It’s every company’s dream to have loyal, lifelong customers. To get this, you need to understand what your customers want, how they view your brand, and how they feel about your products and/or services. To put it simply, you need to understand their entire customer experience, from beginning to end.

One way to do this is through customer satisfaction surveys. Let’s dive into what they are, why they are important, and the different variants of them that you can use.

What Is a Customer Satisfaction Survey?

Customer satisfaction surveys enable you to measure your customer’s satisfaction with any aspect of your business, whether it be:

- Products

- Services

- Experiences

- Staff

These customer satisfaction surveys, also referred to as CSAT for short, offer a holistic view of different aspects of your customers’ experiences. They can use a rating system that can be tracked over time, offer specific insights into your customers’ pain points, and help you work to continue to meet your customer’s needs.

Why Are Customer Satisfaction Surveys Important?

Customer satisfaction surveys are important because they are a direct insight into the customer experience. They help you understand how your business is viewed, and what you can do to improve that. Having high satisfaction rates is important to your brand for many reasons. Satisfied customers spread the word through word-of-mouth marketing. Satisfaction is a great indicator of retention, customer loyalty, and new customer acquisition through referrals.

Customer Retention

Knowing your customers is beneficial from a financial standpoint. Most customers feel that companies should make more of an effort to cater to their feelings and walk out if those needs aren’t met. Maintaining customers is much cheaper than gaining new ones, so ensuring they are satisfied with the service or product, ensures customer retention.

Happy Customers Stay Loyal and Spend More

Research shows that if customers are treated well, they will purchase more. Your returning customers will spend around 67% more than first-time customers. Measuring which interactions your customers value will help you evaluate what they are willing to pay more for.

Satisfied Customers Spread the Word

If customers have a good experience they are more likely to tell a friend or recommend a service. This can have a knock-on effect on the reputation of your company. Most Americans think word of mouth is the most trustworthy form of recommendation. This can however go the other way, in that unsatisfied customers can also tarnish a company’s reputation. Monitoring how your customers feel with a customer satisfaction survey is essential.

What is the Purpose of Customer Satisfaction Surveys?

Customer satisfaction surveys are used for several different purposes, each of which is important to the company that wishes to continuously monitor and improve the customer experience they provide. Top objectives include:

- Fix any meaningful problems that have occurred for customers with the company’s products or services.

- Assess the performance of its customer-facing units (retail locations, call centers, digital care teams, etc.) and staff (salespeople, call center reps, etc.).

- Improve its processes and standards for delivery.

- Understand customers’ needs as they use the company’s products or services so the company can help them have a better overall experience.

An effective customer experience program will address all four of these objectives. To do this, a company may need several different but integrated components. Effective measurement of processes and performance of people requires a focus on transactions and traditional measurement that uses a consistent and robust methodology, whereas a focus on customers as individuals requires a unique and individualized approach that follows a customer periodically throughout his or her tenure as a customer.

Do Customer Satisfaction Surveys Work?

The effectiveness of customer satisfaction surveys is a topic that is often debated. However, it should be clear that customer satisfaction surveys work. Working to improve the customer experience is always a good thing. If you successfully improve the customer experience, you will almost certainly realize improved business results. For example, boosting customer retention by just 5% can improve your profits by anywhere from 25-95%.

The caveat to this statement is that customer satisfaction surveys only work under alignment and the direction of a similar goal. If you send out customer satisfaction surveys just to check a box, the likelihood of you seeing ROI from those efforts is slim to none. For you to get the most out of your CSAT surveys, you need to align with the other stakeholders in your organization.

How to Create a Customer Satisfaction Survey

Creating a survey that yields responses can be a tricky situation. You want to get in-depth feedback but don’t want to overwhelm your customers to the point of them exiting the survey without completing it. To create an effective customer satisfaction survey, you need to keep these tips in mind:

- Define Your Objectives: Determine what you want to achieve with the survey. Are you looking to measure overall satisfaction, identify areas for improvement, gather feedback on a specific product or service, or assess customer loyalty?

