The Ultimate Guide to Google My Business Posts

Google Posts can supercharge your customer engagement on your Google Profile, drive conversions, and even boost your SEO efforts. Learn everything from types and benefits to best practices and examples in this comprehensive guide.

Google Posts are an invaluable tool for businesses to communicate updates, offers, and events directly to their audience. This guide will cover everything you need to know to make the most of them.

What Are Google Posts?

Google Posts are short updates published on Google My Business (GMB) profiles. These posts appear on your business listing, providing a direct channel to communicate updates, promotions, and events.

Types of Google My Business Posts

There are three primary types of Google Posts you should familiarize yourself with. Each type offers specific details about your business to encourage engagement and drive actions, such as purchases or visits to your location.

Offers: Organically promote discounts or special offers directly on your Google Business Profile. Offers appear near the top of the Business Profile on Google Search and Maps, as well as in the “Updates” tab with all other posts.

Updates: Provide general information about your business. Use this post type to share news, announcements, or updates that give potential customers more opportunities to learn about your brand.

Events: Share details of upcoming events to increase registrations and drive foot traffic. Events that meet specific criteria may also appear on the “Overview” tab of your Business Profile, making them more visible to customers.

Why Are Google Posts Important?

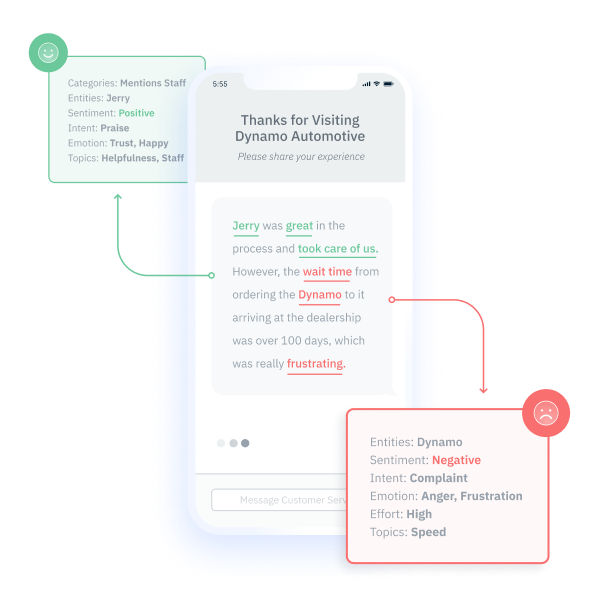

When shoppers browse online and land on your Google Profile, they look to understand if your business offers what they are searching for. Leveraging Google Posts to share business updates, events, and promotions would inform potential customers and allow them to make better decisions about whether they should visit your location.

Google Posts boost engagement by fostering a direct connection with your audience. When integrated with other local SEO strategies, they can enhance your brand visibility and drive higher conversions, making them a powerful tool for local marketing success.

What Are the Benefits of Google My Business Posts?

Incorporating Google Posts into your listings management can significantly enhance brand equity and visibility as well as improve customer acquisition. Here are a few benefits to consider when evaluating if Google Posts are worth your time and effort:

Enhance your local marketing strategy: Google Posts can help strengthen your local presence, making it easier to attract nearby customers. By sharing information about your business, you keep your Google Profile fresh and complete, optimizing engagement and driving more conversions.

Increase engagement: Google Posts enable you to build direct connections with your audience. Using photos, clear calls-to-action, and timely updates demonstrates to shoppers that your business meets their needs and encourages meaningful interactions with your brand.

Decrease your ad spend: Marketing teams invest heavily in promoting their business and offerings. Highlighting offers, discounts, and events on your Google Profile creates an effective inbound channel strategy for generating organic traffic and engagement, reducing the need for expensive paid advertising.

By leveraging Google Posts to enhance local marketing strategy, foster customer engagement, and drive organic traffic, you can amplify your business’s impact while reducing paid promotion.

Do Google My Business Posts Help SEO?

