In 1853, U.S. Commodore Matthew Perry (no, not the Friends actor) sailed to the shores of Japan to strongly suggest (with several gun-laden vessels) that the ruling shogunate open Japan’s ports to outside trade. For 200 years, Japan had embraced a policy of near total isolation from the West, but with the Industrial Revolution fresh out of the oven, even isolationist Japan couldn’t ignore the benefits of trade. What does this history lesson have to do with Product Managers and Customer Success?

Author: Stuart Richards

Recipe for Success: What Pharmacy Industry Leaders Are Doing Right

The booming topic of conversation lately has been the competitive advantage that non-traditional pharmacies (big-box retailers and grocery stores, for instance) have over traditional chain pharmacies. I have always wanted to peel back the layers of the pharmacy industry and determine what exactly differentiates the consumer experience with these two types of drugstore retailers. And now appears to be the perfect opportunity.

We recently launched our annual Pharmacy Benchmark study to our InMoment panelists, and more than 6,000 North Americans shared their thoughts about recent experiences with various drugstore retailers. Our study allowed consumers to openly voice their opinions, which helped us to surface some precise strengths that non-traditional pharmacies enjoy over traditional chain pharmacies.

By looking at key attributes that our identified pharmacy industry leaders are executing at high levels, I was able to draft a “recipe for success” for pharmacy industry leaders.

Recipe for Success for Pharmacy Industry Leaders

Mix your pharmacy with quality products that consumers demand

Non-traditional pharmacies can offer lower prices because they compete on a mass level, hence the name “big-box.” Despite low prices, consumers are interested in the products offered at these locations because of their known quality.

In order to compete on the level of the top industry leaders, it is important to highlight quality products that are in high demand for consumers. Limited-time promotions and deals that may even incorporate a consumer’s loyalty card generate the most success in these circumstances.

Season your pharmacy with well-trained, genuine staff

Aside from convenience, one of the top reasons consumers were drawn to a particular drugstore was for the experience provided. Experiences help to drive loyalty, and, in our study, it was the staff who specifically drove consumers to have an exceptional experience.We asked consumers to rank various staff members based on availability, friendliness, expertise, and attentiveness. For the top industry leaders, consumers gave high acknowledgement to the pharmacist and pharmacy staff. The major differences between top and bottom competitors were focused around wait times and expertise level.

Friendliness of staff members proved to be an expectation, a minimum requirement. It takes a lot more for consumers to confide in a pharmacy as their primary prescription provider. This is why I say it is crucial that pharmacy staff and pharmacists are educating the consumer as much as possible about their prescription(s) and quoting accurate wait times.

Tips to Improve Wait Time and Staff Expertise

- Increase staff count during peak hours

- Encourage consumers to use time-saving ordering methods (call-ahead, online/apps etc.)

- Train staff on ways to effectively communicate with customers

Add a dash of a personalized experience

The nature of consumer feedback has moved toward being more positive than ever before. Our recent CX Trends report highlights this concept, and it was shown to be important for pharmacy leaders looking to provide a personalized experience.Personalization means much more than knowing someone’s name, and that’s where the consumer’s voice is so important. Let them be heard! Offer them the ability to talk about the experience, provided there is a solid foundation to handle the influx of comments.

Whether it is face-to-face or through social media, attentiveness is a quality that consumers who gave the highest rankings to industry leaders monitored closely. Consumers’ voices are empowered in today’s market, and if optimizing these interactions is set as a high priority, consumers will appreciate the extra mile their pharmacy is willing to take for their business.

Online Retail: Opportunity, Not Weakness

We can define “competitive leaders” in every industry—brands that have captured the market by differentiating themselves on several levels from other direct and indirect competitors.

In every client presentation or webinar I’ve ever done, I try to remind the audience that their weakness should be viewed as an opportunity. And yet, when I talk about weakness in terms of online presence, quite a few brands seem ready to give up on expanding online options and services. Our research shows that this approach could diminish brand exposure and dull competitive edge.

