Do You Need a Customer Experience Manager?

A customer experience manager determines, implements, refines, and reports on the customer experience program. This role is crucial to the success of customer experience in enterprise organizations.

Did you know that 80% of organizations have CX teams with 11 or more employees dedicated to the business’s CX program?

As your company begins to scale customer experience operations, it is possible for silos that cause different departments to use separate technologies and focus on different metrics, which fragments your understanding of the customer experience.

To avoid this problem, you need a customer experience manager to break down silos, unify your tech stack, and unite your directors, VPs, and business units with the ultimate goal of creating a friction-free, productive, and delightful customer experience—from onboarding to renewal and advocacy.

What Is a Customer Experience Manager (CX Manager)?

A customer experience manager determines, implements, and refines the customer experience strategy to ensure that all customer interactions with a company are seamless, satisfying, and aligned with the organization’s values.

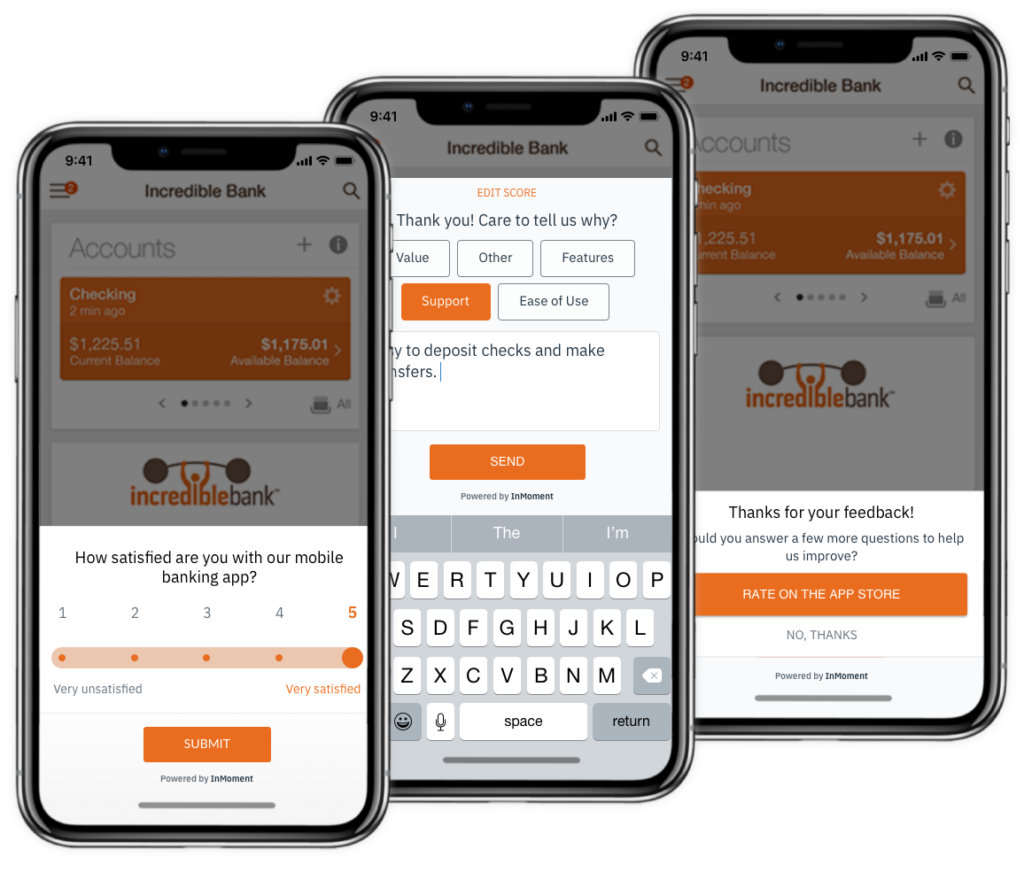

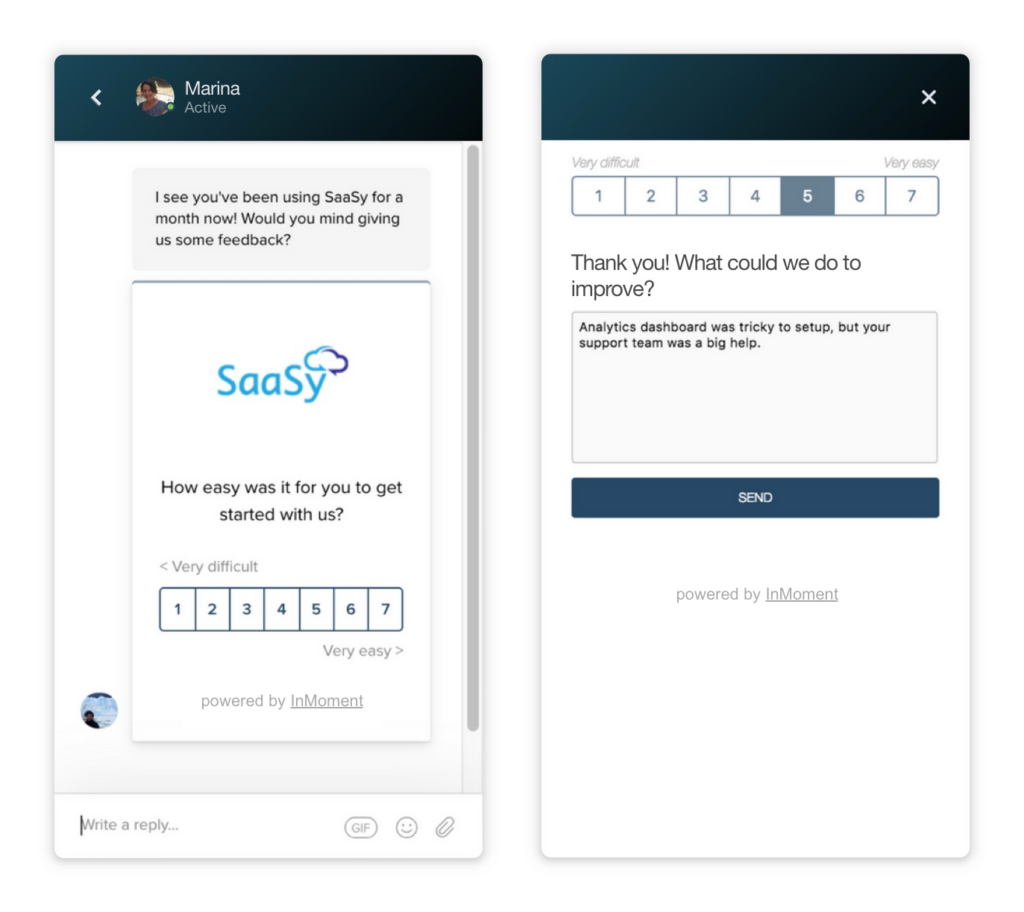

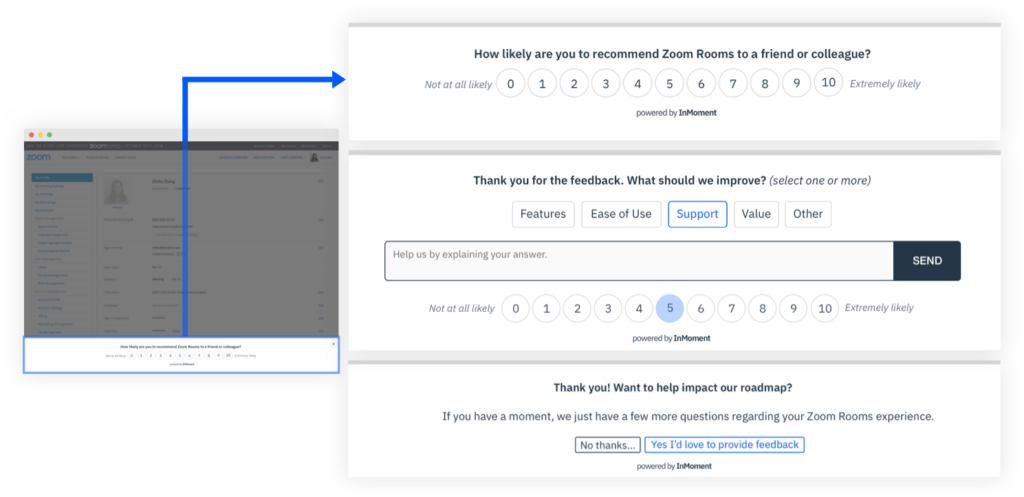

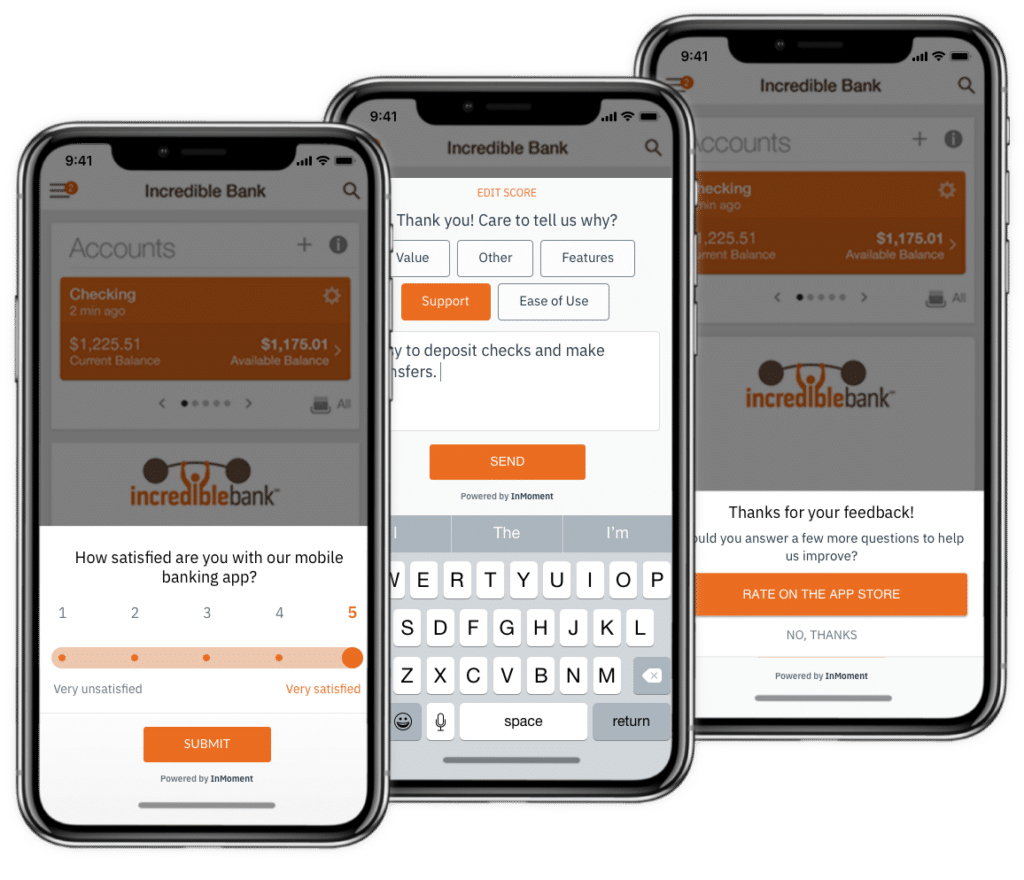

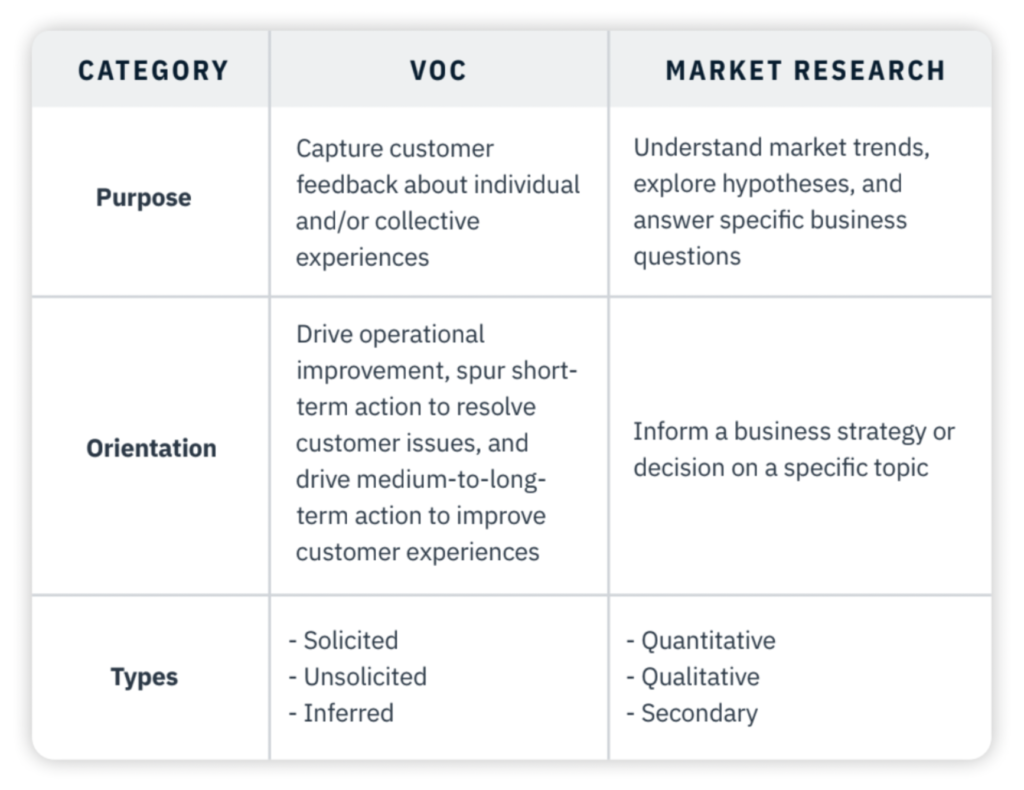

Another important aspect of this role is that it determines the best way to collect, analyze, and act on the voice of customer data at key touchpoints across the customer journey.