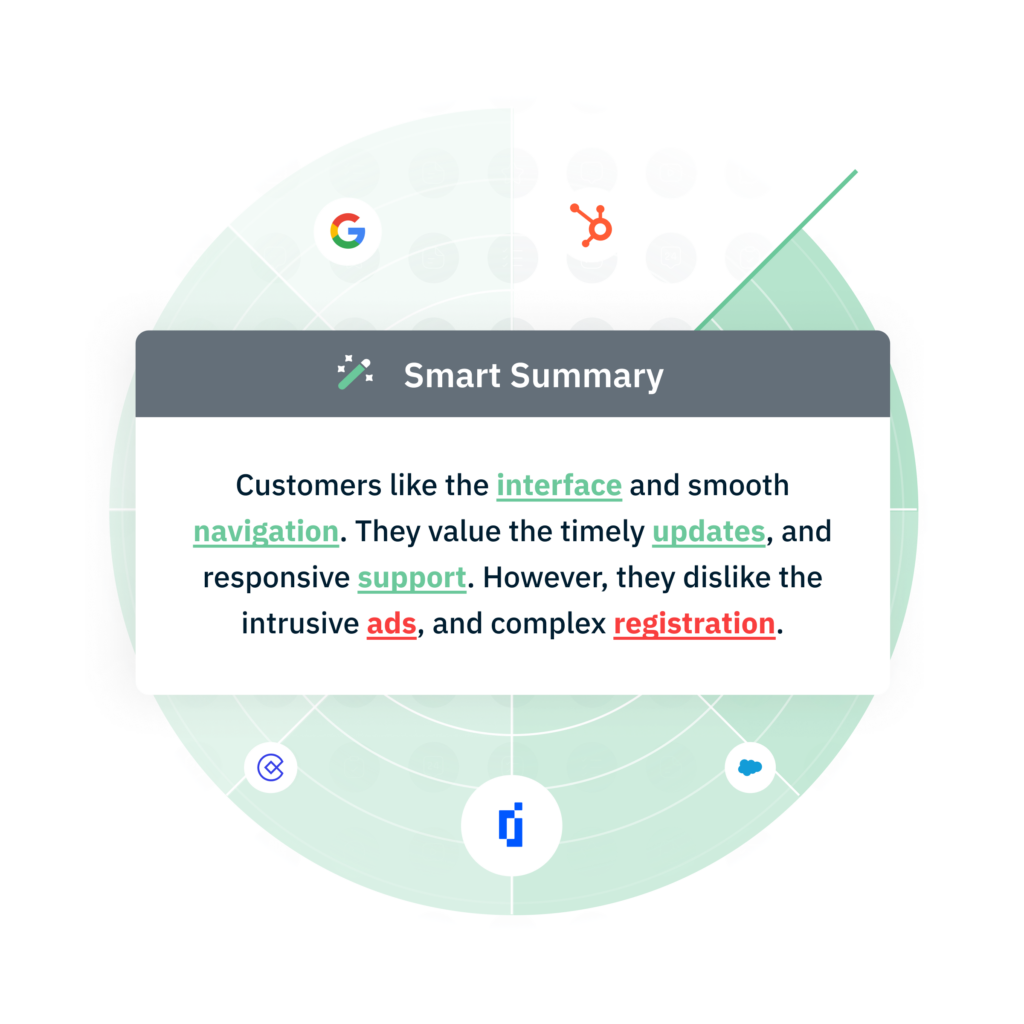

Google Posts indirectly impact your local SEO performance by supplementing your Google Business Profile with additional information and enhancing its relevance. Regularly updating your Google Profile with posts ensures it stays fresh and complete, which signals to Google that your business is active and engaged with its audience.

These posts also help you share timely updates, offers, and events, which can drive more clicks and interactions with your profile. The increased activity and engagement not only attract local customers but can also contribute to increased brand visibility.

It’s important to remember that Google Posts alone would not help your brand rank in the local pack. To optimize your search performance, you need to focus on your overall local SEO strategy – invest in listing management and improve your online reputation.

How to Post in Google My Business?

There are two ways to publish a Google Post on your Google Profile. You can manually do that for each location by logging into your GMB profile. To do that follow the steps below:

- Log into your Google My Business account.

- Select “Add Update.”

- Choose the type of post you want to create.

- In the dialog box, fill in the details.

- Publish!

