“What grade did you get?”

Do you remember getting asked that question in grade school? Or maybe you were the one asking it? Humans like to know how they’re doing compared to everyone else.

This carries over into customer experience as well. At Wootric, we advise companies on setting up an effective Net Promoter Score (NPS) program. We get asked questions about NPS industry benchmarks all the time.

In general, we believe focusing on an external NPS benchmark is not incredibly helpful.

The Net Promoter System is the quantification of customer loyalty and the process for improving it over time. The power of this system lies in the analysis of feedback and the action taken based on that analysis.

However, net promoter score benchmarks are still useful in certain cases, which is what this article is all about.

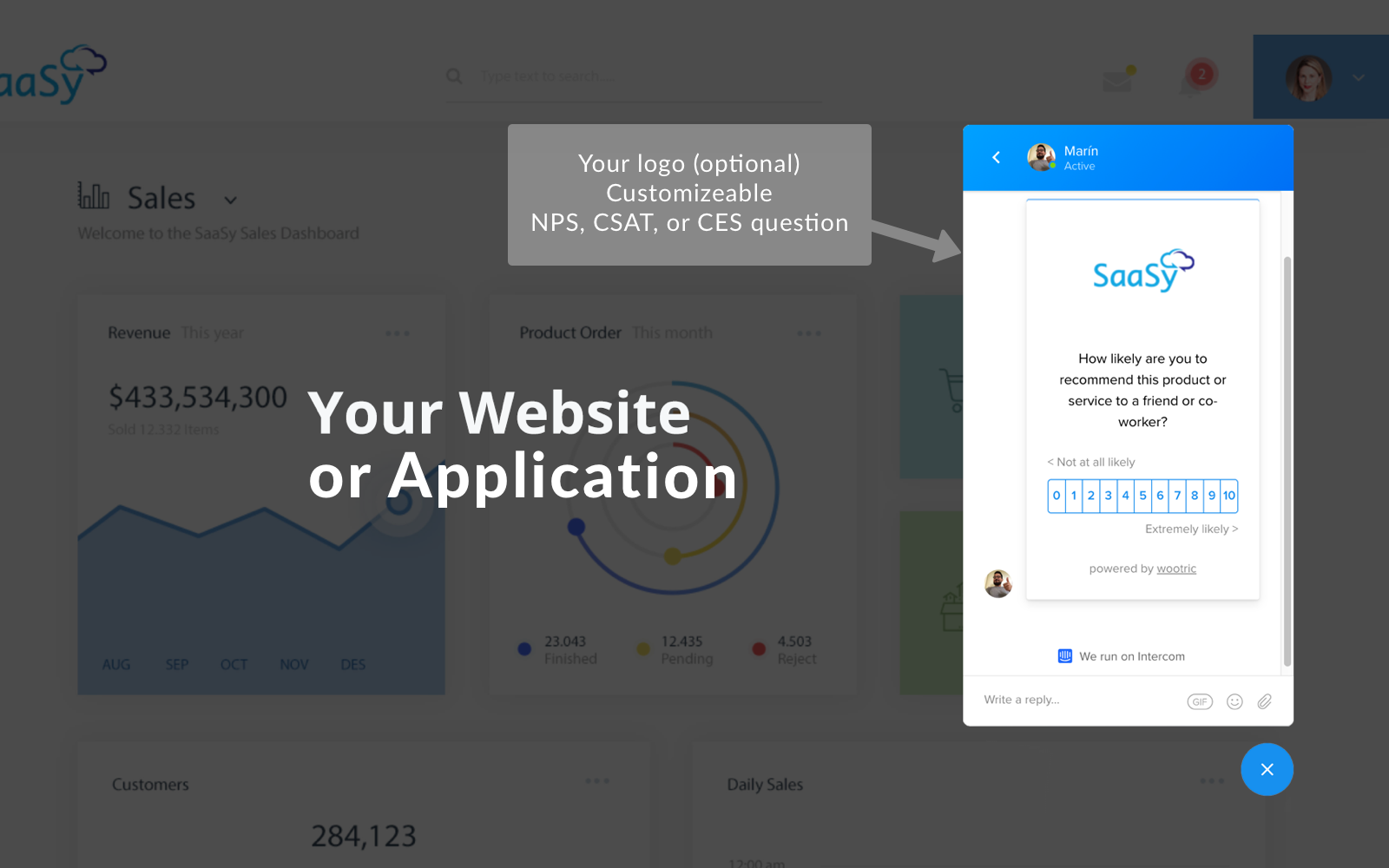

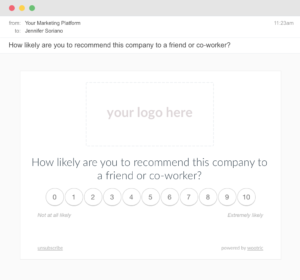

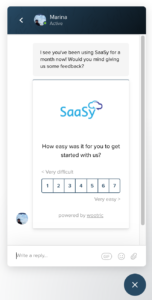

If you’re unfamiliar with NPS, here’s a quick rundown:

Net Promoter Score (NPS) is a customer loyalty metric between -100 and 100 that captures the propensity of a company’s customers to attract and refer new business or/and repeat business.