In our recent Online Retail Industry Benchmark study, where 15,000+ North American consumers shared thoughts on the their online experiences at various e-tail and brick-and-mortar stores, we noted three key areas that can drastically help your brand rankings in the online space:

1. Make it quick. Make it simple.

The Top 10 industry leaders got this right. User friendly websites with organized content can truly increase both your Likelihood to Recommend and Return ranks, which, in turn, increase your Overall Satisfaction measures.

Consumers are asking for a means to quickly research and purchase products with a few clicks of their mouse. Slower page response times cut into an e-tailer’s bottom line, because consumers want to be able to purchase products in a matter of minutes.

Also, they want to avoid the additional “promotional,” loyalty, or feedback pages. Those should come later, in an email they can circle back to at a more appropriate time.

2. Don’t be afraid to offer more products and services.

Online consumers are more careful than your average in-store consumers. This is mainly because they understand that products can be researched with a simple click of a button and feedback can be found on every product/service today.

Yet, one key notion e-consumers agree on: They are willing to pay more for products and services that truly match their needs. Our top 5 e-tail and brick-and-mortar brands do just that, offering not just unique products and exclusive brands, but also services that can help consumers as well.

This notion of more being better is also important on a shipping scale; offer your consumers more shipping options and you’re likely to see them return to your site in the future.

3. By all means, give them social media!

Unlike many of the offline industries, social media plays a valuable role online. Our top 5 e-tail brands all have a strong social media presence. In return, they noted a higher “likely to return” value overall.

Consumers want to share their experience online and are likely to do so if you give them more unique means of building a stronger e-relationship with their brands. Encouraging your loyal consumers to interact with your brand should be approached in a manner that is relative to your product or service. In some cases, this could mean offering various e-points/e-rewards to help promote social media interaction.

Remember, social media comes with both positive and negative commentary. Yet negative brand mentions should be taken as an opportunity, not weakness, and consumer transparency must be a key means of communicating change with your consumers.

You can learn more about retail’s critical customer experience drivers here.

The Nature of the Customer

Understanding your customers can be a difficult task. No one would blame you for feeling like they’re not always on your side. The truth, though, is that customers are actually quite positive and helpful by nature.

Customers are people who have chosen to “consume” your product or your service. They have already invested in your offering and gained some value from you, for which they are often thankful. They are not coming at you as a neutral third party; they are coming from the perspective of knowledge and connection.

Turn That Frown Upside Down

In our recent CX Trends report, we asked organizations to share their perception of how much negative feedback they receive from customers versus positive feedback. Our results showed that there is a disconnect between brand and consumer perception.

Of the brands surveyed, we found that their perception of customers leaned toward negativity. In reality, the numbers reported by consumers skewed toward the positive.

The CX Glass Is Full

Now that you know your customers are your friends, it’s time to view the CX glass as half full instead of half empty.

Positive customer comments can help your organization satisfy and retain customers. Identifying the voice of the customer can help you move beyond a solely reactive approach to a more effective proactive one. This strategy will align your brand’s perception of customer sentiment with reality.

Show Some Span: Pay Attention

Our business revolves around listening. Specifically, it revolves around empowering business organizations to listen to their customers on a scale and in a manner that drives improvement. And, as much as large-scale listening methods can start to sound like just “cold technology”—comment boxes, voice transcription, text analytics, mobile alerts, real-time reports, experience data—these methods still boil down to the same “warm listening” that courses through our human senses.

Cues for Communication

As the product team at InMoment works to model our accelerated listening solutions after the social and one-on-one interactions we experience in our private lives, it’s caused me to ponder the fundamental principles of the listening I do daily. I’ve thought about how involved my other senses can be (and should be) in listening. For instance, it’s amazing how important visual cues from the listener are to everyday conversation.

