There is a thriving Meetup group of Customer Success professionals here in the San Francisco Bay Area. Customer Success is a new and evolving field, so each monthly gathering is packed with Customer Success Managers from SaaS (Software as Service) companies around San Francisco who want to learn the latest insights from experienced Customer Success leaders. (Note: If you don’t live in the SF Bay Area, you can still benefit from the expertise shared at these monthly meetups. Whenever possible, Junan Pang and the other organizers post a video of the event on their meetup page. )

In January, the group met up at Rainforest QA to explore a topic that is a big part of every Customer Success organization but may not always get the right level of focus…Net Promoter Score (NPS)!

Running an NPS survey program is easier than ever. No more annual NPS email survey campaigns or analyzing data in spreadsheets. A modern Net Promoter Score platform will survey your customers in real-time, start collecting data, and do the analysis for you.

Can’t get much simpler than that, right?

Actually…

There’s a lot more to NPS than what you see on the surface and every CSM knows it.

Maranda Ann Dziekonski, VP Customer Operations at HelloSign and Jennifer Ruth, Sr Director of Customer Success at Optimizely shared how they approach Net Promoter Score and tips for getting the most from this metric including whether it should be anonymous, how to improve it, and how an enterprise company should handle feedback.

For starters, the experts shared what NPS is and how to calculate your score. While most tools will automatically calculate it for you, it’s good to know what goes into this important number because it has such a significant impact on your company.

Setting up an NPS program? Get the ebook, The Modern Guide to Winning Customers with Net Promoter Score. Leverage customer feedback and drive growth with a real-time approach to NPS.

What is Net Promoter Score (NPS)?

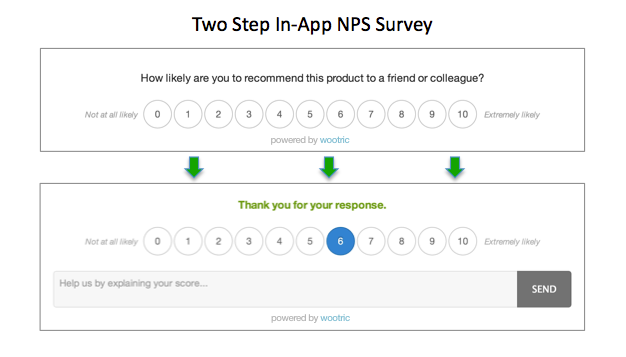

NPS is a one- question survey that asks: “How likely are you to recommend our product to friends of colleagues?” It is generally followed by a single, open-ended question, like “Care to tell us why?” that gives your customer an opportunity to elaborate on the reason behind their score.

NPS delivers a board-level metric and the “one number you need to grow.” The survey “metricizes” customer loyalty. It is the most important baseline metric for driving improvement in customer experience. NPS stands above CSAT (customer satisfaction) and customer health scores because it is meaningful and understood across all departments. Your NPS indicates precisely how happy your users are with your product/service, so it holds everyone accountable for customer centricity.

NPS delivers a board-level metric and the “one number you need to grow.” The survey “metricizes” customer loyalty. It is the most important baseline metric for driving improvement in customer experience. NPS stands above CSAT (customer satisfaction) and customer health scores because it is meaningful and understood across all departments. Your NPS indicates precisely how happy your users are with your product/service, so it holds everyone accountable for customer centricity.

Why does Customer Success use NPS?

One reason Customer Success departments in particular pay close attention to Net Promoter Score is because a low NPS can be an indication of potential churn.

How is NPS calculated?

