The 5th of October of this year marks an important deadline for the financial services industry: there are new Internal Dispute Resolution (IDR) standards and guidelines outlined in Australia’s RG 271. And for many companies, this is proving to be a difficult nut to crack. A lot of customer experience (CX) teams are being asked by the business to solve new problems for the first time. This marks one of the first times that many elements that make up a holistic CX program will dictate a financial services firm’s adherence to a legally enforceable regulatory requirement.

There are two ways to look at this—you can take on the new regulations as a difficult inconvenience, or instead, there’s an opportunity for CX and insights initiatives to demonstrate ROI and start adding significantly more value to the wider business. Here at InMoment, we would advocate strongly for CX and Insights teams to see this as an opportunity.

RG165 Is Out and RG271 Is In. What’s Changing?

- The definition of ‘complaint’ now incorporates dissatisfaction expressed on social media. “It is the complainant’s expression of dissatisfaction (that meets the definition of ‘complaint’ in RG 271.27) that triggers a firm’s obligation to deal with the matter according to our IDR requirements, not the referral of a complaint to a specialist complaints or IDR team.”

- There is a reduction in deadlines for complaints, including superannuation complaints. “Staffing numbers must be sufficient to deal with complaints in a fair and effective manner within maximum IDR timeframes. This includes resourcing the IDR function to deal with intermittent spikes in complaint volumes.”

- There is updated guidance on the identification and management of systemic issues, including the role which the boards and the front line staff have to play in the process. “Financial firms must also have robust systems in place to ensure that possible systemic issues are investigated, followed up and reported on.” “Firms should analyse complaint data regularly so that they can: (a) monitor the performance of the IDR process; (b) identify possible systemic issues and areas where product or service delivery improvements are required;”

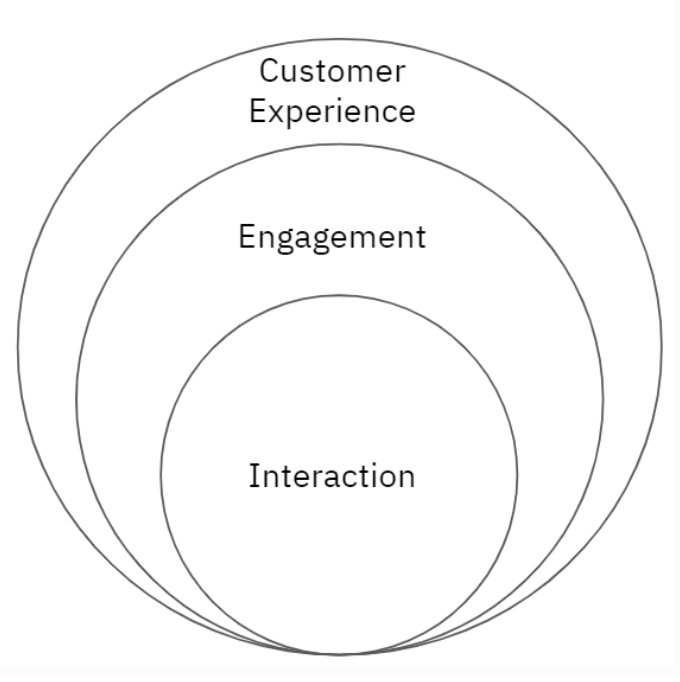

A key takeaway for CX and Insights teams—and what makes this such a difficult regulation to adhere to—is the blurring of the lines between unsolicited/unstructured feedback and a traditional complaint. Likewise the traditional strategic “outer loop” has now become a compliance requirement.

So how can CX and insights teams become compliance heroes? Here are three ideas for complying with new regulations while elevating your program at the same time:

Tip #1: Use Text Analytics to Uncover Implied Dissatisfaction

Implied dissatisfaction is an incredibly hard thing to identify, but is a key component of RG 271 compliance. Explicit dissatisfaction is as easy as someone giving you a low NPS score in your opening question. However, uncovering the true implied meaning in their responses requires a high level of technological sophistication. This is especially true at scale, where this process must be automated. There are several approaches to text analytics that can start to provide this insight, and they work in roughly the same way. That is, all verbatim (unstructured written or transcribed communication) is run through an analytics engine, and keywords and phrases that are used in the text then categorise the communication according to a predetermined set of rules (knowledge-based and/or machine-learned). In addition to determining categories, most text analytics solutions will also determine the sentiment associated with each category. Also, some advanced text analytics solutions will also determine what (if any) emotions are being expressed.

To make that distinction, we first need to define the difference between sentiment and emotion.

- Sentiment is essentially a 3 point score (positive, negative, and neutral (and/or mixed which indicates that both positive and negative sentiment are present)).

- Emotion, on the other hand, is a deeper expression of feeling that goes beyond simple positive/negative.

