Satisfaction Visualized: The Power of Multimedia Customer Feedback

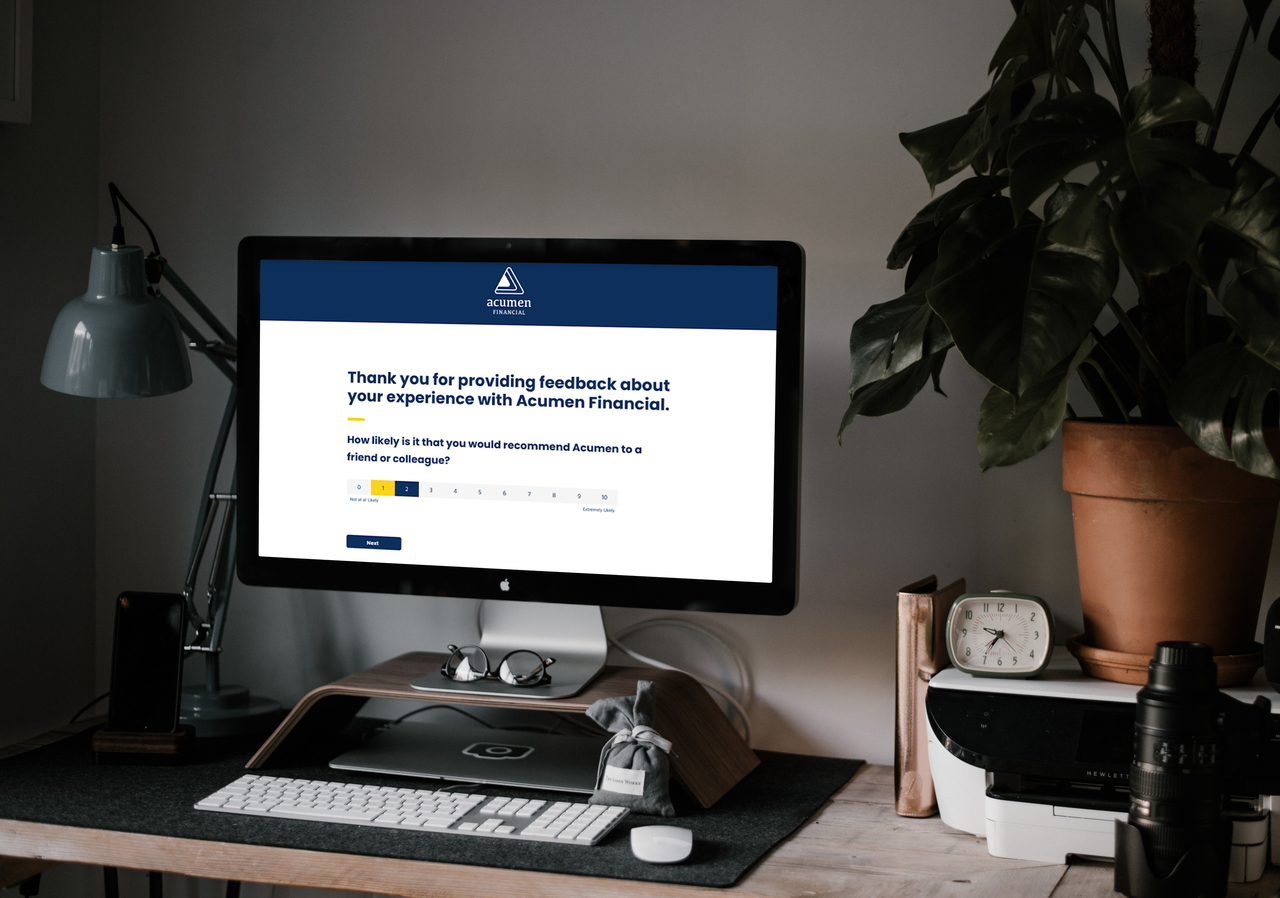

Surveys are at an interesting crossroads in the modern experience landscape. On one hand, brands have traditionally relied on written questions to solicit feedback and suggestions from customers. However, as technology and social media continue to evolve, the idea of a long survey that’s packed with nothing but questions seems a bit antiquated. Fortunately, brands don’t have to stick with sending out tomes of questions ad nauseum and hoping for a response. Survey design, like everything else having to do with customer experience (CX) has to stay as limber and ever-changing as the customers it aims to attract. There are many design elements to consider here, but multimedia feedback is arguably the most important.

