Given the popularity of Net Promoter Score (NPS), maybe you are wondering if you should too adopt it too. As you consider whether NPS is right for your business, it might help to understand some of the reasons why it has become so popular in the first place.

In this guest post, Melinda Gonzalez outlines the reasons and her philosophy for success with NPS. Melinda is CEO of Melinda Gonzalez Advisors, a customer experience consultant, and a contributing author in SaaS Startup Founder’s Guide.

NPS was introduced nearly 15 years ago by Fred Reicheld and the global management consulting firm Bain & Company as a C-suite metric that is intended to measure customer loyalty and satisfaction by asking a single “what is the likelihood you would recommend…” question. At the outset, enterprise companies and major brands like Costco, USAA, Apple, and Amazon.com used it, and they have long held leadership rankings in the industry. NPS has since grown tremendously in popularity, and it is often used by small and mid-size businesses as a tool to drive profitability and growth.

So much has been written about NPS. Yet I still come across businesses that are struggling to make it work. Until the time comes when that no longer happens, I’ll continue to share my experiences and advice to help others.

Increased Popularity of NPS

First, companies are becoming more customer-centric out of necessity. The traditional sales and marketing funnel is dead, particularly with the “as a service” revolution. Whether you view it as flipped funnel, an hourglass, or something else, most companies realize they’re missing the boat if they’re not working towards creating an army of customer marketers and cultivating increased profitability through follow on deals and word of mouth within their customer base.

Second, there is an ever increasing and intensified need for companies to make more data driven decisions. Companies now have exponentially more data at their fingertips, particularly with the explosion of the cloud industry. This has completely revolutionized the ability for companies to be more informed and targeted in how they evolve business strategy. NPS indulges this appetite handily.

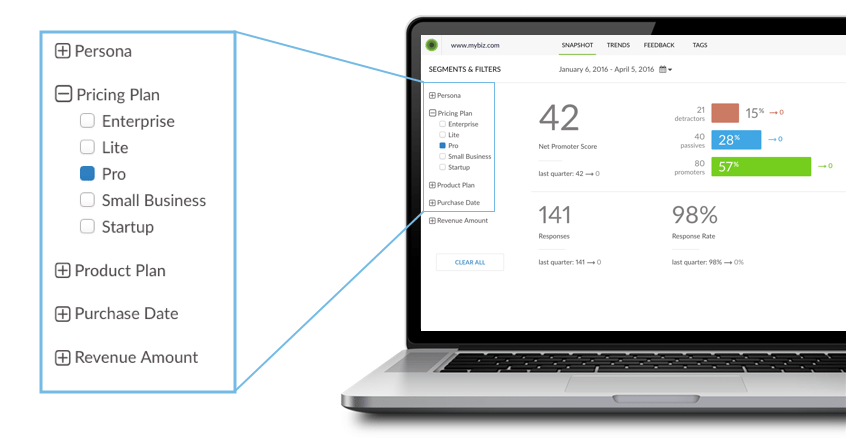

Third, NPS enables companies to “metricize” the customer experience. Companies are making significant investments to collect customer feedback in real time. NPS and other types of experiential data are often used to measure customer loyalty-related sentiment and behaviors. Connecting this data with operational and CRM data can enable more powerful and predictive insights. This can be a game changer for companies trying to create personalized interactions to differentiate their brand and increase customer engagement.

Last, the perceived simplicity of having a single metric is very attractive. This has been both the blessing and the curse of NPS. Executive leaders are constantly barraged with highly complex data and information. So, I get it. Here comes a single number that is supposed to provide an immediate gauge of how loyal customers really are. Only, it doesn’t actually do that on its own. The score informs little about how to drive improvements or where to double down on things that are working well. This level of insight only comes from digging deeply into the respondent segments, reviewing qualitative feedback, understanding root cause issues and key themes, and ideally analyzing the data in conjunction with operational data such as (re)purchase behavior.

Get the ebook, The Modern Guide to Winning Customers with Net Promoter Score. Learn how to modernize your NPS program for the most successful year ever.

Focusing on the System over the Score

Is it a “score” or a “system?” Focusing on the score by itself short-changes the investment of implementing NPS in the first place. Understanding and taking action on the insights is equally if not more important and impactful. Fred Reichheld and Bain & Company did a great thing for the industry by renaming it to Net Promoter SystemSM. There are many who seek to entirely debunk NPS as a metric. That’s not my goal. If you’ve implemented NPS that shows some desire to improve services for your customers, which is a great start. I prefer to treat NPS more as a change agent to collectively focus the business on improving the customer experience. I advocate against myopically focusing on the score and recommend using NPS as a “north star” metric, much like Airbnb views it.

Two Aspects of Net Promoter Success

That being said, I do have two basic philosophies about NPS.

First, if you’re going to focus on the NPS score, know that it is a relationship level metric. Not everything can or should be measured by the “likelihood to recommend.” Do not NPS your customers to death. Consider implementing the NPS question as part of a broader voice of the customer ecosystem. This could include measuring transactional interactions, product adoption indicators, behavioral or purchasing patterns, etc. This allows you to build a comprehensive picture of overall customer health, position the business to take action as needed, and inform changes that increase customer engagement. Sorry, there’s no single, magical metric. That said, measuring NPS is a great place to start.

Second, it’s critical to be transparent with customers about the steps you’ve taken to improve products and services based on their feedback. This presumes feedback is actually being used to do so. The easiest and fastest way to lose customer trust and damage the relationship is to spend an enormous amount of effort collecting the feedback then doing nothing with it. NPS can be an impactful change agent to drive innovation, but it does not happen organically. It must be indoctrinated as a core value at all levels of the business. An understanding of root cause issues is also required to drive necessary changes. While one person often owns NPS as a program, it is not one person’s job to drive change from NPS – nor is that in his/her power.

Next week, Melinda will share Eight Principles for Driving Change with NPS.

Start measuring Net Promoter Score for free with InMoment