Financial Services Reputation Management: Secure Lifelong Customers

Financial services reputation management is important for institutions looking to build a loyal customer base. Reputation management initiatives can help you earn trust and increase consumer retention.

Did you know that over half of financial services consumers say they have low trust in their provider? And, of those consumers, only 34% of them would recommend their brand to friends and family.

Financial services providers are tasked with a unique challenge. Since finances are such a personal part of our lives, consumers in the industry are the most withholding of their trust. So it is up to the organization to earn that trust and prove to the consumer that they are deserving of their business and can be trusted with their finances.

Why Reputation Management Matters in the Financial Service Industry?

To gain this trust, it is now more important than ever for financial services institutions to implement strong online reputation management initiatives. Online reputation management gives businesses the power to control the narrative surrounding their brand, respond swiftly to feedback, and proactively address any negative publicity, thereby fostering credibility and confidence among current and potential clients. This holds significant importance for every business operating within the financial services sector including:

- Retail and commercial banks

- Investment banks

- Insurance companies

- Savings and loans associations

- Brokerage firms

- Mortgage providers

- Credit unions

Given the critical role money plays in people’s lives and its direct impact on their livelihoods, individuals often conduct thorough research, including assessing a financial institution’s online reputation, before making a decision.

Financial Services Reputation Management Strategies

Financial services reputation management is not as tricky as it may seem. If you are just beginning your online reputation management journey, your goal should be to monitor, influence, and improve the perception of your company. This can be done in a variety of ways, and you are going to need effective strategies that resonate with your customers. Based on data and market research, we’ve pulled together some reputation management strategies that are most likely to land with your customers and improve your brand reputation.

1. Respond to Reviews

Data shows that in the financial services industry, the average time taken to respond to reviews is 3.44 days. However, the leaders in the industry (10% of organizations) have an average response time of just 1.59 days — a 54% difference.

Not only does responding to reviews in less than two days mark you as a leader in the industry, but it also shows customers that you care about their feedback. With that, it is important to learn how to respond to negative reviews. If and when negative feedback arises, the sooner you take action, the more likely you are to resolve the issue and turn a negative review into a positive one.

2. Create Educational Content

More than anything, your consumers want to feel educated and supported throughout their journey with your brand. Creating educational content shows your customers that you value them and that you want them to succeed. Here are some examples of educational content you could provide:

- Online educational resources where they can expand their financial knowledge on their own time

- Real-time investment tips and awareness

- Personalized suggestions that are tailored to where they are in their financial journey, perhaps through an online portal or virtual advisor meeting

Your customers see you as a partner, and they feel that you should be helping them on their journey to financial freedom. By creating educational content such as the ones listed above, you prove that you are buying into that partnership.

3. Improve the Customer Experience Based on Feedback

While responding to reviews and creating content to support your customers are important, there is only one group that can tell you the changes you need to make: your customers.

Your business needs to set up an integrated customer experience program that combines structured and unstructured data that will give you a holistic view and understanding of your customers. Your customer experience program also needs to utilize predictive customer analytics so that you can fix the problems your customers didn’t realize they were having.

