How to Turn Your Call Center Into a Customer Retention Powerhouse: 9 Strategies

Turn every call into a retention opportunity. Explore 9 key strategies to boost customer loyalty and satisfaction through your call center team.

Customer acquisition costs have risen by over 200% over the past decade. Yet, many businesses pour the bulk of their resources into chasing new customers rather than holding on to the ones they already have.

With customer retention becoming an increasingly important strategy for business growth, your call center is perhaps your most valuable asset. Every conversation is a chance to build trust, deliver value, and strengthen customer loyalty.

But, doing so at scale takes more than just good intentions. It requires a data-driven approach in the form of conversational intelligence to better understand customer needs, solve problems faster, and build stronger relationships.

What is call center customer retention?

Call center customer retention refers to the practices agents and managers use to keep existing customers satisfied, loyal, and engaged over time. With customer acquisition costs rising every year and loyal customers contributing heavily to the bottom line, it’s more crucial than ever to improve retention strategies.

The goal is to make the most of the contact center environment to meet (and ideally exceed) customer expectations during moments of need, frustration, or decision-making. Businesses looking to boost retention treat every conversation as an opportunity to create positive experiences. These experiences are vital for building trust and extending lifetime value.

Why does call center customer retention matter?

Did you know that a 5% increase in customer retention more than doubles revenue? With the call center being a crucial touchpoint that helps you hold on to customers, businesses must invest in strategies and tools that make every agent-customer interaction count. Let’s look at three powerful reasons why these call center customer retention strategies can transform your business:

Call centers are key customer touchpoints

It’s pretty telling that even younger customers treat digital self-service as a last resort option. According to data from McKinsey research, 71% of Gen Z customers would rather contact customer support through a live phone call. As a result, the contact center remains the most frequent human interaction a customer has with a brand.

As a vital driver of customer experience (CX), your call center can make or break the customer relationship. The way your agents listen, communicate, and resolve tickets has a direct impact on customer satisfaction and future behavior.

Customers who feel heard and helped are more likely to become loyal customers and share positive experiences through word-of-mouth. This brand advocacy is key for increasing retention and reducing acquisition costs.

Retention drives long-term business growth

Retaining and engaging existing customers leads to lower churn, higher lifetime value, and more sustainable revenue. With 80% of profits coming from 20% of your most loyal customers, it makes sense to start viewing call centers as potential revenue drivers. When agents solve problems effectively and offer personalized experiences, they become frontline contributors to business growth and profitability.

Customer feedback lives in the call center

Your call center is a rich source of customer feedback. Customer interactions with agents provide insight into needs, expectations, frustrations, and opportunities for improvement.

Analyzing this feedback enables leaders to uncover patterns that inform broader business strategies, from pricing and product updates to new service offerings. And when they share this data across departments, the entire organization benefits from what the customer support team hears first.

Strategies to improve customer retention in a call center

If you still view your call center as a cost center, here are eight customer loyalty strategies you can implement to drive revenue.

1. Leverage conversational intelligence software

Wouldn’t it be great if your agents could focus on delivering the human touch without sacrificing productivity or increasing costs? This is exactly what conversational intelligence (CI) enables you to do by leveraging AI-powered tools to capture, analyze, and surface insights from customer interactions.

However, selecting the right software is crucial to capitalize on this data-driven approach. The InMoment CI Platform helps agents detect early signs of dissatisfaction, track key metrics like first contact resolution (FCR), and highlight the root causes of churn. Its analytical and automation capabilities enhance QA, detect customer sentiment, and flag compliance issues without requiring manual intervention.

The results of investing in good CI software? Faster issue resolution, proactive agent coaching, and a boost in customer satisfaction, all of which increase retention.