At InMoment, we have a team of linguists and behavioural scientists who currently map verbatim into 14 different emotions, and this keeps growing. Just as multiple categories and sentiments can be expressed in a single comment, so, too, can multiple emotions. The difference between sentiment and emotion is important. Take for example the following phrase:

“As a customer we have received an abysmal level of service. On top of that the system is so complicated that it requires lots of effort to understand it and make sure I have not been invoiced incorrectly. Thankfully the person who helped me was very good, he had all the answers and my problem was sorted out quickly and professionally”

There is both positive and negative sentiment in this statement, and sentiment analysis would likely place this in a neutral/mixed basket overall, with negative sentiment associated with service and system, and positive sentiment associated with staff and problem resolution. However, if you look at the emotions, the first section expresses Anger, Confusion, and Dissatisfaction. The second part—although expressing positive sentiment about the staff and the problem resolution—does not really express any emotion.

Although sentiment analysis may pick up some implied satisfaction/dissatisfaction, customers are not binary, especially when ranting on social media. Human communication is significantly more complicated than a simple “positive, negative, or neutral,” and having emotional analysis can identify more complex customer expressions.

Tip #2: Leverage Case Management to Manage IDR Complaints

Most financial services firms have both a complaint management system and a case management program running simultaneously. Even complaints management and customer advocacy often sit in different business units according to the team responding to detractors.

RG 271, however, has removed the distinction between the feedback and complaints. Where does “feedback” end and a “complaint” start? We would encourage any organisation with a comprehensive case management system to look at combining the two functions and using the case management capability to help drive efficient resolution. The goal is to meet the reduced timeframes whilst trying not to increase the cost of management.

In order to manage the challenge, you need to be able to strategically disaggregate the responses. If you already know the problem the customer has, you can route their case to the right person automatically, and you can give your staff insight into the customer’s complaint straight away. This will allow you to streamline your processes and increase your ability to respond effectively and efficiently at speed.

However, most organisations’ complaints systems do not have the ability to pinpoint the drivers behind customer sentiment to understand what the root cause of the problem is. But many CX programs have the ability to run layers of text analytics at speed in order to provide immediate and accurate routing of cases.Likewise, a good case management system has many layers of rules in a hierarchy that automatically control the case routing to ensure that there is no overloading or double handling.

Many communications can also be automated by leveraging a robust case management system. By reducing manual handling as much as possible, you increase the capacity of your team to deliver on the requirements of RG 271. More importantly, it allows you to deliver a better service to your customers.

Tip #3: Use Text Analytics to Uncover Systemic Issues

Text analytics is the tool of choice for deriving meaning from unstructured text. Most commonly, this involves categorising words and phrases to uncover key themes and trends in verbatim at scale. Now, not all text analytics is created equally and to be effective you need a high degree of accuracy, combined with other statistical analysis tools such as correlation analysis.

If your organisation has a text analytics capability, it is likely that it exists within your CX and insights initiatives, and not the complaints management function (where one-to-one recovery is more of the focus). Collating feedback data, complaints data, other unstructured data (social, webchat, etc.), and operational/behavioural data in one place, then applying text analytics to that data is the most efficient and effective way to uncover key systemic issues that are causing complaints.

The benefit to this approach is not just compliance to RG 271, but also is a fantastic way to identify fracture points, reduce cost to serve, and reduce churn, whilst maintaining compliance.

As an example, one of our health insurance clients tasked their CX team to address a critical pain point for customers—excessive contact centre wait times. The team had to figure out a way to reduce failure demand (avoidable call volume) rather than increasing available staff.

To determine what was driving the greatest volume of avoidable calls, the client reviewed multiple data sets including call reason codes, agent call notes, NPS survey results, complaints data, agent feedback, and qualitative research. No individual data source delivered sufficient levels of insight into the underlying challenges, nor were they providing adequate coverage across all the calls they were receiving.

As a result, the client leveraged Natural Language Processing (NLP) powered text analytics, which was applied to 12 months worth of agent call notes. The subsequent analysis generated a custom text analytics category set incorporating 184 unique categories. Tens of thousands of call notes were then categorised at a phrase level with sentiment also assigned. Then each comment was married up to detailed operational data to enrich the analysis.

By addressing the pain points surfaced through the failure demand analysis, the client was able to reduce 20% of total calls coming into the call centre. The financial impact was very significant, saving the company millions of dollars in operating costs and ensuring that the business did not have to continue expanding its contact centre workforce in line with overall business growth. All of this without sending out a single survey!

Here at InMoment we strongly encourage the CX and insights teams to take ownership of this element of RG 271 compliance, as it is in alignment with one of the core capabilities that should already be embedded in their initiatives. Compliance also results in significant business value and further demonstrates the value of customer experience across the business.

Wrapping Up

At a time when many organisations are struggling to demonstrate the value of customer experience, RG 271 has made a robust inner loop and outer loop a compulsory requirement. As long as CX and insights teams can keep control of these processes and continue to demonstrate compliance as well as business impact, then this is a real opportunity to move up the value chain.

Want to learn more from the experts at InMoment? Check out our InMoment Resources Page, which is packed with industry thought leadership, best practices, and more!

*All quotations are from this article.