Shopping for Experiences, Not Products: A Primer on Retail Customer Experience in the Experience Economy

Retail customers’ primary objective used to be providing a great product, but as brand competition fiercens and consumer expectations rise, retailers need to find new, bolder ways to stand out from the crowd. Consumers are no longer satisfied with “just” a product, and are finding different, more fundamental means of identifying (and spending money) with brands.

Retail brands’ primary objective used to be providing a great product, but as competition heats up and consumer expectations grow more complex, retailers need to find new, bolder ways to stand out from the crowd. And that’s why the retail customer experience is more important than ever before.

Consumers are no longer satisfied with “just” a product and are finding different, more fundamental means of identifying (and spending money) with brands.

Andrew Park, Vice President of Customer Experience Strategy & Enablement at InMoment, sat down with The Retail Focus Podcast to break down:

- Where customers’ expectations have been

- Where they’re going

- What retailers can do to keep up with it all

What Is the Experience Economy?

As previously mentioned, customers used to consider a great product the end-all-be-all of an experience, but as those expectations have since evolved—and so must retail brands’ strategy. These days, retail customers prefer to spend money with brands that deliver great experiences, and great experiences go far beyond what’s on a store shelf.

It used to be that a retail experience consisted only of an in-store visit, but in this modern era (and especially since COVID), a customer’s retail experience spans so many different channels. For a customer, their overall experience is informed by a combination of the following:

- Brand Identity

- Online Reviews

- In-App Experience

- Website Experience

- In-Store Experience

- Employee Interactions

- And So Much More!

You might sense what we’re getting at here: customers consider experiences to be journeys, not single stops—and brands that fail to approach their experience accordingly won’t be able to differentiate in the experience economy.

For example, an airline may consider a passenger’s flight the extent of that individual’s experience, but this view fails to account for buying a ticket, waiting in the airport, finding a hotel, and all the other parts of the journey besides ‘just’ the flight.

What Makes for a Great Retail Customer Experience Journey?

Brands that focus only on one aspect of the experience are missing a huge opportunity. The winning organizations in the modern experience landscape create journeys that are:

Seamless

Customers should receive the same quality of experience whether they are online, in store or in app. Obviously, there will be some differences in the actual experience (in store purchases provide instant satisfaction, while online requires customers to wait for shipping), but the quality must remain the same.

A positive example of consistency comes from one of our home furnishing clients, who prides itself on the knowledgeability of its staff in store. It wanted to provide that same quality of service on their e-commerce site, and was ultimately able to stand up an online chat that gave its customers instant access to expertise.

On the other end of the spectrum, it’s extremely disruptive to a customer when a product’s online and in-store price tags differ. Customers have come to expect seamless experiences—it’s key for brands to deliver on that expectation.

End-to-End

If you’re a regular on the InMoment Blog, you’ll be familiar with our phrase, “design with the end in mind.” And there’s a reason why we return to it time and time again. When it comes to retail customer experience (and really anything in life), if you aren’t actively thinking about your desired outcome when you’re in the planning stages, it’s highly unlikely that you’ll end up with the results you want.

So, when you are designing a customer journey, be sure to think about every step of the process, but especially the end result. Do you want customers to post about their new product? Share their excitement with friends and family? Come back for more next month? There is so much you can do to influence these actions, if only you plan for them.

Consistent

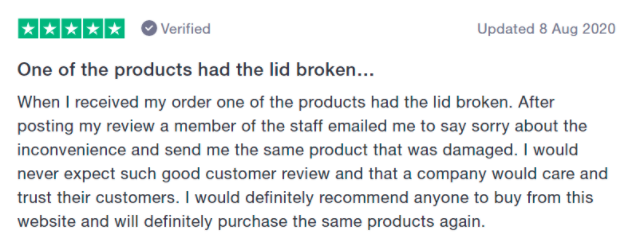

This one is pretty straightforward. If you provide consistently disappointing experiences (out of stock items, check out lines a mile long, etc.) you will be hard pressed to convince customers to return—or make a purchase in the first place. If you provide consistently excellent experiences, customers will be excited for the next time they get to shop with you, they’ll tell your friends about you, and they’ll likely buy more when they shop with you.

Now, creating consistency across multiple locations with numerous employees is a lot of work, but it is so worth it. Our proprietary research has even found that customers will spend more money with a company that provides a great experience. If you’re looking for strategies to increase consistency, check out this post or this post (centered more around your employees).

Say it with us: Designing best-in-class retail customer experience journeys is a worthwhile investment! In our decades of experience working with the world’s best known retailers, we’ve found that great customer experiences have big business pay off in these four areas:

- Acquiring Customers

- Retaining Customers

- Increasing Customer Lifetime Value

- Reducing Business Costs

Learn more about how here!

Customers Expect Great Retail Customer Experiences

It’s become common in the last 5-10 years for retailers to be compared not just to each other, but to brands from other industries and the experiences they provide. It probably comes as little surprise to most retailers that customers frequently compare them to Amazon, but what about a restaurant?

Restaurants are not retail outlets, but if they provide a great experience, customers will come to expect similar commitment from retailers and vice-versa. The same is true of other types of businesses. (You can learn more about this cross-industry experience expectations in our Retail Experience Trends Report here.)

The final word here is just that: expectation. As we mentioned up top, customers’ expectations are growing more complex as countless brands vie for their attention. This means that, no matter whether a brand sells shoes, cars, meals, or airline tickets, it’s no longer enough to focus solely on a product.

Make no mistake, offering a quality product is obviously still important, but it’s no longer enough to capture and hold customers’ attention. Experience is the differentiator now, and brands that endeavor to deliver a great experience will come out on top in both their verticals and in customers’ eyes.

To hear more about retail customer experience in the experience economy, listen to the full podcast episode today!