How to Level-Up the CX Program at Your Growth Stage Business

You’ve been using Net Promoter Score in all the right ways, and now you’re looking to advance your CX program. Fear not, you’ve come to the right place!

The next level of CX for Growth Stage companies focuses on a few key things:

- Taking a more holistic view of the entire customer journey

- Leveraging technology to listen to hundreds and thousands of customer comments

- Employing robust analytics

We’ve previously explained how to quickly build your first customer feedback program with a single survey like Net Promoter Score in a single channel. Now we’ll combine surveys with behaviors and concrete numbers to see how CX impacts metrics like product use, retention, and sales.

Yes, it’s time to level up your CX program!

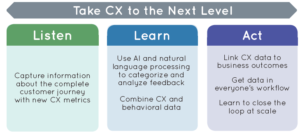

We’re sticking with the 3-step Listen, Learn, and Act model but upgrading each step’s activities from Early Stage to Growth Stage CX programs.

Step 1: Listen

In this step, you’ll gather information across the customer journey. Many people at the Growth Stage have already identified critical touchpoints in the customer journey that drive success, including:

- Achieving first value

- Support interactions

- Using a new product or service

The Listen step focuses on asking the right questions at these touchpoints to help you optimize your CX. During the Early Stage, you offered up the Net Promoter Score survey. Now it’s time to move on to two other important customer experience metrics.

Customer Satisfaction Score (CSAT)

The Customer Satisfaction Score (CSAT) asks customers how satisfied they were with a recent interaction, like a support call. CSAT is the most popular CX metric for transactional interactions, and you use it to gauge how well these interactions are being handled.

How might you use CSAT? If you’re with an e-commerce company, you likely use it to get post-delivery feedback on a purchase. At SaaS companies, product teams use a CSAT variation called a Product Satisfaction survey (PSAT). It’s often triggered in-app to get feedback that helps product teams optimize the user experience.

Customer Effort Score (CES)

The CES survey asks, “How easy was it to _________?” CES is used to improve systems that may frustrate customers. It allows you to capture early feedback and discover ways to make sure the path to the all-important first value is smooth.

Use CES surveys to measure how customers feel about their onboarding, which is the critical first step of the customer journey. It’s much easier to retain a customer who has had an excellent first experience with your product than win over a customer reeling from poor onboarding that missed the mark.

When you combine the information gathered from NPS, CSAT/PSAT, and CES, you can uncover previously hidden areas of the customer journey and understand how those affect overall CX.

Step 2: Learn

You now have a plethora of customer feedback from your three surveys, and it’s time to extract actionable insights. The important thing to realize here is you’re collecting feedback from thousands of surveys. That amount of data quickly becomes hard to address at scale, and text-match tags won’t capture the wealth of information available. You’re going to need more advanced tools than what you used at the Early Stage.

Customer insights through machine learning

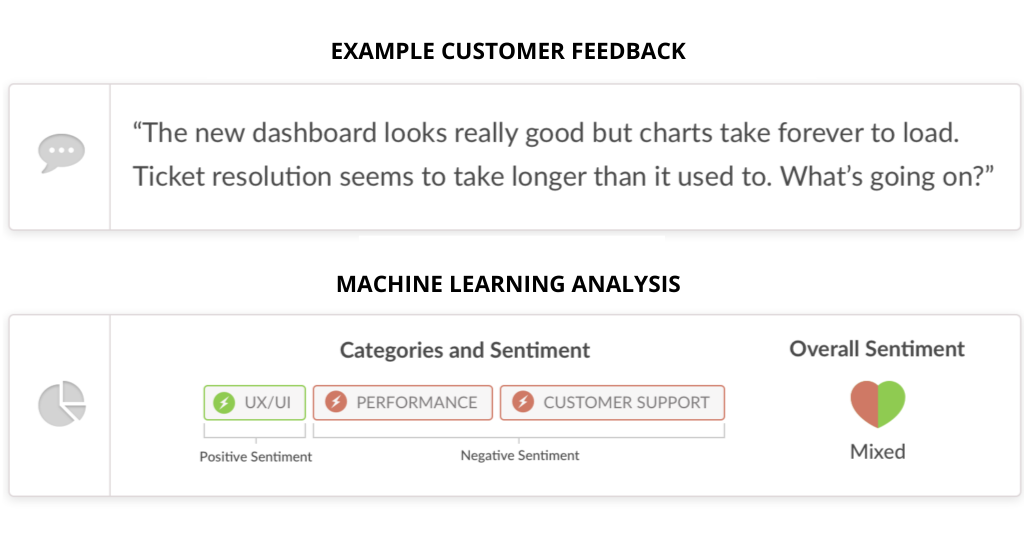

The most insightful input from customers comes in the free-text portion of your surveys. To mine that rich data, you’ll need a tool that uses Natural Language Processing (NLP), a form of AI for real-time text categorization and sentiment analysis.