- Select Survey Type: Choose the type of survey that best suits your aforementioned objectives. Some common types of surveys include Net Promoter Score, Customer Satisfaction Score, and Customer Effort Score.

- Consider Survey Length: Keep the survey short and relevant to prevent survey fatigue and increase response rates. Aim for no more than 10-15 questions, and prioritize the most important ones.

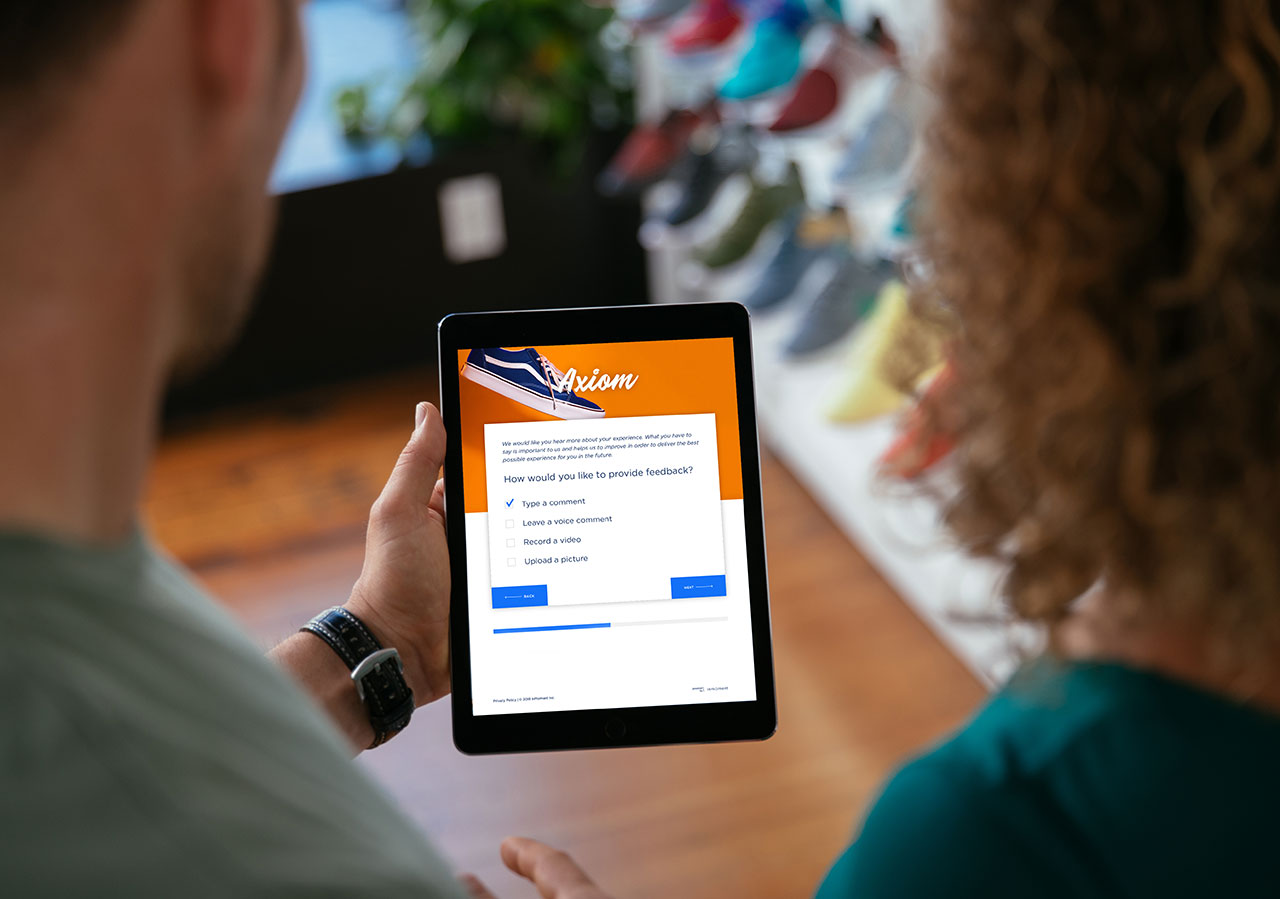

- Design a Welcoming Survey Layout: Choose a clean and user-friendly layout for your survey. Use a mix of text, visuals, and white space to enhance readability. Ensure that the survey is accessible across different devices (desktop, mobile, tablet).