While thinking about this, my mind has returned to a phrase common in—but not exclusive to—my childhood: “Pay attention!” We’ve all had that message sent ringing in our ears at some point, haven’t we? It happens when someone is speaking—a school teacher, perhaps—and our eyes or minds or both have wandered, leaving our ears deaf to their words. As a child, this usually happens simply due to a short attention span, whereas, as adults… well, I guess it’s the same.

The point is, it’s extremely important to those with whom you converse that you show you’re listening, that you pay attention. I’m so impressed with my colleagues for understanding this as they’ve built those cues into our platform, especially through Active Listening™. Tons of credit to our developers and product marketers for investing time into that authentic layer of listening, so that our clients can listen on a large scale to their customers in a way that shows they are, indeed, paying attention, and creating the reciprocal relationship that consumers crave.

Our newly released 2016 CX Trends Report: Trending Positively Toward Personalization and Transparency goes more in depth on the nature of today’s consumers and the ways in which they expect companies to show they are paying attention.

In the Moment

In this age of technology, if we remember the fundamentals of listening and paying attention, we can use our mobile devices and cool tech to converse in a way that informs, instructs, and connects—rather than distracts.

A year and a half ago, we gave our company the name “InMoment” to remind us of that very thing. If you are spending time with a friend, put your attention on that friend. If you are sharing the road with other drivers, put your attention on them. If you are helping a customer, put your attention on that customer. Or flip that last one: If you’re the customer asking for help, put some real attention on the employee helping you.

There’s really no end to the people we share moments with, and in every moment the principle remains the same: Pay attention.

Qualitative Data & Reaching Problem-Solution Fit & Product-Market Fit: An Interview with Morgan Brown

Morgan is 15-year startup marketing vet, who is passionate about helping great ideas and companies grow. He’s currently the COO of Inman, a real estate media company that covers the residential real estate space in the U.S. He’s also married to an awesome woman and has two kids that remind him of how lucky he is every day.

He loves to study what makes online companies grow, what makes some brands successful and others not, consumer behavior and all things business. He reads a ton, with his favorite reads being business books and biographies of famous leaders. His latest read, Leadership BS, is a great book on how most of the leadership advice is misguided and harmful to leaders and their teams.

You can follow Morgan on Twitter at @morganb.

- How have you used qualitative research in your career as a growth marketer?

Qualitative research for me really lies at the heart of what it means to be a marketer.

Talking to customers, listening to people, peeling back the onion with the right questions to really assess their needs, wants and motivations is incredibly powerful. Running growth at Qualaroo certainly meant a lot of time studying and using qualitative research. It really helped me see first hand how powerful it can be when deployed properly.

I’ve used it in my career in all sorts of ways: conversion rate optimization, product development, marketing campaigns, website and email copy, and software package and pricing. It’s helped me learn what matters most to people, what concerns people have, and the words they use when they talk about a product and solution.

- What are the differences between qualitative and quantitative research?

Analytics tells you what’s happening, but voice of customer research tells you why. It’s that contextual layer that helps put data into perspective. You can stare at numbers and guess at what’s happening, or you can ask your customers and get feedback about what’s really going on.

- What is the importance of qualitative research for online businesses?

The beauty of qualitative feedback is that it helps you define the problem space better when you’re looking to improve the performance of your business. For example, you can see a really high cart abandonment rate and guess at all the potential issues preventing someone from purchasing or subscribing, or you can talk to some people and narrow your set of potential hypotheses and experiments. It’s a great way to shorten your experimentation process and find higher quality tests that are more likely to be wins.

- What methodologies can be used to conduct qualitative research? How can a business make sense of all the feedback they get ? We think some people inherently distrust qualitative, don’t know what to do when they get A LOT of it.

There are lots of ways you can collect qualitative feedback, from interviewing people in person or on the phone, surveying users via an onsite survey, using Net Promoter Surveys via companies, to marketing panels where you survey people who are in your target market. The key to effective user surveys is to ask the right questions to the right people, so that you’re eliciting valuable feedback.

