What Is Customer Lifetime Value?

The technical definition of Customer Lifetime Value (CLV) is the revenue earned from a single customer over time. It’s an equation that subtracts the cost to acquire a new customer (CAC) from the total revenue from that customer. The goal is to make the revenue-over-time from each individual customer as high as possible.

But the technical definition doesn’t cover the magic that’s actually in customer lifetime value – as a metric and as a mission for a digital marketplace, an e-commerce site, and SaaS businesses. Because when you go after customer lifetime value with intention, making it one of your “North Star” metrics, you’ll find that the cost-to-acquire actually shrinks. It becomes less expensive to acquire new customers, and the revenue pours in exponentially.

We are also at an inflection point with SaaS. While many SaaS companies are still largely concentrated on acquisition-based growth through demos and trials, we’re seeing a shift to focus on the end-user and the metrics that capture how happy they are, because those end-users lead growth. And that’s where customer lifetime value comes in as a business case. It is the ideal way to tie customer loyalty to revenue.

Those end users who are sticking with you are buying more from you (cross-sells and upsells) and they’re telling their friends and colleagues how great you are (referrals). In a sense, they become your virtual sales army. They’re out there warming up leads and sending them to you, so you don’t have to pay to find them.

This is the magic we’re going to unlock for you in this comprehensive article. If you want to know how to maximize your bottomline, then improving Customer Lifetime Value is key. And we’re going to explain how it all works, and how you can start using it to get better ROI for your business right now.

Part 1: Making the case for Customer Lifetime Value as the key metric for your customer experience strategy

I don’t know a single company that hasn’t pondered these questions:

- What resource investment will have the most impact on customer health and revenue growth?

- What can (or should) I automate?

- Should I invest more money into customer experience (CX), customer support, or customer success right now?

- Should we focus on building this new feature or should we focus on infrastructure improvements that might make our platform more secure or faster, etc.?

- Should we invest in self-service onboarding to improve the journey for the end user?

The answers to all of these questions lie in Customer Lifetime Value.

If your business thrives on high-volume sales and high turnover, then you’re probably not a subscription-based business – but you also don’t need to worry so much about customer lifetime value.

But, if your business would benefit from high-volume sales AND returning customers AND lower acquisition costs, then customer lifetime value is your metric, and you’ve probably got your answers to the above questions. The more you invest in both user experience and customer experience, the less you have to invest in customer support, leading to organic growth and a higher customer lifetime value.

Customer lifetime value isn’t a passive metric – a numerical pat on the back for when you’ve done a “good job.” It’s an active, actionable metric that can be used in a few different ways.

Let’s look at a few different ways to use the Customer Lifetime Value metric:

CLV as Profit Metric

Traditionally, customer lifetime value has been used as a benchmark for whether your business is going well or going under. You look at your CLV/CAC ratio, and if it works out to at least 3 or higher (for every $1 dollar you spend acquiring a customer, you earn at least $3 dollars) you’re in the clear. You could then calculate the CLV/CAC ratio across your marketing channels to determine which are creating the most lifetime value (invest in those more) and which aren’t.

CLV as Customer Persona Builder

Once you start parsing out which clients have the highest customer lifetime value, you can look for what they have in common in terms of demographics, psychographics, user behavior, how they found you, and other characteristics. You can then use those commonalities to create better customer personas so you can go after higher CLV clients with intention.

Predictive CLV

Customer lifetime value can be used to predict the lifetime value of new customers when you examine current behavior and purchase patterns, and then base projected behavior and patterns based on those early indicators. You might already know how to predict churn based on “red flag” customer actions, and this concept is the same but in the opposite direction. You look for retention and upsell-predictive behaviors by reverse engineering what your best customers did at the beginning, middle, and ends of their journeys with you (if they’ve ended!).

CLV as Key Performance Indicator

Customer lifetime value is a broad KPI of how well you’re serving clients, how valuable your product or service is to them, and how well you’re delivering your solution with the appropriate customer experience. It’s a great North Star metric. You know you’re headed in the right direction as CLV rises. But, you’ll also need metrics that tell you, more granularly, what’s going on and why at each stage of the customer journey. So we also use Customer Journey Metrics like Net Promoter Score, Customer Effort Score, Customer Satisfaction, etc.

Once you start tracking customer lifetime value, you can a lot with it to improve your business – which we’ll get to in Part 3. But for now, let’s look at customer lifetime value as an equation – or really, several equations.

Part 2: Customer Lifetime Value as Equation – how to crack the code of calculating this complicated metric

If you are not mathematically-inclined, I’ll make this as straightforward as possible.

Customer lifetime value is revenue you expect to receive from a customer over time, less the cost of acquiring and keeping that customer.

Here it is in equation form:

CLV = (ARPU X average # of months or years retained) – (CAC + CRC)

People have been refining ways to calculate more accurate CLV ratios for years. What’s so hard? So. many. variables. Here are the basic numbers you’ll need for the CLV calculation for a SaaS business:

Average Monthly Revenue Per Customer (ARPU)

Here are all the different ways customers bring in value in a subscription software business model.

