Customer Churn and Its Impact on Business Success

Customer churn is when a customer stops doing business with your organization. This is an important statistic for businesses to have to assess customer satisfaction and build sustainable growth.

It’s important to keep track of how many customers leave and why they leave so that you can make the right adjustments for future customers and hopefully improve customer retention. However, it can be difficult to measure these types of factors and produce usable data. That’s why businesses need to keep track of customer churn, which is the metric used to measure how well you are retaining customers. Discover the ins and outs of customer churn and what business owners can do to make the most of their circumstances.

What Is Customer Churn?

Customer churn occurs when someone chooses to discontinue using your products or services—or in other words, they are no longer a customer. Also known as customer attrition, customer churn gives a business owner insight into how well their business is doing over time, which is an essential part of management and growth.

More specifically, customer churn is measured and evaluated using a customer churn rate. This rate reflects the number of customers who stopped using services or products during a set period. This set period could be any relevant time frame your company is analyzing, including a year, a financial quarter, or even a single month. This churn rate is also useful in customer churn analysis.

Types of Customer Churn

When looking at customer churn, each case can be divided into one of two categories: voluntary churn or involuntary churn.

- Voluntary Churn: Voluntary churn occurs when a customer actively chooses to stop doing business with you. This decision is driven by dissatisfaction, a change in needs, or moving to a competitor. This may look like a customer buying from a competitor after experiencing long wait times with your organization.

- Involuntary Churn: Involuntary churn occurs when customers stop doing business with you without intending to. This is often due to avoidable factors such as payment issues or subscription expiration. An example of this is a customer’s credit card expires, and they forget to update their payment information, leading to an unintentional cancellation of their subscription.

It is important to understand these two types of churn and how each of them can be addressed.

Why is Customer Churn a Problem?

Customer churn is a problem that businesses should seek to solve because it directly affects revenue, reputation, and growth.

When customers leave, your business loses the immediate sales from those customers and the potential for future revenue. Since acquiring new customers is more expensive than retaining existing customers, you will be forced to spend more to cover the churned customers’ loss.

Furthermore, a high churn rate can be indicative of dissatisfaction with your products or services. Dissatisfied customers who have churned can harm your brand reputation by leaving a negative review or sharing their bad experiences on social media.

These results of customer churn will ultimately end with your business struggling to maintain sustainable growth. Long-term customer relationships are important for an organization to be able to grow, and customer churn disrupts this cycle.

Why Is Customer Churn Important?

Churn rates examine the recurring business and value lost over certain periods. It’s important to look at customer churn to prevent customers from leaving due to problems you could potentially solve, which protects your brand, money, and future. Here are some of the more specific reasons why customer churn is important to measure:

Brand Impact

Dissatisfied customers negatively impact your brand equity, and especially in a market that is driven by the internet and influencers, it can be dangerous to your company if customers leave for a similar reason and discuss it online.

Not only are you losing their business, but having dissatisfied customers also makes it more difficult to find new customers if the brand receives a bad reputation from dissatisfied customers. This could be news spreading by word of mouth, reviews, or social media.

Costly Consequences

Customer churn costs money, not only because you would be losing someone’s immediate purchases, but because customer loyalty is a huge asset to companies. Returning customers tend to spend more money on a brand once they have made a decision to become loyal customers, and finding and persuading new customers can be very costly and time-consuming. Ultimately, losing customers who spend a lot on your brand can affect the bottom line in the present and over time.

Future Growth

You need the loyalty of your customers to sustain your business, especially when you roll out new products or initiatives. If there aren’t people around to get excited about new products and services, companies can wear themselves thin because they focus on the basics that need to be fixed rather than healthily expanding.

Competitive Advantage

With every industry getting more and more competitive, it’s more important than ever to be at the top of your game. The last thing you want is a new competitor stealing clients or customers, especially if you can offer a solution for those customers. This competition should encourage organizations to focus not only on new business but also on retaining existing customers.

Proactive Business Strategies

Some problems arise seemingly out of nowhere and businesses must adapt as needed. Others, though, can be identified in advance by closely watching customer churn, which means you can put certain procedures in place to prevent serious losses. If you can predict customer churn after measuring it over time, you can do more to prevent it than wait until it is too late.

Why Does Customer Churn Happen?

Customer churn is more than a metric; it’s an indicator of how well your services, products, and sometimes employees are performing. Sometimes all companies go through a higher customer churn period, but it’s always important to know your potential blind spots and look for creative solutions. The most common reasons include the following scenarios.