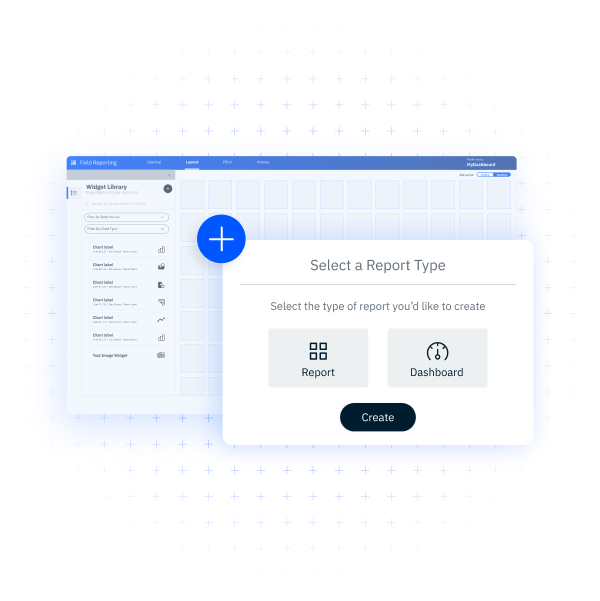

While this approach may work well for single-location brands, organizations with multiple locations often struggle to scale their efforts. If you are a multi-location brand, implementing a reputation management solution that offers listings management, including Google Posts, would help you create and publish posts at scale, while consolidating your daily operations into one platform.

See how easy it is to publish Google posts from the InMoment platform by taking a tour of the platform here!

What Are the Google Posts Dimensions?

All types of Google Posts allow a description of up to 1,500 characters. Use this space thoughtfully to craft engaging content that highlights the most important information while inspiring readers to act.

For images, prioritize high-quality visuals that are clear, well-lit, and professionally composed. Avoid significant alterations or excessive use of filters to ensure your images look authentic and appealing.

The recommended Google My Business post image size is:

Default Size: 720x 540pixels (4:3 aspect ratio)

Inches: 12.5 x 9.38 inches (width x height) at 96 DPI

Minimum Size: 480x 270 pixels

Maximum Size: 2120x 1192 pixels

Format: JPG or PNG up to 5MB

Google Business Posts Best Practices

Avoid phone numbers in descriptions: Including a phone number in your post description may result in rejection. Ensure this information is listed in the appropriate section of your Google Profile. You can attach a “Call now” button to your post that uses your verified Business Profile phone number.

Focus on quality: Make sure your posts are free of misspellings, gimmicky symbols, or meaningless content. Avoid anything that appears automated or overly distracting. While it may be tempting to use all 1,500 characters in your post description, focus on the primary goal of your post and highlight the most important details in an engaging way that resonates with your audience.

Make them actionable: Always include a call-to-action in your Google Posts, along with a link to a landing page that aligns with the next step in your buyer’s journey. A strong CTA can drive clicks, bookings, conversions, and in-person visits to your business.

Use high-quality images: Adding visuals to your Google Posts makes them more eye-catching and increases engagement. Use high-quality images that align with your brand, and avoid low-resolution visuals that fail to represent your promotions effectively.

Best time to post on Google My Business: As a general rule, avoid posting on major holidays or during very early or late hours. Depending on the type of post, consider the recommended times and days to publish to maximize engagement on your Google My Business profile.

- Business Updates

- Best time to post: 8 am – 10 am

- Recommended days: Weekdays

- Worst time to post: Before 7 am, after 9 pm, major holidays

- Offers

- Best time to post: 2 pm – 4 pm

- Recommended days: Thursday and Friday

- Worst time to post: Before 7 am, after 9 pm, major holidays

- Events

- Best time to post: 3 pm – 5pm

- Recommended days: Midweek

- Worst time to post: Before 7 am, after 9 pm, major holidays

Examples of Google My Business Posts

Now that we’ve covered the basics of publishing Google Posts on your Google My Business profile, let’s explore a few examples to inspire your strategy.