Benefits of Having A Customer Experience Manager

Employing a dedicated customer experience manager can profoundly enhance your organization by providing a singular leadership point for the entire customer experience program. This role ensures that all initiatives to improve customer satisfaction are strategically aligned and executed efficiently across various departments.

A skilled customer experience manager not only fosters collaboration among teams but also takes charge of managing personnel and allocating resources wisely. By streamlining processes and integrating diverse strategies, this leader plays a pivotal role in driving both operational efficiency and sustainable growth, ultimately creating a more cohesive and impactful customer journey.

What Background Should a CX Manager Have?

It is common to see a wide range of candidates succeed in the role of CX manager—from Salesforce Administrators to Senior Sales Operations professionals to Customer Success or Customer Experience/Voice of the Customer leaders. Even marketing professionals have successfully led CX operations efforts.

It makes sense that effective CX professionals would come from different backgrounds since this role is about as cross-functional as it gets. We can tell you that certain qualities and skill sets, rather than specific career trajectories, predict success in this role.

Key Skills and Traits of a Successful CX Manager

Customer experience managers will not all share the same background. Some customer experience managers will have marketing experience, others will have sales experience, etc. However, all successful customer experience managers share the same traits that make them successful leaders of customer experience initiatives. Some of these skills include:

- Diplomacy and negotiation skills

- Tech literacy

- Project management mastery

- Understanding of procurement

Diplomacy and Negotiation Skills

A customer experience manager needs to have excellent interpersonal skills and be able to balance all the stakeholders’ needs and achieve goals with their available resources. They’ll need to convince a range of departments—not just the customer-facing ones—just how vital these efforts are to the company’s long-term success.

A CX manager will lead team meetings, communicate strategies, and move projects forward while holding everyone to a timeline (including executives). On top of that, they must obtain a clear mandate and buy-in from their C-suite sponsors. This is especially important, as only 51% of customer experience decision-makers who state that improving the customer experience is a priority for their executives said that those executives act like CX is important most or all of the time

Tech Literacy

Your various technology platforms need to work together as a system. Otherwise, your information silos stay intact and your customer journey remains fragmented.

On top of that, they’ll need to find the gaps in your current capabilities and identify solutions to fill them. Sometimes, this involves purchasing entirely new systems. Other times, it’s simply a matter of integrating what you’re currently working on. Usually, it’s a bit of both.

InMoment’s CX integrations seamlessly integrate with over 100 enterprise systems to ensure you have a holistic and unified view of the customer experience data to make better business decisions.

Project Management Mastery

Your customer experience manager will need excellent project management skills, including planning timelines and budgets end-to-end and getting personnel to stick to them. They also need to know how to purchase from vendors without using an RFP.

A Strong Understanding of Procurement

Executives have grown wary of new B2B software that promises to solve all their problems, and middle management is rarely overjoyed at the prospect of retraining staff on new platforms. That said, sometimes the current systems don’t cut it, and it’s up to the CX manager to understand the tradeoffs when evaluating new technology and delivering an integrated system that gets the job done.

How to Hire a High-Impact CX Manager

If you want a customer experience manager that will truly revolutionize the customer experience at your organization and be able to tie those improvements to business success, you are going to need to make sure you conduct a hiring process that will yield the highest-performing professionals. Here are some steps to follow that will help you hire a high-impact customer experience manager:

1. Define the Role:

One of the most important parts of the hiring process is to make sure that it gets started the right way. When you are looking for a CX manager, clarify what you are looking for and what they will be in charge of.