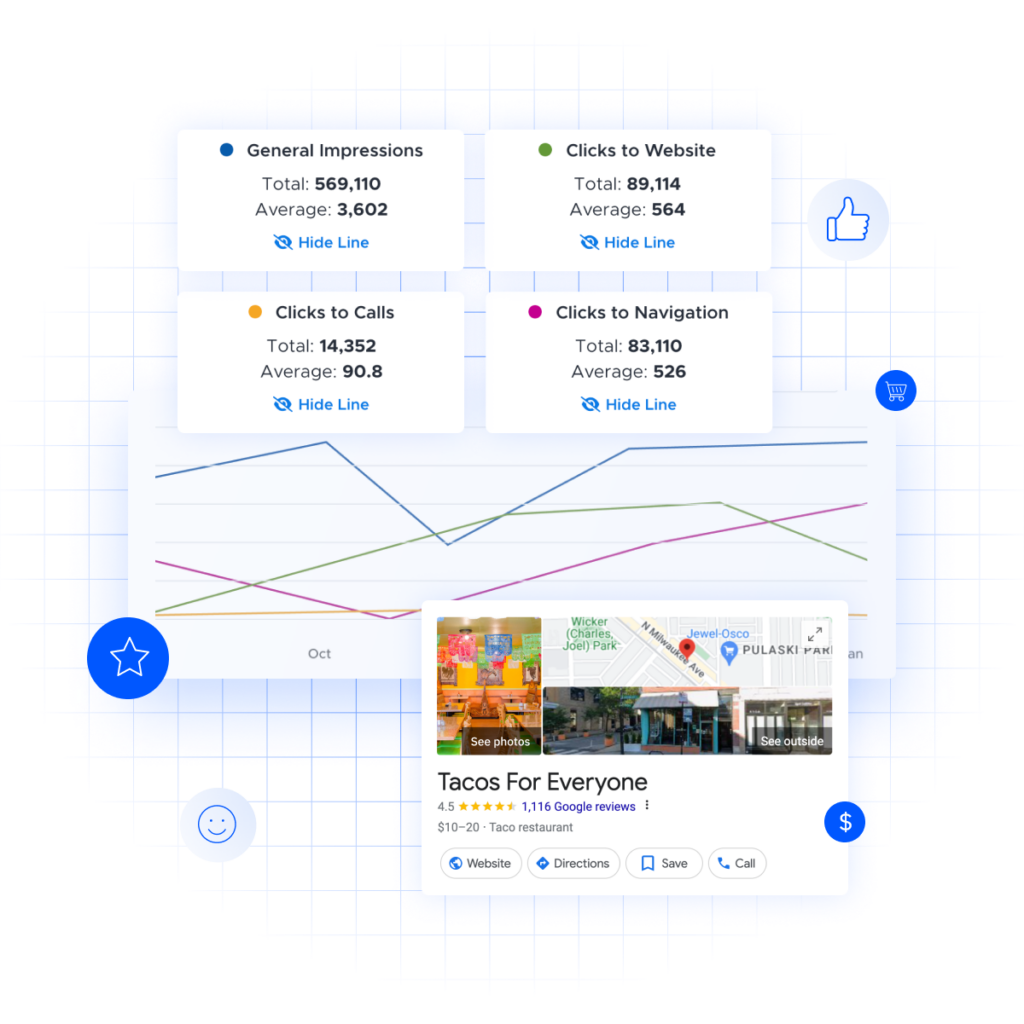

2. Offer omnichannel support

Modern customer expectations demand more than just a phone number. Policyholders and customers now engage with brands across a growing number of channels, including email, live chat, social media, and in-app messaging. This expectation calls for an omnichannel support strategy that allows contact centers to meet customers where they are.

But, it’s crucial to understand how this strategy differs from a multichannel approach. The latter offers multiple means of communication, without any synergy between them. An omnichannel customer experience, on the other hand, integrates these channels to create a unified and smooth journey across all touchpoints.

For example, a customer can lodge a complaint via a chatbot and later pick up the phone knowing that the human agent on the other end is up to speed on their concerns. As a result, customers don’t have to repeat themselves across different channels, making for a seamless and personalized experience.

Omnichannel support also opens the door to smarter insights. It helps you identify high-volume channels, spot recurring customer pain points, and adjust staffing accordingly.

