A CSAT score is a commonly used customer experience (CX) metric that helps a company build a relationship of trust and understanding with its customers. A successful organization knows that a key element of success is a loyal foundation built within its customer base.

On paper, it may seem simple, but in reality, many companies struggle with building a customer-centric foundation within loyal customer relationships. One way to build and maintain solid relationships is to establish a channel for customers to communicate experience feedback to the company.

The goal of a successful organization is to fully grasp what customers value—as well as dislike—regarding their experience with a business. A proven channel to understand customer sentiment is by implementing customer satisfaction surveys.

What Is a Customer Satisfaction or CSAT Score?

CSAT is short for customer satisfaction score. It’s a commonly used measurement tool that acts as a key performance indicator for customer service and product quality. CSAT is a general term understood, recognized by, and beneficial to a wide variety of industries.

While customer satisfaction as an idea is a general one, CSAT is a more defined and specific metric that is expressed as a percentage. These more defined metrics can present as any of the four types of CSAT surveys:

#1: Customer Satisfaction Score (CSAT)

#3: Customer Effort Score (CES)

In this blog, the spotlight stays on what CSAT is, but it’s beneficial to have at least a brief understanding of the three other types of CSAT surveys to have a full grasp of the entire concept and how customer satisfaction can play a major role in organizational decision-making processes.

Net Promoter Score:

Net Promoter Score, or NPS, is a metric that indicates the willingness of customers to promote a company’s product or services and separates customers into promoters, detractors, and passives. While NPS is a valuable indicator of customer satisfaction, it also can surface pain points that can lead a company to revise, shift or fix friction points in the customer journey to encourage positive customer experience that leads to customer promotion.

Customer Effort Score:

Customer Effort Score, or CES, is a specific customer experience survey metric that enables companies to track the ease of or effort required within the customer interaction with a product or service within the duration of the customer relationship with the company. In measuring CES, organizations gain insights and data that enable business improvements in and around the customer experience to uncover laborious friction points that act as roadblocks to customer interactions.

A Milestone Survey:

A Milestone Survey is a questionnaire sent out at specific moments throughout the customer journey to help organizations better understand the customer experience over time. A milestone can either be triggered by time (after 30 days) or by experience (after onboarding).

What Types of Questions Would a Customer Satisfaction Survey Include?

When drafting a CSAT survey, it is wise to consider including a variety of questions that explore the different aspects and relationships surrounding the customer’s journey with a product or service.

The five most beneficial and key question types that provide a wide and valuable range of insight that will likely benefit any organization are:

- Product Usage Questions

- Demographics Questions

- Psychographics Questions

- Satisfaction Scale Questions

- Open Ended Text Questions

Product Usage Questions:

Product Usage Questions explore when and how, and why customers are interacting with your product; they will be critical in identifying customer expectations and needs that lead to product engagement. Product usage questions point to the value or lack thereof that a product provides. Listening to the voice of the customer regarding our product will provide clarity and insight beyond what controlled studies can provide. With product usage data, companies can get a more complete picture regarding functionality and value its product provides.

Demographic Questions:

Demographic Questions can help you determine a variety of components within a population’s characteristics that may influence a customer’s decisions surrounding your product. It’s common within demographic questions to gather information about customers’ income level, marital status, gender, identity, and geographical location. With product usage segmented data, companies are better informed to make wise business decisions on how to target a specific demographic by utilizing the data from their customer feedback. This data-based information may help you develop products and or services that relate more specifically to customers.

Psychographic Questions:

Psychographic Questions will give valuable insight into the customer lifecycle by providing you with information about unique customer specifics. Psychographics describe human traits that could include: hobbies, interests, likes and dislikes, goals, values, lifestyle, or physiological tendencies. Psychographic survey questions may help measure the personality traits and tendencies of a customer’s preferences regarding a company’s products and services.

Satisfaction Scale Questions:

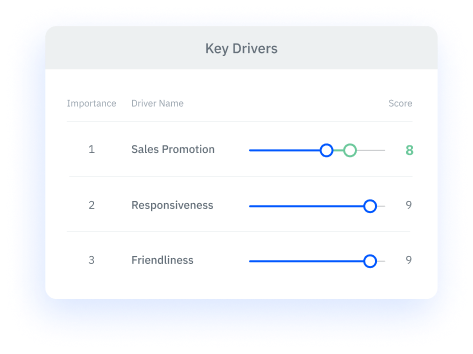

Satisfaction Scale Questions may promote feedback and curb survey fatigue as the structure of the question can be an easy way for customers to give an overall sentiment of their experience with the company or product using a single click. The satisfaction scale asks, on a scale of 1-5, or 1-10, how satisfied a customer is. This scale can be as general or specific as the feedback a company would like to receive and can provide companies direction on who their promoter and detractor customers are and allow them to target them according to their overall satisfaction sentiments.

Open-Text Questions:

Open-Text Questions allow customers more freedom to share and expound upon unique experiences and assist in gathering highly valuable responses not available in other forms of questioning. Open-text questions are relatively harder to analyze as data sets and require text analysis, but they help capture subjective and individualized experiences regarding the customer journey better than other forms of questioning.

How Do You Calculate and Measure a CSAT Score?

CSAT score is a customer feedback metric measured via one or more variations of this question: “How would you rate your overall satisfaction with the products or service you received?” Respondents use the following or similar 1 to 5 scale:

- Very Unsatisfied: ( Where a customer would be considered a detractor)

- Unsatisfied: (Where a customer would be considered at risk of churn)

- Neutral: (Where a customer would be considered a slight risk of churn)

- Satisfied: ( Where a customer would be considered a promoter)

- Very Satisfied: ( Where a customer would be considered a promoter)

CSAT scores are usually developed into a percentage scale, with 100 percent representing complete customer satisfaction. The results of a CSAT survey can be averaged out to give a Composite Customer Satisfaction Score by taking the number of satisfied customers and dividing them by the number of surveys received. CSAT Surveys remain the most successful way to elicit customer feedback and come in a variety of forms and templates. Customers may be accustomed to a traditional questionnaire or website form, but more and more, the less traditional format, such as a popup, an app, via text message, or other unconventional methods, are being adopted as users can easily navigate these methods within the comfort of their touchscreen devices.

Why Are Customer Satisfaction Surveys Important?

When customers feel their voice is being heard, they are more likely to communicate their unique and personal experiences with a product or service. In the event of negative experience feedback, customers are more likely to stay if they can see their experience remedied. Unsatisfied customers have the potential to become loyal promoters after being retained from negative feedback, and a well-timed customer satisfaction survey can hone the customer journey and improve satisfaction, retention, loyalty, and likelihood to repurchase.

Moving Forward with CSAT Surveys

Occasionally customer satisfaction feedback will provide a descriptive experience, especially if open-ended questions are included, but most customer feedback will be brief, concise, and to the point. Whatever form the feedback takes, the notion that any feedback is better than none remains, and the CSAT score is the best way to receive, sort, and take data-based action to improve.

Utilizing CSAT scores and insights wisely can lead to a positive influx of new customers and contribute to well-maintained relationships with existing ones.