- Test the Survey: Before launching the survey, conduct a pilot test with a small group of respondents to identify any issues with clarity, flow, or functionality.

InMoment’s dynamic XI Platform gives you the ability to create your surveys or choose from prebuilt templates. These templates enable you to customize branding, question types, logic, design, and other features seamlessly within a single user-friendly interface.

How to Start a Customer Satisfaction Survey

When designing a survey, sometimes starting the survey can be the most difficult problem. If you are wondering what the best way to start a survey is, you aren’t alone. While it may seem like there are a lot of ways to go about asking the first question, you should keep one thing in mind. Your first question should always be associated with the metric or business goal you are trying to achieve.

This question is the most important one in the survey, and should always be answered first. The questions that follow this one are where you can get a bit more creative. You can ask follow-up questions to the first question that allow the respondent to provide more information about their first answer, or you can ask a question about a secondary metric or topic that you may be tracking.

How to Measure Customer Satisfaction

If you want to know just how satisfied your customers are, you need to go directly to the source and ask them. Customer satisfaction surveys are the best way to identify the highlights and the pinch points of your product or services. You need a metric to help quantify the experience your customers have, which all starts by establishing a framework for their feedback.

Three Crucial Customer Satisfaction Metrics

There are many ways to measure customer satisfaction, but there are a few that are more prominent, popular, and productive than their counterparts. Here are three of the most common types of customer satisfaction surveys or measurements:

Customer Satisfaction Score (CSAT)

Customer Satisfaction scores are an attempt to capture how satisfied customers are with a company’s goods and services. A survey asks a customer to rate their satisfaction, typically on a scale from 1 to 5.

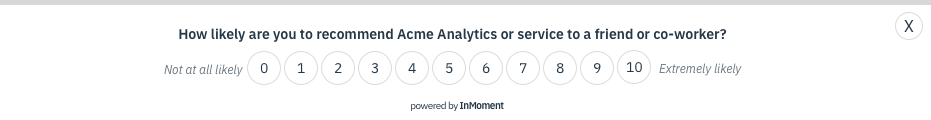

Net Promoter Score (NPS®)

Net Promoter Score® (NPS) is a trademarked metric between -100 and 100 that captures in aggregate the propensity of a company’s customers to attract and refer new business or/and repeat business.

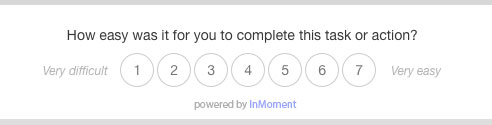

Customer Effort Score (CES)

The Customer Effort Score is an index from 1 to 7 that measures how easy a company makes it for customers to deal with its products and services. A company that provides effortless service gets a 7 while a company that makes it difficult gets a 1. In other words, the higher the CES, the better.

For example, your customer satisfaction survey could instruct your customers to rate their satisfaction with a service or product on a scale of 1-5. If you want to get an idea of how your customers view your brand, you can use the Net Promoter Score (NPS) that asks how likely a customer is to recommend your company to a friend using a scale of 0-10.

Deciding on the rate metric and the best response type will depend on what you want to know. What drives the experience of your customers? What causes them to feel the way they do about your brand or business offering? As you hone your feedback survey questions and the type of metrics that benefit your business most, you can collect data over time and gain greater insights.

