Just discovered InMoment? Curious to know a little more about us and our differentiated Experience Improvement (XI)? Well allow us to introduce ourselves!

Own the Moments That Matter

At InMoment, we have this saying: “Own the Moments That Matter.” This is fundamental to our mission, because those moments—packed full of emotions, judgements, learnings, and more—shape the world we live in. And with every moment, there is an opportunity to make a positive impact; to leave a mark.

But when it comes to your business, there are simply some moments that matter more, to your customer, employees, and beyond.

Our goal is to empower you with the data, technology, and human expertise necessary to identify the moments that matter, understand what’s working (and what might need improvement), take informed action to solve business problems, and ultimately provide a truly differentiated experience for your business.

Our CEO John Lewis said it best: “InMoment’s unique combination of world-class technology and expert service enables clients to integrate growing and disparate customer signals and separate predictive understanding from the noise.”

What Is Experience Improvement (XI)?

Despite increased investment, experience management programs have plateaued. Why?

Because experiences don’t need to be managed or measured, they need to be improved.

The truth is that monitoring services and D.I.Y. approaches aren’t enough for today’s businesses; they cause program stagnation and make meaningful return on investment (ROI) impossible. Instead, what’s required for success is a new approach: an Experience Improvement (XI) initiative that solves the biggest business challenges, like retention, growth, and cost savings.

The Moments That Matter

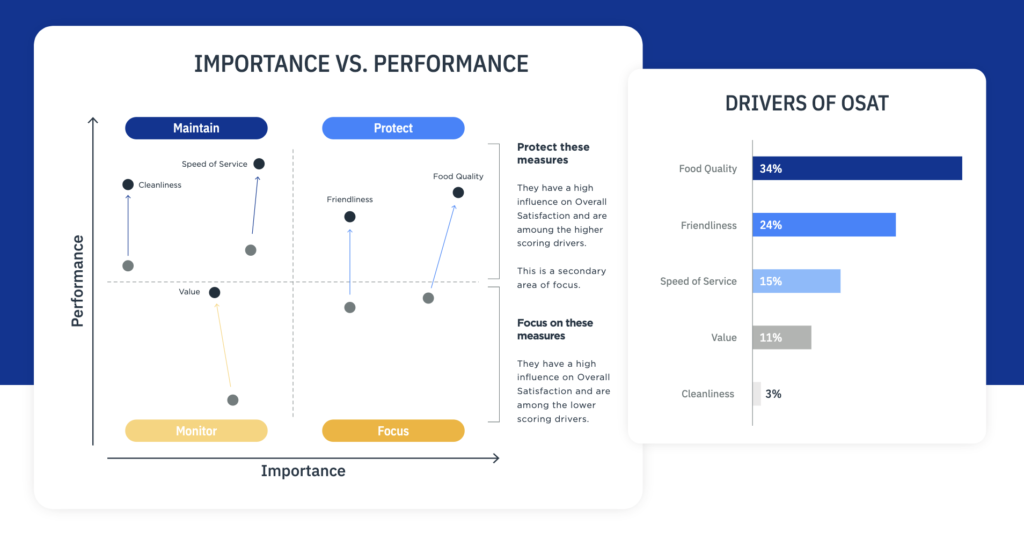

Improving experiences begins with sifting out the noise from experience data and identifying the moments that matter: where customer, employee, and business needs meet. This allows businesses to prioritize their focus on high-emotion, high-impact areas and connect with their most valued customers. Additionally, businesses can empower their employees to recognize and take action in these moments, ultimately culminating in organization-wide transformation from the boardroom to the break room.

Data, Technology, and Human Expertise

Experience Improvement is made possible through our industry-leading Experience Intelligence XI technology and our in-house Experience Improvement (XI) services teams. With our ability to collect and gather data from anywhere and in any form with our Integrated CX approach, industry-leading technology, and decades of experience in key industries, InMoment can help you craft an experience initiative that truly meets the unique needs of your business. We are dedicated to being more than just a vendor to our clients—instead we take the role of a dedicated partner committed to a businesses’ short- and long-term success.