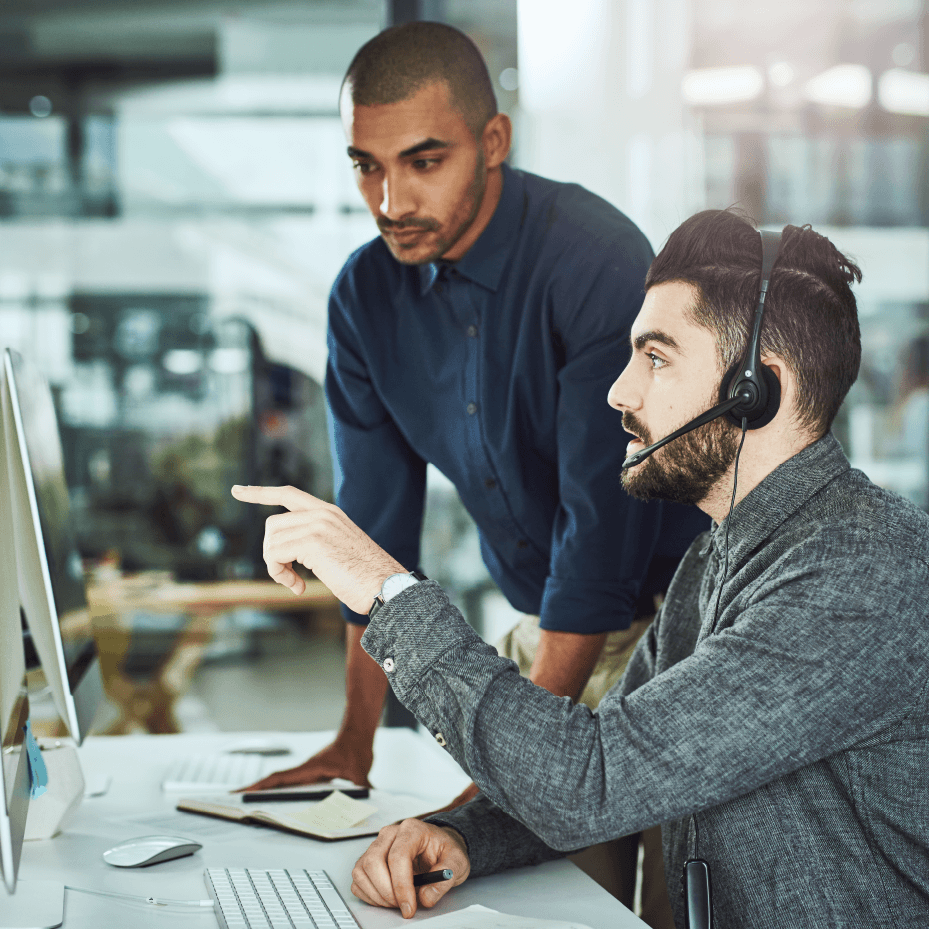

3. Train agents in empathy and emotional intelligence

Your call center agents do two things when they pick up the phone: resolve customer issues, and represent your brand. Therefore, it’s not just what they say during the call but also how they say it.

Building soft skills like empathy and emotional intelligence goes a long way towards creating memorable experiences that can turn the most disgruntled customers into loyal brand advocates.

Train your agents to listen actively, express understanding, and respond with care, especially during stressful situations. However, effective training shouldn’t rely on guesswork.

A conversational intelligence tool like InMoment CI goes beyond manual call reviews by analyzing the tone and sentiment behind real customer interactions. It also automates QA based on your company’s unique rubric, covering 100% of customer-agent interactions to provide comprehensive insights.

This information helps managers build tailored coaching programs that reinforce good CX practices and guide agents toward emotionally intelligent service.

4. Focus on First Contact Resolution (FCR)

Few call center metrics are as closely tied to customer retention as First Contact Resolution (FCR). According to an InMoment survey of 1,215 census-representative consumers, 61% of respondents expect brands to resolve the issue after first contact with support. Otherwise, they will start considering competitor brands.

A low FCR is also bad news for call center operational costs. Since the issue doesn’t get resolved on first contact, there are multiple follow-up calls, each of which takes vital seconds and dollars away from the business.

As a result, improving FCR is one of the most impactful customer retention strategies for the modern contact center. A proven CI tool helps here by analyzing patterns in customer interactions and providing insight into root causes of poor FCR. From knowledge gaps to operational bottlenecks, these issues become immediately visible, allowing managers to address them through targeted training or efficient workflows.

5. Personalize every interaction using customer insights

While we’re on the subject of growing expectations, it’s clear that customers seek out brands that offer personalized services. A 2024 Deloitte Digital report revealed that brands excelling in personalization are 71% more likely to report improved customer loyalty. If your call center isn’t personalizing customer interactions, your business could lose significant market share over time.

Start by investing in a good CI tool and train your agents to use it for rich customer insights. For example, the InMoment CI platform leverages CX integrations to break down silos and access a complete picture of the customer experience. This information includes transaction history from CRMs, reviews from social media, and product usage data from analytics.

This step empowers agents to tailor responses, anticipate needs, and deliver personalized experiences that feel effortless and human. When customers feel like you truly “get them,” they’re far more likely to remain loyal, even when issues arise.