Poor Customer Service

Whether you offer an immediate service or online resources for purchases, how people feel treated makes a big impact on whether or not they stick around. High customer churn rates may be an indicator that your employees or teams “on the field” directly interacting with customers may need more training or evaluations.

Misalignment with Customer Needs

You may have a great product, but you aren’t going after the right group of customers. Marketing is a key element of any business venture, including gathering research about who needs your products and how. It’s also possible that customers need new or improved features, so you may have the right audience, but you don’t understand their needs. Feedback is critical to understanding the needs of your customer community.

Pricing Concerns

If your prices are lightyears ahead of competitors and you don’t update your services, especially as other competitors join the market, even the most loyal of customers may switch to either a more affordable option or whoever gives them the biggest bang for their buck.

External Factors

If you’re in a niche industry, you may not get consistent sales—a Christmas lights company isn’t going to have the same customer volumes year-round. You should consider this when calculating your churn rate and also see if there are things you can do during the off-season to bring in more customers. This could be adding products or services to make your offering more appealing outside of your primary season.

Furthermore, economic downturns or personal financial difficulties can cause customers to cut back on spending, resulting in churn. These factors do not affect your business exclusively and need to be taken into consideration when examining churn rates.

Lack of Engagement

Most businesses need to have an online presence to properly promote and market their company and products. Without it, your brand awareness and loyalty will go down, meaning valuable old customers won’t stick around with a decent competitor actively drawing them away. Similarly, low-quality content and communications are also a turnoff for a lot of customers.

What is Customer Churn Analysis?

Customer churn analysis examines an organization’s customer churn rate to understand what caused customers to churn and how it can be improved in the future. Customer churn analysis is a critical part of improving your organization’s customer churn rate because you will gain the necessary information to create an action plan to reduce churn and improve overall customer satisfaction.

An example of customer churn analysis is seeing why a specific subset of customers are churning. To do this, you can take the number of customers that churned and filter that data to represent just the demographic you are examining. Then, you can identify what caused these customers to churn and work on making customer experience improvements to prevent it from happening in the future.

How To Calculate Customer Churn Rate

The customer churn rate is usually expressed using a percentage, and the higher the percentage, the more customers are leaving and the more business you’re losing. At its core, the customer churn rate is calculated by dividing the number of customers lost by the number of total customers in a set period.

Another way to look at it is by using a formula. The customer churn rate equation looks like this:

For example: let’s say a company has 500 customers at the beginning of the quarter, but by the end, it has 450 customers. That means the company lost 50 customers, and when you divide that by the total number of customers for that quarter (500), you get 0.1. Multiply that by 100 to get your percentage and there you have it: the company had a 10% churn rate for that quarter.

Depending on the service or product, it may be challenging to determine what losing a customer looks like. If your service is a monthly subscription to your product, it’s easy to determine when someone unsubscribes. However, if you have a one-time service, it’s more difficult to approximate when you’ve “lost” a customer.

Some industries go months before services are needed, like home furniture stores or car dealerships. Those sales cycles are much broader and if they don’t see returning clients for even years, it doesn’t mean they’ve lost any value or money—that’s simply the nature of the field. Generally, you can estimate when a customer no longer uses your service by using the frequency of their purchases as a baseline.

Average Churn Rate

Ideally, everyone would have a 0% churn rate, but that’s not a realistic expectation to have. A 5%-8% churn rate is usually considered average, but it depends on the market, the industry, the size of your business, and more.

What is A Good Customer Churn Rate?

A good average churn rate across all industries is 4%, which can generally be used as a good benchmark for your business. However, customer churn rates vary widely by industry.

For example, the median churn rate for the digital media and entertainment industry is 6.9%, while the median churn rate for the software industry is almost half of that at 3.5%. Knowing these industry-specific metrics will be much more valuable than an umbrella statistic.