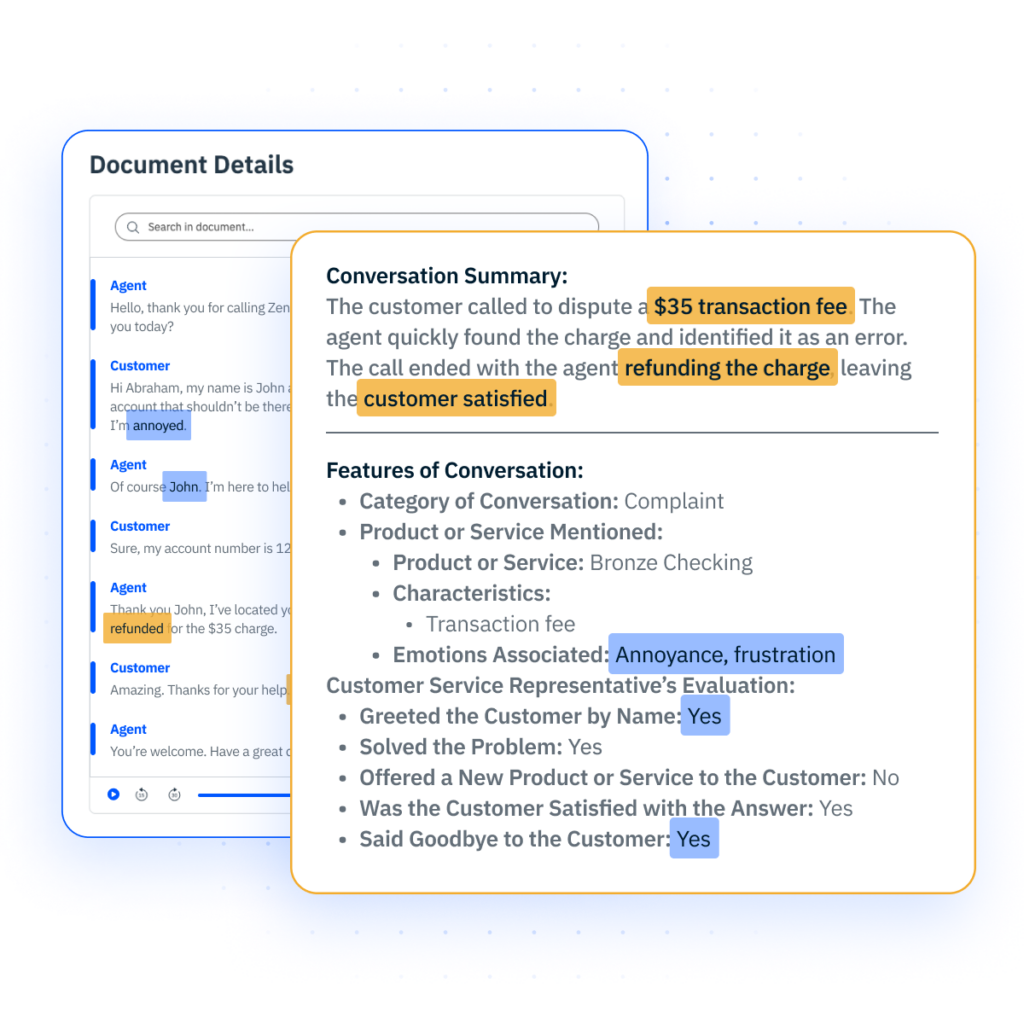

Good Examples Google My Business Posts

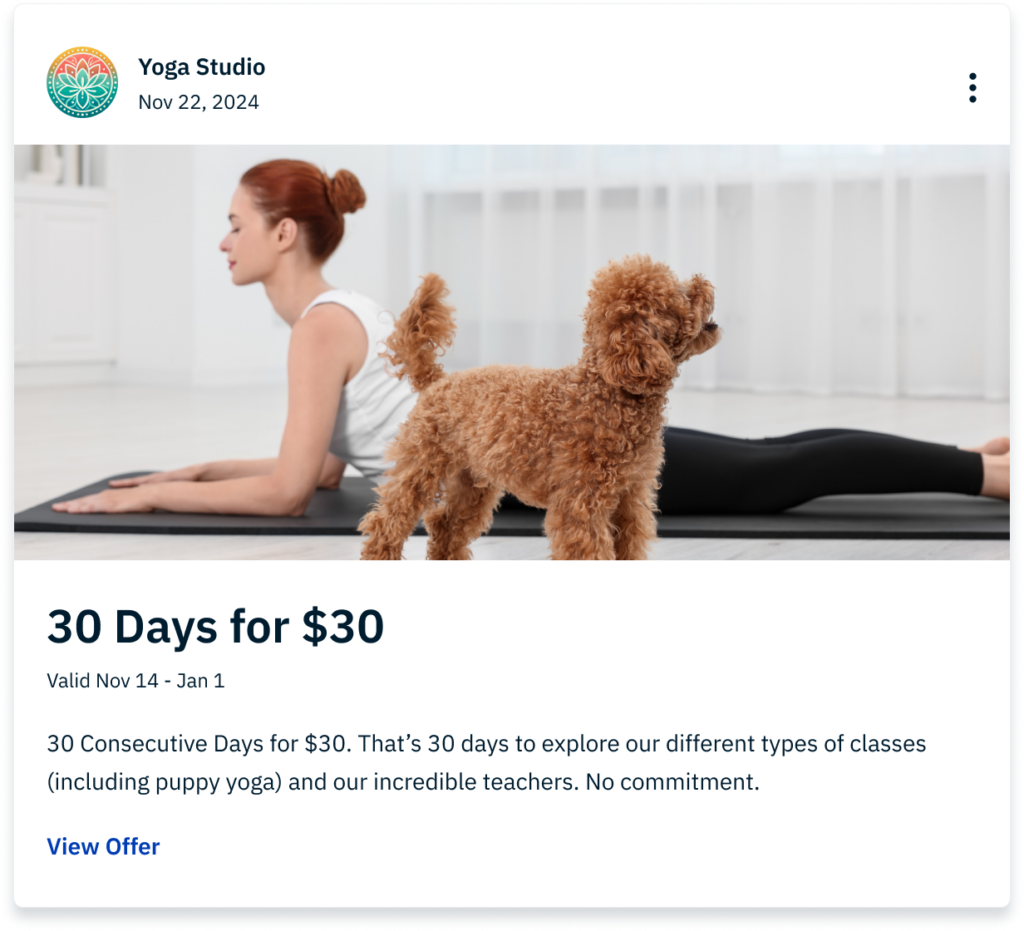

A good example demonstrates a well-crafted Google Post that effectively engages its audience.

It features a high-quality, visually appealing image that aligns with the content, capturing attention instantly. The message is concise, clear, and focused, highlighting a 30-day trial for yoga classes without requiring a membership commitment. Additionally, it includes a compelling call-to-action (CTA) that encourages participation.