Surveys are at an interesting crossroads in the modern experience landscape. On one hand, brands have traditionally relied on written questions to solicit feedback and suggestions from customers. However, as technology and social media continue to evolve, the idea of a long survey that’s packed with nothing but questions seems a bit antiquated. Some might even call that type of survey a sore thumb amid all the visual media swarming the internet.

Fortunately, brands don’t have to stick with sending out tomes of questions ad nauseum and hoping for a response. Survey design, like everything else having to do with customer experience (CX) has to stay as limber and ever-changing as the customers it aims to attract. There are many design elements to consider here, but multimedia feedback is arguably the most important.

Worth (60) Thousand Words

There’s a strong case for allowing customers to submit visual feedback instead of just written answers, and it’s that people process images about 60,000 times faster than text. Quite an order of magnitude. While brands shouldn’t necessarily do away with written questions altogether, customers’ propensity for pictures means that image and video upload options must be included in surveys.

Additionally, customers don’t just process images faster than text—they tend to attach more meaning to them, too. This means that if they have a chance to enclose the images and videos they care about in feedback, they’re more likely to find the entire experience more rewarding. Brands benefit from this cycle as well, because a piece of authentic visual media is much more powerful than a written response.

Uploading Meaning

There’s something to be said for the emotional power derived from an image, especially within the context of customer experience. Customers don’t “just” record themselves unboxing a product or take a selfie with one—they’re conveying their wider experience using a meaningful medium. This is the root of visual media’s feedback effectiveness.

Brands that allow customers to submit images or videos with their other survey feedback can tap into this emotional power as well. As previously mentioned, people process images much faster than text. Combine this heightened speed with the added meaning conveyed by an image, and the result is a piece of feedback that CX practitioners can process faster and act upon more meaningfully. Since more meaningful feedback is one of the hallmarks of any best-in-class CX program, it’s important to give customers the ability to express themselves through multimedia options.

Going Deeper

Once brands gather more meaningful feedback from multimedia surveys, they have an opportunity to enact truly meaningful change. These changes are also much more likely to reflect what customers are concerned about because images and videos are much more unequivocal than words.

Think about it—a written phrase like “the checkout process was muddled” is open to many interpretations. By contrast, a video of a customer interacting with an automated checkout machine is specific, impactful, and much more likely to let brands learn exactly what the problem is.

Once brands learn precisely what customers love or what went wrong, they can take steps to enhance that offering or correct the process in question. In short, multimedia feedback enables everyone to win. Customers are more likely to provide feedback because they can communicate in ways they prefer, while companies glean much more specific and relevant feedback.

The Human Connection

Multimedia options enable brands to better experience a customer’s emotional connection to them. Reading written answers is one thing, but hearing stories through voice feedback, watching body language through video feedback, and seeing facial expressions in an image adds context that writing simply cannot convey. This type of feedback also shows the customer’s passion and emotional connection to the issues enabling CX leaders to help internal leaders connect with the customer. Brands can turn that context into action, which adds another layer of meaning to customers’ images, videos, and recorded messages.

In short, multimedia feedback transforms feedback from mere questionnaires into human connections. It enables brands to better harness emotion, which in turn empowers them to enact far more meaningful change. That potential for meaningful change is the crux of multimedia feedback, which is why it’s key for any brand hoping to reap transformative success to include it.

Want to read more about how you can effectively listen to your customers, employees, and the greater market? Check out this InMoment Point of View, “How to Achieve Meaningful Listening Through Surveys” today!