- Original revenue

- Renewal revenue

- Upsell revenue

- Cross-Sell revenue

- Referral Revenue

Most calculations only deal with original revenue and renewal revenue, but that doesn’t cover the whole picture. When calculating Average Monthly Revenue Per Customer (ARPU) for our customer lifetime value equation, just remember to account for upsells and cross-sells, not just original revenue and renewal revenue. Referrals take care of themselves — they’ll show up in the customer acquisition cost (CAC) calculation because you’ll see that you’re getting more new customers without spending more on sales & marketing.

You’ll also want to know your CAC because the two are intertwined. Your CLV will increase if you are able to increase revenue from customers while maintaining or lowering your acquisition cost.

Customer Acquisition Cost (CAC)

How much you spent on sales & marketing in a given time period (learn more about this here)

Divided by…

How many new customers you gained in the same given time period

Customer Retention Cost (CRC)

The cost of serving the customer is often overlooked in CLV calculation. And if your onboarding customer success and/or customer service programs are significant, you definitely want to factor in Customer Retention Cost. Totango, a Wootric integration partner, wrote a whole book on calculating CRC, but a quick estimate looks like this:

How much you spend to onboard, train and support customers in a given period

Divided by…

How many new customers you gained in the same given time period

Customer lifetime value calculation in non-subscription models

One more way to calculate CLV is through a predictive model that can be highly accurate. This method is common in consumer businesses such as e-commerce. That equation looks like this:

CLV = (Average monthly transactions X Average order value) X Average gross margin X Average Customer Lifespan*

*The average customer lifespan is calculated in months.

Segment Customer Lifetime Value to make it more actionable

Calculating customer lifetime value for your company can be revealing and is a great start to working with this metric. Like measuring NPS though, it really isn’t actionable until you start segmenting the metric. To make customer lifetime value more actionable and predictive, you’ll want to separate these numbers by customer segment and acquisition channels. That’s when you’ll be able to optimize your acquisition strategies to raise your CLV rates even higher.

Start by looking at customer lifetime value by pricing tier or persona. For example, you may discover that the CLV for enterprise customers is no higher than self-service customers once you factor in the high cost of acquiring and supporting “the big fish.”

Part 3: The 4 Most Powerful Ways to use Customer Lifetime Value to grow your business

To use CLV as an actionable, predictive, productive metric, you have to segment your users and rank them by their CLV. Then you can look at the data you’ve collected on them – which acquisition channels they came from, what their first interaction was on your website, what their customer journey looked like through onboarding and beyond – to optimize each stage of the customer journey.

And then you can return to customer lifetime value as a ‘big picture’ measurement of your optimization progress.

Here are three primary ways to use customer lifetime value to optimize acquisition and retention.

1. Optimize your acquisition strategies for CLV – and use CLV to optimize your acquisition strategies.

Your CRM platform should tell you which channels customers came through to find you, and you may notice that your high-CLV customers tend to come from one of those channels over the others.

One of the most clear-cut stories of how a big company used customer lifetime value to increase profit is IBM. IBM used customer lifetime value to determine the effectiveness of their marketing channels to attract high-spending customers – direct mail, telesales, email, and catalogs per customer (yes, this is an old story – way back in 2008). When they reallocated resources to the best-performing channels, they 10Xed their revenue.

It’s low-hanging fruit to decide to spend more marketing money on the channels yielding the highest CLV clients. But we can go one step further.

2. You can use your Customer Lifetime Value to create better buyer personas.

Yes, this requires a platform that can gather all of the available information on each customer. But use whatever information you’ve got. You will find that your high CLV customers have a lot in common (though you may need to form segments for the commonalities to clearly emerge).

Once you have your high CLV buyer personas, you can use them to form marketing, outreach, and retention strategies based on their specific acquisition channels and user behavior through onboarding and retention.

For example, let’s say that you find that your high CLV clients come to you through G2 or Capterra. And once they reach your site, they don’t just “buy now” – they have at least one interaction with your live chat helpline. Your high CLV customers need a conversation before converting, which means if you tweak your G2 listing or website content answer their questions without having to reach out, you’ll likely see higher conversions from customers who’ll stick around.

3. Use Customer Lifetime Value with Customer Success for higher retention rates & referral revenue

Customer lifetime value and customer success are so intertwined as to be inseparable. Why? Successful customers don’t leave. So, when you want to improve your customer lifetime value, having a customer success program in place is one of the best ways to do it. Customer success asks, at each stage of the customer journey: What is the customer’s ideal outcome, and how can we best move them towards it? Then the customer success team can create strategies around supporting customers at pivotal moments – like places in the onboarding process where customers tend to get frustrated and leave (Customer Effort Score surveys are ideal for flagging these points of friction) or using churn-predictive behaviors to ‘red flag’ certain interactions to receive Customer Support pop-up chats.

4. Use Customer Lifetime Value to obtain more referrals from customers.

Your long-term high CLV customers are your brand ambassadors and influencers, and once you identify them, you can start to leverage that by rewarding and strengthening their connection to your brand. That could be something as simple as inviting them to be part of a free Beta testing group, so they can give you their insights into the next iterations of your product or service, or even just asking them to write an online review. Some businesses host online communities for their best clients, or offer them priority support.