If you use a Net Promoter Score survey, you’ll get a numeric representation of your overall customer happiness or satisfaction with your service. You can benchmark yourself over time and also to other companies who publish their NPS online. It gives you some context to the results you’re getting and helps you gain some understanding of the feedback you’re getting.

You don’t necessarily need a ton of feedback from qualitative research to find answers that can help your business. Jakob Nielsen, one of the foremost user experience experts, wrote an article 15 years ago that showed that getting feedback from just five users uncovered 85% of usability problems. So you don’t need a ton of feedback to uncover important learning that can improve your growth, conversion rates, etc.

- What are some of the common mistakes people make (or fears? resistance?) when conducting qualitative research and how can they be avoided?

The two biggest mistakes are: not doing qualitative research in the first place and then not putting it to use. People are afraid that they’re going to ask the wrong questions, get a non-representative sample, hurt their conversion rate and more. The third big mistake is asking the wrong people for feedback.

These are all easily avoided. The first is to just do it. Qualitative feedback doesn’t have to be hard. Just start by talking to customers, on the phone, via email, onsite, in surveys, etc. Getting over the fear of doing it is the hard part. Then, once you have data flowing in, it’s important to share it with your team.

Finally, asking the wrong people is a big issue. You want to ask people who are potential customers, not just random people who never have any intent or landed on your site by accident. Just like you wouldn’t do customer development interviews with someone outside of your target audience, don’t waste your time getting feedback from people who will never buy.

To do this, filter out unqualified traffic, users, etc. For example, at Inman we don’t run onsite surveys to older content which gets great SEO traffic but is written for a different audience. Those readers are not the people we’re trying to build our business with.

- How can qualitative research be used to find language-market fit, problem-solution fit, and product-market fit?

This is where qualitative research really shines. For language-market fit it gives you insight into the exact words and positioning they use to describe your product. You can use their words to help with copy and positioning that is relatable and intuitive to your target audience.

For problem-solution and product-market fit you can ask questions like ‘What product would you use if you didn’t use ours?’ or ‘How disappointed would you be if our product was no longer available?’ or ‘What’s the one thing that would make this product indispensable?’ and more to gauge how important your product is to your users and how to make it a must-have.

One of the best ways to improve retention is to ask people who leave why they left and then work backwards to solve those issues and keep people engaged and happy with your product.

- How can it be used to help scale a startup once product-market fit has been established?

Qualitative feedback is essential to conversion rate optimization. If you have PMF, then you want to maximize your growth through improved conversion rates, messaging, acquisition, retention and more. Qualitative research can give you the insights you need to improve all of those things.

One of the best qualitative questions to ask as part of conversion optimization is to ask people who just successfully purchased or signed up this question, ‘What almost stopped you from signing up/purchasing?’

The answers you get from your new customers will point you directly to the moments of confusion and hesitation that almost derailed them. If you go back to those spots in the funnel, you’ll likely find many more people who couldn’t get over that hurdle. That intelligence gives you great insight on where to start experimenting to improve your overall conversion rate.

Start gathering qualitative feedback today. Signup for free in-app Net Promoter Score with InMoment.

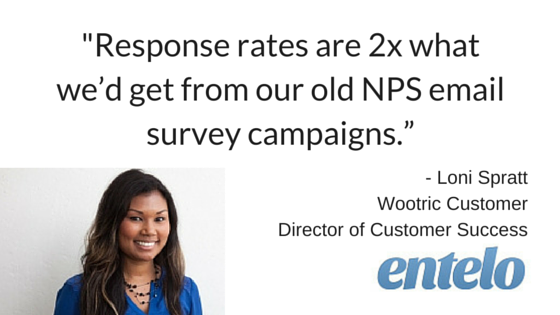

Case Study: How Entelo uses In-app Customer Feedback to Prevent Churn

- 2x response rate versus email provides a more complete picture of the Entelo customer base

- Real-time feedback helps Entelo jump on customer issues quickly, rather than letting problems go unaddressed for months at a time

Don’t Know Option in Surveys

Editor’s Note: This blog was originally posted on CX Cafe’.