NPS also stands for the Net Promoter System®, which was built around the Net Promoter Score. It is a model that ties a corporation’s bottom line to customer happiness and loyalty.

Get the ebook, The Modern Guide to Winning Customers with Net Promoter Score. Learn how to modernize your NPS program for growth and higher loyalty.

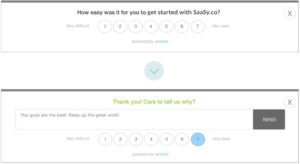

In the NPS survey, customers rate their likelihood to recommend your company on a scale of 0-10. To get your Net Promoter Score, take the percentage of people who are happy and willing to recommend your product or service (those who respond with a 9 or 10) — “promoters”– and subtract the percentage of people who would not be willing to recommend your product or service — (score of 0-6) “detractors.”

For example, a +50 NPS means that the company has more than 50% promoters and less than 50% detractors, so generally an NPS score of +50 is, indeed, great! You may see scales out there that say +30 is a decent score, and that +80 or greater is the ultimate dream score.

To learn more about NPS, get the ebook, The Modern Guide to Winning Customers with Net Promoter Score, which teaches how to modernize your NPS program for growth and higher loyalty.

Net Promoter Score industry benchmarks

There are two different types of NPS: absolute and relative. Absolute NPS refers to the NPS in and of itself, and comparing the score with what is generally considered a “good” or “bad” score. Relative NPS is taking into account the average NPS within an industry, which takes into account the factors that could affect an average Net Promoter Score, and can change the NPS benchmarks you set.

While an absolute NPS goal is nice and simple, it can be helpful to take a look at what others in your industry have been able to achieve, since every industry is different and has unique relative NPS results. The relative Net Promoter Scores generally achieved in each industry help construct what are called the NPS industry benchmarks. NPS Industry benchmarks give you a way to evaluate your NPS relative to your competitors. They help control for factors that often create major differences in what is considered a good NPS score.

Oftentimes, other companies in your industry have established an average NPS for you to use as a net promoter score benchmark. If you make smartphones or other tech hardware, for example, companies like Apple have been tracking NPS for years.

To get averages and examples from your industry, try reports from the Fortune 500.

NPS Benchmark variance between industries

Let’s take a look at some examples of net promoter score benchmarks according to your industry.

Let’s say you have an NPS of +50. As we explained, that’s already pretty good! But if you’re a department store or specialty store, you are actually below the NPS benchmark (+62) for the industry.

Walmart pharmacies have an NPS score of +32. Considering the highest score is +100, you’d guess that they’d be lukewarm with this score, but I’m sure that the folks in charge of customer experience there are actually ecstatic. Walmart pharmacies have one of the highest NPS scores within the drug store & pharmacy industry.

Compare this number to the software industry, where +34 is the average. Becoming a leader in the software industry would mean having an NPS in the +60 range, like Salesforce (+66) and Adobe (+62).

If I tell you that the industry average NPS for laptop computer manufacturers is +43, can you guess what Apple’s NPS is? Consider their brand reputation and customer loyalty…

In 2018, Apple’s laptop product team reported an NPS of +63. You probably got pretty close, since you knew the industry average! This is why relative score comparison by industry is more useful than evaluation based on an absolute scale.

Caveats for using NPS industry benchmarks

Unfortunately, NPS benchmark programs aren’t always as helpful as you’d hope. This comes down to the nature of surveying for feedback. There are so many contributing factors to an NPS benchmark, such as:

- Which channels you use to survey customers

- Demographics and habits of your customer base

- Customer tolerance levels

- The size of your competition

- The difficulty of building brand loyalty

- External circumstances (such as a global pandemic)

- When and how often you ask

- Whether you have enough data to be statistically significant or not

All of these factors can have varying effects on your overall NPS score. For example, your competitor may ask the NPS question within the context of a longer annual brand survey, while you survey using just the NPS question after a transaction. These will have different consequences for the feedback you gather. If you don’t have enough feedback coming in, your NPS may vary significantly from quarter to quarter or month to month.

Bear in mind, a ‘good NPS score’ doesn’t just depend on your industry, since it’s not difficult to game the system. It’s not always fair to compare your NPS score to another company’s NPS score because you don’t know their survey methods, or their employee compensation plans.