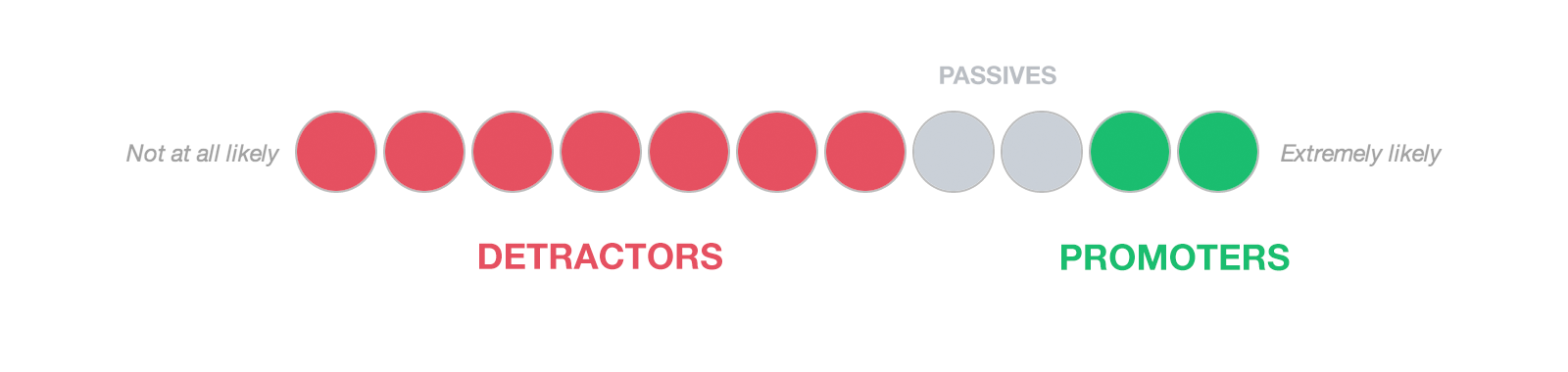

Customers rate their likelihood of recommending your company on a scale of 0-10. Survey answers 9 & 10 are considered promoters, 7 & 8 are passive, and 0-6 are detractors. You take the percentage of detractors and subtract it from the percentage of promoters to get your score. Here is more on the concept and formula.

NPS = % Promoters – % Detractors

What is an average NPS?

Everyone wants to know — how does my NPS measure up to the competition? In the tech industry, Maranda Dziekonski suggests that a score of 25-50 is average.

Why use the NPS survey?

One reason is that the non-intrusive one-question NPS survey is customer friendly, especially when compared to the user experience of traditional “This will only take 10 minutes” multi-question surveys. As a result, NPS surveys garner much higher response rates. And you want to be hearing from as many customers as possible because, as Dziekonski of HelloSign says, “80% of your detractors are tweeting complaints on social media, 80% of your promoters are those who will contribute to expansion revenue.” Knowing how they feel can help you engage with them in the right way.

Who should own NPS in your company?

Both experts agreed that the NPS point person should be customer-facing. For example, the NPS champion should be on the customer success or support team. In their experience, other departments such as marketing are less likely to take the key step of closing the loop with the survey respondents. CSMs, on the other hand, will reach out and learn how they can keep the customer as a promoter.

What about Net Promoter Score within enterprise businesses?

Marketing, Product, Sales, Education, Service/Support, and the C-Suite are all stakeholders in the Net Promoter Score program you create. All of them benefit from NPS data. While every department should get the information, only one should own it and drive motivation for improvement. That department should also regularly track what is being done to impact and improve NPS by all departments.

How often should you ask your customers the Net Promoter Score question?

Both experts agree that no customer should be asked more frequently than every six months. However, that doesn’t mean you only execute the survey every six months. For example, if you survey a new user after she completes the on-boarding process and then survey her again every six months, you will have a constant pulse of NPS data coming in all the time from various users. However, you’ll have to decide how often works best for your company.

In-app or Email NPS Surveys?

“I get more responses from in-app users. Where with email, it gets lost in the shuffle. However, if your customers or stakeholders don’t log in to your SaaS product, then in-app won’t work and email is the way to go,” said Maranda Dziekonski.

How often should you run other surveys?

The experts agreed that CSAT should run after every contact with support. However, it’s important to schedule out how often a person will be targeted for feedback; you don’t want to over-survey customers and risk annoying them.