Tips for Customer Churn Rate

To predict customer churn, you need to be able to identify the things that have the biggest impact on your customer experience. This involves a combination of data analysis, customer feedback, and understanding the nuances of your customer journey. Here are some steps you can take to predict customer churn:

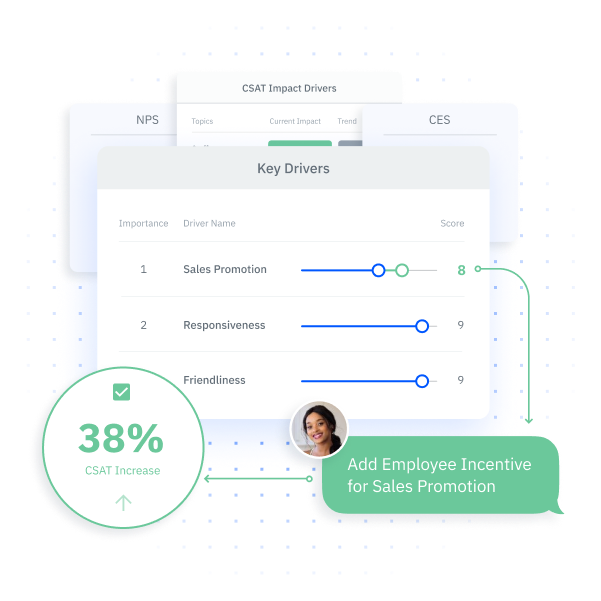

Know Your Key Drivers

In order to identify customer churn indicators, you need to identify the key drivers behind your customer experience. If you know that sales promotions have the biggest impact on your customer experience metrics, then a lack of sales promotions could be an early sign of churn. Other factors include a drop in engagement, lower transaction volumes, or an increase in negative feedback.

Once you know your biggest CX drivers, you can continuously monitor them to keep customers from churning.

Identify and Address Early Warning Signs

Depending on your business, there can be many early warning signs that a customer is about to churn. For example, if they become inactive or are using your product less frequently, cancel or downgrade a subscription, or start making late payments, these are all early signs of churn.

When customers exhibit these behaviors, it is important that they become a top priority and are re-engaged as soon as possible.

How can Customer Churn be Prevented?

Preventing customer churn is essential to your business strategy. It starts with measuring customer churn and finding the root of the problem. Then, you work on solutions. Here is a list of ideas and tips on how to tackle customer churn.

Focus on Your Best Customers

Pay special attention to your most loyal customers and make sure they feel appreciated. Loyal customers will share your content and be a promoter for your brand without being paid if they feel appreciated.

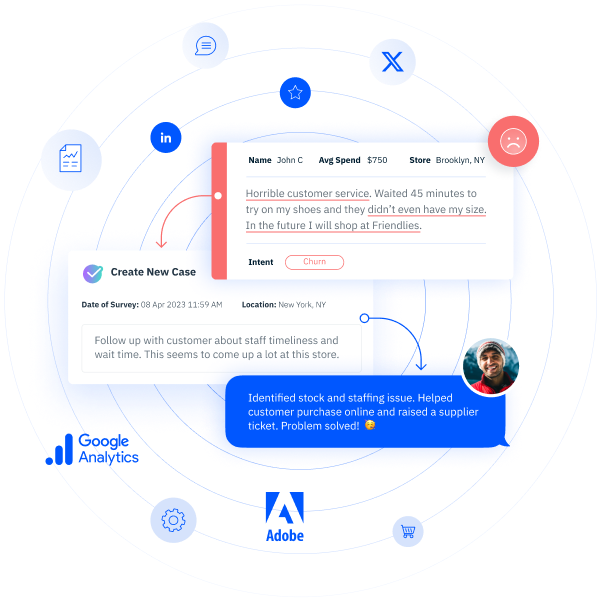

Analyze Churn in Real-Time

Analyze churn as it occurs instead of waiting to fix the issue. The more preventative maintenance you can do, the better. In order to prevent customer churn, you need customer experience software that can accurately predict customer sentiment. Being able to detect customer sentiment will allow you to predict what actions a customer is likely to take based on their feedback.

For example, a customer might leave an online review expressing their negative feelings about their most recent purchase. With the right tools, you can recognize the importance and flag this review as a high-priority case so that it is resolved quickly, which will result in a saved customer.

Conduct Competitive Analysis

Do a competitive analysis to see what your competitors are offering that may persuade customers to abandon your brand. Understanding their strengths can help you address gaps in your own offerings that might be driving customers away.

Lower Customer Churn with InMoment

InMoment’s customer experience platform gives you all the tools you need to analyze, track, and reduce customer churn. With the ability to view customer interactions from every source in one place, measure unstructured feedback, and more, it is the perfect tool to help you connect more with your customers. To see how it can help your business, schedule a demo today!

References

Recurly Research. What is a good churn rate? (https://recurly.com/research/churn-rate-benchmarks/). Accessed 8/30/2024.