When competitive individuals are incentivized based on NPS score, things can get ugly.

A motivated person or company could improve their numbers by letting their customers know that positive feedback would mean a lot to them or by only showing the survey to customers who are positively inclined. They might offer incentives to customers to complete the survey. Clearly, the feedback received from these methods will lead to an inflated NPS score that is not a useful comparison for those using a more objective survey process.

Setting an NPS goal if you don’t have a benchmark

If no Net Promoter Score benchmark exists for your industry, benchmark against yourself.

The great thing about NPS is that it is an actionable metric. It’s a number that you can rally the company around as a north star to guide improvement efforts.

“A good NPS score is one that is better than the last.”

– Jessica Pfeifer, CCO & Co-founder of Wootric

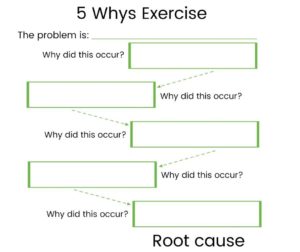

Remember, NPS isn’t just a score. It’s a system that’s meant to drive business improvement in product and customer experience. It helps you identify and close the loop with unhappy customers and solve their specific problems in real time.

Your goal is to boost customer loyalty and retention, and that happens by reading verbatim comments to understand the why behind the scores you receive. By making changes based on customer feedback, and responding quickly to detractors, you will naturally see your NPS improve. And gains in NPS correlate with revenue growth.

How to report NPS

After all this, you will want to report numbers to the rest of the team on a regular basis. NPS should be shared along with other monthly or quarterly metrics like revenue, new customers and customer churn.

We understand that, so here’s what we recommend:

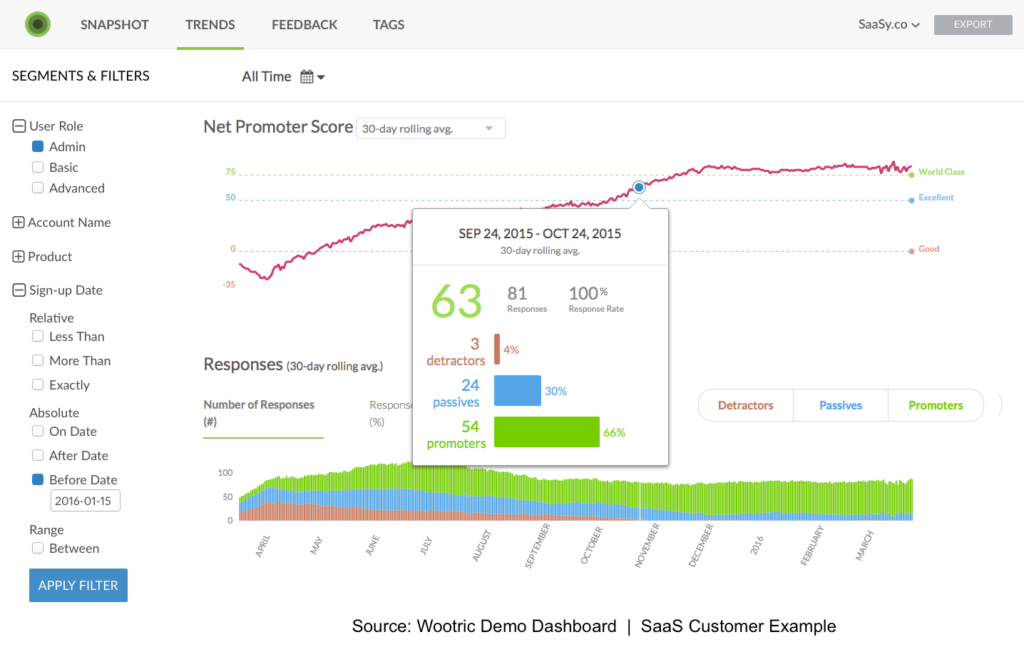

- Instead of fixating on your score in the absolute sense, we recommend focusing on improving your score over time. Understand NPS as a trend over several periods, like if you were looking at a stock’s price.

- Determine the business goals of your NPS program, then report NPS in relation to the goals. For instance, if you are trying to improve retention, report NPS alongside churn data.