Your respondents might know more than you think.

Including a “don’t know” option in a survey is an issue that is currently under speculation. The “don’t know” option can be explicit, as shown with the scale, or it can be implicit by the use of skip patterns within a survey. It’s a powerful option to give survey takers who don’t really know the answer–an option so they don’t get frustrated, but it also can serve as a cop-out for those who just don’t want to answer the question. So where do you draw the line?

The “don’t know” option can contribute to good survey design, because it utilizes skip patterns to alleviate the need of showing respondents a set of questions that are not applicable. However, if the “don’t know” option is associated with attitudes concerning relevant touch points or facts, you may want to reconsider including that option in your surveys.

So what happens if you include the “don’t know” option in your Survey?

- First, when that option is present, respondents are more likely to select it than engaging in the question.

- Second, researchers have found that respondents do a pretty good job at answering questions in the face of uncertainty. For example, if a fact-based question had four choices, respondents who initially said don’t know had much higher accuracy than the 25% that guessed at random.

- Third, attitudes can be more reliably “guesstimated” than facts.

- Fourth, if respondents choose “don’t know,” multivariate analysis requires those answers to be treated as missing, so the data is not inaccurate. For missing values, we often use methods to try to recover those answers (imputation). Who do you want to estimate those underlying values? The researcher? The respondent?

- Fifth, and finally, placing a “don’t know” option on a crowded scale or not setting it apart from equidistant scale points can lead to respondent confusion and incorrect selections.

The fear of not using “don’t know” is that you are forcing the respondent to provide meaningless responses. However, the use of “don’t know” can lead to MORE data problems. In general, minimize the use of “don’t knows” in your surveys, for a more powerful and informative survey.

Note: There are some considerations about omitting the “don’t know” option on mandatory questions. If there are too many questions which force the respondent to answer, the respondent could get more frustrated without the “don’t know” option. Depending upon the questions you are asking on your survey, it is key to find a healthy balance between adding “don’t know” on your survey and taking it off.

5 Keys to Successful Social Listening

Wade through the Digital Noise

Your customers have a voice, and they want you to hear it. Unfortunately, in the digital age we live in, customer stories can get lost in the deluge of social media unless organizations are properly equipped and prepared to listen.

Based on an article originally published on MyCustomer.com, we’ve put together five great ways your organization can develop a successful social listening program and start hearing the voice of your customers.

The 5 Keys of Successful Social Listening Programs

1. Come Up with a Strategy

A successful social listening program requires strategy and process. For example, don’t immediately give the job to young team members because of their perceived expertise with social media. Cater to all of your customers and ensure your organization harnesses customer interactions as an opportunity to build strong relationships. Before your organization can even begin to think about having an effective social listening program, it needs to have a plan in place. Success doesn’t happen on accident.

2. Define Your Strategy

When defining your organization’s social listening program, be sure to target all of your customers—not just the younger demographic. Your customers use social media in different ways, and your organization needs to make sure it’s tuned in to the specific social channels where customers are talking about your brand.

For most organizations, social listening programs require the ability to monitor and analyze unstructured customer feedback. Equipping your program with advanced text analytics tools should be an essential part of your brand’s social listening strategy.

3. Listen to Your Customers

It may surprise you to learn that the most valuable insights come from your customers. If that didn’t blow your mind, this will: Listening to your customers is a key component to a great social listening strategy. For organizations with large followings, create individual engagement strategies. Creating social customer advisory committees can also be an effective way of building relationships and uncovering valuable customer insights.