By incorporating a deadline, the post creates a sense of urgency, motivating potential customers to act. This post was also published on the Google Profile at the start of the offer, ensuring timeliness and relevance.

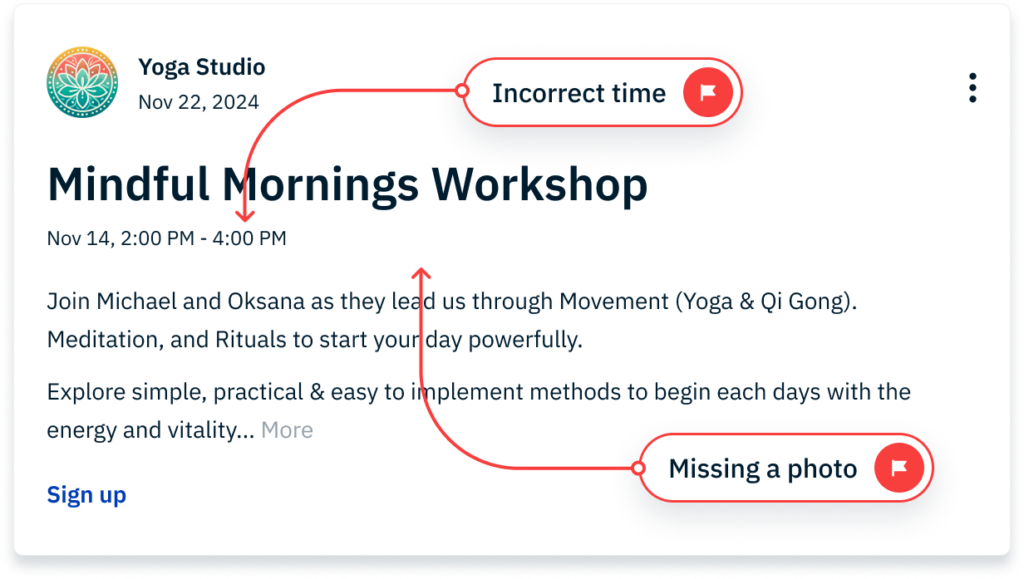

Poor Examples of Google My Business Posts

Now, let’s examine a Google Post that wasn’t as thoughtfully constructed as the previous example. What’s the first thing you notice? It’s missing an image! Without a visual element, the post fails to grab attention.