Question Types to Include in Your Customer Satisfaction Survey

Embarking on the journey of creating a customer satisfaction survey is akin to crafting a conversation with your customer base—each question type serves as a different form of dialogue, each with its own strengths and considerations. Here are some core question types that you should consider including in your customer satisfaction surveys:

Likert-Scale Questions

Likert-scale questions are the bread and butter of nuanced feedback. They invite respondents to indicate their level of agreement or satisfaction across a symmetrical, often five or seven-point scale. When you’re seeking to grasp not just the “what,” but the “how much,” Likert scales are invaluable. These are particularly effective when you aim to measure various dimensions of the customer experience, such as ease of use, quality, or responsiveness. They are straightforward for customers to understand and quick to complete, boosting completion rates and, by extension, the richness of your customer satisfaction survey data.

Multiple Choice Questions

The jack-of-all-trades in the survey world, multiple-choice questions, offer pre-set answers that make it easier to standardize responses. Ideal for quantitative analysis, these questions help to streamline the data collection process. Want to know which features are most useful to your customer base? Or maybe you’re curious about how often respondents use your service? A well-crafted multiple-choice question can provide that clarity. Importantly, keep the options mutually exclusive and collectively exhaustive to avoid ambiguity—a cornerstone principle of customer satisfaction survey best practices.

Open-Text Questions

If Likert-scale questions give you the “how much,” open-text questions deliver the “why.” They are your gateway to the qualitative nuances that multiple-choice or Likert-scale questions can’t capture. They provide the space for customers to articulate their thoughts, emotions, and suggestions freely. While they may be more time-consuming to analyze, the richness of the insights gained can be deeply revealing. Open-text questions are especially useful when you’re searching for constructive criticism, in-depth product feedback, or new ideas for improvement. It’s like having a one-on-one conversation with your customer, but at scale.

Binary Questions

Binary questions cut to the chase. They are a straightforward yes-or-no format that is quick to answer and easy to analyze. These are your go-to when you need a clear-cut view of a situation. Did the customer find what they were looking for? Was the check-out process smooth? The simplicity of binary questions makes them highly effective for issues that are black and white. However, their simplicity also means they lack the depth of insight gained from other question types, so use them judiciously within your customer satisfaction survey.

Follow Up Questions

The follow-up question is where the art of survey design truly comes to life. After capturing the core data, use follow-up questions to drill down into specifics. Was a customer dissatisfied with their purchase? A well-placed follow-up can reveal whether it was due to product quality, delivery time, or perhaps customer service. Follow-ups are instrumental in adding layers of understanding to your basic findings, allowing you to formulate more precise and impactful action plans. They’re the epitome of turning data into dialogue, contributing to a customer-centric culture that values feedback at every turn.

20 Customer Satisfaction Survey Question Examples

There are a wide variety of questions you can ask across multiple types of surveys, it just depends on what you are looking to get insight on. Here are examples of categories of questions and example questions.

Product Usage

- How long have you been using the product?

- How often do you use the product or service?

- Does the product help you achieve your goals?

- What is your favorite tool or portion of the product or service?

Demographics

- Where are you located?

- What is your level of education?

- Where do you work and what’s your job title?

- What industry are you in?

Satisfaction Scale

- On a scale of 1 to 10, how satisfied are you with your experience today?

- Did you feel that our team answered your inquiry promptly?

- Do you agree or disagree that your issue was effectively resolved?

- How likely are you to return to our website?

Open-Text

- How can we improve your experience with the company?

- What can our employees do better?

- How can our employees better support your business’s/your goals?

- Why did you choose our product over a competitor’s?

Longevity

- May we contact you to follow up on these responses?

- Can we connect you with a customer success manager via chat?

- Would you be open to discussing upgrade options for your product?

- Can we send you a list of useful resources for getting the most out of your product?

Customer Satisfaction Survey Design Best Practices

One of the most important things to remember when designing customer acquisition surveys is that if your survey is too long, or too tedious, you will not get responses. Timing your surveys right, and designing them effectively will help you get all the information you need to keep your customers happy and satisfied with your products. To get the most out of your customer satisfaction survey efforts, here are some of the dos and don’ts of the process.

Do

- Ask for the overall company rating first. Starting with someone’s overall impression of your company can help you compare your business to your competitors and your industry’s market, which is important for creating internal benchmarks.