The Intersection of Value

Our mission is to help our clients improve experiences at the intersection of value—where customer, employee, and business needs come together. Ultimately, our clients are able to move the needle and go beyond managing their experience to actually improving it. With the right intelligence, businesses can empower the right people to take transformative, informed action in the most effective ways and drive value across four key areas: acquisition, retention, cross-sell & upsell, and cost reduction. In other words, better results for the business and better experiences for their customers and employees.

The Continuous Improvement Framework

The key to taking an experience program beyond metrics is to move beyond monitoring customer feedback and stories and focus on the formation of actionable plans for changes informed by them. Customer narratives contain meaning that companies can use to diagnose both superficial and deep-seated problems, define remedies to those problems, positively impact the bottom line, and create more meaningful experiences. We help our clients achieve all of this by sticking to a simple, five-step framework that we call the Continuous Improvement Framework: define, listen, understand, transform, realize. (You can read all about it here!)

What Third Party Analysts & Customers Say About InMoment

And don’t just take it from us—InMoment has received third-party validation from multiple third-party research firms. We have been named Leaders in the Forrester Text Analytics Wave, Forrester Customer Feedback Wave, the Gartner Magic Quadrant for Voice of the Customer, and more!

Forrester Text Analytics Wave

InMoment received the highest possible score and was named Leader in the Text Analytics Wave report. The Forrester Wave says, “InMoment XI is a solid choice for customers who want a platform with a well-balanced mix of knowledge and ML-based AI, the ability to deploy OOTB solutions quickly, and deep custom application development capabilities.” As mentioned in the report, “InMoment’s people-oriented text analytics capabilities…enable it to address all relevant use cases beyond just VOC or CX analytics.”

Forrester Customer Feedback Wave

InMoment was also named a Leader in Forrester’s Customer Feedback Wave Report. The Forrester Wave says, “InMoment is a good fit for organizations looking for a ROI-focused technology and services partner.” As mentioned in the report, “reference customers say they selected InMoment for its technology capabilities and value citing the vendor’s pricing as reasonable and transparent. They also praise the vendor’s partnership and focus on delivering outcomes. References appreciate that not everything is “tool driven;” instead, the vendor provides strategic guidance, helping them innovate their approach to surveys or embrace new forms of feedback.

Gartner Magic Quadrant for Voice of the Customer

Furthermore, InMoment was named a Leader in the Gartner Magic Quadrant for Voice of the Customer. The report says, “InMoment is a Leader in this Magic Quadrant. The company’s Experience Improvement (XI) Platform combines a broad set of VoC technologies as part of an integrated offering that focuses on blending services and software to help fulfill its clients’ evolving CX ambitions. The company has established operations around the world, with a notable presence in Asia/Pacific.” Continuously, the report mentions,”InMoment is investing in intelligent self-service and workflow automation to help simplify the user experience (UX), while furthering its vision to support four tailored XI clouds for CX, employee experience (EX), product product experience (PX) and market experience (MX).”

“InMoment has an impressive ability to deliver business value through its consulting-led methods and programs.” – Gartner Magic Quadrant for Voice of the Customer

Industry Dominance

Not only have we been recognized by multiple market research firms, but our success is also shown in our reach across multiple industries. InMoment is currently improving experiences with:

- 90% of the world’s leading automotive brands

- 8/10 of leading banks

- 4/5 of the top insurers

And one more thing. 100% of our clients would recommend us.

Recognized as a leader and innovator in our sector, we collaborate with the world’s leading brands to attract, engage and retain their customers. We are fiercely proud that our clients continually tell us they love the experience of working with our company, as we constantly stretch to exceed their expectations.

Our Experience Improvement (not management) approach provides context to feedback at the intersection of value—identifying what’s important to customers, employees, and the business. Our expertise enables brands to align their CX and EX programs with business goals, prioritize actions, determine and monitor impact of change, address issues, and celebrate successes—all leading to true Experience Improvement.

Does this Experience Improvement (XI) mission align with your vision? You can learn more here!