There is something to be said about how vital it is to leverage market research to understand your non-buyers so you can convert them into customers. But focusing on how to improve customer retention is just as important, if not more. It is more profitable to invest in existing customers, especially since acquiring a new customer is anywhere from five to 25 times more expensive than retaining an existing one.

The market may be vast, but there is a finite number of potential customers, so making a good lasting impression is key to keeping the customers you have already won, regardless of the industry you’re in. That is why your customer retention efforts are so important.

What Is Customer Retention?

The definition of customer retention is pretty simple: it’s your business’s ability to keep your existing customers coming back to you time after time. But with such a crowded market, that is easier said than done.

Did you know that the average business today loses between 10-30% of its customers annually? Additionally, research by CarlsonMarketing shows that U.S. companies lose 50% of their customers every five years.

The fact of the matter is that today’s customers have more options than ever before when it comes to purchasing products and services. So, if you aren’t working purposefully to keep those customers, it’s likely they will go somewhere else.

How Is Customer Retention Measured?

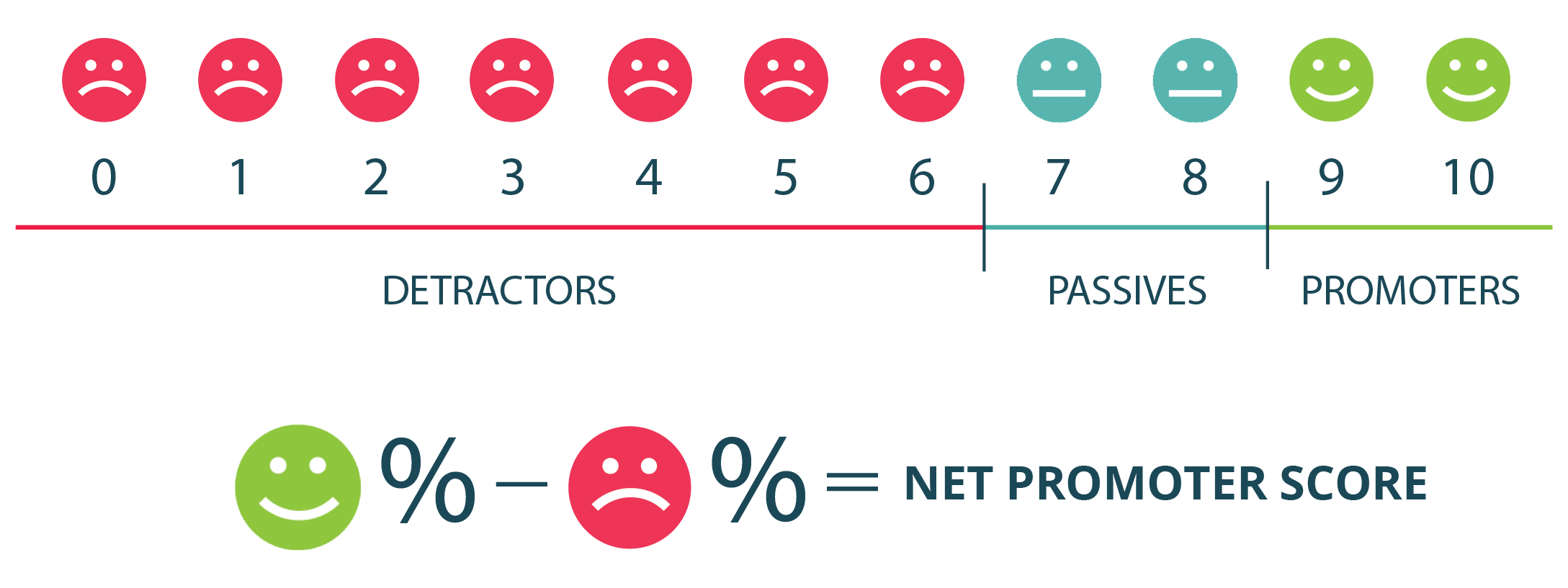

We’ve already mentioned a few customer retention statistics, so you might be wondering how those are calculated. Well, let’s do some math here.

Assume the following definitions:

- CE = The total # of customers when the period ends

- CN = The total # of new customers that you acquired during the period

- CS = The total # of customers at the beginning of a period

To calculate retention rate, you need to use the following equation:

- Retention Rate = ((CE-CN)/CS)) X 100

What Is Considered a Good Customer Retention Rate?