For many businesses, the wealth of customer experience data has become overwhelming. Artificial intelligence gives us the means to retake the initiative.

– Jessica Pfeifer CCO, Wootric

Advanced tools for the Growth Stage Learn step share two essential elements:

Categorization in real-time

One of the reasons you’re not manually analyzing the text is you don’t want to wait weeks for insights, and your customers certainly don’t want to wait that long for action. Natural Language Processing allows computers to auto-tag, interpret, and analyze text data as new topics arise, highlighting any issues immediately so you can take timely actions.

Sentiment analysis

Simply put, sentiment analysis tells you why your customers do or don’t love you. NLP performs sentiment analysis on your customer and user feedback, taking you way beyond the traditional text-match tagging. Not only is every topic tracked over time, but NLP also tracks the positive and negative tone and tenor of the customer voice. In a quick review, you can instantly gauge whether a specific product touchpoint performs well for your customers. This lets you see how your business initiatives are affecting your users in real-time.

Auto-categorizing feedback is a powerful step in VoC, taken with the help of new technologies like Natural Language Processing.

Link CX metrics to business outcomes

You can tie CX directly to business outcomes by linking customer survey data to business-focused metrics like purchases, conversions, churn, and sales.

Say you want to tie CX to churn through your mobile app. No problem!

- Look at your post-survey 90-day churn metrics and see at what scores you begin to lose customers rapidly.

- Compare that with your NPS. Let’s say your NPS shows you can tolerate some Passives and maybe even some Detractors scoring you at a 5 or 6. Cool, you can let those ride a bit if you’re resource light.

- Detractors scoring you at a 0 or 4, however, could be at serious risk of leaving if they don’t receive the support they need to succeed. Put your resources there ASAP!

How else can you monitor the risk of churn? Well, if you’re a B2B business, you’re probably already looking at your Customer Health Score. Factor NPS and other CX metrics into your Customer Health Score and get even more insight with a system that takes into account behavioral metrics like the number of support tickets per user, usage of product features, and other engagement metrics.

Step 3: Act

You’ve listened, you’ve learned a lot, and now you’re ready to make an impact. But here’s the thing: CX is built by and affected by more than just one team at a company. So there are two critical parts to the Act step.

Get CX data into everyone’s workflow

A customer-centric organization relies on everyone having access to VoC data, so no individual or team at your company should ever have to search for it. All functions can drive better customer experiences and benefit from having CX data and analytics at their fingertips.

- Sales needs CX metrics at the account level in Salesforce to prepare for an upsell conversation.

- Customer Success uses Gainsight or other platforms for regular communications with customers.

- Customer Support is in Intercom or ZenDesk.

- Product may want data in their analytics platform like Tableau.

- Analysts will want to pull CX data into their relational database.

By connecting your CX program to the applications and software used by other teams, you can destroy silos and create powerful interactions that delight your customers. Look for CX platforms with native integrations and open APIs to make these connections seamless.

Optimize your product with CX

It’s all good and well to gather and distribute essential data and insights, but a CX program’s real power comes from making your product and services better.

Use your CX data to rank and address the things that matter most to your customers and thus to your business’ success. We recommend creating a dual-axis plan of attack to prioritize what you optimize.

- Look at the number of impacted customers and their average score for each issue.

- Combine that number with a qualitative measure of the engineering and operational effort required to address the issue.

Close the loop at scale

Once you’ve taken actions to improve CX, don’t forget to communicate back to your customers who gave you the feedback to make those changes. Let them know you appreciate their input and that it made an impact.

You now have hundreds and thousands of customers giving your feedback, and you won’t have enough resources to call each one personally. Thus you’ll need a hybrid model to close the customer feedback loop.

- High touch. A customer success agent or account manager can reach out to their customers when they respond, even if just to say “Thanks!” This connection lets customers know you’re listening and appreciate their feedback. For a B2B business, this is the way to go if you have the resources.

- Medium touch. Segment the list by survey scores. Sync with a platform like Intercom to trigger automated messages or schedule a weekly email campaign to each group.

- Thank Promoters and possibly offer them an incentive to be brand advocates, perhaps by sharing their positive feedback on social media.

- Route Detractors to Customer Success or Customer Support. That team can devote time to understanding why the customer’s not happy — especially those who didn’t leave feedback — and make the CX and relationship better.

- Automate a reply to Passives who didn’t leave feedback, spurring a “What would make you LOVE us?” conversation.

- Low touch. Respond with information-sharing and transparency, such as a blog post or newsletter at the end of the month, summarizing the feedback you’ve received and stating your plans to address issues customers have raised.

A growing company needs to grow its CX program. By expanding your view to the full customer journey, expanding the feedback you’re requesting, and then using more advanced tools to pull insights from the feedback, you’ll be ready to optimize the customer experience you provide and enjoy the success it brings.