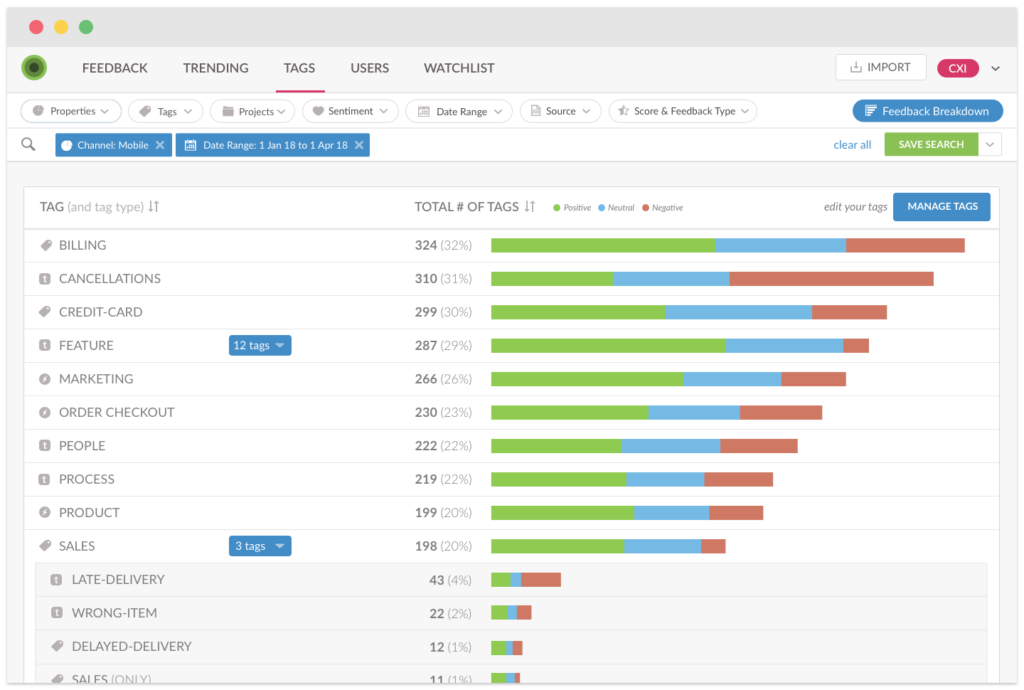

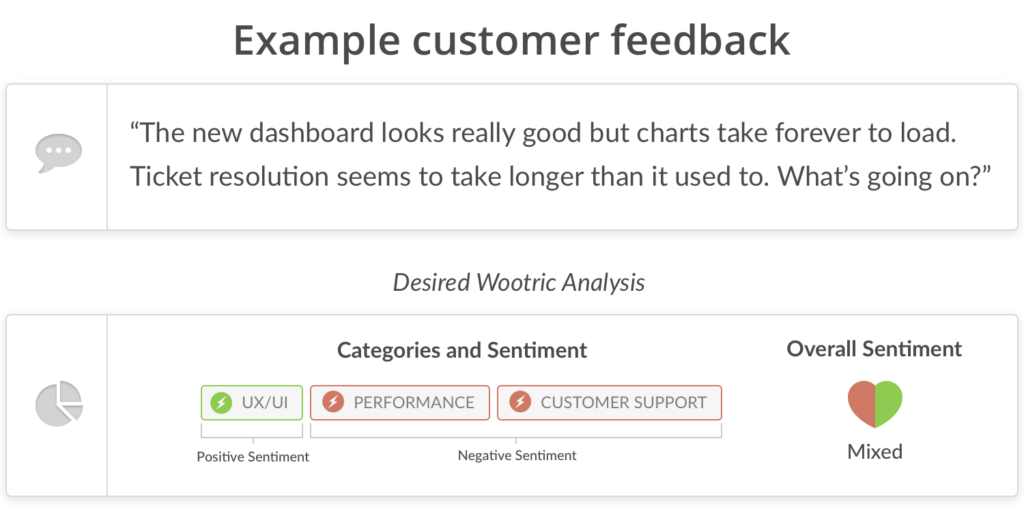

- Pay attention to trending topics in your verbatim responses. Reporting these topics will help everyone understand what’s important to your customers, and the pain points they experience. Share what customers love and what they don’t love about your company with internal stakeholders. Then you can work to make those points as frictionless as possible.

Note: For startups, be sure to read and respond to every single comment. As you grow, you’ll start needing aggregate and to pull themes from customer comments. To automate that process, check out AI-powered text and sentiment analysis.

- Segment your Net Promoter Score by relevant customer groups. For example, this could be by user role (in the SaaS example above), geography, or size/frequency of purchase–whatever drives your business. This will help you pay close attention to groups that are critical to your business success. Learn more about segmentation here.

- If you want to compare your score to a competitor, choose a company in your industry that you admire and use their score as an aspirational benchmark. Many companies have volunteered their NPS scores to research and reports such as this one by the Fortune 500.

Measure NPS and work to improve it over time. Dig into customer comments and close the loop with customers. You will learn their needs, and their pain points, and have plenty of guidance to make those improvements. Both your NPS and your customer retention rates are sure to improve.

Sign up today for free Net Promoter Score feedback with InMoment.