4. Identify Your CX Goals

Effective social listening programs provide information that can improve just about every area of the business, from new product ideas and escalating trends to upcoming competitors and shifts in customer attitudes. Identify what your organization wants to accomplish with its social listening program and shape your program around those goals.

5. Measure Your CX Efforts

Organizations often don’t identify what they want to accomplish with their social listening programs, which means they can’t measure or determine whether their efforts are successful. Determine the purpose of your brand’s social listening program and measure your customer experience (CX) accordingly.

Execution. Execution. Execution.

We’ve provided you with five keys to creating a successful social listening program, but the greatest strategy in the world won’t matter if the plan isn’t executed properly. Share your social listening strategy with your entire organization and make sure that each employee—from C-level to front line—is on board with the plan.

Building a Net Promoter Score Tool is Easy, Until It Isn’t

I joined Wootric last spring as the first full-time engineering hire. When I’m not busy scaling out our infrastructure, designing APIs or squashing bugs, I enjoy writing about our technology.

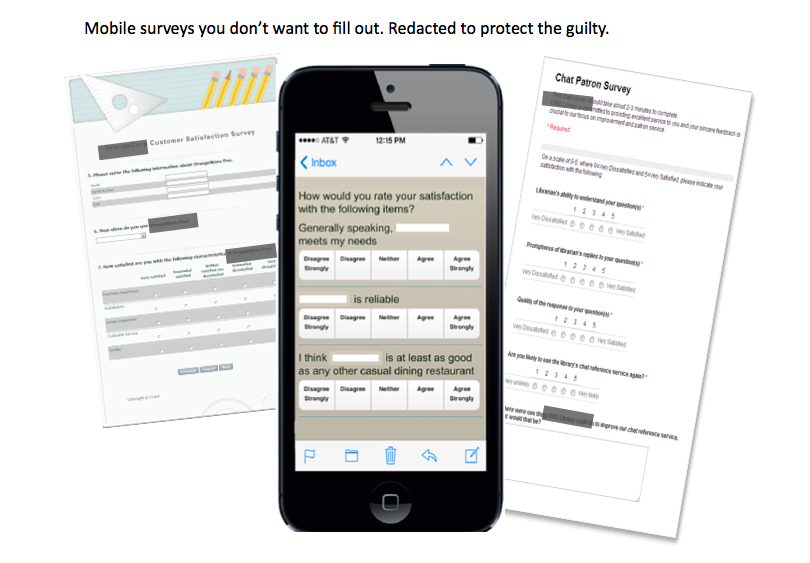

How to Get High Response Rates to User Surveys on Mobile

In this age of survey fatigue, getting users to engage with a survey in any medium is challenging. Mobile apps are no exception, and have their own unique constraints. The good news is that in-app surveys can provide a streamlined mobile experience that results in super-high response rates and meaningful feedback, too.

Asking for survey response on a mobile screen can create a friction-y experience for users.

Low screen attention. Small, cramped mobile screen. Tiny text. Question after question. Who wants to deal with that?

You need a streamlined survey solution that reduces friction but still provides rich feedback. So, how do you overcome the constraints of mobile?

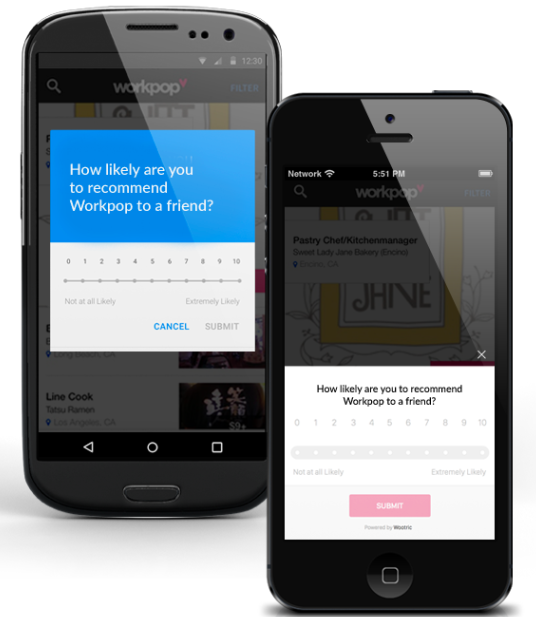

Net Promoter Score surveys minimize friction.