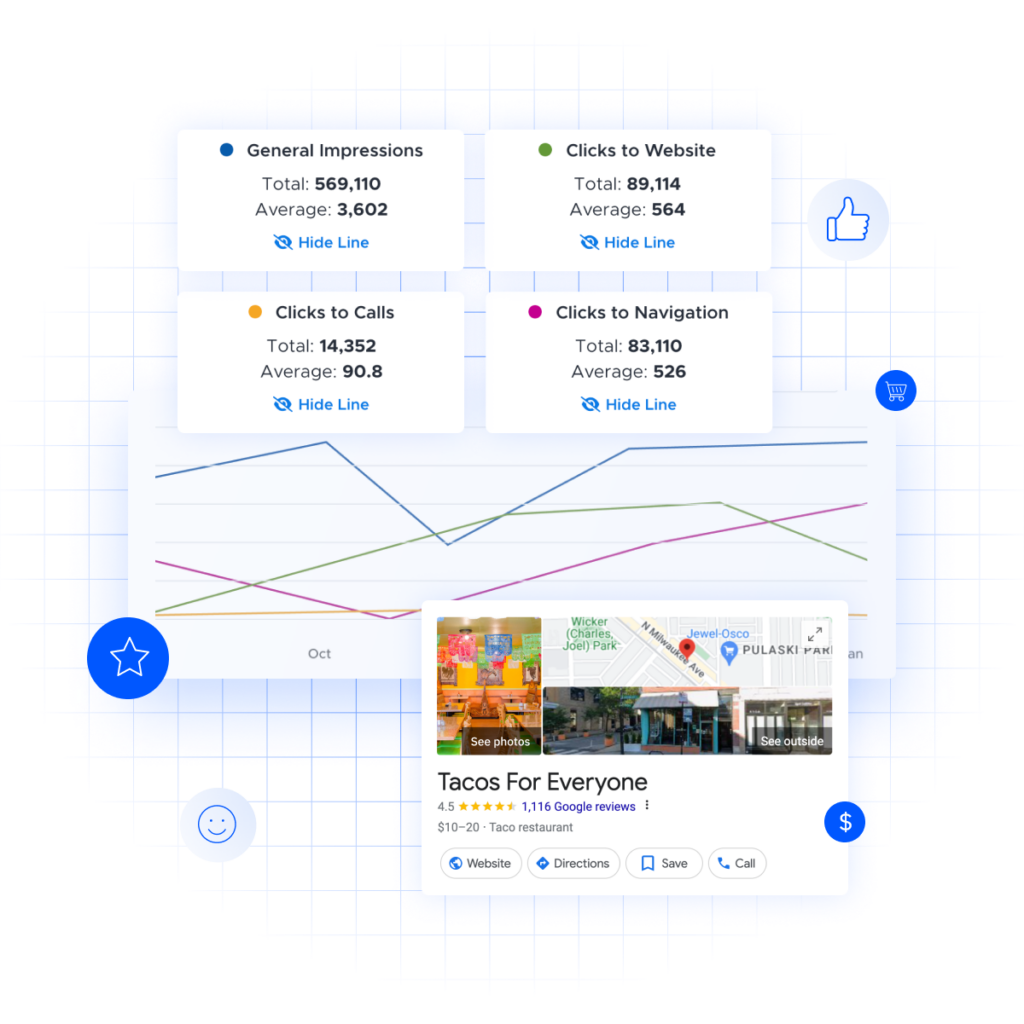

If you are wanting to be proactive about your reputation management initiatives, you can streamline your efforts with reputation management software. Softwares such as these can reduce the hassle of manually managing listings and reputation management for financial services organizations.

Reputation Management Tips for Businesses in Financial Services

Financial services reputation management can look different for organizations depending on which corner of the industry you operate in. Insurance customers have different needs and priorities than mortgage consumers do. It is your job to identify what is most important to your consumers and prioritize your reputation management strategies accordingly.

Retail and Commercial Banks

For retail and commercial banks to realize reputation management success, they should put a focus on improving customer service, convenience and accessibility, seamless digital experiences, and communication strategies.

This is important because it will increase a bank’s reliability, trustworthiness, and overall satisfaction. By prioritizing these aspects, banks can cultivate strong, enduring relationships with their customers, leading to increased loyalty, positive word-of-mouth referrals, and ultimately, sustained growth and profitability

Some other areas for improvement may include fees and charges, security and fraud protection, product offerings, and social responsibility. These improvement will go above and beyond reputation management and affect the overarching customer experience and give retail banks more of a competitive advantage.

Investment Banks

Investment banks can succeed with their reputation management by consistently demonstrating integrity and transparency in their dealings. This will foster trust among clients and stakeholders. This can be done by adhering to ethical standards, providing accurate and timely information, and upholding a commitment to client interests above all else.

Additionally, maintaining open lines of communication, actively addressing concerns, and adapting to evolving regulatory requirements can further bolster a reputation as reliable and reputable financial partners.

To go even further, consider implementing a focus on your expertise and advisory services. Consumers in this space want to feel educated and be a part of the process. In educating and advising them regularly, they feel included and will be more satisfied with their returns than if they were left in the dark.

Insurance Companies

Insurance companies need to put a heavy emphasis on agent training and customer service. In the insurance industry, every customer will have to talk to an agent—whether through online chat, over the phone, or in person—and these are the interactions that matter the most with your brand.

These interactions need to be positive for your insurance reputation management to improve. If a customer is dissatisfied with an interaction, it could cause them to leave a negative review about the entire company. Contrarily, a positive experience will cause them to respond well to post-claim surveys and favorably improve your brand reputation management.

Savings and Loans Associations

Savings and loans associations can succeed with their reputation management initiatives by focusing on providing exceptional customer service, offering personalized financial solutions, and cultivating strong relationships with their members. This involves ensuring that members feel valued, understood, and supported throughout their financial journey.