- Allow for open-text feedback. There are pros and cons to both free-response questions and more limited-response questions. In some aspects, it’s easier to gather hard and definitive data with limited-response questions, but you also need to understand the motives and concerns behind someone’s feedback by learning details you may not have otherwise anticipated.

- Always A/B Test Your Surveys. You wouldn’t put a new product into the market without first testing it with your target audience, right? The same principle applies to your customer satisfaction surveys. A/B testing—comparing two versions of your survey to determine which performs better—can radically improve the quality of the feedback you receive.

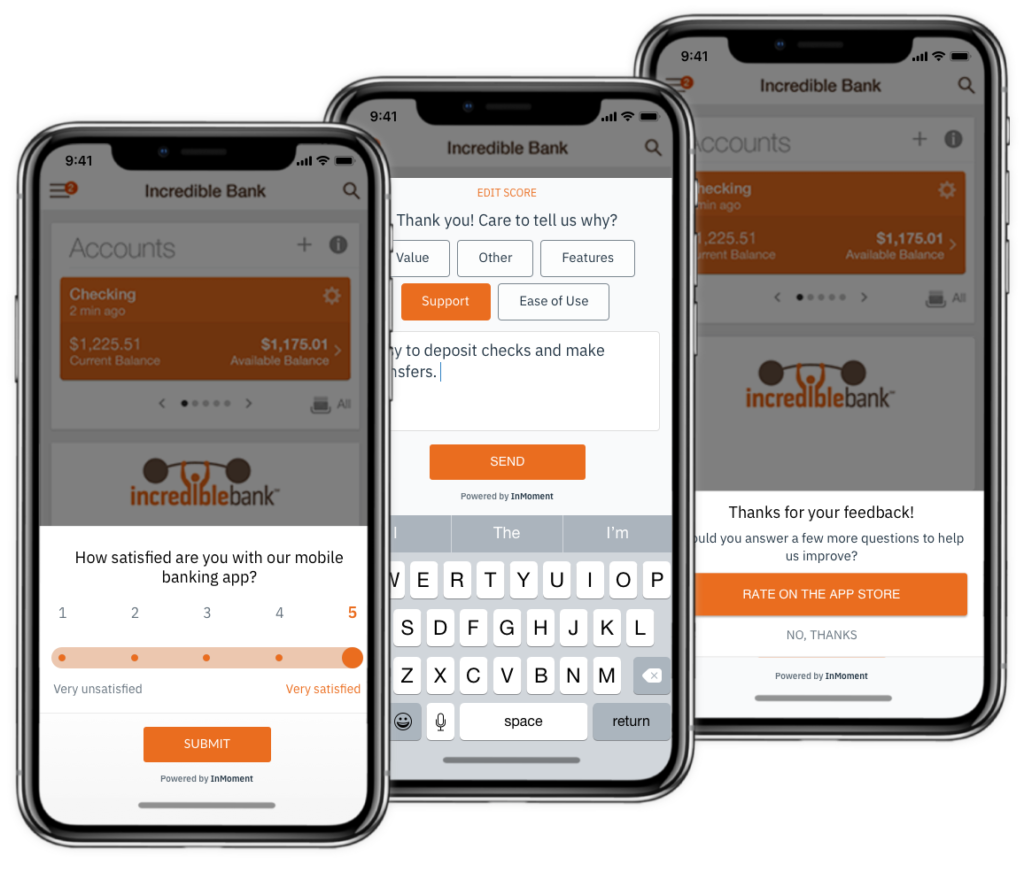

- Optimize for mobile. Mobile apps and devices are growing in popularity and not as many people are using a desktop computer to complete their customer satisfaction survey. If your survey process is clunky on mobile or takes too long, customers are less likely to finish or even start the survey to begin with.

Don’t

- Ask double-barrel questions. Your question needs to focus on one aspect or issue—a double-barrel question covers more than one issue but only allows for one response. To reduce confusion or gathering inaccurate data, simplify your questions.