Looking closer, you’ll see that the workshop’s listed start time doesn’t match the title and description, creating confusion for the reader. Additionally, the event description could be clearer and more concise, making it easier for users to quickly understand the post’s purpose and take action.

Can Google My Business Posts Get Rejected?

Yes, Google My Business Posts can be rejected if they fail to comply with Google’s content policies. To avoid rejections, ensure you follow best practices when creating your posts. Below are some common reasons for rejection:

Low-quality media: Posts featuring poor-quality visuals, such as blurry or pixelated images, may be removed. Per Google’s policy, removals based on media quality cannot be appealed.

Prohibited or restricted content: Posts containing irrelevant or misleading information, such as off-topic content, fabricated experiences, or repetitive and unclear language (e.g., random characters), are likely to be rejected. Additionally, links leading to suspicious or untrustworthy websites are prohibited.

Phone stuffing: Google does not allow phone numbers to appear within post content to prevent abuse. Ensure contact information is provided only in the designated sections of your profile.

By adhering to these guidelines, you can reduce the chances of your posts being rejected and maintain a professional presence on Google My Business.

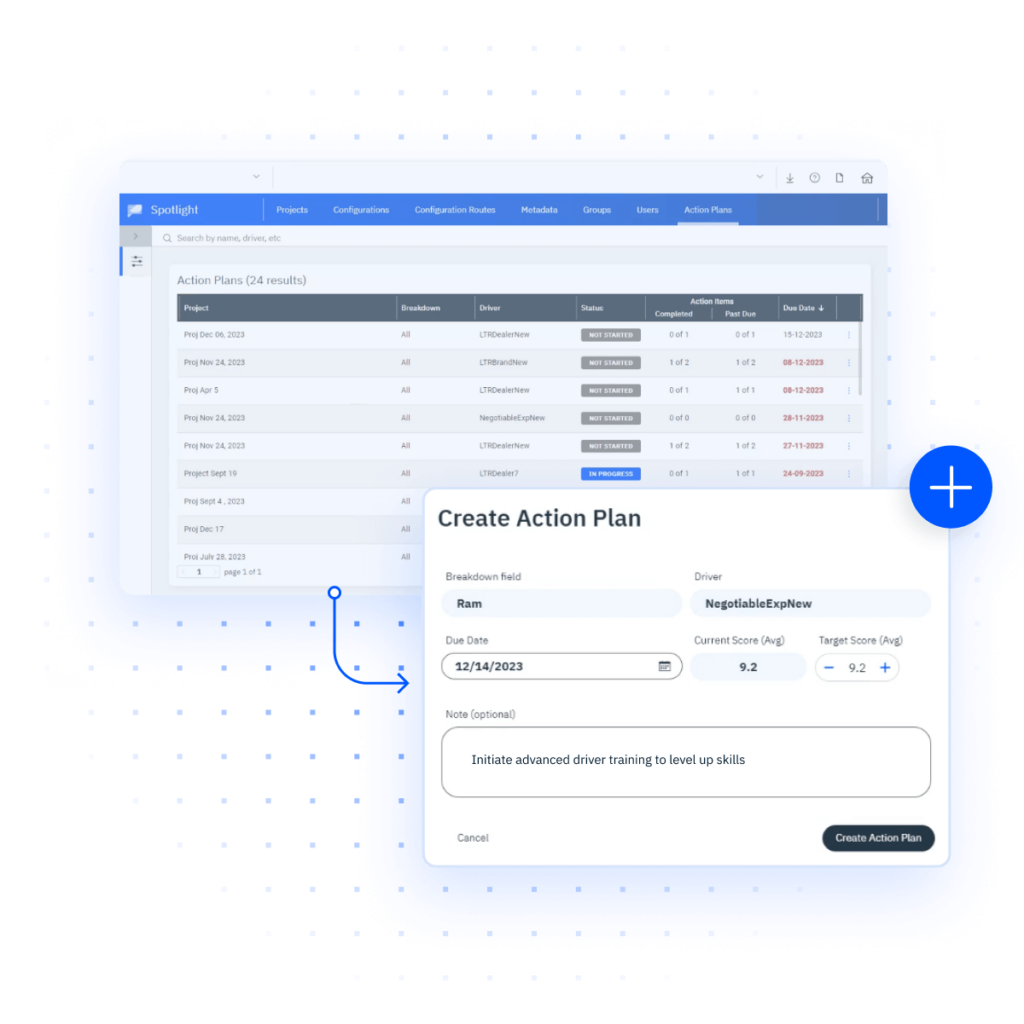

Google My Business Posting Software

Incorporating Google Posts into your online reputation management strategy and listings management activities is worth your time. However, manually publishing posts for multiple locations can be overwhelming. Implementing a solution that enables you to create and publish Google Posts in bulk can save time while unlocking the full benefits of this feature.