Net Promoter Score (NPS) is recognized as a powerful measure of customer happiness, and a lean, agile way to elicit meaningful feedback from users. Not familiar with NPS? Here are the basics.

The NPS survey consists of a single survey question, plus an opportunity for a quick qualitative response. Because of its simplicity, the NPS survey really shines in the mobile context. Have a look at how it works here on Android and iOS.

Surveying mobile users via email can mean low response rates.

Until now, mobile businesses have had to rely on email surveys to get NPS user feedback, and email certainly has its place. Trouble is, app developers may not have a user’s email. Even when you do, inboxes are noisy places and readers are less likely to click through from mobile devices. Also, an NPS survey via email arrives after the fact, after your user has left your app. Their attention is elsewhere.

For high response rates, ask the powerful NPS question right in your mobile app.

You can now show your user an NPS survey in real-time, when he or she is engaged with your app on a mobile device. Users are scoring and commenting in context – feedback is fresh and relevant, which helps make it more actionable. Typically, you will see a 40-60% response rate right off the bat.

Surveys can be triggered to suit your business needs. For example, a user could see a survey after she has logged in x number of times, taken a specific action, or 30 days after downloading the app.

Using an external platform to manage your NPS process has its advantages. It can scale easily, is hassle free to try and deploy, and frees up resources to focus on the “so what?” — leveraging NPS results to improve your application. A streamlined version of an NPS platform can come free and shouldn’t break your budget. Our tool, Wootric, is one example.

Get the ebook, The Modern Guide to Winning Customers with Net Promoter Score. Learn eight ways to leverage Net Promoter Score for customer loyalty and growth.

To maintain strong response rates, take action on user feedback.

Maybe you filled out a survey once — really took the time to give constructive feedback. Did you hear back from the company? If you did not, how likely are you to fill out another survey from that company? Not very likely, right?

For you to continue to garner high survey response rates, your mobile users must know that their feedback matters. An NPS platform dashboard makes it easy for you to respond. The dashboard is where you can monitor the cumulative Net Promoter Score your app is earning, and slice and dice your data. It is also where you can see individual scores and qualitative feedback from individuals.

If your users have accounts and you have the resources, you should respond directly to individuals. You can do so right from your NPS dashboard. You can also forward feedback to a team member in Customer Support, Customer Success, or Product Management for further action. To streamline the process, you might automate an email response to the bulk of respondents depending on whether they are Promoters, Passives or Detractors.

If your users are anonymous, at a minimum, you can acknowledge in software release notes that it was user feedback that revealed that recently-squashed bug, or drove the development of xyz feature.

High response rates and rich user feedback are possible in the mobile environment.

The streamlined nature of the NPS survey is a great fit for the low-attention span of the mobile user and the constraints of the small screen. Consider in-app NPS surveys for higher response rates than email. Be sure to show your users that you listen to their feedback, they will be more likely to answer another survey down the line.

Start measuring Net Promoter Score in your mobile app for free with InMoment

How & When To Survey Your Customers for NPS Feedback

When it comes to using Net Promoter Score surveys to gain insights from your customers, you probably have questions about sampling.

How do you decide how many customers to survey? When should you first survey a customer? What about after that? These are three important questions to think about in advance of getting started.

In this post, I’ll discuss best practices for survey sampling for NPS. While these practices apply to many types of businesses, I’ll relate them to gathering customer feedback in the online world — inside web and mobile applications, and on websites.

Setting up an NPS program? Download the free ebook, The Modern Guide to Winning Customers with Net Promoter Score.