Are you hiring a CX manager to start your customer experience from scratch? Are they taking over a pre-existing business unit? What kind of results do you expect from a successful customer experience manager? These questions ensure that applicants are educated on the role from the beginning and eliminate misunderstandings later in the hiring process.

2. Look for Someone Who Understands the Customer

Whoever you choose as your customer experience manager should have a strong understanding of the modern consumer and the experiences they are looking to have. The ideal candidate understands that only a fraction of customer feedback comes from surveys and that an effective customer experience program will source customer feedback from multiple sources in order to tap into the 85% of customer feedback that is unstructured.

3. Can Tie CX to Business Performance

One of the biggest challenges for customer experience professionals is to tie customer experience business improvements with business performance improvements. In the current business environment, this is a crucial skill. Regardless of their background, your chosen candidate should have experience with this to ensure that you can measure the ROI of your CX program.

4. Assess Cultural Fit

Your customer experience manager will be responsible for communicating across your organization, whether it be executives or associates. Since the CX manager will touch many departments, it is important to take the time to ensure that they are also a cultural fit for your company. This will make the adoption and execution of customer experience initiatives a lot smoother.

5. Understand the Importance of the Agent/Customer Interaction

One of the most important parts of the customer journey is the experience that the customer has with a contact center or customer support team. 78% of customers prefer to contact customer support through online chat or voice calls. Furthermore, 76% of customers get frustrated when they do not receive a personalized experience.

It is important to hire a customer experience manager that understands the weight the contact center holds in regard to the entire customer experience and empowers the organization to invest in solutions that will meet customer expectations.

Tools and Technology for CX Managers

For your customer experience manager to be successful, they need to be equipped with tools that give them the best insights into the state of the customer experience at your organization. These include, but are not limited to, CRM systems, analytics platforms, collaboration tools, and customer feedback platforms.

The most important of these tools is a customer experience platform. A customer experience platform helps you connect data from multiple sources to get a holistic view of how customers view their interactions with your organization.

InMoment’s customer experience solution is the premier choice for successful customer experience managers as it combines up to six different solutions, such as conversation intelligence, customer experience surveys, digital listening, reputation management, and more!

How to Measure the Success of a Customer Experience Manager

There are multiple ways to measure the success of your customer experience manager to understand the impact they are having at your organization. The three main categories of metrics you can use are:

- Customer Experience Metrics

- Operational Metrics

- Business Impact

Customer Experience Metrics

To measure the success of your customer experience manager, you will need to benchmark their performance against the customer experience metrics that were agreed upon early on in the hiring process. These can include:

- Net Promoter Score (NPS)

- Customer Satisfaction (CSAT)

- Customer Effort Score (CES)

These metrics can reflect the changes in how the customers perceive their experience. For example, an increase in customer satisfaction in the six to twelve months of a customer experience manager’s time with your organization means the changes and initiatives they have implemented have resulted in a more positive customer experience.

Operational Metrics

Operational metrics are metrics that reflect the processes within your organization. To measure the performance of your customer experience manager using these metrics, you can compare CX efforts against:

- Resolution time

- Average time in queue

- Conversion rate

These metrics reflect the smoothness of operations in your organization or in a specific business unit. For example, the average time in queue and resolution time are often used as call center metrics. A higher resolution time and a lower average time waiting to talk to an agent means that customers have better experiences.

Business Impact

Perhaps most importantly, you will want to measure how your customer experience manager demonstrates the ROI of CX initiatives through their tangible business impact. This can be done using metrics such as:

- Average order size

- Customer churn rate

- Cost per conversion (CPC)

These metrics help measure the ROI of CX initiatives. Using the right tools, you can gauge the financial impact that a successful customer experience program is having on your business.

Fill out the calculator below to see the ROI you could get from utilizing InMoment’s customer experience platform:

Empower Your Customer Experience Manager with InMoment

A successful CX Manager doesn’t just improve customer experience—they drive meaningful, measurable business growth by putting customers at the heart of every decision. Schedule a demo today to see how InMoment’s platform can set your customer experience manager up for success!

References

McKinsey & Company. The value of getting personalization right—or wrong—is multiplying. (https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying). Accessed 12/17/2024.

Forrester. The State Of Customer Experience Teams, 2023. (https://www.forrester.com/report/the-state-of-customer-experience-teams-2023/RES180035). Accessed 12/17/2024.