In addition to NPS and CSAT, HelloSign does an annual marketing survey. Jennifer Ruth said that when she was at Adobe, they sequenced NPS with other surveys and supplemented that data with Customer Advisory Board feedback.

Therefore, it’s important for companies to have one person or function create a centralized customer feedback plan. When other departments need feedback, they can do it through that point person. There is nothing worse that overwhelming customers with too many surveys, and having a gatekeeper and a plan ensures that doesn’t happen. “Come up with an approach that minimizes customer burden,” said Jennifer Ruth.

On Choosing the Right NPS Platform

You’ll want one that can quickly scale as you grow. Multichannel NPS tool is best. It should be easy to reach customers on your website or in your SaaS, in your mobile app, and through email.

Your NPS platform should handle sampling for you and help you analyze the data for deeper insight. For instance, you can run in-app surveys in your SaaS product and have your NPS platform automatically resend the survey to customers every six months. You might want to analyze data by certain groups — Enterprise versus SMB users, for example — and the right NPS platform will help you do this.

It is also important that your tool integrates with other platforms like Mixpanel, Intercom or Salesforce, so you can easily automate sending the survey based on customer “events” such as use of a particular feature, or a support conversation. Integrations also mean the feedback can be pushed to platforms that you and the other departments are in regularly. For example, when NPS scores and feedback are pushed into Salesforce, account managers can have more informed conversations with customers. They will know before the call if the account might be primed for upsell or need some TLC.

Should NPS surveys be anonymous?

Jennifer Ruth of Optimizely shared that at one company she worked at, the company did maintain customer anonymity. The thinking was that customers would be more honest if they knew they were not identifiable.

Most companies, however, feel that it is critical to know who the survey response is coming from. This is for two reasons. First, and most importantly, it allows you to respond directly to the customer. You can thank them for their feedback and hopefully addressing any concerns they have. You can also invite happy customers to advocate for your brand. When customers know that their input is valued, they are more likely to respond to future surveys.

Second, knowing who responded enables deeper analysis of NPS data. Companies often segment responses by persona, plan or other properties for deeper insight into the “Why?” behind the score.

How do you improve NPS?

Several ways to improve NPS were discussed.

The first, and the easiest way to do it, says Jennifer Ruth, is by reading through the open-ended feedback given, identifying the customer’s issues, notifying and working with the departments involved to address the issues of individual customers.

Another approach involves segmenting data –deeper research to understand which cohorts are happy or unhappy, and specifically working on strategies to respond to their input and improve their loyalty. HelloSign segments their NPS data by salesperson, CSM, and product line to thoroughly understand any trends and where there are issues with customer happiness. Since their feedback scores are not anonymous, they can also have CSMs connect with those who are detractors (0-6) to find out why their score is low and help them be more successful with the product.

Improving response rates

Everyone wants to hear from as many customers as possible. HelloSign uses this approach: Before they send an NPS survey via email, they reach out before hand and let users know how important the NPS survey is. Their users know their responses will be reviewed. They also reach out after the survey is sent to remind and encourage response.

Including a deadline for the survey has also helped encourage feedback. They found that getting the email addresses of the people who use the product — not just the person who installed it — and surveying them was critical to getting relevant responses. (In the past, HelloSign noticed that engineers who regularly install their product don’t respond to the survey requests.)

How do you follow up with Passives and Detractors?

The good news is that if Detractors responded, they are engaged. Do your research — look at all tickets, analytics before you reach out to the customer. Be direct and be human. People will respond to that authenticity and will give you feedback and tell you how you can help. Make sure the customer feels empowered.

The NPS survey system is a powerful, yet streamlined way for customer success teams and companies to metricize customer loyalty and work to improve it. A Net Promoter Score program can help you keep customers happy, prevent churn, and improve your product.

Retain more customers. Sign up today and get started with free Net Promoter Score feedback with InMoment.