But how do you choose the right Google My Business posting software? Consider these key factors when evaluating your options:

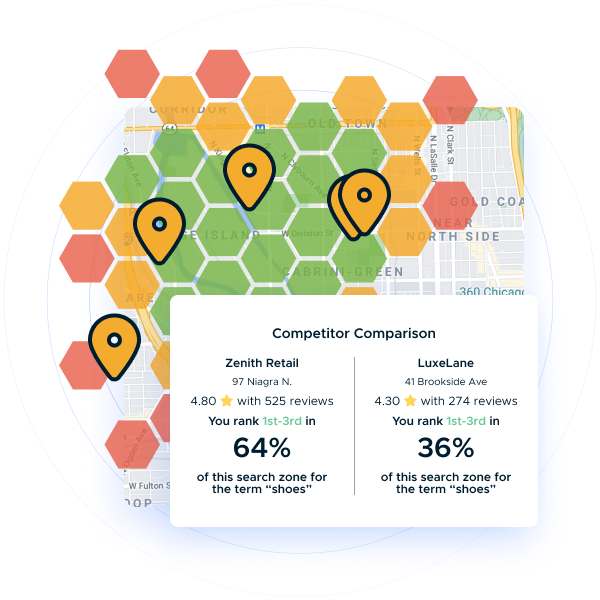

Align with reputation management goals: Ensure the tool supports your broader reputation management strategy by helping you build and maintain a strong online presence that attracts and retains customers.

Listings management capabilities: Select a local listing management software that simplifies managing multiple locations, ensuring your profiles are consistent and up-to-date across all platforms, and allowing you to publish Google Posts in bulk.

Scalability: Opt for an all-in-one platform that streamlines operations across locations and adapts as your business expands. This approach enables you to monitor results from a centralized dashboard, improving your strategy and results.

Ease of use: Opt for software with an intuitive interface that lets you start quickly without a steep learning curve. This not only saves time when adopting a new tool but also enables your team to manage Google My Business profiles more effectively.

Access to support: Look for platforms that provide reliable customer support, offering prompt assistance and access to tips and best practices to help you succeed in the long term.

With the right software, you can simplify Google Posts publishing, enhance engagement, and focus on growing your business by maintaining a positive reputation and boosting your brand’s visibility in search results.

