Airport Series: Dallas/Fort Worth and The Dirty Secret

In our fourth airport analysis, we turn to Dallas/Fort Worth International Airport in Texas. As the fourth busiest airport on Earth, DFW is larger than the island of Manhattan. Every year it caters to 64 million passengers. Here is what they have to say.

Today we’re continuing our ongoing analysis of Facebook reviews for the busiest airports in America. Next up is Dallas/Fort Worth International Airport (DFW) in The Lone Star State, Texas.

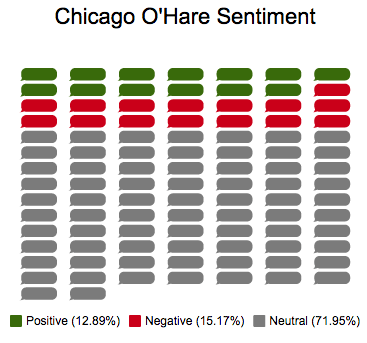

Interestingly, DFW was named both the best and worst airport in 2017. What’s more, the results of our sentiment analysis were mostly neutral. These two facts suggest that DFW is simply not an airport customers are particularly passionate about. But, as we’ll see, when Dallas/Fort Worth falls down, it falls down hard. Addressing these foibles could directly improve DFW’s revenue.

Dallas/Fort Worth has cleanliness problems

Dallas/Fort Worth’s Facebook reviews comprise of 88,163 words, split into 2,249 comments. 7% of these pertain to cleanliness. Comments about “gross stains,” “sewage smells,” “human excrement,” cries to “CLEAN UP!” (and worse) permeate the data set. “I was embarrassed to be an American in an American airport.” said one reviewer, returning from a vacation in Mexico.”Gray, dingy, dirty, old…an embarrassment…” echoed another. “I have traveled outside our country, in third world airports even, and they were cleaner then [sic] this airport.”

Remember, airports depend on non-aeronautical revenue. This means they depend on the dollars travelers spend while in the airport. Thus, maintaining facilities to attract consumers is key.

DFW is flailing here. As one woman pointed out, “The ladies bathroom by gate 12 was disgusting, there was pee everywhere… If I can avoid your airport in the future, I will!”

In fact, our data set is replete with similar examples.

“This airport is one of the dirtiest I have passed through,” one said, then continued, “The bathrooms always smell of urine and the seating has crumbs and spills… I will avoid going through this airport in the future.”

Many more flyers swore off DFW after citing its cleanliness.

“Carpet was so dirty your feet stuck to it. Also family restroom was dirty. The terminal was very old and is in need of updating. If I return to Dallas, I will probably try and fly into a different airport.“

Customer experience is key to airport success

The Airport Cooperative Research Program (ACRP) has repeatedly cited customer experience management as key to the success of modern airports. As they point out in their latest report, “Ad hoc brands are formed over time by the many associations customers have made with an airport. These associations shape the customers’ expectations and perceptions of the services, products, and encounters that they expect at the airport and become the airport’s de facto promise. Actual customer experiences, reports in traditional and social media, and hearsay all contribute to these associations, in good ways and bad.” The ACRP continues, “Airports do not have a choice about whether to be involved in social media; the question is how well they do it.”

The ACRP operates under the Transportation Research Board (TRB), itself a division of the National Research Council. These organizations serve to not just benefit the traveler, but also the organizations they support. So, it’s with no uncertain weight that the ACRP dedicates an entire section of their Report to airport cleanliness. “A statistical study of the drivers of airport satisfaction and dissatisfaction based on a content analysis of 1,095 traveler comments on an airport review website concluded that key drivers of customer satisfaction included terminal cleanliness and a pleasant environment.”

What’s worse than a dirty airport? Waiting in one

Now we understand the gravity of facility cleanliness, it merits asking “what could be worse than a dirty airport?” According to travelers, being stuck in one is even worse. 18% of DFW’s Facebook reviews pertain to waiting: waiting for food, waiting for the bathroom, waiting for the shuttle, and – worst of all – waiting for baggage.

While waiting might seem an endurable irritation, the consequences can be meaningful.

“My 80 year old Grandma had to withstand endless hours of waiting in lines that curved around halls…”

Another reviewer was not as patient:

“You won’t be receiving my money again and I will make sure everyone I know knows that you have raised your rates and decided to cut the amount of buses you have in half. There were families waiting with little babies in the heat while we watched many other buses go by that could have easily been re-routed.”

What should Dallas/Fort Worth do?

Addressing cleanliness and the other factors holding customers back is a simple way to protect the DFW brand. A look into the most positive comments offer a suggestion about how airports can salvage the customer experience for inconvenienced travelers. Individual interactions with staff can make all the difference. While it’s not yet appropriate to call this a trend, it’s a theme we’ve recognized in every airport dataset we’ve analyzed.

Customers take notice of how they’re treated by staff, whether they go online and write about it or not. Employees who are curt, disinterested, or impatient exacerbate already stressful situations. The negative sentiment associated with an unavoidable mishap, like a delay or layover, can be alleviated by a positive staff interaction. This not only helps the customer, it also shores up brand loyalty. As one DFW reviewer laconically puts it, “Friendly and helpful staff at airport… Definitely will return.”