- Make the survey too long. If you lose your respondent’s interest with a huge customer satisfaction survey, you’ll miss out on helpful information and make customers feel like they wasted their time. Satisfaction surveys don’t often need to exceed 10 questions.

- Use internal or industry jargon. The language you use will not only leave a certain impression on your customers, but if respondents can’t understand what you’re really asking them, they may not respond accurately or even finish the survey.

How to Distribute Your Customer Satisfaction Survey for Optimal Data

Navigating the intricate landscape of customer satisfaction surveys requires a thoughtful approach, from choosing the right platform to identifying the optimal timing and debating the merits of incentives. In the upcoming sections, we’ll demystify these key considerations. We’ll explore how the medium of your survey can shape its effectiveness, why timing matters in capturing the most accurate customer sentiments, and the pros and cons of incentivizing your respondents. Get ready to elevate your customer satisfaction survey strategy with these essential insights.

Choosing the Right Platform for Your Customer Satisfaction Survey

- Online Platforms: In today’s digital age, online platforms such as social media channels, your company’s website, and dedicated survey platforms are powerful tools. They offer the convenience of anytime, anywhere access and provide immediate feedback. Online surveys can be designed to be visually appealing, easily shareable, and interactive.

- Emails: Still an effective method, emails allow for a direct reach to your customer’s inbox. With a compelling subject line and a personalized touch, it can drive higher response rates. Plus, the convenience of answering when it suits them makes emails a preferred method for many.

- In-app Prompts: For businesses with mobile or desktop applications, in-app prompts can be a seamless way to gather feedback. As users interact with your app, strategically timed prompts can ask about their immediate experience. It’s timely and directly related to the user’s current action, ensuring relevant feedback.

When to Send a Customer Satisfaction Survey

Ideally, you want to avoid asking for feedback during a purchase or experience. Doing this can interrupt the process and worsen the customer experience. Here are some examples of acceptable times to ask for customer feedback:

- Post-purchase: Once a customer completes a purchase, their experience with your product or service is fresh in their mind. A short, focused customer satisfaction survey can help gauge their immediate reactions.

- After-Service Experiences: If a customer has interacted with your customer service team, for a query, complaint, or any other reason, it’s essential to know how they felt about the interaction. Sending a survey shortly after can provide insights into your team’s performance and areas for improvement.

How Often Should You Conduct a Customer Satisfaction Survey

The frequency with which you conduct a customer satisfaction survey depends on various factors such as the nature of your business, the industry standards, and the pace of change within your organization.

That being said, it is important to conduct these surveys at regular intervals. Having a regular cadence for your customer satisfaction surveys helps you track overall changes in performance over time. Some common frequencies include quarterly or semi-annually.

If your business undergoes significant changes like launching a new product or service, implementing a major policy change, or experiencing a merger, it might be wise to survey to gauge how these changes are perceived by your customers.

In industries influenced by seasonal trends, such as retail or hospitality, it might be beneficial to conduct surveys during peak seasons or before major holidays when customer engagement is high.

Ultimately, the key is to strike a balance between gathering sufficient feedback to make informed decisions and not overwhelming customers with too many surveys.

How to Improve Customer Satisfaction Surveys

In order to get the best data that gives you the most actionable information, you will need to constantly work to improve your surveys. This can be done through a various number of ways. Trial and error can be an effective method to improve your surveys. If you have one goal in mind for your survey, you can ask one question that relates to that question, and then change the follow-up question over time. This follow-up question can act as an independent variable that you can measure against. While there are other ways to improve your survey over time, here are some ways to improve them right out of the gate:

- Ask specific questions: Ask specific questions that relate to your business goal. Whether it is product quality, customer service, or ease of use, these questions will get you closer to data that you can use.

- Test the survey: Before deploying the survey widely, test it with a small sample of customers to identify any potential issues or areas for improvement. Gather feedback on the survey itself and use this input to refine the questions and format.