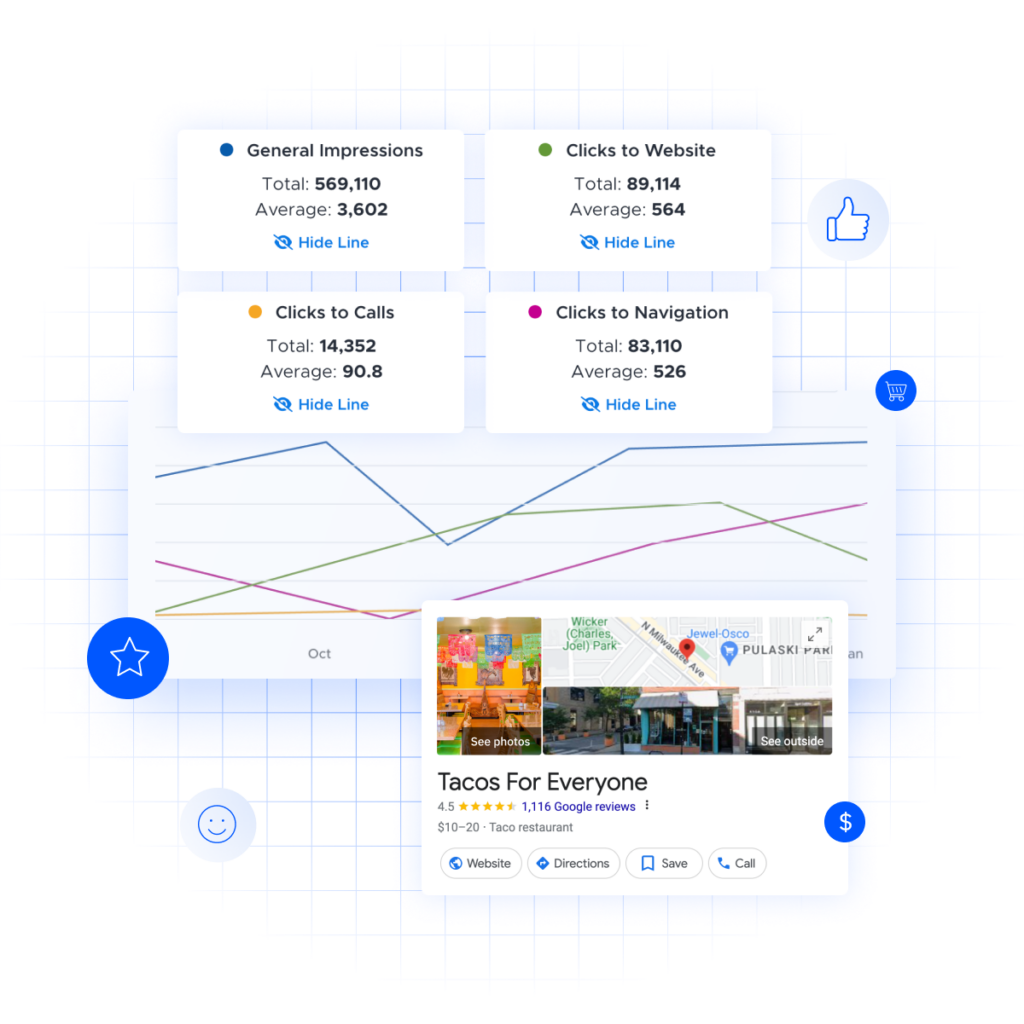

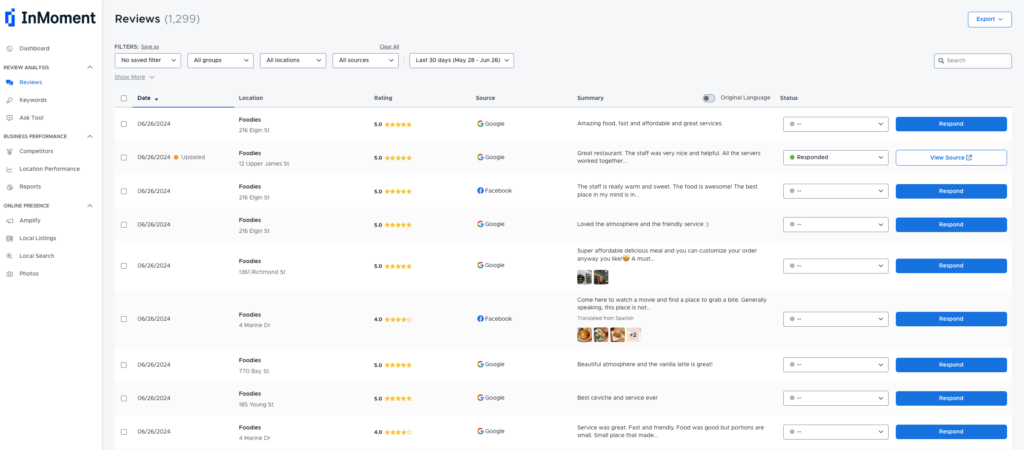

Take Your Local Listing Management to the Next Level with InMoment

Partner with InMoment to build a reputation management strategy that turns online searches into location visits. Our reputation management software allows you to optimize the performance of your business listings and increase search visibility and engagement on your Google Profile.

We make it easy for multi-location brands to create and manage Google Posts while providing them with a centralized place to streamline their listings and reputation management efforts and improve results in less time than other vendors.

Schedule a strategy session with our reputation management experts to learn how we can help you build a brand that attracts customers!