This article was originally published on CustomerThink.

Whenever the subject of employee satisfaction and engagement arises, it is often difficult to differentiate between them. Just as customer satisfaction doesn’t equate to loyalty behavior, if you believe that “a satisfied employee IS an engaged employee”, it’s likely that you can’t articulate a distinction.

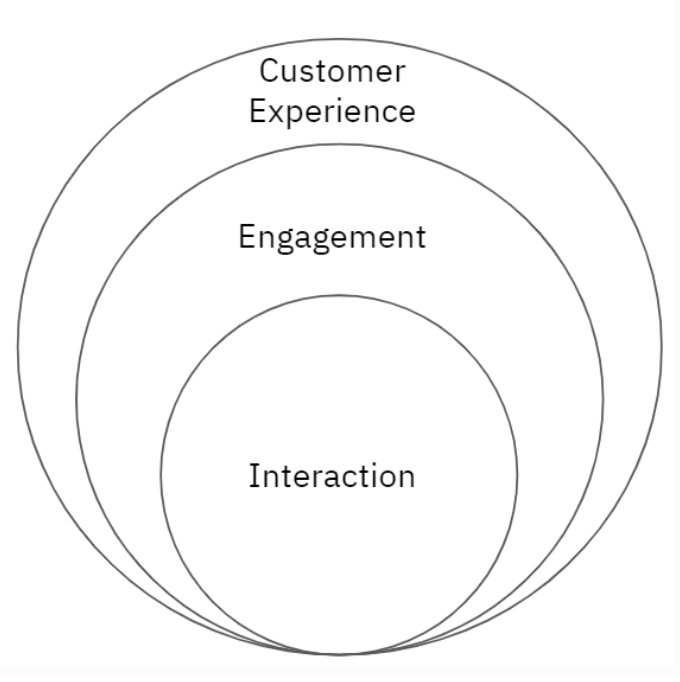

A satisfied employee can pretty much be described as one who is relatively happy or more than complacent about their day-to-day job experience: the work, pay, benefits, possibilities for growth, promotions and possibly more – – like training, work environment, and reward and recognition. These employees start their work day, they perform their job at acceptable levels, and they go home (or, are already at home due to traditional workplace restrictions resulting from the pandemic). Although satisfied employees are generally supportive of the business and what it represents, they likely won’t go beyond doing the basics of their job descriptions.

Rules of Engagement

An engaged employee, to follow the accepted range of definitions by HR professionals and consultants, is a fit for his/her role, is aligned with the goals of the organization, and is a productive individual. These employees have some potential to impact the customer experience; and there is documented, often incidental, evidence of correlation between the two. However, today more is needed of employees: Namely, proven direct causation, the specific defined linkage, and intersection, of employee thinking and behavior to customer brand/company loyalty and advocacy in the marketplace.

In part because of today’s greater emphasis on the emotionally-based components of customer experience and customer value delivery, and how this must be an enterprise cultural priority, employees have become center stage in optimizing customer behavior. Company goals now include building a corps of employees who perform at proactive, customer-centric levels beyond engagement and satisfaction. These “employee advocates” have three key and core behavioral traits:

- Commitment to the company: Commitment to, and being positive about, the company (through personal satisfaction, fulfillment, and an expression of pride), and to being a contributing, loyal, and fully aligned, member of the culture

- Commitment to the product/service value proposition: Commitment to, and alignment with, the mission and goals of the company, as expressed through perceived excellence (benefits and solutions) provided by the employer’s products and/or services

- Commitment to the customers: Commitment to understanding customer needs, and to performing in a manner which provides customers with optimal experiences and relationships, as well as delivering the highest level of product and/or service value

Additionally, and not unimportantly, these employees are often vocal, social supporters of their employer and the value its products and services, and fellow employees, represent to stakeholders. In other words, similar to the behavior of vocally loyal customers, they are advocates.

The Missing Link

In looking at the progression from satisfaction to engagement to advocacy, we have examined research conducted over the past three decades. What we have observed are studies that examined some contributing factors of employee experience and value, such as reward and recognition, job fit, career opportunities, work environment, and departmental and management relationships. But the critical component often totally missing, or lightly addressed, from all of this material is the definitive linkage and commitment to customers.

Employee advocacy identifies new categories and key drivers of employee subconscious emotional and rational commitment, while it is also linked with the emotional and rational aspects of customer commitment.

When offering results of research on employee satisfaction and engagement, companies will often emphasize things like brand image and social media activity as part of employee training and responsibility. These are certainly important; but, just because employees have a solid understanding of the brand does not mean they will deliver on the product or service promise the enterprise has made to customers.

Tony Hsieh, the late founder and CEO of Zappos, said: “The brand is just a lagging indicator of the company’s culture.” He hit the mark with that statement. Brand image needs to be complemented and supported by a culture and set of processes dedicated to both employee and customer experience. That brand promise has to be delivered for customers every time they interact with the company. Contribution to customer experience also needs to be fully, and strategically, baked into the organizational DNA and into every employee’s job description.

The Path to EX Maturity

Consider how frequently your customers interact with your employees, either directly or indirectly. Whether it is through a computer screen in a customer service chat, on the telephone, or in person, every employee, whether customer-facing or not, should be an enthusiastic and committed representative for the brand. If employee satisfaction and employee engagement are not designed to meet this critical objective of the customer experience, almost inevitably there will be a sub-optimal downstream result with regard to customer behavior.

In any group of employees, irrespective of whether it’s a service department, technical and operational division, or a branch office, there will be differing levels of commitment to the employer’s brand and the company itself, its value proposition, and its customers. If employees are negative to the point of undermining, and even sabotaging, customer experience value, they will actively work against business goals and outcomes. However, if employees are advocates, and whether they interact with customers directly, indirectly, or even not at all, they will better service and support customers.

For companies to create and sustain higher levels of employee advocacy, it’s also essential that the employee experience be given as much emphasis as the customer experience. If employee commitment and advocacy are to flourish, there must be value, and a sense of shared purpose, for the employee as well as the company and customer – in the form of recognition, reward (financial and training), and career opportunities. Combined with advanced analytics and other employee-related data, the advocacy concept can lead and enable any organization to be more stakeholder-centric and dynamic.

This is a clear path to EX maturity. Where is your company on the maturity spectrum?