- Ensure accessibility: Make sure the survey is accessible to all customers, regardless of their preferred communication channels or accessibility needs. Offer multiple ways for customers to access the survey, such as email, website links, or mobile apps, and ensure that it’s compatible with screen readers and other assistive technologies.

To Incentivize Responses or Not to Incentive Responses?

Pros of Offering Rewards:

- Higher Response Rates: A small token of appreciation can motivate customers to take a few minutes out of their day to provide feedback.

- Positive Sentiment: Offering rewards can leave a positive impression, showcasing your brand’s appreciation for their time and effort.

Cons of Offering Rewards:

- Quality of Responses: Some customers might rush through the survey or provide inauthentic responses just to claim the reward.

- Cost Implications: Depending on the incentive, it might increase the cost of conducting the survey, which businesses need to factor into their budget.

How to Turn Customer Feedback Into Action

Once you have gathered useful and relevant data from your client satisfaction survey, it falls back on your business to make that data impactful and lucrative. If you want to improve the customer experience, here are some core principles to keep in mind.

Close the loop:

Negative feedback is always going to exist, and to show that a customer’s response matters, respond quickly after receiving that feedback from customer satisfaction surveys. A customer feedback loop boosts customer loyalty, even for those who didn’t have a great initial experience.

Analyze for trends:

Dig into your metrics and data to see if you can identify any patterns or commonalities. If more than half of your respondents struggled to navigate the online store on your website, then it may be time to revamp or redesign your website interface.

Company-wide effort:

Make sure you align your improvement efforts at every level of your organization. From product development to customer service, everyone needs the same expectations and strategy, which often means greater communication and collaboration. Feedback from customer satisfaction surveys can help different teams and departments come together to improve and prioritize the right elements of their projects.

How to Present Customer Satisfaction Survey Results

The data you get from surveys is important, but it is only as great as your ability to make sense of it and report on your findings. In order to make sure the right insights are shared with key stakeholders, you need a repeatable and scalable way to report on your survey data.

With InMoment’s dynamic reporting capabilities, you have the ability to make sense of large amounts of data in seconds. You can see what is impacting your metrics, filter out data you don’t want to see, and share these reports across your organization.

Other Ways to Understand Customers

Using customer satisfaction surveys is a key component of improving your business and understanding what your customers need. When it comes to marketing, there are even more things you can do outside of CSATs and surveys. It’s best to approach customer needs from several angles, including customer satisfaction surveys and the following strategies.

Personas:

User personas are detailed portfolios of your target customers that highlight a made-up customer that emulates the primary motives, needs, and concerns of specific users. This helps you group certain users that you can better serve and address their pain points.

Market research:

Customer satisfaction surveys are part of your research, but you can go deeper by learning about your market customers. Gathering this kind of data helps you identify customer fears, drives, frustrations, and preferences, which can be used to bolster both products and the customer experience.

Heatmaps:

A heatmap is a visual depiction of user behavior that documents where users click, tap, and scroll—essentially identifying how users interact with your website. What pages are performing well and what elements are being ignored? This makes it much easier to discover what is working well and what is distracting on your website.

Customer Satisfaction with InMoment

InMoment’s dynamic customer experience platform has everything you need to help you collect, measure, and act on your customer satisfaction data. Check it out today!

References

business.com. Returning Customers Spend 67 Percent More Than New Customers – Keep Your Customers Coming Back With a Recurring Revenue Sales Model. (https://www.business.com/articles/returning-customers-spend-67-more-than-new-customers-keep-your-customers-coming-back-with-a-recurring-revenue-sales-model/). Accessed 3/18/2024.

Retail Customer Experience. Uniting transactional and relationship surveys to capture the entire experience. (https://www.retailcustomerexperience.com/blogs/uniting-transactional-and-relationship-surveys-to-capture-the-entire-experience/). Accessed. 3/18/2024.

Zippia. 28 CRITICAL CUSTOMER RETENTION STATISTICS [2023]: AVERAGE CUSTOMER RETENTION RATE BY INDUSTRY. (https://www.zippia.com/advice/customer-retention-statistics/). Accessed 4/1/2024.