Secondly, they should emphasize financial stability and security by reassuring customers that their deposits are safe and that the institution is well-managed and financially sound. Transparency regarding their financial health and regulatory compliance is crucial in building trust and confidence among members.

Lastly, they should actively engage with their local communities and demonstrate a commitment to social responsibility and contribute to initiatives that address community needs. By being seen as a trusted and involved community partner, S&Ls can enhance their reputation and foster a positive brand image.

Brokerage Firms

Brokerage firms should focus on operating with the high ethical standards. Firms should prioritize integrity in all interactions with clients, regulators, and the public. This includes transparent fee structures, honest communication about risks, and avoiding conflicts of interest.

Furthermore, implementing up-to-date trading platforms and tools, expanding investment offerings, and effectively securing accounts will build trust with current customers and improve brand reputation.

Mortgage Providers

There are many things mortgage companies can do to improve their brand reputation. Since mortgages commonly represent a large milestone in the consumers’ life, they want to feel educated, reassured, and supported throughout the entire process.

One of the biggest ways mortgage companies can improve their reputation by being transparent in lending practices. Customers want to know specific credit requirements and approval criteria, as well being assured that the company is following ethical lending requirements. Effectively implementing these tactics will make any mortgage company quickly become a trusted partner in the community.

Credit Unions

For credit unions to improve their brand reputation, there needs to be an emphasis on the member experience. When consumers choose credit unions over traditional banks, they are looking for a local partner for their financial journeys.

To capitalize on that, credit unions need to prioritize member feedback. Credit unions are member-operated by definition, and it needs to be clear that every member’s feedback is going to be taken into consideration when making business decisions.

Furthermore, members want access to personalized guidance, and resources, and want to be able to access those resources across different channels. Being able to implement cross-channel experiences that deliver personalized attention will lead credit unions to realize reputation and business success.

Communication and transparency is important across the board for all of these financial businesses, regardless of the niche they operate in. Prioritizing transparent communication and utilizing customer feedback will help any financial institution succeed.

The Benefits of Reputation Management in Financial Services

We’ve covered why consumer trust is so important in financial services, and that you need to implement a reputation management strategy in order to earn that trust, but there are also business benefits that come from those strategies. Here are some of the outcomes you can expect from an effective reputation management strategy.

- Increased Trust: Financial services rely heavily on trust. Positive online reputation management helps build and maintain trust with clients, investors, and stakeholders by showcasing reliability, professionalism, and integrity.

- Risk Mitigation: Financial institutions are particularly vulnerable to reputational risks due to the sensitive nature of their services. Effective online reputation management helps identify and address potential risks, minimizing the impact of negative events such as data breaches or customer complaints.

- Competitive Advantage: A strong online reputation can differentiate a financial institution from its competitors in a crowded market. Positive reviews, testimonials, and a favorable online presence can attract new clients and retain existing ones.

- Regulatory Compliance: Compliance with regulatory standards is essential in the financial sector. Online reputation management strategies can ensure that institutions adhere to regulatory requirements regarding transparency, disclosure, and customer protection.

- Crisis Management: In the event of a crisis or negative publicity, having robust online reputation management strategies in place enables financial institutions to respond promptly, manage the narrative effectively, and mitigate reputational damage.

These benefits will not only benefit your consumers, but they will also affect your bottom line. Creating a consistent brand image and consistently presenting it across all of your platforms can increase revenue by almost 25%!

REPORT

2024 Financial Services Online Reputation Benchmarks Report

InMoment’s 2024 Financial Services Online Reputation Benchmarks Report provides a top-level view of the state of reviews today for the financial service industry — and how these reviews reflect the experiences financial services consumers want to have. The benchmarks serve as a valuable tool for organizations looking to assess their reputational performance, set goals, make informed decisions, and drive continuous customer experience improvement.

Improve Your Financial Services Reputation Management with InMoment

Many of the world’s leading financial institutions already partner with InMoment to help them understand and act on customer feedback. InMoment’s dynamic XI Platform gives brands the ability to engage with their customers across all platforms, make sense of their feedback, and, leverage data to improve their business performance. See for yourself by scheduling a reputation management demo today!

References

Forrester. Financial Services Firms Need To Learn How To Earn Customers’ Trust. (https://www.forrester.com/blogs/financial-services-firms-need-to-learn-how-to-earn-customers-trust/). Accessed. 3/28/2024.

Status Labs. 52 Online Reputation Statistics for 2023. (https://statuslabs.com/blog/reputation-management-stats). Accessed 3/28/2024.