We live in a world that is all talk. With social media platforms everywhere and growing, more and more people are chatting 24/7. When it comes to business, customers don’t want to be talked at; rather, they want to connect with their favorite brands knowing their voices are heard.

Many businesses are missing the opportunity for building and fostering strong relationships with their customers by not showing up to the conversation. Successful companies, on the other hand, find ways to show up—not only in stores, but online and through social media interactions. By engaging with your customers, acknowledging their concerns and complaints, and striving to put them first, you can foster long-term relationships with them.

Your customers have their own stories, and, if you are willing to listen, they will tell you what it is. While you build and cultivate the customer experience, remember that experiences aren’t born but are made. Each moment a customer engages with your products, services, and people is a moment that could sway them to be a lifelong customer or turn them away.

How would you rate your customer experience? As you evaluate your customer experience, here are 5 things to help you improve it.

Be proactive

Successful companies are always looking for ways the can provide their customers—current, past, and future—with the best service possible. By understanding your customers, being proactive, and anticipating their needs (and wants) businesses have the opportunity of gaining a loyal customer for life.

You’ve probably heard people say, “Get out of your comfort zone.” Businesses can have trouble doing this, especially if everything seems to be going well. However, are you continually looking for new ways to improve the customer experience, or are you comfortable in a company structure that isn’t willing to try something new? There are a lot of companies out there taking smart risks and reaping the rewards.

Show empathy

More companies are realizing that empathy is key to providing their customers with better service. Empathy is the act of putting yourself in someone else’s thoughts, feelings, personality, and circumstances. By simply taking time to be more empathic to your customers, you can better understand their needs and provide them with better service.InMoment believes that no one person owns the customer. Instead, everyone—customer and company alike—owns the experience, and by equally sharing in the experience, everyone carries equal weight. To better serve their customers, brands must understand why their customers have chosen to interact with their company. To do that is to show empathy.

If you want to learn more about showing empathy to connect and build better relationships with your customers, take a moment to check out and download our empathy map exercise.

Empower employees

Many companies overlook the power of their employees and miss out on untapped potential. In many cases your employees are the face of the company. Think about it. They are interacting with customers on a day-to-day basis, answering their questions, dealing with their complaints, and building (or not building) strong relationships with customers.Take time to train and ensure your employees develop the skills they need to be successful. Brands with a strong company culture that encourages employees to engage and share appropriate company Tweets and posts can have a positive influence on strengthening the company’s brand.

Also, encourage your employees to offer feedback and suggestions, and listen to their concerns. Businesses that listen to their employees, along with their customers, have more insights on where they can improve and strengthen the brand image.

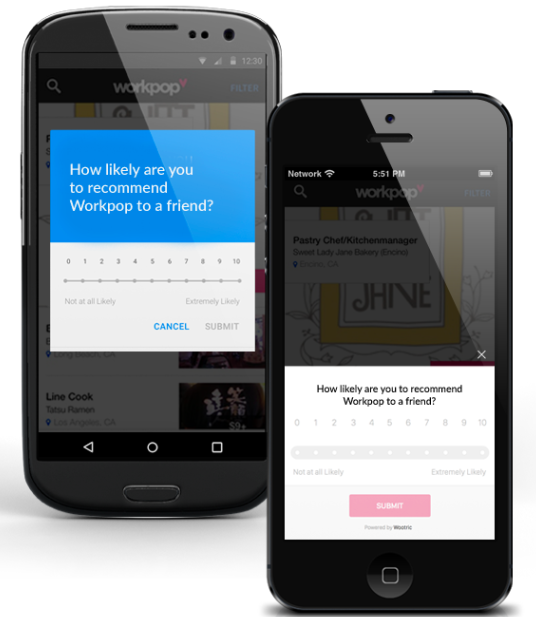

Collect customer feedback

How do your company, products, and services rate with customers? If you aren’t taking the time to gather feedback from customers, you are missing out on actionable insights for improving the customer experience and implementing new strategies for meeting and exceeding their expectations.By collecting customer metrics and stories, you get a better idea of where you stand with your customers. In addition, the data gathered can help you develop more targeted interactions with your customer base and allow you have a more personalized experience with them.

Creating more personalized interactions and connecting with your customers is important. So, how are you winning the moment with your customers?

Exceed expectations

Stand out from the crowd by providing your customers with the best service, content, and overall experience possible. You are not only competing with your competitors, but with yourself. Where can you improve and how can you exceed your customers expectations? Look at what your competitors are doing and what they are talking about. Can you take another angle that they may not have mentioned and talk about it? There are always ideas out there that can be expanded on.With social media and other digital marketing platforms, create the best campaigns or blog posts that will not only inform but engage your online audience. Be authentic and add value to their lives in the content you create and share. In a world where there is a lot of chatter and information being thrown at people, you need to capture their attention with interesting and well-thought-out campaigns.

The more you understand your customers and their needs, the better products, content, and overall service you can provide them. InMoment wants to help you “own the moment.” That’s why we have developed products and services to not only improve the customer experience, but to truly empower each person in your organization.