Want an even easier way to identify the customers most likely to refer you to others? Learn how to use NPS surveys to not only find your promoters, but encourage them to promote you more.

5. Use Customer Lifetime Value to guide product design and validate product development decisions at the business level.

Product teams may be removed from revenue goals on the day-to-day, but strategic decisions about where to expend engineering resources should be made with business impact in mind. Product can use CLV to inform what customer segments the product should be designed for. Building CLV-related goals into user stories or feature specifications can help prioritize the roadmap and provide a success metric for retrospective once the product is out the door.

Part 4: 10 Ways to Increase & Optimize Your Customer Lifetime Value

- Prioritize customer experience above everything else. And don’t just say it; measure it with metrics like Net Promoter Score, Customer Satisfaction, and Customer Effort Score. Calculate and track churn rates and engagement metrics.

- Invest in customer success. Customer success drives acquisition, retention, and customer spending (upsells and cross-sells), raising customer lifetime value by helping customers achieve their ideal outcomes.

- Invest in UX testing. The data you get from UX testing makes your product easier to use, reducing friction, and making it a must-have tool for your users.

- Pay special attention to onboarding. Churn happens most frequently during or shortly after onboarding, so paying attention to churn-predictive behavior patterns (often identified by a Customer Effort Score survey) in the onboarding process can help you form a strategy to smooth those friction points and find easier ways to move your client towards meaningful success milestones.

- Bring product management, customer success, customer support, and marketing together in shared responsibility for metrics. Collaboration between product and customer success is common, but it is a good idea to expand the team because they have so much to gain from working together. For example, with onboarding, product managers need to understand how their tech decisions affect adoption and retention metrics; and customer success teams need to have access to onboarding user data that helps them identify upsell opportunities. Some shared metrics for success include NPS, churn rate, trial conversion rate, adoption rate, and, of course, customer lifetime value.

- Use CLV as a segmentation tool. This allows you to deliver appropriate experiences to customers who are high-value, and who have the potential to become high-value. The appropriate experience might be the level of customer support each segment receives, or the messaging they get throughout their buyer’s journeys. You may also find that each CLV segment has different pain points and needs, which you can target for even higher acquisition and retention rates.

- Ask your most loyal customers for support. Following up a positive NPS survey response with an automated request for an online review is simply asking happy customers to follow through on what they just said they’d be willing to do. They’ve already said yes – so make it easy for them to act on promoting you. This won’t directly affect your CLV score, but it will drive down your CAC as the referrals come in.

- Keep customers engaged by adding value to your product or service, or through high-value content. If you don’t have substantial updates/improvements/expansions planned for your product, you can keep customers engaged with educational materials–i.e. content that helps them reach their ideal outcomes faster and easier. This has the added benefit of being useful for top-of-funnel marketing as well.

- Listen to your customers and act on their feedback. Voice of customer data is so important for improving products and reducing friction. The only problem is that sentiment analysis at scale can be difficult without the right tools.

- Don’t “acquire customers” – build relationships. The customers who stay with you the longest feel like they know you. They feel like you know them. You’ve become an integral part of their daily lives, and they’d miss you if you went away. So consider changing the way you think of acquiring customers. You’re building relationships. And the more personalized and personal you make your customer interactions, the more likely your customers will feel connected to you and committed to your brand.

Maximizing Customer Lifetime Value is really a whole-company effort, requiring a great product, great service, and a deep understanding of your customers’ needs, frustrations, and desires. It’s a ‘big picture’ metric; a North Star number to guide you towards creating better customer experiences. But this one metric can also shed light on valuable segments and strategies that can profitably impact your business. customer lifetime value is a number you can’t afford to ignore.

When you call into their MID, operators use a

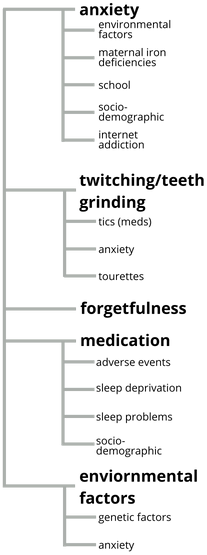

When you call into their MID, operators use a  The human brain is terribly complicated, and two people may experience the same condition in vastly different ways. This is especially true of conditions like Attention Deficit Hyperactivity Disorder (ADHD). In order to optimize treatment, physicians need to understand exactly how their individual patients experience it. But people often tell their doctor one thing, and then turn around and tell their friends and family something else entirely.

The human brain is terribly complicated, and two people may experience the same condition in vastly different ways. This is especially true of conditions like Attention Deficit Hyperactivity Disorder (ADHD). In order to optimize treatment, physicians need to understand exactly how their individual patients experience it. But people often tell their doctor one thing, and then turn around and tell their friends and family something else entirely.

The above applications of text analytics in healthcare are just the tip of the iceberg.

The above applications of text analytics in healthcare are just the tip of the iceberg.