6. Detect and proactively engage at-risk customers

It doesn’t take a soothsayer to tell you which of your customers might leave you. Conversational analytics helps by flagging early signs of dissatisfaction like negative sentiment, repeated complaints, or unresolved issues.

These alarm bells are usually invisible with traditional reporting. However, with the help of real-time analysis of customer feedback and interactions, CI detects emotional cues and sentiment shifts to highlight at-risk customers. These alerts allow agents to shift gears, respond with more empathy, or escalate the issue before it worsens.

7. Capture and act on customer feedback

Your call center is one of the richest sources of feedback in your organization. But without the right tools, that feedback stays trapped in call transcripts or buried in ticket notes.

CI platforms automatically mine high volumes of call data to identify common pain points, emerging product issues, or experience gaps. As a result, you access valuable insights without having to wait on survey responses. And since the feedback comes from real customer conversations, it’s raw, authentic, and actionable.

The insights from customers help guide process updates, product features, pricing, or even agent scripts. As a result, listening at scale helps you streamline customer experience management efforts by closing the loop on critical issues.

8. Use conversation reviews for coaching and QA

Traditional call center QA is limited to reviewing a fraction of the total call volume. Naturally, this leaves countless opportunities for coaching or issue detection sitting on the shelf.

However, CI ensures nothing falls through the cracks by automatically reviewing 100% of customer interactions. The resulting insights not only boost quality assurance, but also guide training, product, and digital teams.

For example, if CI reveals confusion around an online claim form, that insight can be shared with your web or digital channels team to improve clarity and reduce future call volume.

With the help of sentiment analysis, CI also enables smarter agent coaching by surfacing the exact phrases or tone shifts that lower customer satisfaction during calls. Over time, this results in more consistent service and a culture of continuous improvement.

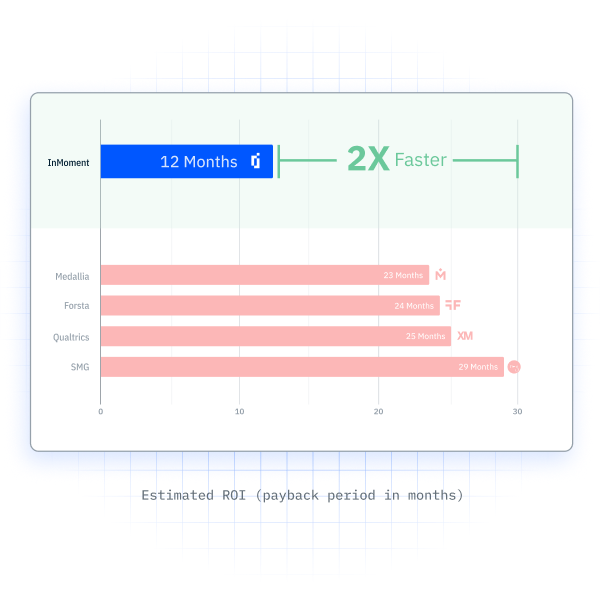

Drive your customer retention strategy with InMoment

When you improve customer retention, you’re not just holding on to people who interact with your brand. You’re also fueling long-term business growth. Loyal customers spend more, stay longer, refer others, and strengthen your brand from the inside out. And no team is better positioned to influence those outcomes than your call center.

With InMoment’s conversational intelligence software, you can turn everyday customer interactions into a strategic advantage. It helps you capture insights, improve agent performance, and proactively address the issues that lead to churn. From real-time coaching to full-scale feedback analysis, the tool gives your team the tools to drive loyalty, elevate the customer experience, and protect your bottom line.See how InMoment’s conversational intelligence software can help you retain more customers and drive revenue—schedule a demo today.

References

SimplicityDX. The Customer Acquisition Crisis (https://www.simplicitydx.com/blogs/customer-acquisition-crisis). Accessed on 5/27/2025.

Deloitte. Valuable experience (https://www.deloitte.com/uk/en/Industries/investment-management/perspectives/valuable-experience-how-customer-experience-can-unlock-value.html). Accessed on 5/27/2025.

McKinsey & Company. Where is customer care in 2024? (https://www.mckinsey.com/capabilities/operations/our-insights/where-is-customer-care-in-2024). Accessed on 5/27/2025.

InMoment. 2025 Conversational Intelligence Report (https://inmoment.com/lp/conversational-intelligence-trends-report/). Accessed on 5/27/2025.Deloitte Digital. Personalizing growth (https://www.deloittedigital.com/us/en/insights/research/personalizing-growth.html). Accessed on 5/27/2025.