It goes without saying that a retention rate of 100% is virtually impossible. But a “good” retention rate is highly varied by the industry you’re in. Here are some industry-average customer retention rates for you to benchmark against:

| Industry | Average Customer Retention Rate (%) |

| Media | 84 |

| Professional Services | 84 |

| Automotive and Transportation | 83 |

| Insurance | 83 |

| IT Services | 81 |

| Construction and Engineering | 80 |

| Financial Services | 78 |

| Telecommunications | 78 |

| Healthcare | 77 |

| IT and Software | 77 |

| Banking | 75 |

| Consumer Services | 67 |

| Manufacturing | 67 |

| Retail | 63 |

| Hospitality, Restaurants, Travel | 55 |

Why Is Customer Retention Important?

Regardless of the industry you’re in, retaining your customers should be one of the top four goals of your overall business (alongside acquiring customers, increasing customer lifetime value via cross-sell and upsell efforts, and reducing operating costs). After all, it is your customers that keep you in business.

If you fail to keep track of your customers, their experiences, and how many of them are staying with you versus leaving for a competitor, you could be bleeding customers (and money) without even realizing it. Need some more convincing? Here are some additional facts for you:

- 68% of sales come from recurring customers

- Loyal customers are more likely to share their experience with the company and they are also more likely to purchase from the company again in the future

- Loyal customers who continue to support your brand will increase your profits

- iLoyal customers will also recommend your brand and give positive reviews to their family and friends”

- Returning customers tend to spend more on your brand over time.

- You get a greater return on your investment (ROI) from repeat customers than trying to acquire a first-time customer

- Even though only 12% to 15% of customers are loyal to a single retailer, they represent between 55% to 70% of the retailer’s sales.

How to Improve Customer Retention

The most effective way to improve customer retention? You guessed it! By leveraging your customer experience (CX) program. Your CX program gives you direct insight into how satisfied your customers are with their experience, and then identifies the areas in which you need to improve in order to keep those customers.

There are four cornerstones of customer retention that your CX program helps to support. They are:

Understand Why Customers Leave

- Exit Interviews: Drive true learnings from the people who understand why customers leave the most (ex customers)

- Market Pulse Programs: Stay ahead of the competition and learn from our competitor’s customers, other industry customers, and identify other opportunities in the market.

- Invest in the Right Analytics: Predictive models help to extend lifetime value (LTV) by warning you when specific customers are likely to churn

Eliminate Customer Friction

- Customer Journey Mapping: Understand moments of impact and potential frustration across your customer journey

- Employee Forums: Access the employee perspective—and socialize that perspective up the chain of command to create effective change

- Leverage All Information Sources: Look beyond traditional surveys to include other forms of experience data, such as social data, review site data, operational data, and more!

- Deploy Microsurveys at Key Touchpoints: Get customer feedback in the moments that matter

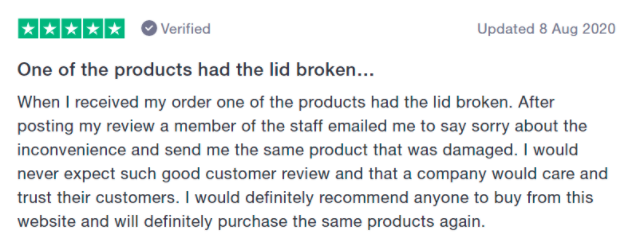

Recover Customers Effectively

- Closed Loop Programs: Address concerns when it matters most

- Multichannel Listening: Fix broken processes before they become retention detractors

- Empower Employees: Encourage and train your employees to use their best judgment and make things right without layers upon layers of approval

Drive Deep Relationships

- Support Teams Consistency: Identify fundamental customer needs and create customized value and benefits

- Formal Relationship Surveys: Create goal-oriented relationship surveys; look for churn warning signs specific to your business

- Leverage Loyalty Programs: Leverage your best customers to be your most outspoken advocates

Calculating the Value of Customer Retention Using Customer Lifetime Value (CLV)

At InMoment, we frequently sit down with brand executives and look at real-time metrics that show how much revenue has been recovered due to their closed loop program. Here is the equation we use to prove that value.

Begin with the lifetime value (LTV) of your customer— for example, a prominent pizza chain has publicly stated that their LTV of each customer is $10,000. So, let’s use that for our example. Because your CX efforts are listening to the voice of your customer across all channels, you have the ability to report that last week (hypothetically) you had 300 service lapse incidents across your digital and retail journeys. Multiply that 300 by your customer LTV of $10,000 and you now have $3M of at risk revenue. (Yikes!)

Studies tell us that 50% of those customers will continue to do business with your brand, however, 50% will defect—this is where your closed loop program comes into play. If we resolve the issues with half of that 50% that might defect, we know we have recovered $750,000 of revenue across your brand just in the last week!

From these numbers, it’s clear that, although it can be complex, focusing your efforts on improving customer retention is well worth it! And if you’re using your customer experience program to guide you, you’re sure to create the types of experiences that keep customers around for a lifetime!

To learn more about how to improve customer retention, download this whitepaper that teaches you how to use your customer experience program to improve customer retention and become a revenue generating machine!