss if we ignored the fact that effective customer experience enablement leads to massive profits for companies of all sizes.

The more value your customers receive from your brand, and the easier it is for your company to provide this value to them, the more money your company will make as time goes on.

It’s that simple.

About the Author: Josh Brown is a Customer Success Engineer and part of the marketing team at Helpjuice. Helpjuice provides easy-to-use knowledge base software that guarantees less support emails and more happy customers.

About the Author: Josh Brown is a Customer Success Engineer and part of the marketing team at Helpjuice. Helpjuice provides easy-to-use knowledge base software that guarantees less support emails and more happy customers.

Learn how Wootric can help you measure and improve customer experience. Book a consultative demo today.

![[AtlantaThemeVolumeVersusNPS.png]](https://inmoment.com/wp-content/uploads/2022/03/AtlantaThemeVolumeVersusNPS.png)

![[woman feeling overwhelmed by customer reviews.png]](https://inmoment.com/wp-content/uploads/2022/03/squashed_gray01-300x291.png)

![[woman who used to be overwhelmed now inspired by sentiment-analyzed customer reviews.png]](https://inmoment.com/wp-content/uploads/2022/03/squashed_color01-300x291.png)

![[SFOReportsDashboard.png]](https://inmoment.com/wp-content/uploads/2022/03/TextAnalyticsReportsDashboard2-1024x576.png)

![[SuccessfulVoCProgram.png]](https://inmoment.com/wp-content/uploads/2022/03/Lexalytics-E_Book-2018-Graphics_5-Success-1024x966.png)

About the Author:

About the Author: